Today’s Letter Is Brought To You By A Golden Visa for the Bitcoin-Forward Investor!

Bitizenship helps Bitcoiners secure EU residency and a path to Portuguese citizenship, without abandoning their long-term thesis.

Bitizenship Helps You:

✔ Unlock visa-free travel across Europe

✔ Secure residency with minimal physical presence

✔ Maintain Bitcoin exposure through a regulated structure

✔ Set up a future-proof Plan B for your family

✔ Gain one of the world’s strongest passports in 5 years

Time-Sensitive Update: Portugal may pass new citizenship rules within the near future, doubling the timeline to 10 years.

Lucky for you, there’s time to lock in the current law if you act now.

To investors,

It is easy to get lost in the weeds of the day-to-day developments in finance. You have to keep track of individual stocks, different economic reports, geopolitical news, interest rate decisions, and much more. Information comes at you fast and furious.

If you are not careful, you will get sucked into the daily gyrations of markets and miss the most important things sitting right in front of your face. I recently forced myself to go through an exercise that created immense clarity for me.

I asked myself “if you could only pick one data point or trend that matters for the next decade, what would it be and what should you do in your portfolio to benefit?”

This thought exercise had many potential answers — artificial intelligence is obviously going to be big, humanoid robots will probably be more abundant than humans globally, and the innovations happening across space, biotech, drones, or self-driving cars can’t be ignored either.

But none of these themes struck me as the single most important thing.

The only answer I kept coming back to was “they are never, ever going to stop debasing the US dollar.” It is really that simple. The national debt is exploding higher and the United States will have to systematically debase the currency, which means all assets priced in dollars are going much higher.

And we are already seeing the effects of this mess.

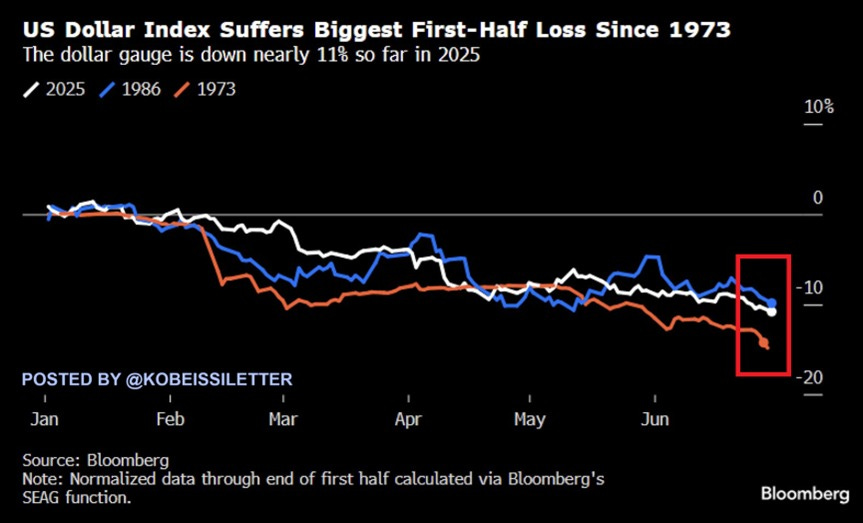

Adam Kobeissi highlights “This has been one of the worst years in history for the US Dollar: The US Dollar index fell -10.8% in the first half of 2025, its worst first-half performance since the end of the gold-backed Bretton Woods System in 1973.

This also marks the weakest performance for any six-month period since 2009. Furthermore, the Bloomberg Dollar Spot Index has posted its 6th consecutive monthly decline, matching its longest losing streak in 8 years.”

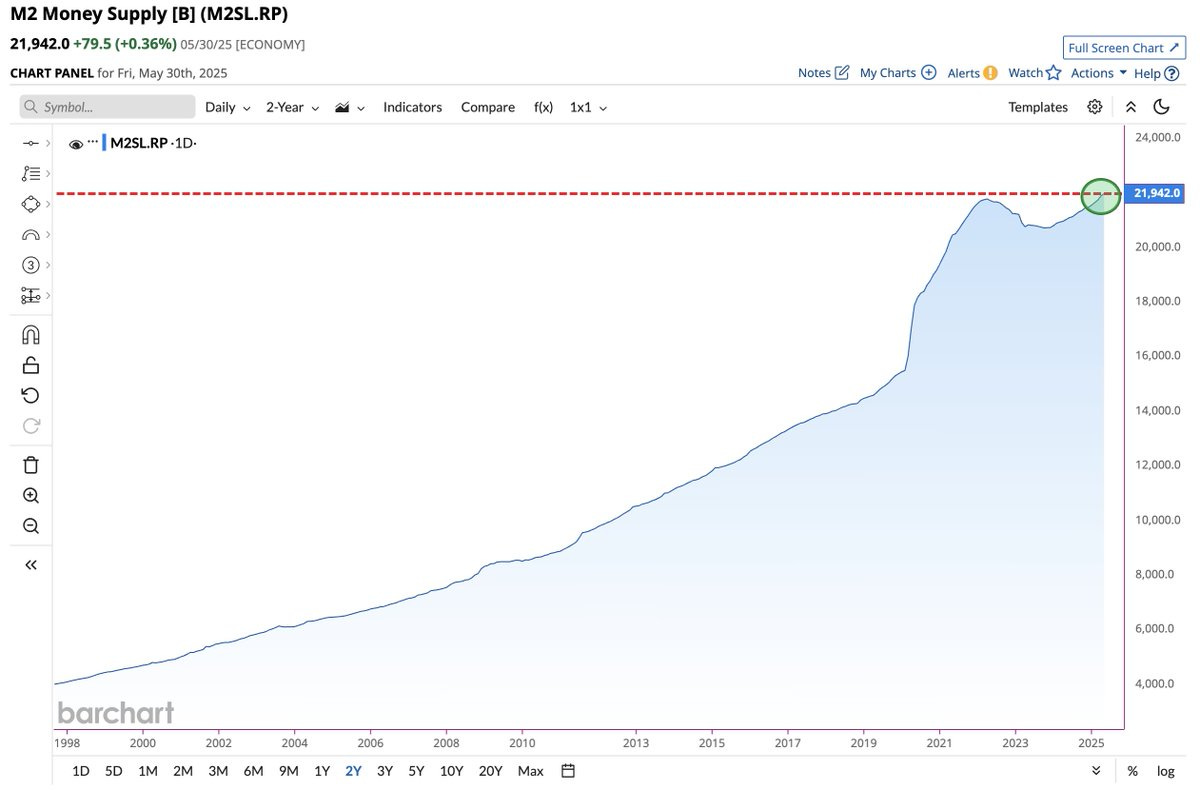

And as if that was not bad enough, Adam goes on to show “the US M2 money supply jumped +4.5% year-over-year in May, to a record $21.94 trillion. This marks the 19th consecutive monthly increase. It has now surpassed the previous all-time high of $21.86 trillion, posted in March 2022. Furthermore, inflation-adjusted M2 money supply rose 2.1% year-over-year last month, the largest increase since early 2022. Since 2020, the US M2 money supply has risen nearly $7 trillion, or ~45%. The US Dollar's purchasing power is in an eternal bear market.”

Take a look at this visual from Barchart:

You don’t have to be Albert Einstein to see the long-term trend. Just open your eyes. So the question becomes — what the heck do you do if the government is going to destroy the purchasing power of the US dollar?

Simple, you buy as much bitcoin as you possibly can.

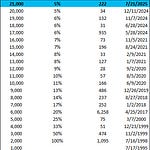

Why would you do that? Based on research from Sam Callahan and Lyn Alden, Bitcoin has become the global liquidity barometer. Their report points out “Bitcoin moves in the direction of global liquidity 83% of the time in any given 12-month period, which is higher than any other major asset class, making it a strong barometer of liquidity conditions.”

So stop getting caught up in the day-to-day noise of financial markets. Zoom out for a second. Ask yourself: what is the single most important trend for the next decade and what should I do about it?

For me, it is clearly the US dollar debasement that is going to continue happening. And bitcoin is the solution to the undisciplined monetary and fiscal policy.

It may sound crazy, but the bitcoiners are right. And they have meme’d the solution into a $2 trillion asset that Wall Street is now clamoring to get their hands on. What an incredible world we live in.

Hope you all have a great day. I’ll talk to everyone after the July 4th holiday.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

The King of Crypto: CZ’s Rapid Rise

CZ is the founder of Binance, and is one of the most successful entrepreneurs of our lifetime.

In this conversation we talk about when he first bought bitcoin in 2013, his childhood with no electricity or running water, career before finding bitcoin, starting Binance, managing bear and bull cycles, regulation, his time in prison, and what the future may hold for CZ and the crypto market.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post