To investors,

The citizens of the United States spoke loudly last night. They delivered a crushing victory for Donald Trump, including a Republican victory in the House, Senate, popular vote, and electoral college. Very few people thought Trump would win the popular vote, but here we are.

This can only be described with one word: Landslide.

The mandate to Trump is clear — get inflation under control, make homes more affordable, secure the border, cut taxes, don’t engage in new wars, stop the woke nonsense, and make America healthy again.

Powerful stuff.

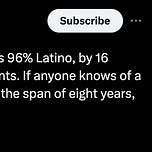

If you want to understand how the victory could be so large, we can look at places like Starr County in Texas.

It is hard to fathom how decisive the election was.

Financial markets love the idea of a Trump presidency as well. Stocks went higher over night, including Tesla up 15% and DJT up more than 30% during the period. More importantly, bitcoin hit a new all-time high price of $75,000 last night as Trump’s odds of winning surged.

Satoshi Nakamoto couldn’t have written a better script. The decentralized currency hitting a new high as the President of the United States is decided. A big part of the reason is Trump will be the first Bitcoin President.

He ran on the idea that a Trump administration would protect bitcoin, create a regulatory environment that would serve as a tailwind, and the United States would create a bitcoin strategic reserve. All of these developments would be good for bitcoin, but they would also kick off a global game theory for other countries.

If Trump embraces bitcoin, other countries will be forced to follow. I explained some of this on CNBC’s Squawk Box this morning:

One other important point is that Trump will likely be very helpful for bitcoin miners.

Deregulation in the energy industry will bring more abundance and lower prices. A pro-bitcoin President will bring a tailwind to the asset. Combine those two things and you could see bitcoin miners becoming an even more attractive opportunity.

As I have previously discussed, I want to be an energy dealer in the years to come — provide energy for modern uses cases in society. The thesis just got even stronger with a Trump victory.

Overall, Donald Trump walked away with a decisive victory last night. Asset prices look ready to surge higher in the coming days. It remains to be seen which policies Trump will enact, but having a pro-business and pro-capitalism President in office should….be good for businesses and investors.

Let’s see what happens. Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC this Friday, November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward.

The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here

Dylan LeClair Explains Why Corporations Are Putting Bitcoin On Their Balance Sheets

Adam Kobeissi is the founder of ‘The Kobeissi Letter.’

In this conversation, we break down the US economy, inflation, national debt, Warren Buffett stacking cash, why homes have become unaffordable, gold bitcoin, stocks, and where the market is going.

Enjoy!

Podcast Sponsors

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token designed to outperform BTC returns. Learn more and view live analytics on our performance dashboard.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

BetOnline is your #1 source for all your crypto sports and politichttp://gemini.com/gowheredollarswonts betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post