To investors,

I have important news to share — I have reached an agreement with Hut 8 ($HUT), a publicly-traded company on Nasdaq, to become an advisor and help them scale the company.

In order to understand why I am spending my most valuable resource—my time— on this, we should start with some context.

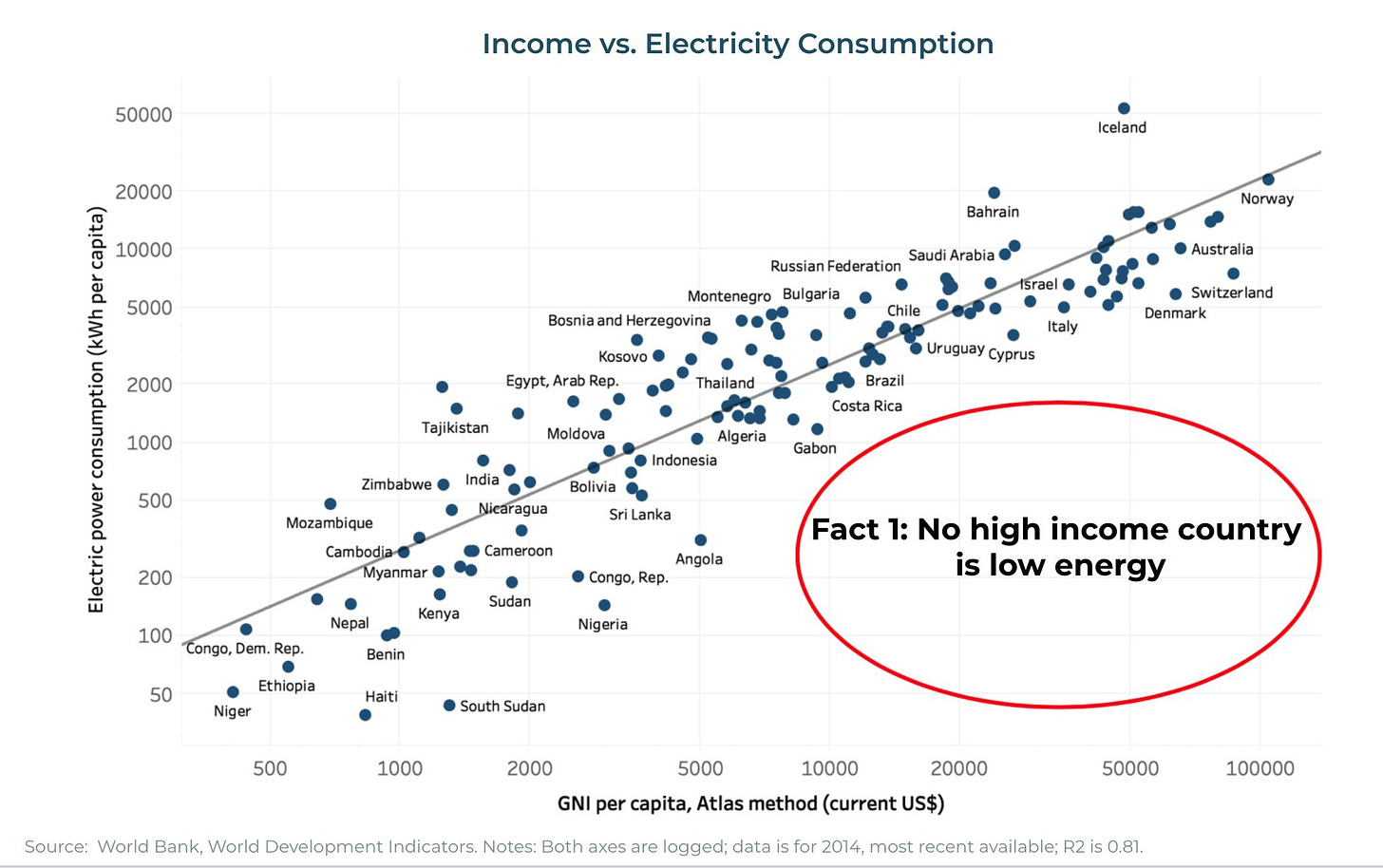

Energy is one of the most valuable commodities in the world. Humans need energy to create a more abundant, prosperous future for our children. In fact, there is no high-income country that consumes a low amount of energy.

This trend is not going to reverse. As technology accelerates, so will energy consumption. Because of this relationship, a key investment theme of the future will be selling energy to the businesses willing to pay the highest price.

As a capitalist, I want to be an energy dealer.

It will be very valuable to own energy infrastructure that can service modern society. These energy infrastructure companies will sell their energy to people using GPUs for artificial intelligence, ASICs for bitcoin mining, and many other use cases. The new energy consumption use cases need a new energy infrastructure partner.

If I had unlimited money, I would invest a few billion dollars into building the premier energy infrastructure provider. Unfortunately, I don’t have unlimited dollars, so I have concluded the better thing to do is partner with the best energy infrastructure company I could find with the hopes of helping them scale.

This is where Hut 8 comes into the picture.

The company is a modern energy infrastructure provider. They are agnostic to the end use case. As long as Hut 8 can provide reliable, low-cost energy to their customers, someone will always be interested in buying available power.

Today the company has two types of customers — bitcoin miners and companies using artificial intelligence. There will be many other use cases in the future. When I went looking to become an energy dealer, it became obvious Hut 8 was already pursuing that strategy.

But I got more excited as I did more work looking at the company.

For example, Hut 8’s business can be broken down into three core components: power, infrastructure, and compute. Power is anything needed for power delivery generation before you get to the data center (land, substation, inter-connectivity, etc). Infrastructure is the data centers, both Tier 1 for bitcoin mining and Tier 3 for AI use cases. And compute is when Hut 8 owns hardware themselves and monetizes their power with ASICs or GPUs to generate additional revenue for their balance sheet.

The company has an advantage with these three layers. They can choose when to sell power to customers or monetize the power themselves. Follow the math. There will be times to sell the power to others and there will be times to sell the power to yourself.

Next, I love the setup of the company from a structure standpoint. The stock is owned by approximately 50% retail and 50% institutional today. But institutional ownership has been growing from around 10% to about 50% since February when the current CEO took over the company. I like holding stock that institutions are aggressively buying.

Hut 8 has just over 9,000 bitcoin on their balance sheet, yet they have less than 100 million shares outstanding. This means the company has low outstanding share count and they appear to have very low dilution year-to-date compared to other bitcoin-related publicly-traded companies.

Low share count. Disciplined treatment for equity owners. Lots of bitcoin on the balance sheet. All good signs in my opinion.

Next, we have to look at the leadership team. Hut 8 is led by Asher Genoot, who has done a great job of creatively structuring deals to give the corporation immense optionality in the future. Take their recent Bitmain deal as an example.

Bitmain signed a contract that will drive approximately $135 million in annual run-rate revenue to the business. That deal brings 15 exahash in bitcoin mining to Hut 8 facilities. But here is the catch — if bitcoin’s price goes down, Hut 8 gets paid as if they are a classic energy provider selling Bitmain energy. If bitcoin’s price goes up, Hut 8 can buy the ASIC machines from Bitmain at a pre-agreed, fixed price.

This type of deal gives Hut 8 an option on the future, while protecting the downside with an attractive outcome as well. Public market investors usually underestimate the importance of creative dealmaking when evaluating companies because it requires qualitative analysis that doesn’t fit into a spreadsheet.

Lastly, Blackrock is the largest shareholder of Hut 8 and Coatue has invested substantial money into the company. As if that wasn’t enough, Anchorage Digital recently converted millions of dollars of debt into equity in the business at a ~ 50% premium to the stock price at the time. Think about that for a second. One of the debt holders, who did not have convertible debt, decided to convert their debt into equity at a 50% premium to the current public market price.

That is the type of conviction I like to see in a company that I am involved with.

So this brings us to the question “what is Anthony Pompliano going to do to help Hut 8?” The simple answer lies in the biggest problem I see the company facing — they have done a bad job telling the market and the world what they do and how the company is progressing against their goals.

Imagine my surprise as I uncovered the various things I am writing about today. I spend a good amount of my time in the industry, yet I was completely oblivious about a number of these developments. If I was oblivious about them, imagine how uninformed everyone else is.

I want to be an energy dealer.

It is incredibly capital intensive to get into this business, so I am choosing to partner with Hut 8 rather than enter the business from scratch. They are going to keep building a leading energy provider that is focused on providing low-cost, reliable energy to industries that make up modern society.

I will help them communicate information to the proper parties. Together we have the chance to build a very large, profitable, and important company. Hut 8 is a ~ $1.6 billion company as of this morning, but I believe they can create tens of billions of dollars in market cap if everything goes right.

You can learn more about the business on their website: Click here

The company’s leadership team: Click here

The stock ticker: HUT

Let’s see what happens. It is time to get to work.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC on Friday November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward.

The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here

Sam Callahan Explains Bitcoin’s Performance Related To Global Liquidity

Sam Callahan writes simple, insightful updates on bitcoin called “The News Block Weekly Newsletter.”

In this conversation, we talk about global liquidity, why bitcoin is so sensitive to it, Paul Tudor Jones comments on bitcoin, companies putting bitcoin on balance sheets, interest rates, and where you can get smarter on a daily basis.

Enjoy!

Podcast Sponsors

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token designed to outperform BTC returns. Learn more and view live analytics on our performance dashboard.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post