To investors,

One of the most surreal aspects of financial markets since the 2008 Global Financial Crisis is that bitcoiners were right. Not in a “I told you so” way, but rather how broken the market has been since the government decided to implement the QE playbook at every downturn.

Everywhere you look you can see someone stuck in the old world yelling and screaming about valuations and frothiness. “This stock is overvalued.” “That stock is overvalued.” “The market is going to crash next week.” These folks are looking at today’s data and comparing it to historic data when the world ran on a gold standard.

They don’t realize that historic valuations matter less today because we have a dollar being inflated away, a government that has outlawed prolonged market corrections, and a retail investor base trained to buy every dip.

The most dangerous words in finance are “this time is different.” That is until something is actually different. And the biggest change in our lifetime to financial markets is how manipulated they have become. In a weird way, true risk has been removed from the market when you evaluate it holistically.

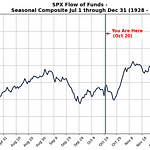

Could individual stocks go down over time? Of course. But is there a single person in the world that believes the S&P 500 is not going to be higher in a decade? How about in 5 years? What about 3 years?

I am sure there is someone out there who has lost their mind and honestly believes the doomsday scenario, but we have a scientific term for those people — clinically insane. They should go get their brains checked out.

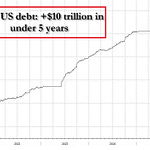

The United States of America has constructed the greatest economy in human history. We have built an environment conducive to creating shareholder value over the last few decades. Publicly traded companies have a persistent tailwind at their back because the currency their stock is denominated in will be devalued at an accelerated rate.

Remember, the US dollar has lost about 30% of its purchasing power in the last 5 years. Gold is outperforming the S&P 500 over the last decade. These are not normal things. And they signal the fact that stocks are going up forever over the long-run. It doesn’t matter what your crazy uncle tells you about yesteryear.

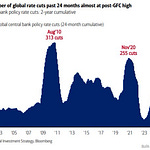

The market is broken. We have engineered a situation where the government is essentially guaranteeing asset owners will always win. They won’t let stock market investors fail in mass. That would spell the death of the US economy and there is no one in Washington that is going to sit around while that happens. The market stared down our fearful leaders and the politicians and central bankers blinked in 2008.

It was game over from that day forward. The market is going up. Bitcoin and gold are going up even more. Central banks will print money until they destroy their currencies. And all you have to do is get long and chill. It is really that simple.

Bitcoiners have been screaming about this for 15 years. Now the rest of the market is starting to catch on to the joke. Eventually even the last remaining bears will capitulate too. If they don’t, they will continue to sit on the sidelines waiting for the big crash that will never come.

There is a saying in the bitcoin world that goes “Bitcoin will stop going up when they stop printing money.” Since they will never stop, bitcoin won’t stop either. But the same is true of stocks and gold. Welcome to the new normal. Make sure you act accordingly.

Have a great day. I will talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Everyone Wants Bitcoin Now

Polina Pompliano and Anthony Pompliano discuss what’s going on with bitcoin, new regulation coming out of Washington DC, the rise of self-directed investors, athletes being paid in bitcoin, and why retail continues to beat institutions to various investment opportunities.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.