To investors,

Pessimists sound smart, optimists make money.

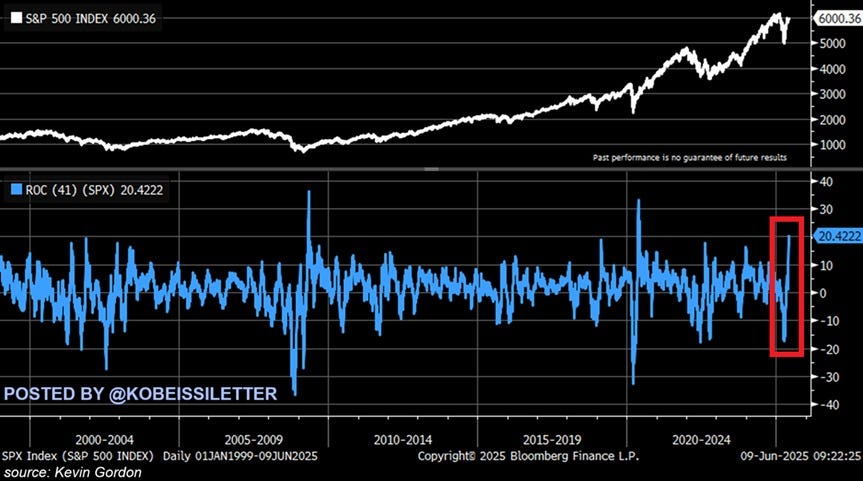

This old adage is proving to be more true every day. Adam Kobeissi is just as impressed with the market’s historic recovery as I am. He writes:

“The S&P 500 has rallied +20.4% over the last 41 trading sessions, its third-best run this century. During the same period, the Nasdaq 100 has risen +27.3%, its third-biggest rally since 2002. Only 2020 and 2008 haven seen such sharp recoveries over the last two decades. As a result, the S&P 500 and the Nasdaq 100 are now trading just 2.1% and 1.8% from their all-time highs. We have gone from a historically weak to a historically strong market in a matter of days.”

And this type of historic recovery usually suggests stocks will be significantly higher 1 year from now. Puru Saxena shows the average return is 20% in the next 12 months when the S&P rallies from -18% below a 52 week high up to -3% within 50 days.

This optimism in the stock market is not exclusively held by investors. EJ Antoni reminds us that “consumer confidence comes roaring back in May, reversing the April plunge; the level is still down significantly from November, but the stock market recovery has given it a considerable boost - it's interesting that the index has become increasingly tied to equity prices.”

So we have a historic rally in public equities, which is driving enthusiasm back into the market, and consumer confidence is finally recovery as well. But another area where we can clearly see the wide-eyed, bushy tail outlook is in the true global macro asset of bitcoin. Bitcoin Magazine writes “Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever.”

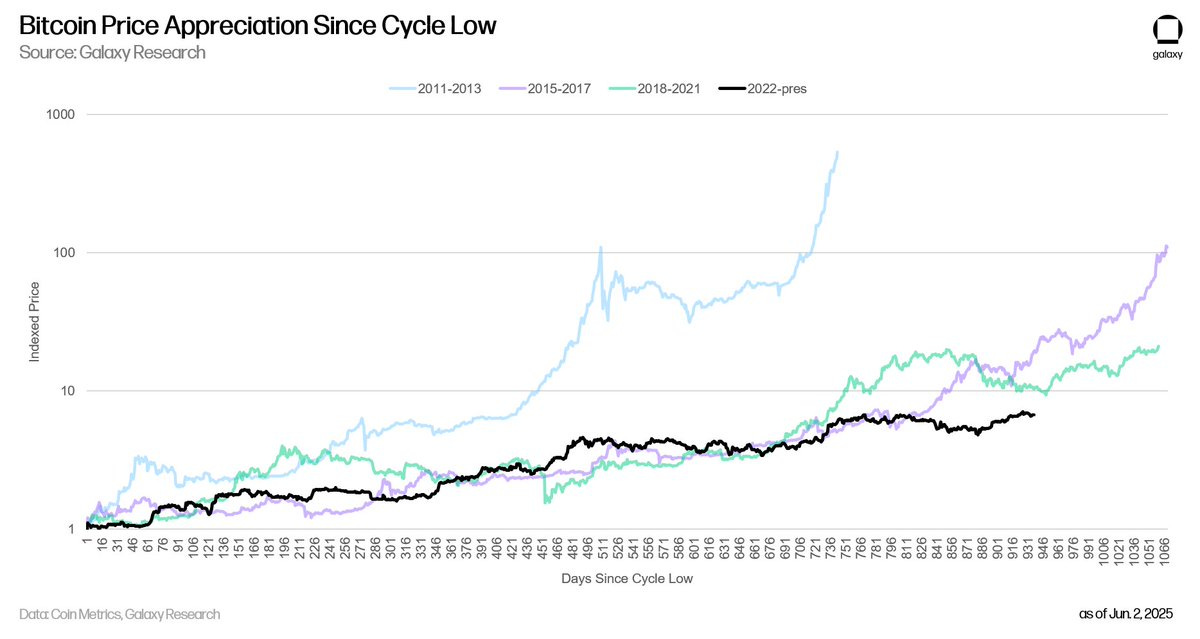

Not bad for an asset that started at fractions of a penny about 15 years ago. But don’t get too crazy in your price predictions for this bull market. Galaxy’s Alex Thorn writes “This is looking like a longer and more measured bitcoin cycle than priors.”

And it is not hard to see where bitcoin will likely go in the coming weeks and months when you take a look at the correlation to global M2 money supply.

So here is the thing — all the pessimists from April sounded smart, but most of them didn’t make much money as the market rallied in a historic recovery. Too many people think they can time markets, predict the future, and optimize short-term results. Obviously, the people who tend to do best though are those with the patience to stay focused on the long-term and simply hold great assets for as long as possible.

Simple strategy, hard to execute.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: We launched a new product recently to help investors manage their financial lives. The product uses AI models to track your net worth, analyze your portfolio, answer any questions you have about your finances, and make suggestions on how you can improve. You can add public stocks, private investments, crypto assets, cars, houses, investment properties, collectibles, and any other assets you own.

You can text, email, or call the CFO too which is really cool. The CFO, called Silvia, now has more than $4.6 billion in assets connected on the platform.

You can sign up for the product completely free here: https://www.cfosilvia.com

Bitcoin Rises Amid Debt, Chaos, and Riots

Polina Pompliano and Anthony Pompliano discuss Circle IPO, bitcoin, rise of crypto companies on Wall Street, what it means for your portfolio, what is going on with LA riots, how we could solve the problem, and why Invest America is pushing to give every newborn $1,000 to invest.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

EightSleep - Recently launched The Pod 5, a high-tech mattress cover you can easily and quickly add to your existing bed. Use code Anthony for $350 off your Pod 5 Ultra

Bitizenship - Get EU residency through Portugal’s Golden Visa while maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp..

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post