Today’s letter is brought to you by Osprey Funds!

The Osprey BNB Chain Trust (OBNB) is the first U.S. tradable ticker for BNB and provides secure exposure to BNB right from your brokerage account—no custodial wallets or private keys required. Due to its unavailability on centralized exchanges in the U.S., OBNB offers one of the only paths for U.S. investors to access BNB exposure via USD.

To investors,

Bloomberg published an article yesterday titled “Citadel Securities Plots Jump Into Crypto Trading After Trump’s Embrace.” The piece explains:

“Ken Griffin’s market-making giant Citadel Securities is looking to become a liquidity provider for cryptocurrencies, betting President Donald Trump’s embrace of the industry will usher in a boom for the asset class.

It’s a clear pivot from the firm’s previously cautious stance on crypto market-making. Citadel Securities has had a limited presence in crypto trading, having steered clear of exchanges frequented by retail investors due to a lack of regulations around it in the US.

The firm aims to get added to the roster of market makers on various exchanges, including those run by Coinbase Global Inc., Binance Holdings and Crypto.com, according to people familiar with the matter.

Once the firm is approved on exchanges, it initially plans to set up market-making teams outside the US, the people said, asking not to be identified as the plans aren’t public. The extent of the push and Citadel’s desire could change based on how or if new regulations roll out in the coming months.”

This is a perfect example of the impact a pro-innovation, pro-technology regulatory environment can have. Major players like Citadel were sitting on the sidelines waiting to participate in the best performing financial asset markets because they felt the rules were unclear.

Think of how insane that is — Citadel Securities, one of the best capitalized investment firms in the world, could not figure out how to participate in crypto markets without regulators coming after them.

Thankfully, the industry now has a tailwind and every market participant is trying to figure out what their crypto strategy will be. You can expect market-making firms like Citadel Securities to drive substantial revenue without having to take significant directional bets on the market.

That could be a good decision at a time where the macro economy is in a weird spot. Mets owner and famed investor Steve Cohen recently said he believes economic growth is going to slow from 2.5% to as low as 1.5% — that would be a very big deal.

Here were Cohen’s negative comments on the economy:

These comments are important because Steve Cohen is one of the smartest investors in the world. He intimately understands financial markets and is well-versed in the complex economic machine.

What Cohen is essentially arguing is that government waste propped up financial markets, so removing that waste will be a headwind for economic growth. I don’t disagree with him. Add in the tariffs and you have an even slower growing economy in the short term.

So what should the Federal Reserve do? How about the Trump administration?

The answer may be right in front of our face. Another article in Bloomberg titled “The Bond Market Isn’t Fully Buying What Musk’s DOGE Is Selling” lays out what Trump, Secretary Bessent, and Elon Musk are currently thinking:

“Musk recognized that the ultimate scorekeepers of the success of his small band of cost-cutters were 200 miles away — on Wall Street. There, bond investors had pushed up yields sharply in the run-up to, and aftermath of, Trump’s election and were now refusing to bid them back down.

Musk got the message loud and clear. The bond market was doubting him, demanding more evidence that the cuts were adding up fast enough to actually rein in the bloated budget deficit and curb the ever-growing national debt. This, Musk insisted, was a mistake they’d come to regret.

“The bond markets do not currently reflect the savings that I’m confident we can achieve,” he said during a freewheeling, hour-long discussion he led on his social media platform, X. “If you’re shorting bonds, I think you’re on the wrong side of the bet.”

Trump has famously obsessed with the stock market as a real-time referendum on his presidency. But now, with Musk and Treasury Secretary Scott Bessent in his ear at the start of his second term, much of the attention has shifted to another benchmark — the 10-year Treasury bond yield.

With good reason. As powerful as the Federal Reserve is, with its control of short-term rates, and as much sway as it has on stock market sentiment, it’s the 10-year Treasury rate that largely determines the cost of money for homebuyers and the biggest US companies. Bring that rate down and it’ll pave the way for millions of Americans to buy the house they’ve wanted for years and, in the process, stoke faster economic growth and curb the alarming surge in the government’s annual interest tab.”

So to recap — Steve Cohen is sounding the alarm on a slowing economic environment and the current administration is doing everything they can to get the 10-year bond yield down, so they can ignite economic growth.

This is a battle as old as time. A negative market force vs an aspirational market intervention. The winner will take trillions of dollars with them in their direction of travel.

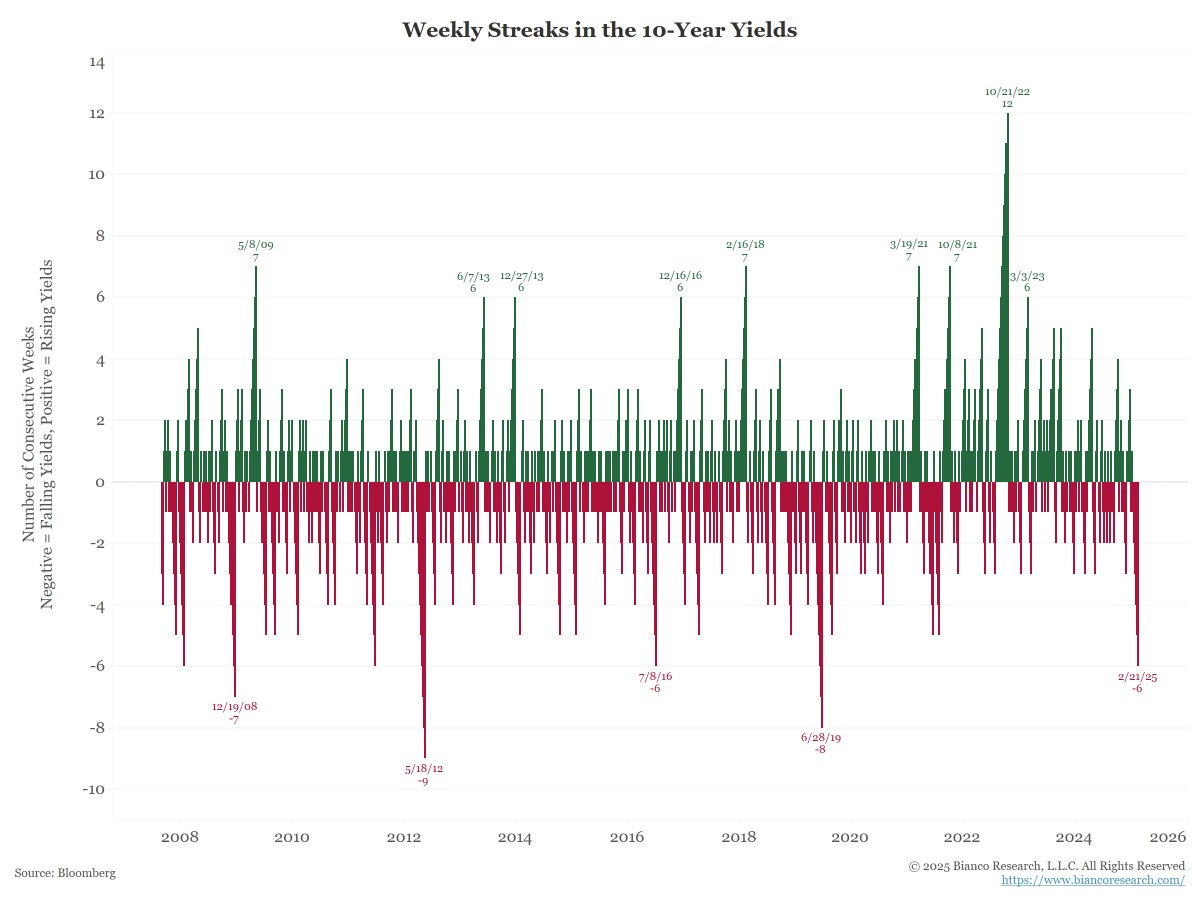

So far, Jim Bianco points out “the 10-year yield is down six consecutive weeks, every week since the inauguration. The longest such streak in 5.5 years.”

That may give you a sense of who will end up winning this game. But while the bulls and bears are fighting it out, Ken Griffin and Citadel will be taking home their profits by market-making through all the volatility.

The big boys are entering the crypto market now that regulators have given them the green light. There will be pros and cons to this institutional participation, including less volatility over time, but you need institutional adoption if you want true mass adoption.

Just be careful what you wish for. When Wall Street is making billions, that money has to be coming from someone else’s pocket. Make sure the pocket isn’t yours.

Hope everyone has a great day. I’ll talk to you tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

My Appearance On CNBC’s Squawk Box Yesterday

Anthony Pompliano joins Squawk Box to talk bitcoin, regulation, current macro environment, memecoins, and where bitcoin could be headed next.

Enjoy!

Podcast Sponsors

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post