To investors,

The rise of self-directed investors has been widely discussed, but we just got new data that suggests the trend is even more pervasive than we previously thought.

As retail investors have entered the market, there has been a bifurcation in their behavior. One group is sophisticated and informed. They follow timeless investing principles, allocating their capital based on thorough analysis, and tend to perform well in their portfolio. The other group, who is less sophisticated and disciplined, is full of people essentially gambling on vibes, hopes, and dreams.

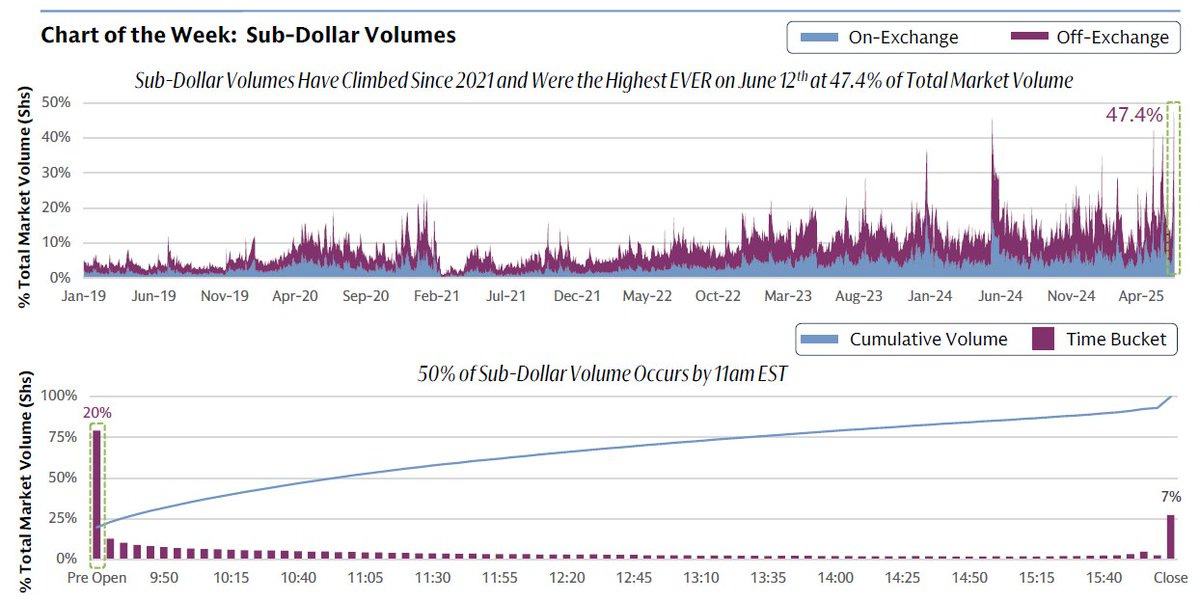

This second group is the cohort that gives retail investors a bad name. And for good reason — take this insane fact from Zerohedge: penny stocks just hit a record 47.4% of total market volume.

Think of how crazy that is. Nearly $1 out of every $2 in market volume is coming from stocks that are worth less than $1. It would be funny if it wasn’t so concerning.

Now here is the thing — we are seeing this rise of retail across different asset classes. For example, the bitcoin and crypto industry, which is just a different type of public market, sees hundreds of billions of dollars in trading volume per day. While the traditional finance folks complain that public companies have fallen from more than 8,000 listed companies to something closer to 4,000, they are missing the fact that an army of investors and traders have taken to crypto markets to get their fix of public, liquid assets with volume.

So the expansion of liquid tradable assets, plus the increased access thanks to infrastructure like Robinhood/Public/eToro, has drastically increased the number of people participating in the market. And these people are looking to financial assets for hope they can capture a slice of the American Dream, including the financial security that was enjoyed by their parents and grandparents.

When the system abandons you, some portion of the population is going to take things into their own hands and see if they can grow their financial wealth through risk taking. Of course, this increased demand is not only finding its way to the penny stocks though — we are also seeing tech stocks pushed to alarming levels as well.

Barchart highlights that tech stocks relative to M2 money supply is now higher than it was during the dot come bubble.

On one hand this is concerning because of the relative overvaluation, but on the other hand the tech industry has produced some of the best businesses humans have ever built. So where we go from here is anyone’s guess. I am a believer that capital flows and global liquidity will determine the direction of stocks and crypto much more than the underlying fundamentals of any one asset.

This means the Fed announcement tomorrow will have a large impact on the direction of asset prices through the end of the year. If we get the interest rate cut, assets will go up faster than we think. If we don’t get the interest rate cut, we should expect to continue going sideways or a slight grind up through the summer. Kalshi has the odds of a Fed rate cut tomorrow at only 3%, but I think the odds are higher.

I don’t know if they will do it — however, I know they should do it. Inflation is not a problem, the world is addicted to cheap money, and we need to incentivize investment and risk taking. Cut the rates and give people or businesses access to a lower cost of capital.

I wouldn’t bet on the Fed being ahead of the curve though. They have made a living being a few months late in recent history. Lets see what happens.

Hope everyone has a great day. I’ll talk to you all tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Patrick McHenry on Bitcoin, Stablecoins and Regulation

Patrick McHenry is the former chairman of the House Financial Services Committee, and the Vice Chairman at Ondo Finance.

In this conversation we talk about bitcoin, ETFs, bitcoin treasury companies, legislation around stablecoins, tokenization, and how Patrick sees the world evolving.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

EightSleep - Recently launched The Pod 5, a high-tech mattress cover you can easily and quickly add to your existing bed. Use code Anthony for $350 off your Pod 5 Ultra

Bitizenship - Get EU residency through Portugal’s Golden Visa while maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp..

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post