To investors,

Don’t read mainstream financial news headlines today. If you do, you will be told the world is ending and the market is crashing. You will see doom and gloom everywhere. If you aren’t careful, you may believe that asset prices are destined to fall forever and your portfolio will never recover.

This is all nonsense though.

Another way to describe the current market is that the S&P 500 is flat over the last 6 months.

That is right — insane! Traditional investors are freaking out in recent weeks, yet the stock market is still slightly positive over the last 180 days. Not exactly the big market crash that you were programmed to believe.

But maybe the S&P 500 is an outlier.

What about the Nasdaq 100? Also slightly up in the last 6 months.

Maybe the Dow Jones Industrial Average is different? Nope. That index is up 1.4% in the last 180 days.

Think of how absurd this is — Wall Street is not freaking out because they lost money in the last 6 months, but rather because they didn’t make an absurd amount of money.

The story gets even crazier if you look past stocks though.

Gold is up 15% over the last 6 months.

Bitcoin is up 43% over the same time period.

“Zoom out” is a common phrase repeated by investors who are holding assets that are going down in price, but these investors are usually talking about multi-year timeframes. Zooming out to the last 6 months tells a very different story than what is being portrayed in the mainstream media.

But lets say you think 6 months is an unfair time period to evaluate. The big, bad market crash has been happening in recent days, right?

Let’s define a market crash if we want to try to identify it.

According to Perplexity, my favorite AI search engine, “a stock market crash is typically declared when there is a sudden, steep decline in stock prices across a major index or market, often exceeding 10% within a single day or over a few days.”

Obviously the S&P 500 has crashed in recent days, correct? Wrong! The S&P is not even down 4% in the last 5 days.

The major index hasn’t fallen 10% in the last month either. So much for that big market crash.

In fact, none of the three major indexes have fallen more than 5% in the last 5 trading days. The traditional definition of a 10% drawdown being a crash has not been met, so all the hysteria is misplaced.

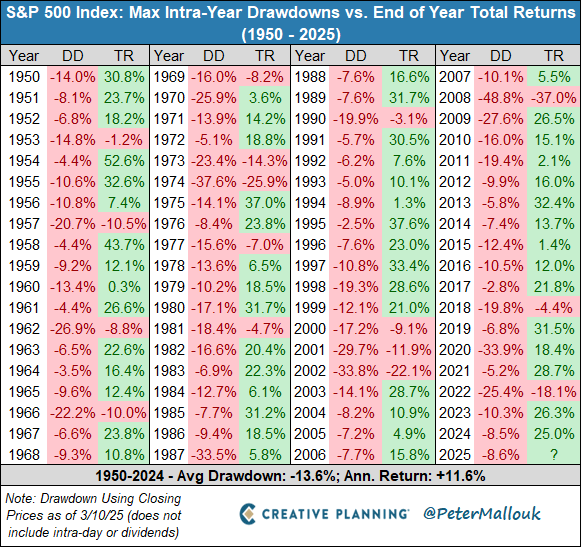

Creative Planning’s Peter Mallouk points out “the S&P 500 is down over 8% from its February closing high. Over the last 75 years, the average intra-year market drop has been close to 14%.”

We aren’t even close to the average intra-year drop yet.

Maybe you think President Trump is worried about the recent price volatility? It appears he is unfazed by what is happening. Here he is telling the media that markets go up and down:

The stock market may have gone up and down, but it is flat over the last 6 months. Not a bad trade considering inflation has dropped 50% in the last 60 days and items like gas, eggs, and other staple consumer items are quickly falling to more affordable levels.

Remember, we are up 153% since COVID and 646% since the Global Financial Crisis.

Next time someone starts complaining about the market “crashing,” remind them you aren’t allowed to complain if you are still making money in the last 6 months. And you definitely aren’t allowed to complain if you are outperforming the stock market average for more than a decade.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Jack Mallers Thinks Bitcoin Is Going Much Higher

Jack Mallers is the Founder & CEO of Strike. This conversation was recorded at Bitcoin Investor Week in New York.

In this conversation we evaluate nation state adoption of bitcoin, what happens when US starts to accumulate bitcoin, how bitcoin can help Americans, operating on a bitcoin standard as a private company, bitcoin cycles, regulation, Wall Street, and what Jack thinks the future of bitcoin looks like.

Enjoy!

Podcast Sponsors

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit here to learn more.

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot - a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post