This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 45,000 other investors today.

To investors,

There were 3.8 million Americans who filed for unemployment last week. This brings the total new claims to over 30 million in the last 6 weeks. The speed and gravity of which the unemployment situation has transpired is breathtaking.

The good news is that the number of first-time jobless claims continues to fall week-over-week since mid-March. The bad news is that we are becoming desensitized to the size of these numbers. There were more than 3,800,000 people who lost their job and filed for unemployment insurance last week. That would have been more than a 50% increase in national unemployment back in February, but now we view this as an encouraging number.

The unofficial numbers for unemployment are likely to be over 20% at this point. Some of these people will hopefully find relief in the coming weeks as various cities begin to re-open. This is going to be easier said than done:

What metrics will determine when a city opens versus when it doesn’t?

How is success measured when re-opening? What will signal it isn’t working?

Can a city re-open all businesses immediately or do they allow certain industries before others?

What are the requirements on citizens during the re-opening? Masks? Social distancing? Curfews?

What is the process for pausing the re-opening if it is not going according to plan? Can a city stop the re-opening and reinstitute the shelter at home order?

This is a highly complex situation. There is unlikely to be one right answer. Each city and population are different. People will politicize whatever decisions are made, which will only add pressure and scrutiny.

There are people much smarter than me that will focus on the re-opening of the economy. The truth is that the economic reality is much worse than what is being represented in the stock market. We are starting to get some of the economic and corporate data that is necessary to help us measure the true carnage.

Take American Airlines for example:

“American Airlines lost more than $2.2 billion in the first three months of the year — its biggest quarterly loss since 2008 —as the coronavirus pandemic drove down demand for air travel.

American’s revenue dropped nearly 20% from a year earlier to $8.52 billion, slightly below analyst estimates. Shares were down more than 3% in morning trading.

American, like other airlines is facing a sharp decline in passengers because of the coronavirus pandemic. U.S. airline travel volumes dropped by about 95% in recent weeks from a year earlier as travelers stay home because of concerns about the virus and shelter-in-place orders.”

These sound like crazy numbers, until you realize that American Airlines is losing $70,000,000 a day right now. This level of economic damage would have been unfathomable only 6 weeks ago. They aren’t the only ones though.

Bob Pisani wrote a nice summary of various companies that are sharing good and bad news at the same time during their earning reports:

“Shipping giant UPS is getting more revenues from Americans shopping online, but delivery of shipments to businesses has shrunk dramatically.

3M is making money selling its N95 masks and noted strong growth in personal safety products but it is still laying off workers in other divisions and withdrew its full-year guidance.

Music streaming service Spotify reported a loss that was less than expected and added more users, both paying customers and those who listened to its free ad-supported category. But it lowered its revenue guidance for the year as ad sales fell.

Even food companies are having a tough time figuring out what is going on. You’d think snack maker Mondelez would be doing better: They make Oreos. They did beat estimates, and consumers certainly stockpiled food. But the company withdrew its 2020 forecast due to uncertainty surrounding the impact of the virus.

You’d think the lab-testing business would be booming, but no. Even testing giant Laboratory Corp., which reported better-than-expected profits and is rolling out a new coronavirus antibody test, is withdrawing 2020 guidance due to the pandemic, and taking other actions including furloughing workers.”

What a weird, unprecedented time we are living in. To make things even more confusing, the public market is not acting how most would have predicted. The economic data is obviously bad, including a 4.8% drop in GDP.

But there are a lot of people scratching their head as to why the economic data is so bad, yet the stock market continues to rally. In fact, the stock market is ending one of the best months ever. According to CNBC:

“Wall Street came into Thursday’s session on pace for one of its best monthly performances in decades. The S&P 500 was up more than 12% for the month and on track for its biggest one-month gain since 1987. The Dow was up 11% in April, which would be its best month since 1987.”

Your guess is as good as mine as to (1) what is actually driving the rally and (2) how sustainable this stock market move is. What I do know is that there are incredible levels of uncertainty at the moment and millions of investors are trying to make sense of it all. Some will make a fortune. Some will lose a fortune. And a good portion of the middle will probably come out relatively flat from all of this.

The economic carnage is also driving something else that was previously underestimated — a feeling of frustration from corporate leaders. Most of them are not going to discuss this publicly, because they don’t want the PR nightmare. One who chose to speak out is Tesla’ Elon Musk. In yesterday’s earnings call, Musk went off about the current lockdown orders:

“I think the people are going to be very angry about this and are very angry. It’s like somebody should be, if somebody wants to stay in the house that’s great, they should be allowed to stay in the house and they should not be compelled to leave. But to say that they cannot leave their house, and they will be arrested if they do, this is fascist. This is not democratic. This is not freedom. Give people back their goddamn freedom.”

He then doubled down on the comments later in the call when he said:

“So the expansion of the shelter in place or as frankly I would call it forcibly imprisoning people in their homes, against all their constitutional rights, but that’s my opinion, and breaking people’s freedoms in ways that are horrible and wrong, and not why people came to America or built this country. What the f---. Excuse me. It’s outrage, it’s an outrage. It will cause great harm not just to Tesla, but to many companies. And while Tesla will weather the storm there are many small companies that will not.”

There are plenty of people who disagree with Elon on these sentiments, but there are also a lot of people who agree with him. The topic is controversial, which means the truth is probably somewhere in-between the extremes.

The situation looks dire on the ground. Thankfully, there appears to be a light at the end of the tunnel with cities re-opening in the next few weeks. It will be important to pay attention to how quickly consumers start to spend again, along with what percentage of companies were able to survive the government mandated lockdowns.

Entrepreneurs are the backbone of the United States. They’ll help us escape this nightmare, but it won’t be easy. We need to do everything we can to empower them with resources and then get out of their way. I’ll bet on the US economy and the entrepreneurs driving it any day of the week.

Hope everyone has a great close to their week. Stay safe and please continue being kind to each other during these crazy times 🙏🏽

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 45,000 other investors today.

THE RUNDOWN:

Telegram Caves to US Regulators: Delays Blockchain Launch, Offers to Return $1.2B to Investors: Messaging app Telegram postponed the launch of its TON blockchain for a second time on Wednesday, pushing the new go-live date to April 2021 and triggering a costly clawback clause in its agreement with token-sale investors. According to a letter to investors obtained by CoinDesk, Telegram is offering to return up to 72% of each investor's stake. Read more.

Alibaba Patents Blockchain System That Spots Music Copycats: Alibaba has patented a blockchain-based means of vetting the originality of songs. Granted by the U.S. Patent and Trademark Office on April 21, the process as described by the Chinese e-commerce giant addresses one of the recording industry’s major issues – protecting the copyright of music tracks – by hosting and vetting that content on a blockchain. Read more.

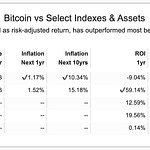

Bitcoin Jumps 12% as Fed Keeps Money Flowing and US Economy Shrinks: Bitcoin's price jumped Wednesday by the most in six weeks, outpacing U.S. stocks, after the Federal Reserve pledged to keep pumping new money into markets and government data showed the economy sliding into recession. Bitcoin rallied 12% to $8,703 as of 19:30 UTC (3:30 p.m. Eastern time). The Standard & Poor's 500 Index rose 3.1%. Read more.

US Weekly Jobless Claims Hit 3.84 Million, Topping 30 Million Over the Last 6 Weeks: First-time filings for unemployment insurance hit 3.84 million last week as the wave of economic pain continues, though the worst appears to be in the past, according to Labor Department figures Thursday. Economists surveyed by Dow Jones had been looking for 3.5 million. Read more.

Binance, Brock Pierce Donate $1M to Puerto Rico’s COVID-19 Fight: Brock Pierce’s Puerto Rican nonprofit has teamed up with Binance to buy $1 million in personal protective equipment to help fight coronavirus in Puerto Rico. Integro Foundation – run by one-time bitcoin billionaire Brock Pierce who in 2018 tried to make Puerto Rico into a crypto utopia – donated 44.5 BTC to Binance Charity on April 23. Binance Charity announced Thursday that it was matching that donation 2:1 at a valuation of $333,333 USD. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Adam Traidman is currently CEO and co-founder of BRD, one of the first Bitcoin wallets in the app store. He is also currently the CEO of Ripple Asia and the CEO of SBI Mining Chip Company. It was interesting to talk to Adam, especially since he has such a good understanding of what is happening in Asia and how that should affect the rest of the crypto world in the coming months.

In this conversation, Adam and I discuss:

The founding story of BRD

How the company has evolved over the last few years

What the current environment for crypto in Japan is

How the chip manufacturing business has changed due to coronavirus

What Adam thinks of China's digital currency efforts

I really enjoyed this conversation with Adam. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

We have started a new show exclusive to YouTube called Lunch Money. The goal is to cover current events in business, finance, and technology from the perspective of the every day citizen, rather than the talking heads on television. It is just as funny and entertaining as it is educational. Hope you enjoy it and make sure you go subscribe to the YouTube channel!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

TaxBit automates your cryptocurrency taxes, enabling you to effortlessly track, calculate, and report your transactions. Get 10% off your tax plan today with a free trial by going to www.taxbit.com/invite/Pomp

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

If you enjoy reading “Off The Chain,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.