To investors,

Government spending is out of control. We already knew that, but now we have data that suggests the problem is getting worse and at an alarming pace.

Our friends at Geiger Capital were rightfully outraged at the February spending deficit:

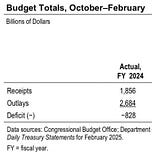

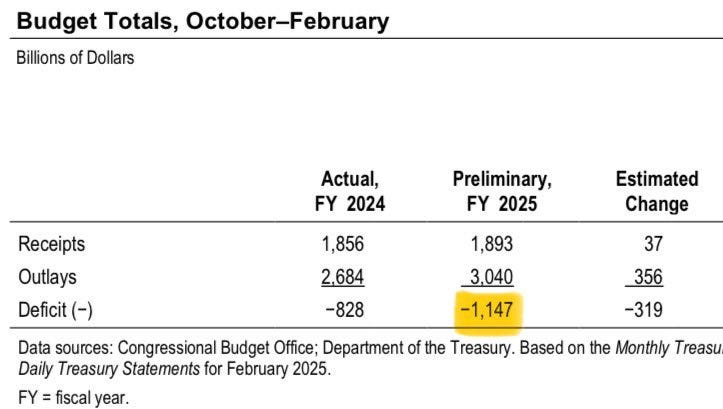

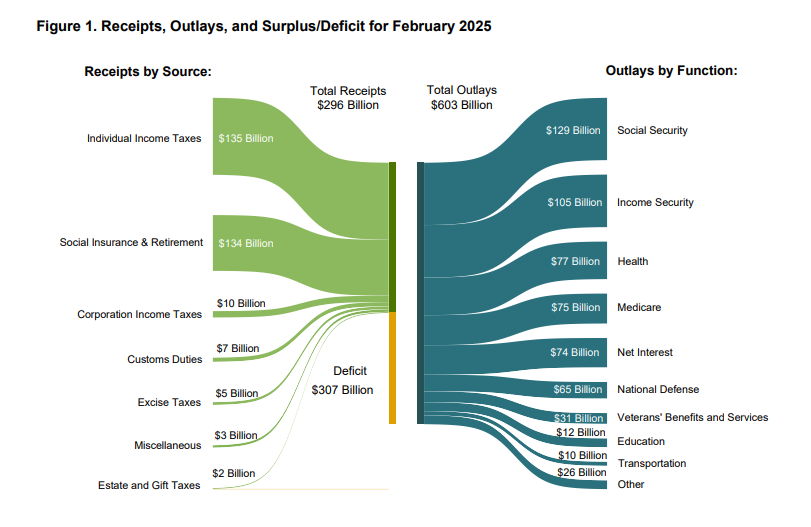

“In the month of February, the US Government collected $297 Billion. Just one problem… They spent $605 Billion.

A $308 BILLION deficit. In one month.”

But the problem is not confined to only February. The first five months of the fiscal year have been disastrous at best. Geiger Capital says:

“The train is out of control… The first five months of FY 2025 produced a deficit of $1.15 TRILLION. That’s $319 Billion more than the deficit recorded in the same period last fiscal year.

We’re running a $2.75 TRILLION annual deficit.”

As if it wasn’t bad enough to see a widening deficit, Heritage’s EJ Antoni explains that “51 cents out of every dollar the federal government spent in February was borrowed!”

It is impossible to state how serious of a problem the national debt has become.

Not only has every recent President overseen an explosion in the annual deficit, but we have financed our out-of-control spending with debt because politicians are incentivized to spend everyone else’s money.

Spending more money than you take in as income can only end in one way — disaster!

But government spending is part of a much larger story. We are a country that became dependent on the government. The United States was built on the idea of a small government and a powerful private sector, but we lost our way in recent years.

Mike Zaccardi points out a recent Bank of America investment note that puts it perfectly:

“In 2024, the US had never been more government-dependent: for 85% of job growth, 33% of all spending, 6-7% budget deficits; all record highs ex-crisis.”

One area where you can see the increased dependency on the government is what percentage of someone’s personal income comes from the government. The bipartisan Economic Innovation Group point out a report last year stating:

“Income from government transfers is the fastest-growing major component of Americans' personal income. Nationally, Americans received $3.8 trillion in government transfers in 2022, accounting for 18 percent of all personal income in the United States. That share has more than doubled since 1970.”

The most insane part of the report is what happened in the approximately 50 years from 1970 to 2022. We went from less than 1% of counties in the US receiving 25% or more of their personal income from government transfers to now more than 53% of all counties receive a quarter or more of their personal income from government transfers.

1% to 53% in 50 years. Absolutely insane.

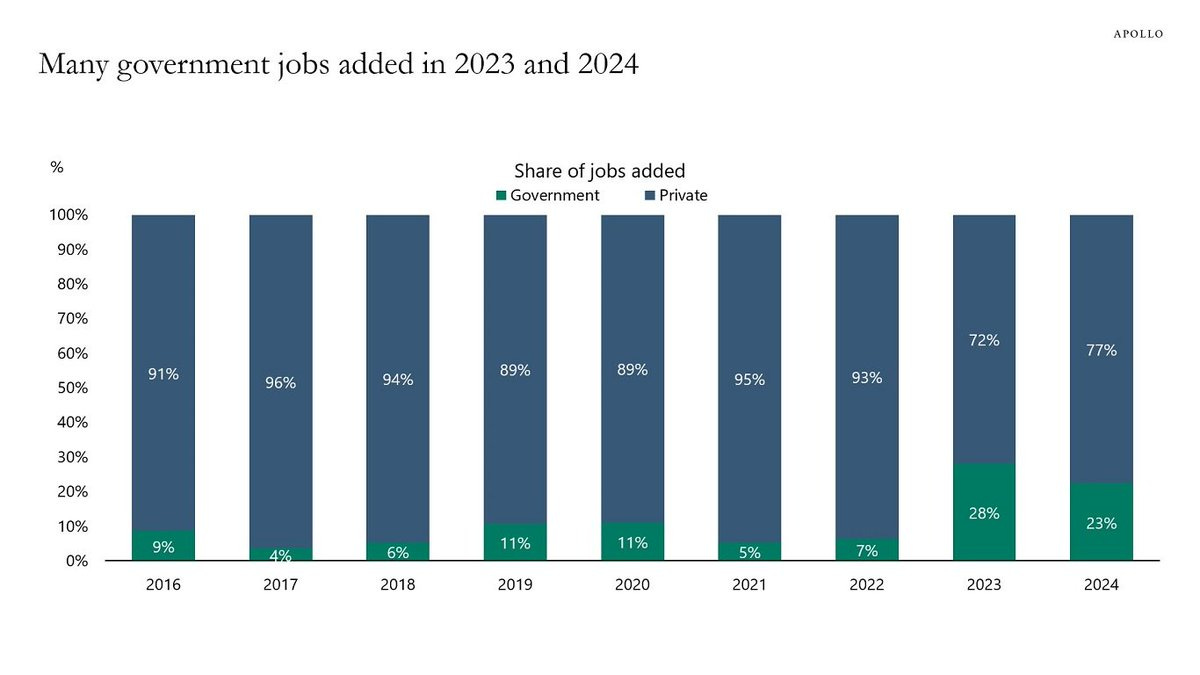

But there is even more nonsense to be found. Our friends at Unusual Whales have been hard at work uncovering the absurdities in the US economy for years. Did you know that 25% of jobs added to the US economy in the last two years were government jobs? Now you know.

According to Apollo, that number is up from 5% in 2021 and 7% in 2022.

The United States has become dependent on the government. The government is responsible for blowing out the US debt because we have zero discipline when it comes to spending.

We don’t have a revenue problem, we have a spending problem. Both political parties are responsible for this mess. And nothing is going to change unless the Department of Government Efficiency is successful and politicians realize there are consequences for a lack of fiscal discipline.

But I wouldn’t hold my breath.

Out-of-control government spending makes a lot more sense once you understand that most government spending is a legal way to convince people to vote for a certain politician. Show me the incentive and I'll show you the outcome.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

This Public Company Wants To Buy More Bitcoin

Eric Semler is the Chairman of Semler Scientific, Founder of TCS Capital Management, and serves on the board of Fundstrat Global Advisors. This conversation was recorded at Bitcoin Investor Week in New York.

In this conversation we talk about why Semler Scientific put bitcoin on the balance sheet, feedback from customers and shareholders, challenges, thinking through leverage percentage, potential market reaction if companies start to sell bitcoin, and more.

Enjoy!

Podcast Sponsors

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit here to learn more.

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot - a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post