To investors,

There has been a lot of talk about bitcoin coming to the bond market in the last few weeks. We have seen Strategy and other bitcoin treasury companies use unique structures to get capital leveraging anything from convertible debt to structured notes.

But the more interesting area is the idea of a BitBond.

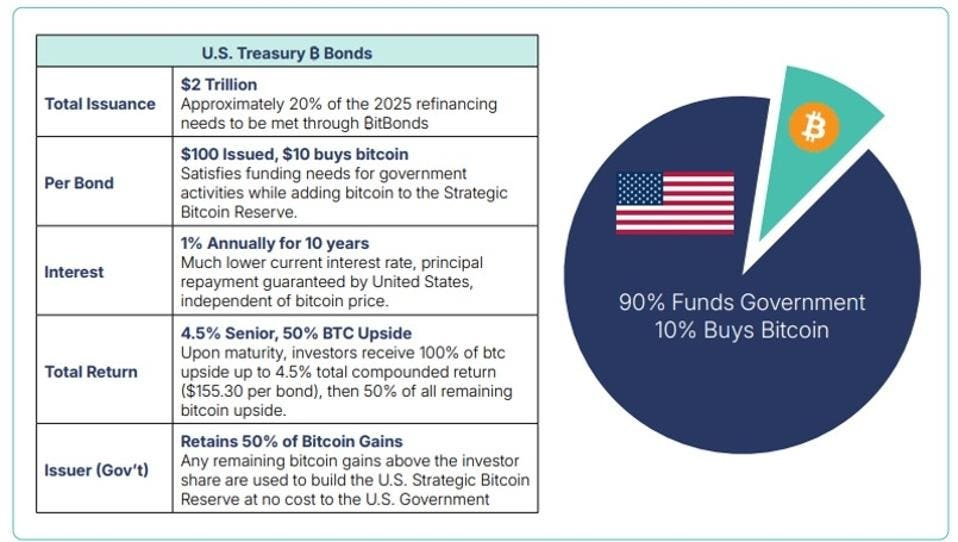

“BitBonds are like regular bonds in the sense that Treasury would allocate 90% of the bond to fund the government. But it would then use the remaining 10% of funds to purchase bitcoin…Upon maturity, investors would receive 100% of the bitcoin upside up to 4.5% of the total compounded return. After this benchmark is reached, investors would receive 50% of all remaining bitcoin upside. Meanwhile, the government would keep the other 50% of remaining bitcoin upside to supply the strategic bitcoin reserve.”

This graphic from the Bitcoin Policy Institute shows how they work:

This obviously a clever idea and there are rumors that the US government could issue BitBonds to address the national debt. I recently spoke with Jordi Visser about BitBonds and here is how he described the situation, including New York City Mayor Eric Adams commitment to issue the first BitBond:

But bitcoin is not only going after sovereign, state, or city bond markets. We got news from Francisco Rodrigues at Coindesk yesterday that “Sberbank, Russia’s largest bank, has introduced a new structured bond that tracks the price of bitcoin and the dollar-to-ruble exchange rate. Initially available over the counter to a limited pool of qualified investors, the bonds let holders earn based on two variables: the future performance of BTC in U.S. dollars and any strengthening of the dollar relative to the ruble.”

Bitcoin is a magnet for capital. The bond market wants to play with the new shiny toy on Wall Street. There will be no stopping this asset from getting cozy with one of the largest pools of capital. BitBonds are interesting. Structured bonds are interesting. And there is going to be a plethora of new bonds related to bitcoin that we haven’t even thought about yet.

We are so fortunate to be living in this moment. I can’t wait to see what people come up with next. Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Jordi Visser Explains The Link Between Bitcoin and Artificial Intelligence

Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.

In this conversation what’s going on with bitcoin, bitcoin bonds, why countries are buying bitcoin, AI, what’s going on with tariffs, and how it all impacts your portfolio.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.