Today’s letter is brought to you by Espresso Displays!

I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop.

So I started to use a second screen and it seems to have fixed the issue.

It took awhile to evaluate many different screens — Espresso Displays was by far the best one.

I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself.

Any reader of The Pomp Letter who orders one today will get $100 off before midnight. Highly recommend!

To investors,

Liquidity drives asset prices. As liquidity increases, asset prices go up. As liquidity is drained, asset prices go down. This is a fairly well understood phenomenon in economics and the professional investment community.

Historically, the problem is that liquidity can be very difficult to track. I recently met the team behind Liquidity Wiz and have been impressed with their product. It tracks liquidity by allowing the user to cut the data in a variety of different ways. As a disclaimer, I have no financial relationship with the company and am not incentivized to share their product. I am just a fan, but figured we could do a deep dive today on global liquidity using their data.

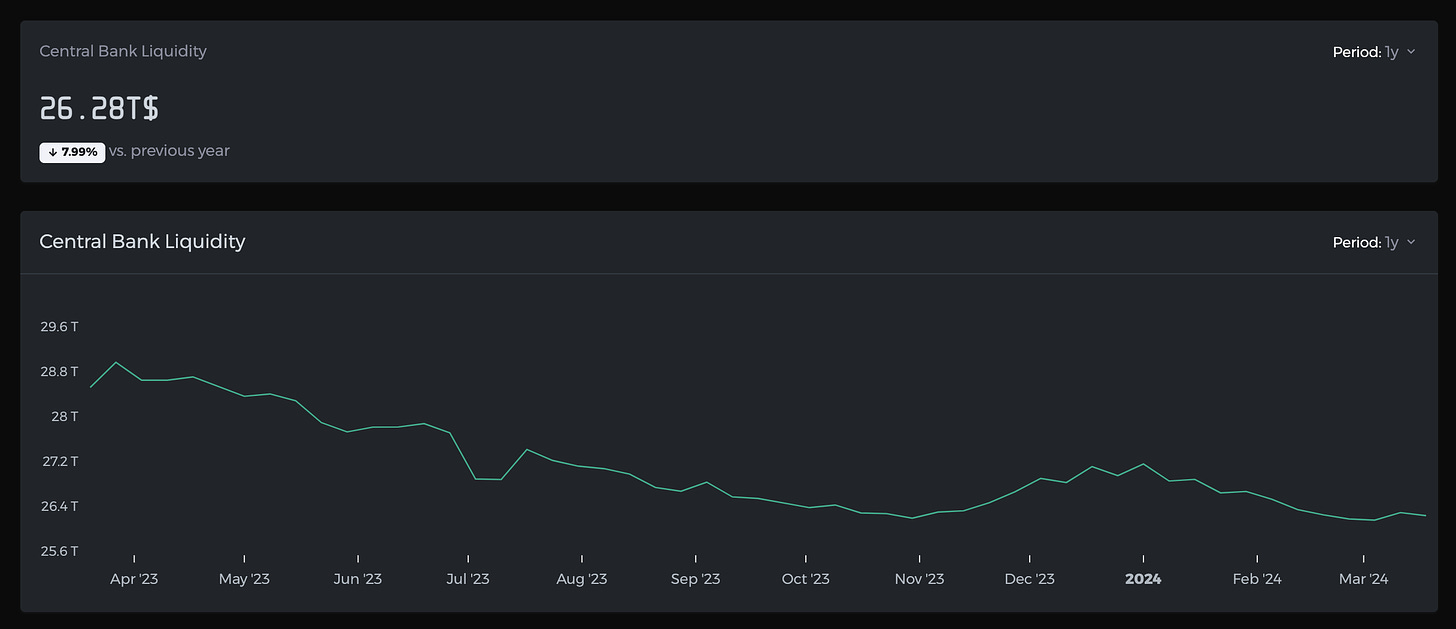

First, we can see that global liquidity is down approximately 8% over the last 12 months.

If we drill into the broad money supply growth by country, we can see that global liquidity has been driven by China’s continued expansion (blue line below).

It doesn’t hurt that China is not only growing their broad money supply, but they are also the largest country in the world by money supply with double the United States’ $20.8 trillion.

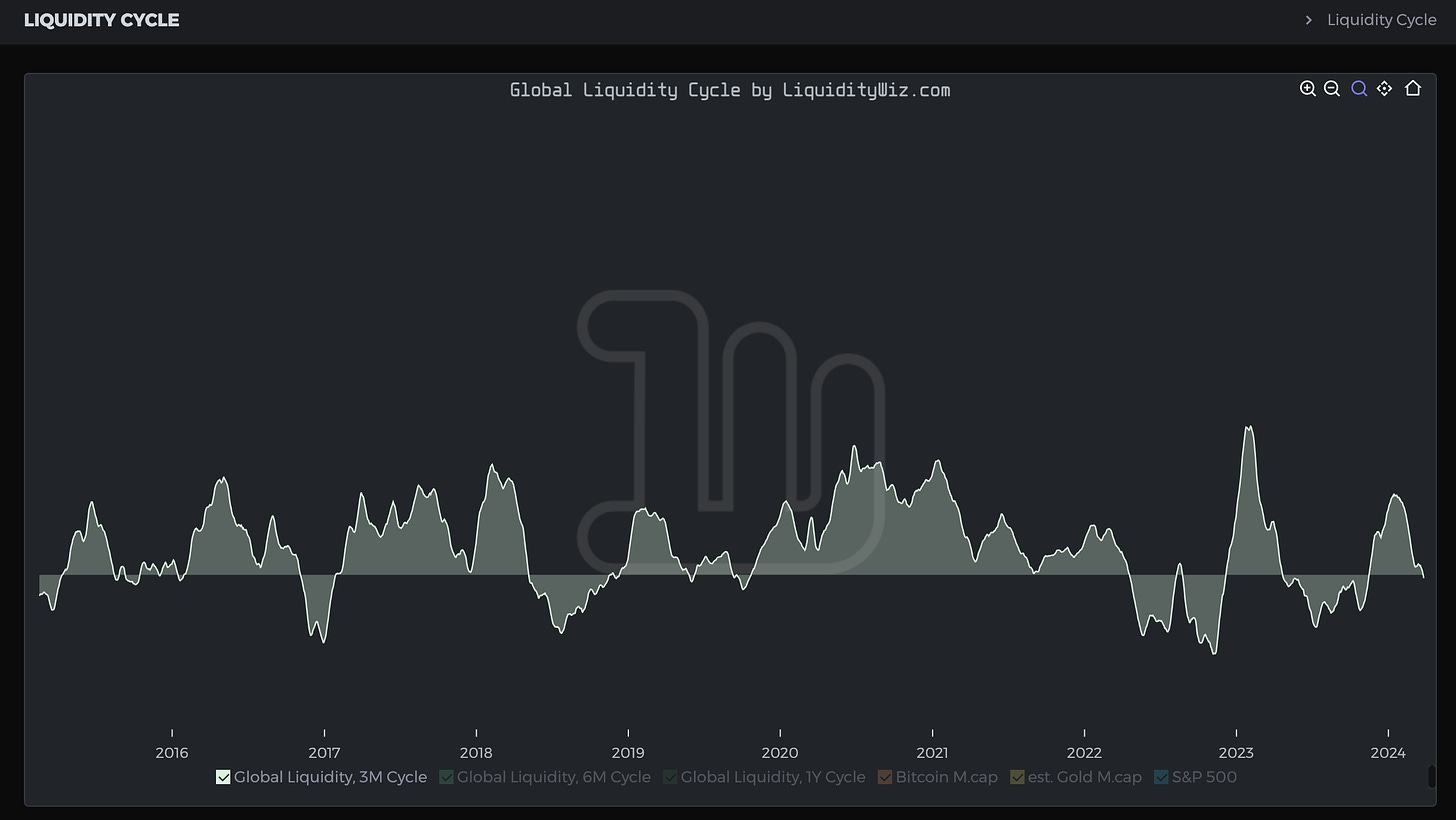

A deep dive into the liquidity cycle shows that the 3-month liquidity cycle reveals draining of liquidity globally since the local high in January of this year.

The 1-year cycle shows the same phenomenon, but this chart does a better job of highlighting how outrageous the increase in liquidity was during the 2020-2021 zero-interest rate days.

Next, we can see that bitcoin, gold, and the S&P 500 all tend to move in the same general direction based on these liquidity changes.

What is interesting though is that bitcoin and the stock market have been appreciating in price since the start of the year, yet global liquidity has been draining.

One argument is that markets are forward-looking and investors are trying to front run central banks. They want to buy assets before the Fed and others pivot to looser monetary policy, while simultaneously pumping the global economy with liquidity.

Remember, the Fed has been draining their balance sheet and trying to create tight financial conditions.

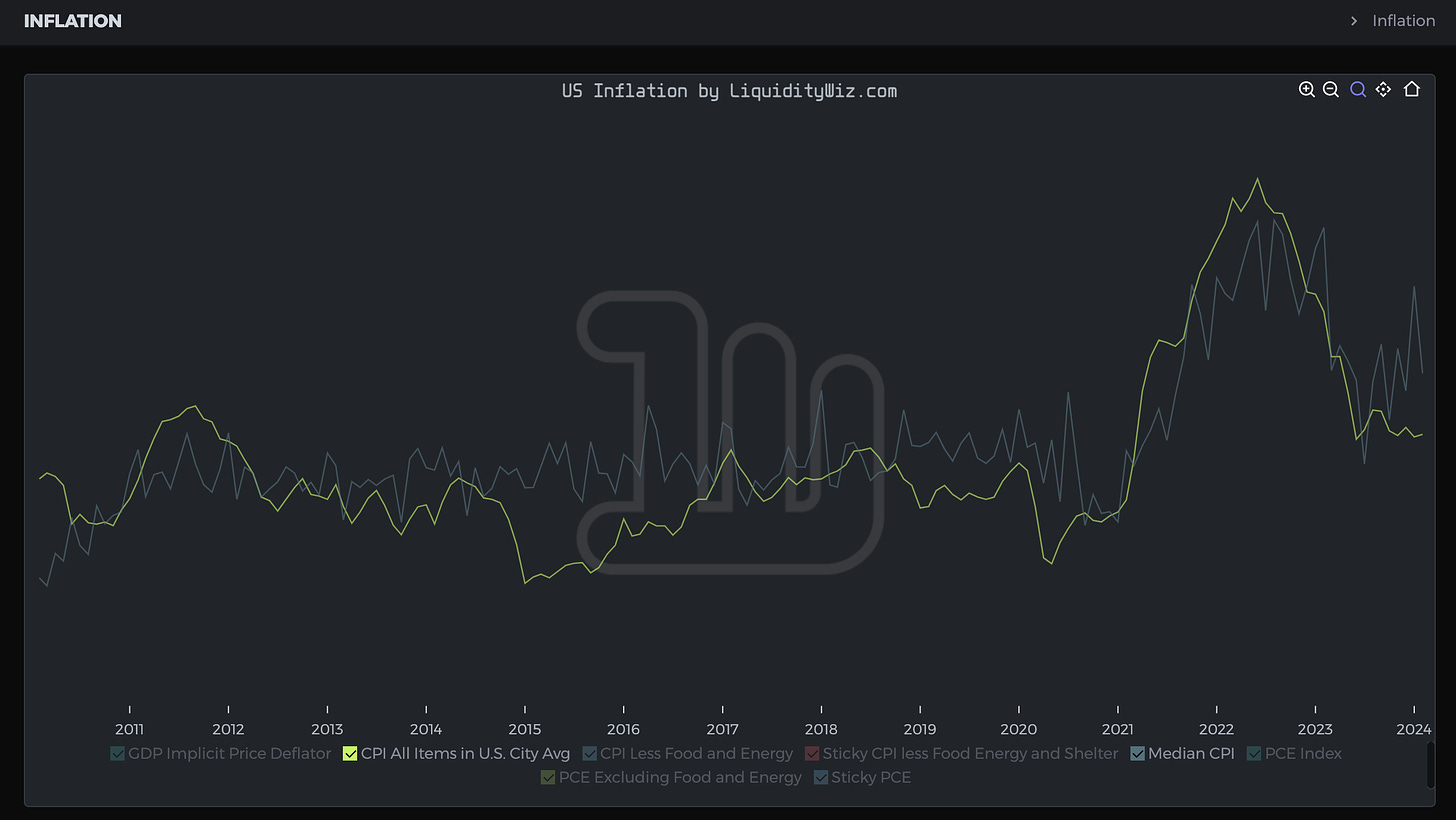

And the US central bank has been successful in getting year-over-year CPI to fall drastically from the elevated levels that we previously saw.

But if asset prices have continued to rise, despite the tighter financial conditions, then we must ask the question “what happens when loose monetary policy returns and global liquidity begins growing aggressively again?”

The simple answer is that asset prices will take off, just as we saw in 2020 and 2021. The investors who were able to hold on to their investments over the last 2-3 years during this tighter period will be rewarded. But it would be hard to argue that central banks around the world are excited about pivoting back to loose policies given where the stock market, bitcoin, and gold currently are.

Asset prices at all-time highs during tight conditions spell disaster for preventing euphoria and speculation when the macro environment improves.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

John Arnold is the Principal at Ten31, a bitcoin focused investment platform.

In this conversation, we talk about the total addressable market for bitcoin, what that means for financial returns, where to place capital, products, services, industries that will get built around bitcoin, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Bitcoin Is Eating The World with John Arnold

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post