To investors,

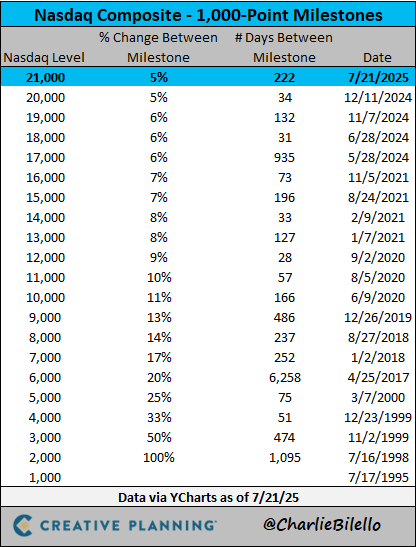

The stock market is on fire in the last few weeks. The S&P 500 and Nasdaq each hit a new all-time high yesterday. This puts a cherry on top of an incredible performance run for Nasdaq in particular. Creative Planning’s Charlie Bilello writes “the index has doubled over the last 5 years and quadrupled over the last 10 years.”

A 2x in 5 years and a 4x in 10 years. Not too shabby, right?!

As for the S&P 500, its all-time high yesterday was the 10th of the year. Not exactly what people expected earlier in the year when the media and economists were predicting a recession or a massive financial calamity. In fact, the S&P is now up 30% since the April lows. Complete defeat of the pessimists and doomsday enthusiasts.

But there is something interesting happening underneath the surface. Stocks are going higher, but retail investors are also pouring capital into money market funds at a historic pace. Adam Kobeissi writes “total retail assets in money market funds are up to a record $2.9 trillion. Since 2022, household inflows into these funds have DOUBLED. The average yield is currently 4.15%, according to the Crane 100 Money Fund Index, which tracks the 100 largest money market funds. Retail investors are chasing yield like never before.”

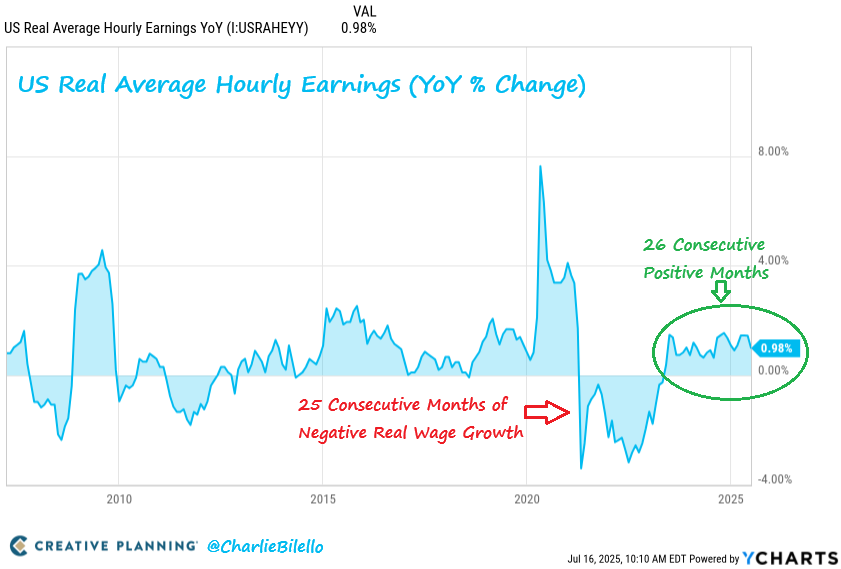

Now the only explanation for retail investors stuffing more capital into stocks AND money market funds is that these investors are somehow getting more money than normal. And Bilello shows that “wages have now outpaced inflation on a YoY basis for 26 straight months. This is a great sign for the American worker that hopefully continues.”

So your average American has more money because real wages are finally growing in a sustainable way again. They are taking that money and allocating to both the US stock market and money market funds. If there is more capital in the market, usually people become bullish. And that is exactly what the Wall Street Journal’s Rachel Wolfe and Konrad Putzier recently noticed in the economy. They wrote this weekend:

“Businesses and consumers are regaining their swagger, and evidence is mounting that those who held back are starting to splurge again.

The stock market is reaching record highs. The University of Michigan’s consumer sentiment index, which tumbled in April to its lowest reading in almost three years, has begun climbing again. Retail sales are up more than economists had forecast, and sky-high inflation hasn’t materialized—at least not yet.”

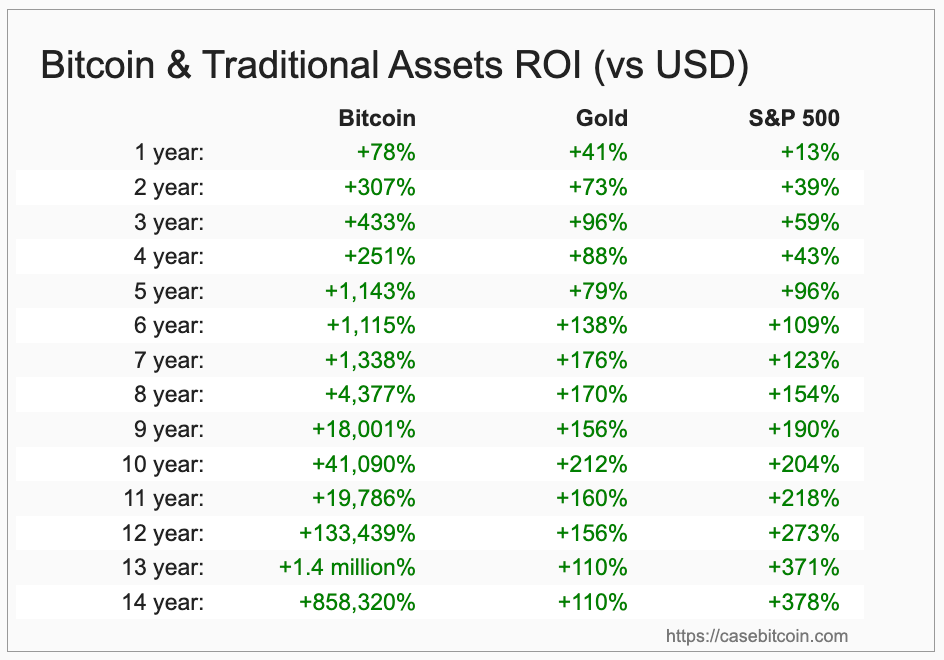

So the good times are rolling. Optimists are in control once again. Everything is smooth sailing, right? Not so fast. We are watching bitcoin and gold skyrocket in recent years. Both assets are up 27% to start the year, which signals an uneasiness investors have with the legacy system.

If you zoom further out, bitcoin and gold have both outperformed the S&P 500 over the last decade. People are realizing they have to gain exposure to sound money principles if they hope to protect themselves from currency debasement.

This is important to watch because we are watching the consensus economic views get violated in real-time. Cash-flowing companies are not necessarily going to outperform non-productive assets unless they can grow very fast. Retail investors will allocate to stocks and money market funds at the same time. And the US economy is doing much, much better than most people predicted.

There are always potential issues on the horizon to be aware of, but right now things are looking good. A strong second half of the year should bring us many more new all-time highs in stocks, bitcoin, and gold. And investors will keep winning, while those saving economic value in US dollars will continue to get punished by their undisciplined central banks and governments.

Hope you have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

The Truth About Bitcoin Treasury Companies

Will Clemente and Ben Harvey from Keyrock discuss the big report they just put together on bitcoin treasury companies, what is going on with their premiums, how to think about debt, how to think about bitcoin per share, inflation, interest rates, and where the market is headed.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.