This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

To investors,

Every business and household knows that the secret to sustainable financial success is to spend less money than you make. This simple rule can prevent bankruptcy, while ensuring that there is more money in the bank account at the end of each month or quarter. Remember, access to cash is the oxygen of a business or household.

The United States government obviously missed the memo though. The Treasury Department announced yesterday that the government spent $864 billion more than they took in as revenue in the month of June. This is more than a 10x increase in year-over-year growth of the June deficit after June 2019 only saw approximately a $8 billion deficit.

So how exactly can the US government be spending so much more money than they are making?

Frankly, the perfect storm has occurred. June 2020 saw the government spend about $1.1 trillion, which is nearly double what they have historically spent on a monthly basis. Couple this drastic increase in spending with near zero growth in historical monthly revenue (approximately $240 billion) and you get the single largest monthly deficit ever recorded in American history (previous largest monthly deficit was $234 billion).

The $1.1 trillion in spending was a direct response to the COVID-19 induced economic shock that rocked the US economy. This enormous number was part of more than $2 trillion that has been spent since April 2020, which was authorized in the monetary stimulus package approved by Congress back in March. Since then, the government has been handing out money in every way they can imagine in an effort to mitigate the economic damage. There was billions of dollars sent directly to millions of Americans in the form of stimulus checks, a significant increase in weekly unemployment benefits, and various financial relief programs for businesses of all sizes.

Another important factor to the large increase in the deficit is that the US government was previously not counting the forgivable PPP loans as part of their monthly spending. The logic behind this original decision is questionable, but the money used for PPP loans is finally being counted as government spending as of May 2020.

So the increase in spending makes sense, by what is going on with the lack of increase in tax revenues?

First off, the tax deadline was moved from April to July this year. That means that most Americans aren’t going to be sending in their final checks until after June, which drove a lack of “new” tax revenue for the month. Additionally, the government mandated shut down of most cities and local economies has led to less opportunities for traditional tax revenue as well.

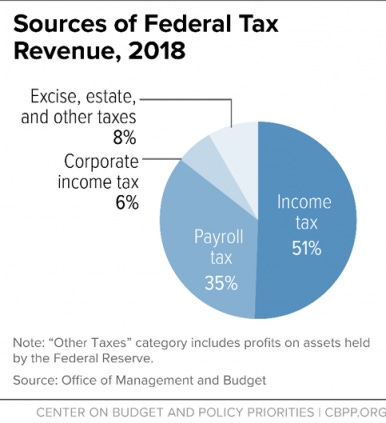

For those that don’t know, here is a breakdown of the various tax revenue sources for the federal government.

Just over 50% of all federal taxes comes from income tax and another 35% is from payroll taxes. But did federal tax revenue really stay flat? It is hard to tell, but we do know one wild statistic —Federal tax revenue has increased each of the last six full fiscal years, including an all-time high record of $3.4 trillion in fiscal year 2019. Here is a breakdown of the previous six fiscal years according to Countable:

FY2014: $3.021 trillion in revenue and $3.506 trillion in spending yielded a $485 billion deficit (2.8% of U.S. gross domestic product or GDP).

FY2015: $3.250 trillion in revenue and $3.692 trillion in spending yielded a $442 billion deficit (2.4% of GDP).

FY2016: $3.268 trillion in revenue and $3.853 trillion in spending yielded a $585 billion deficit (3.2% of GDP).

FY2017: $3.316 trillion in revenue and $3.982 trillion in spending yielded a $665 billion deficit (3.5% of GDP).

FY2018: $3.329 trillion in revenue and $4.108 trillion in spending yielded a $779 billion deficit (3.8% of GDP).

FY2019: $3.4+ trillion in revenue leading to a $984 billion deficit.

So wait a minute, if the federal government continues to collect more and more money each year, why are we generally running a larger deficit every year as well? Welp, it is because we continue to spend more and more money. The US government is breaking the number one rule in finance of spending less than you make.

Government spending is a black box to most people, but once you start to dig into the details it can become fairly crazy almost immediately. For example, 40% of the $3.8 trillion spent in fiscal year 2018 was for Americans over the age of 65. As the US population continues to get older, we will spend 50% or more on people over the age of 65 by the end of the 2020s.

Additionally, as the national debt continues to increase, so does the amount of money needed to service the debt. The current US national debt sits at over $26 trillion. Yes, you read that right. The US government has more than $26,000,000,000,000 in debt. Absolutely mind blowing. The cost of servicing this debt is over $400 billion on an annual basis.

So the United States is spending almost half a trillion dollars to service the ever-expanding national debt that has no end in sight. Estimates from the CBO state that the cost of servicing the national debt annually will come close to $1 trillion by the end of the decade.

In essence, the United States is basically a poorly run company. This would be like a business that spends WAY more than it makes every year and even though it continues to collect more revenue each year, it actually ends up losing more money year after year. The only way that a company like this could survive is if they (a) stopped outspending their incoming revenue or (b) they went to the capital markets and raised equity or debt capital.

Thankfully for the US government, they are not a business though. They don’t have a plan for reigning in the spending and I would even argue that they wouldn’t be able to without an entire generation of baby boomers rioting in the streets. They also don’t have to go to the capital markets because they have access to the one thing that companies don’t — the Federal Reserve’s money printer.

This is the only way that the United States can continue operating in the way that they are. They have to print and print and print and print. They literally can’t stop printing money or they will succumb to the absurd debt levels and outstanding expenses that have to be paid on an annual basis. Some people may think of this a modern day magic trick. Others may consider it the most sophisticated ponzi scheme ever invented. And still others believe this is the only way to manage an economy that believes in innovation, entrepreneurship, and capitalism.

Rather than debate the merits of the system’s structure, it is increasingly clear that one of two things will happen in the future — the system will break under the increasing pressure and/or the currency will fail after being devalued for decades. We have seen both things occur in other countries, but the American elitism held by most of the wealthy in our country has created and embedded a belief that these economic travesties could never occur in the United States.

This incredible level of arrogance is likely to be a contributing factor to the fall of the American empire. It is unclear whether that is a decade away or hundreds of years in the future, but a few things are indisputable:

You can not create trillions of dollars in deficits and hope you never have to deal with the consequences.

You can not print trillions of dollars and hope there is no negative impact on the currency or the poorest people in your society.

There is a strong argument that the Federal Reserve and US government’s recent actions helped to mitigate the economic pain of COVID-19 for millions of Americans in the short term. But to be clear, that is exactly what has happened. We chose to deal with the short term issues at the detriment of the long term sustainability of the system. Some people believe that is the right decision and others do not.

Regardless of what side you are on, the trade-off is clear. Save people today and accelerate your demise tomorrow. Or sit and watch people suffer today to increase your odds of surviving in the long term. These are difficult decisions that have no clear answers. It definitely doesn’t help though that the government just ran the largest monthly deficit in American history.

We are not getting better at managing the finances of our country. In fact, we are getting worse and worse. There is no solution in sight and every politician, regardless of their political affiliations, continues to treat the P&L of the United States like something that future generations should deal with. Those future generations will definitely deal with it, the problem though is that it is likely going to be too late based on the pace we are operating at currently.

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

THE RUNDOWN:

Bank of England Debating Digital Currency Creation, Bailey Says:The Bank of England is reviewing whether it should create a central bank-backed digital currency, according to governor Andrew Bailey. “We are looking at the question of, should we create a Bank of England digital currency,” Bailey said Monday in a webinar event with students. “We’ll go on looking at it, as it does have huge implications on the nature of payments and society.” Read more.

Compound Tops $1B in Crypto Loans as DeFi Farmers Keep Digging for Yield: Compound, the leading lending protocol on Ethereum, has broken a billion dollars in total assets borrowed, according to the tracker on its website. This is the latest milestone for a project that has led the yield farming craze in decentralized finance (DeFi), where both large and small investors search for the best place to park their assets in order to earn the strongest returns. Read more.

Singapore Enters Recession After Economy Shrinks More Than 40% Quarter on Quarter: Singapore’s economy entered a technical recession after shrinking by 41.2% in the second quarter compared to the previous quarter, advance estimates by the Ministry of Trade and Industry showed on Tuesday. The latest gross domestic product estimate — computed largely from data in April and May — was worse than analysts’ forecast. Economists polled by Reuters had expected the Southeast Asian economy to shrink by 37.4% quarter-over-quarter. Read more.

SoftBank Hires Goldman Sachs to Explore Sale Options for Chip Designer Arm: SoftBank has hired Goldman Sachs to explore both an initial public offering and a sale of U.K. chip designer Arm Holdings. SoftBank has been preparing to spin out Arm in an IPO but has recently begun exploring sale options after receiving interest from an outside party, said two people, who asked not to be named because the discussions are private. It’s unclear if the outside company or entity is interested in buying all or just part of Arm, which was acquired by SoftBank for about $32 billion four years ago. Read more.

Crypto Firm Co-Founder to Plead Guilty in Celeb-Touted Scam: The third co-founder of a cryptocurrency firm plans to plead guilty to duping investors into putting more than $25 million in an initial coin offering that the company promoted with the help of celebrities including boxer Floyd Mayweather and musician DJ Khaled. Sohrab “Sam” Sharma, co-founder of Centra Tech Inc., has agreed to change his plea, his lawyers told U.S. District Judge Lorna G. Schofield in a court filing Monday in New York. Sharma had been scheduled to go to trial in November. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Mikey Taylor is a former professional skateboarder who now spends his time investing in real estate across the United States at Commune Capital. He previously founded and sold Saint Archer Brewery to MillerCoors, along with running a number of other businesses that he started. This episode is fast-paced and full of great business nuggets. It is always fun to talk with someone who has found success in multiple industries.

In this conversation, Mikey and I discuss:

Mikey's epic run as a pro skateboarder

Learning to be an entrepreneur

How he used self-evaluation to pursue self-improvement

How the Saint Archer acquisition happened

What he is seeing happen in the real estate market

Why market cycles are essential to understand

I really enjoyed this conversation with Mikey. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

We have started a new show exclusive to YouTube called Lunch Money. The goal is to cover current events in business, finance, and technology from the perspective of the every day citizen, rather than the talking heads on television. It is just as funny and entertaining as it is educational. Hope you enjoy it and make sure you go subscribe to the YouTube channel!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Helium Hotspots allow you to earn cryptocurrency by building a new wireless network for the Internet of Things and creating a more connected future in your city. Get $50 off your Helium Hotspot by going to helium.com and using my special code POMP at checkout.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post