Today’s letter is brought to you by Osprey Funds!

The Osprey BNB Chain Trust (OBNB) is the first U.S. tradable ticker for BNB and provides secure exposure to BNB right from your brokerage account—no custodial wallets or private keys required. Due to its unavailability on centralized exchanges in the U.S., OBNB offers one of the only paths for U.S. investors to access BNB exposure via USD.

To investors,

Rumors continue to circulate about the White House Crypto Summit planned for this Friday in Washington DC. This will be the first time industry leaders meet in a public setting with the President’s working group to discuss key issues related to bitcoin and the cryptocurrency industry.

One of the main topics of conversation leading up to this meeting has been the Strategic Bitcoin Reserve. President Trump promised on the campaign trail that he would implement a bitcoin-only reserve, but more recently posted online that a crypto-related reserve would include altcoins like ETH, SOL, XRP, and ADA.

The backlash on the proposed bait-and-switch was loud and swift. Most people in the crypto industry, including those who hold some of the altcoins mentioned, agreed the country’s strategic reserve should be bitcoin only. As I wrote earlier this week, there is nothing strategic for the US with the altcoins.

But it looks like the administration understands this point.

Commerce Secretary Howard Lutnick gave an interview earlier today and explicitly called out the different treatment of bitcoin. He shared the following statement with The Pavlovic media outlet:

“The President definitely thinks that there’s a Bitcoin strategic reserve. Now, there will be the question of, how do we handle the other cryptocurrencies? And I think the model is going to be announced on Friday when we do that.

A Bitcoin strategic reserve is something the President’s interested in. He spoke about it all during the campaign trail, and I think you’re going to see it executed on Friday.

So Bitcoin is one thing, and then the other currencies, the other crypto tokens, I think, will be treated differently—positively, but differently.”

This is an important development in the broader conversation. If the United States creates a strategic bitcoin reserve, without the altcoins, then most bitcoiners will feel like Trump delivered on his campaign promise.

Does that mean he will be abrasive towards the other coins? No, not at all. He can be supportive of other coins without putting them in the country’s strategic reserve.

My guess is that is where we end up, but we will learn more on Friday.

In the meantime, there are a few trends worth paying attention to across the bitcoin network. For example, the balances on exchanges continues to plummet, which suggests bitcoin holders are unwilling to sell their bitcoin at these levels.

Prices will have to substantially increase in order to unlock more liquidity from the long-term holders. What could drive that substantial increase in price?

More buying from various sources.

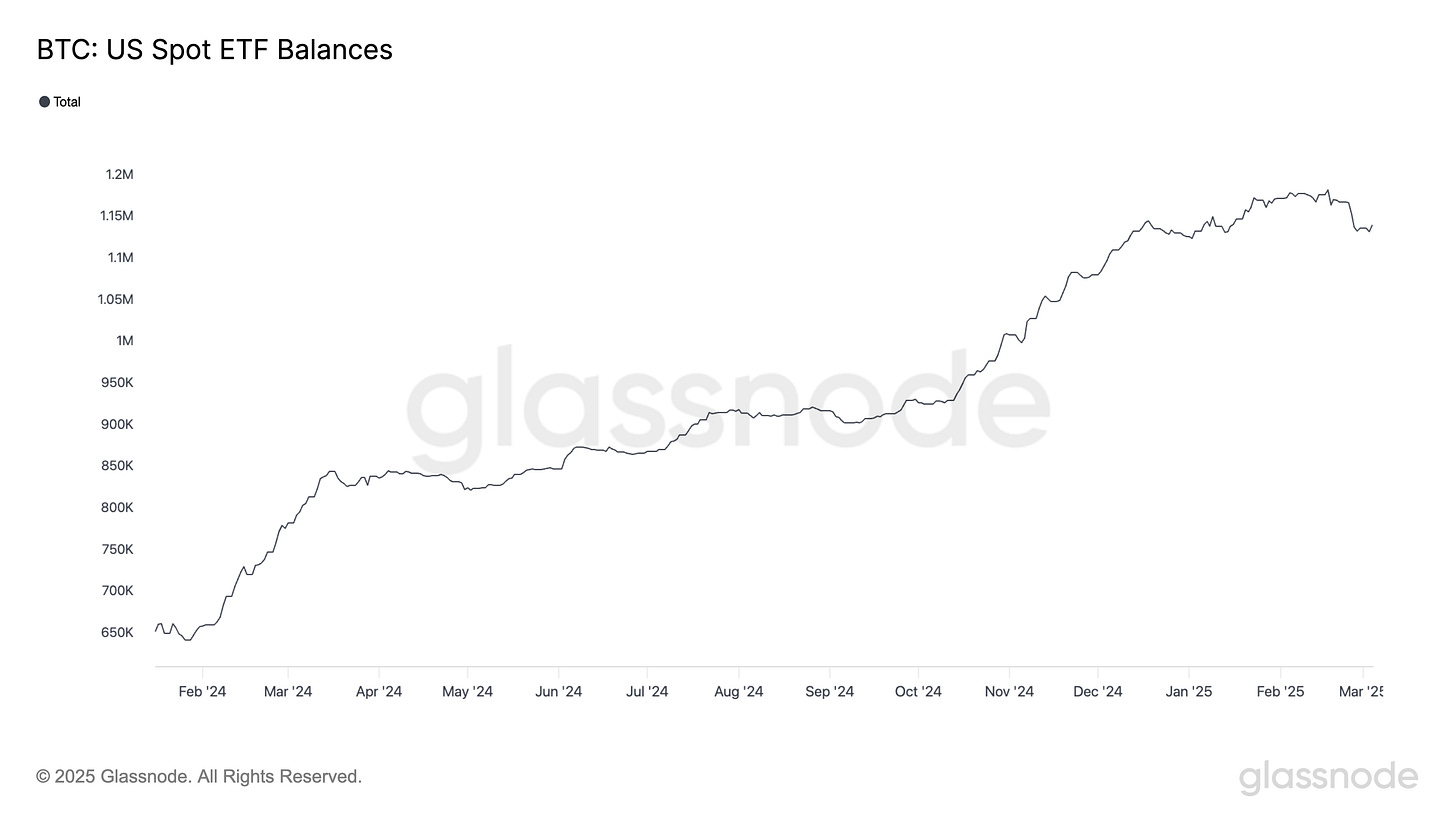

You can see here the ETFs continue to accumulate more bitcoin regardless of the price action. The collective funds started with approximately 650,000 bitcoin in January 2024 and today hold nearly 1,140,000 bitcoin for various investors.

The ETFs are not the only buyers either. Take a look at Japan’s Metaplanet. They continue to acquire as much bitcoin as possible for their balance sheet, including 497 bitcoin in the last 24 hours.

That number 497 is important because that means one company bought more than 100% of all the new bitcoin that was created yesterday and put into circulation. It doesn’t take a genius to realize the price has to go up if people and companies are buying more bitcoin each day than what is being created.

Supply and demand is one hell of a concept. This brings us back to the White House Crypto Summit on Friday — if the United States announces a strategic bitcoin reserve that includes the nation buying more bitcoin, all bets are off on what could happen to the digital assets’ price.

There will be a lot of speculation between now and Friday. But something tells me we are going to get fireworks in DC to close out the week.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Darius Dale Explains Why The Government May Be Crashing The Market On Purpose

Darius Dale is the Founder & CEO of 42Macro.

In this conversation we talk about global liquidity, what’s going on with inflation expectations, why the government may be tanking the market for a foundation of strength, and how this impacts asset prices.

Enjoy!

Podcast Sponsors

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

SimpleMining -

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post