To investors,

We have been hearing for months about an incoming economic calamity. The doomsday predictors promised us recessions, depressions, and stock market crashes that would make Black Friday blush. Of course, these people look absolutely insane in hindsight.

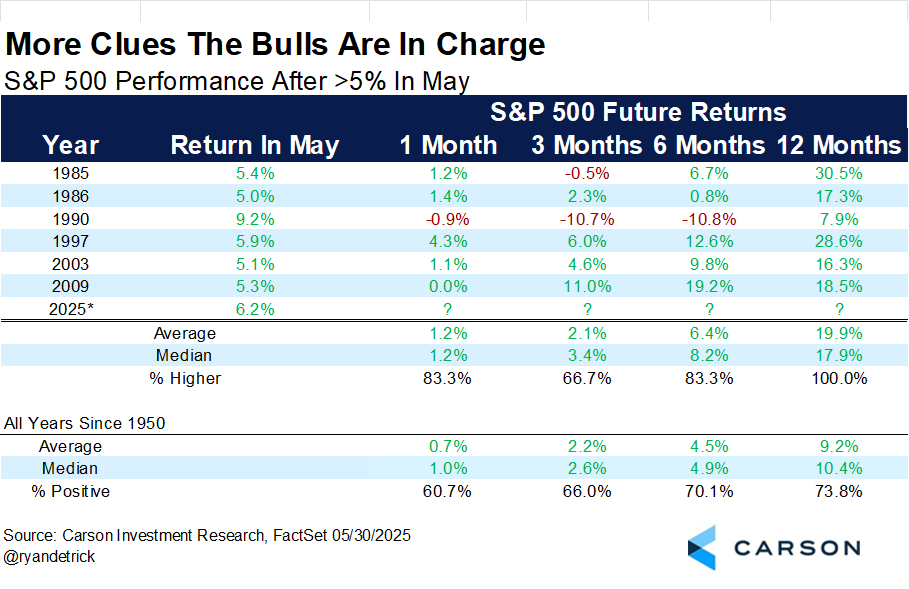

We didn’t get any of that. In fact, we got the exact opposite. Ryan Detrick shows the S&P 500 just posted the best performance for the month of May in the last 35 years.

That is crazy considering the fear-mongering that has been spread in the media and online for the last 2 to 3 months. The best stock performance in May for the last three and a half decades!

Ryan wasn’t done delivering the bears bad news — he writes “when the S&P 500 gains more than 5% in May (like 2025) the next 12 months have never been lower and gained nearly 20% on average. No month has better future performance after a 5% gain.”

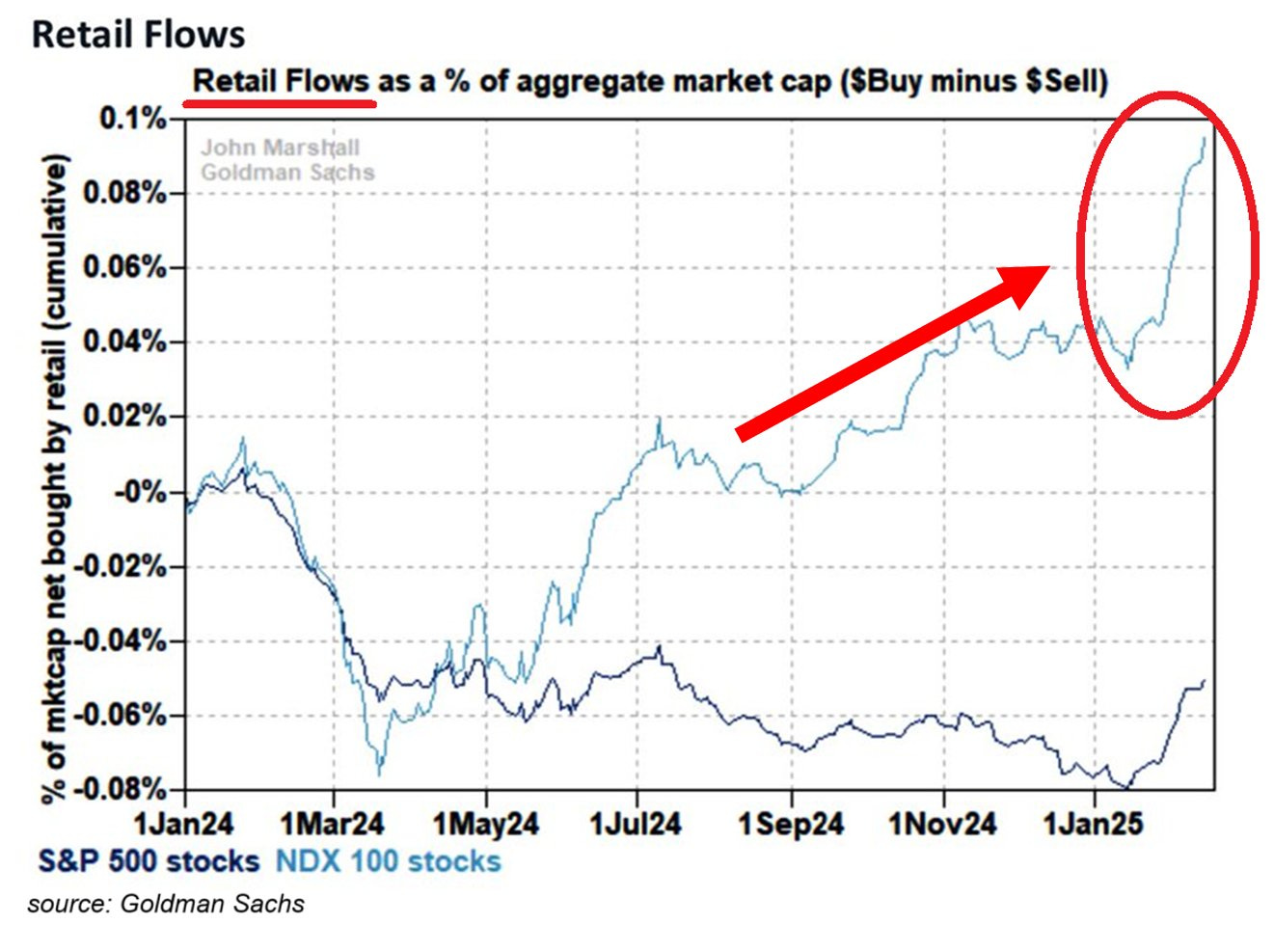

This is obviously great news for investors that kept, or increased, their exposure to stocks through the volatility. Remember this chart from Goldman Sachs back in February? It shows retail investors started pouring capital into the market at an accelerated pace.

And that trend never stopped. Adam Kobeissi wrote two weeks ago:

“Retail investors have been buying stocks at a historic pace: Retail investors’ equity ETF net inflows have reached ~$122 billion year-to-date. Since mid-March, individual investors' inflows have DOUBLED despite the market sell-off, according to Goldman Sachs. On the other hand, professional investors have withdrawn ~$25 billion so far this year. Since March 1st, retail investors have ben net sellers of stocks in just 6 trading session, per JP Morgan. While retail investors have tried to buy the dip, institutional investors are selling into strength. It's Wall Street versus Main Street.”

And before you think retail is dumb money, it is important to understand they are making a lot of money right now — Global Markets Investor writes:

“Retail investors have bought every dip this year. The S&P 500 has returned 0.36% on average following a down day, the most ever recorded. By comparison, last year it was just 0.02%. Retail investors purchased over $50 billion in US equities since the April low. Incredible.”

So we now have a market divergence that highlights the rise of self-directed investors. Institutions are either selling or sitting on the sidelines, while retail has a persistent bid in the market. These self-directed investors are able to profit because they are essentially working together in a decentralized manner. They all share the mentality of buying the dip, so their collective action drives market results to swing positive.

The market is the referee and it seems like retail is holding its own. This doesn’t mean the institutions are losing, but rather that everyone is making money. Add in the recent change in economic policy, including a focus on growth, government spending, and removing the debt ceiling, and it is not hard to see the bull case for liquid assets such as stocks and bitcoin.

The next few months should be fun. Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Jordi Visser Explains The Link Between Bitcoin and Artificial Intelligence

Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.

In this conversation what’s going on with bitcoin, bitcoin bonds, why countries are buying bitcoin, AI, what’s going on with tariffs, and how it all impacts your portfolio.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post