To investors,

The big question in financial markets over the last two weeks has been “is Donald Trump intentionally trying to tank the US stock market?”

This would have been an absurd question before the inauguration. The general thought process was President Trump is a businessman and investor. He measures the health of the US economy through the stock market performance, so you can expect the stock market to go up if Trump becomes President.

I know this was the consensus because I believed it too.

There was no obvious reason why Trump would allow the US stock market to drop, let alone take actions to crash the market himself.

But that is exactly what is happening now.

Here is President Trump talking over the weekend about his plan to get interest rates and energy down:

Kris Patel and Amit Is Investing highlight how this plan works:

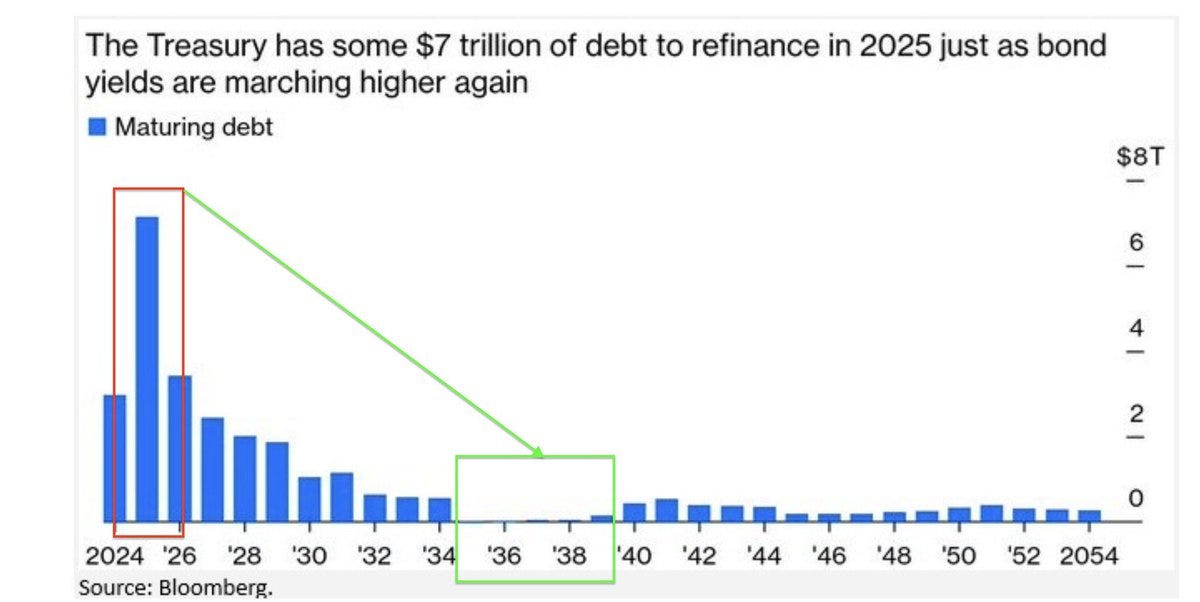

1. We have $7T of debt we need to pay in the next 6 months…if we don’t pay it, we’ll have to refinance.

2. The Trump admin does NOT want to refinance at a 4%+ rate…the 10yr at one point this year was 4.8%.

3. How do you get the 10yr to come down? Markets need to show weakness in growth, DOGE has to be perceived as actually working, interest rates need to come down.

The way to do that is to create massive uncertainties — aka tariffs — which can slow down growth in the short term, get the bond market to start BUYING bonds ASAP because of how scared they are of touching stocks (causing yields to fall which is what we need to refinance the debt) and then that gives the Fed the authority to lower rates which continues to bring yields down.

So, although conventional wisdom says tariffs are inflationary and the 10yr should be spiking on more tariffs — it’s actually going down because its bringing so much uncertainly to equity markets that people are selling stocks and buying bonds! Which is exactly what the Trump administration wants to happen in the short term in order to bring refinancing costs down.

Now this is not the easy way to get interest rates down. The easy way was to have the Federal Reserve cut interest rates at the start of the year, but that didn’t happen.

In fact, many of you may remember that Trump kept telling Jerome Powell to cut interest rates last year. Powell was public in his defiance of Trump’s request, so now Trump and Scott Bessent are taking matters into their own hands.

They are crashing asset prices in an attempt to force Jerome Powell to cut interest rates. We will see who blinks first.

Don’t believe me? Here is Trump explicitly saying you can’t watch the stock market right now:

So the entire administration has their eyes on the 10-year Treasury yield. But even without Powell stepping up to the plate and slashing interest rates, we have already seen the 10-year drop from 4.8% in January to 4.25% this weekend.

That is a good start. We are going to need much more movement on interest rates though if we want to have a profound impact on our refinancing costs.

Lower interest rates don’t merely affect the US government though. The drop in interest rates since the start of the year have helped drop mortgage rates as well. Kris Patel points out “as interest rates decline, more buyers will emerge, but so will many sellers. We need the housing market to thaw.”

Housing is not the only game in town that benefits from lower interest rates. Perplexity, my favorite AI search engine, explains:

“Lower interest rates generally benefit American consumers by reducing borrowing costs, making it cheaper to finance large purchases such as homes, cars, or education through loans or mortgages. This can also increase disposable income, encouraging spending on big-ticket items and boosting economic activity”

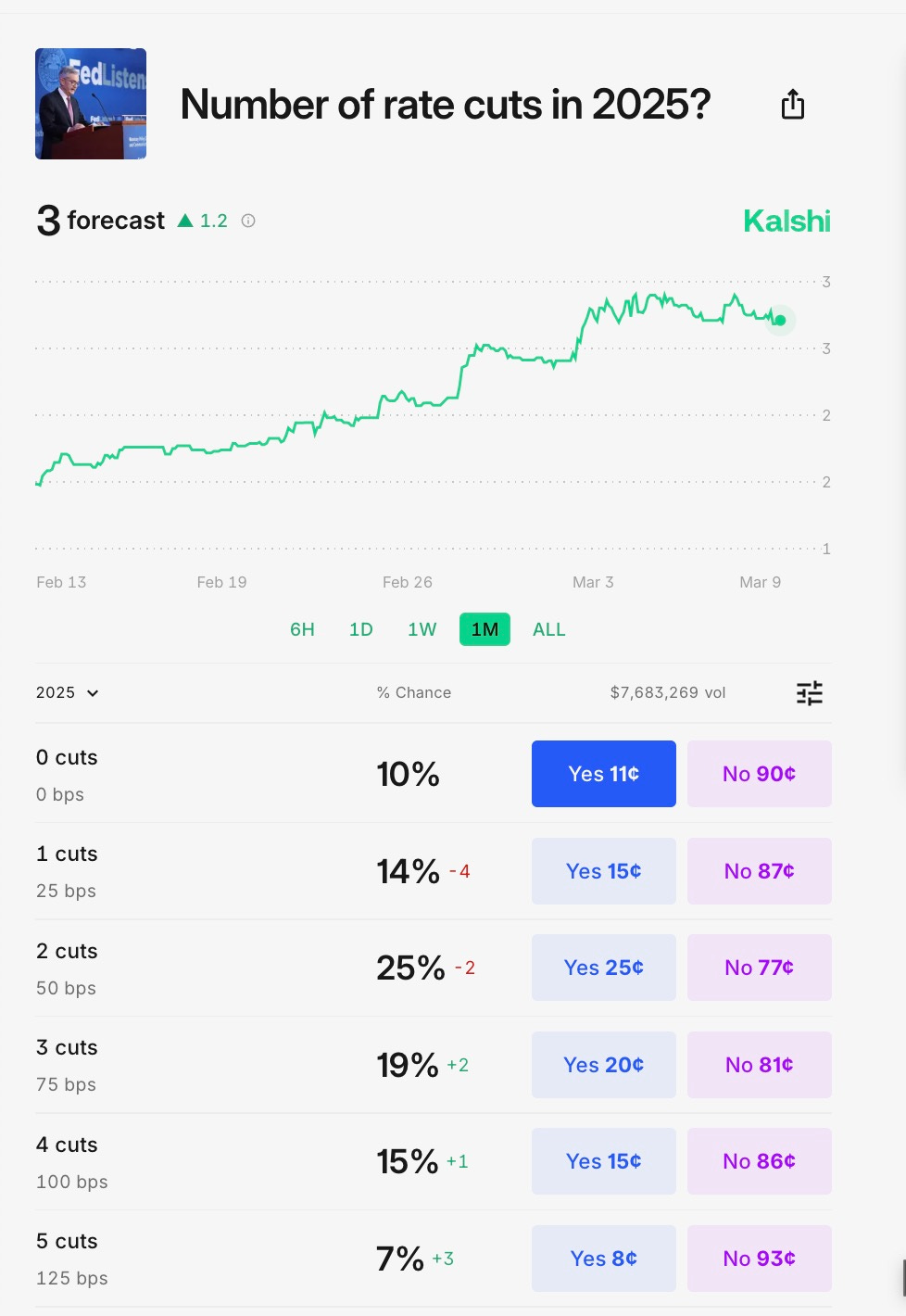

So how many interest rate cuts can we expect in 2025? Prediction market Kalshi says the market has increased its expected number of rate cuts. It now gives >75% odds of two or more cuts this year.

Kalshi is also showing a 38% chance of a recession this year.

So is Donald Trump, Scott Bessent, Howard Lutnick and the current administration trying to pull down asset prices? Absolutely.

They claim to be focused on Main Street over Wall Street. The big goal is to get interest rates down, which will lead to more economic activity thanks to the access to cheap capital.

This is not your grandfather’s economy. And this is not your grandfather’s economic policy. No wonder there is so much controversy over the strategy — people hate new things, especially when they are bold bets coming from one side of the political aisle.

But if we end up with lower interest rates and can somehow avoid a recession, then we will all have to tip our cap to the current leadership team. I don’t envy their position. Something new has to be done since we can’t continue on the path we are on. Let’s all hope this plan works. Millions of Americans are depending on it.

Have a great start to your week. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Why Bitcoin Crashed After Trump Strategic Reserve News

Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.

In this conversation we talk about what is going on with tariffs, how it’s impacting the economy, how to think about the bitcoin strategic reserve, and what investors are currently thinking about.

Enjoy!

Podcast Sponsors

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot - a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post