To investors,

President Trump fulfilled his campaign promise of implementing tariffs on Canada and Mexico over the weekend. This comes after majority of the country voted for Trump to assume office and implement his America First strategy.

Tariffs, especially the blanket tariffs that were implemented in the last 48 hours, are one of the most controversial parts of the America First strategy. Most market participants critique the tariff decision as being negative for the US consumer, while also being ineffective in driving the other policy goals.

I know these critiques well because I believed this mainstream narrative until a few weeks ago. Given my increasing focus on reading source material and spending the time and energy to come to my own conclusions, I went down a deep rabbit hole to better understand tariffs, their history, the policy goals, results in modern society, and the impact on prices, domestic manufacturing, and national security.

What I discovered surprised me. The information ran counter to almost everything I had been told about tariffs. The overwhelming consensus opinion from economists and media outlets previously seemed like common sense, but now it appears to be more similar to state talking points that could be compared to “inflation is transitory.”

I have completely changed my mind on tariffs, so I thought it would be important to share what I learned and how I think about these economic tools now.

Tariff Experiment

In order to understand the current situation, it is important for us to get context on what I believe to be happening. My best guess is that Trump learned from his experiment during his first term on how to use tariffs as a lever to drive down income tax without creating inflation and simultaneously increasing domestic manufacturing and jobs.

Now Trump is back in office with a mandate and he is going to transition from the Tariff Experiment (2017-2020) to the Tariff Era (2025 and beyond).

As a reminder, President Trump implemented tariffs during his first term against solar panels and washing machines (January 2018), steel and aluminum (March 2018), and Chinese goods (four separate tariffs from March to September 2018).

During the same time period, Trump dropped the federal income tax from 39.6% to 37%. A good summary of the Tariff Experiment is that the President was able to increase tariffs, drop federal income tax, avoid inflation, and strengthen American manufacturing.

But before we dig deeper into what happened in 2017/2018, or why the mainstream narrative around tariffs is highly inaccurate, we have to talk about why tariffs are one of the longest standing American traditions.

Tariff History

The United States used to have no federal income tax and the country survived almost exclusively through tariff revenue. George Washington signed tariffs into law as the second bill of his administration as the first President of the United States. A year later, the US Revenue Cutter Service (which later became the US Coast Guard) was created to collect the 5% tariff on all imports to the country.

Tariffs continued to be the main source of government revenue for about 70 years. These tariffs also protected American industries from foreign competition and ensured America was able to become self-sufficient, which was considered a national security issue at the time.

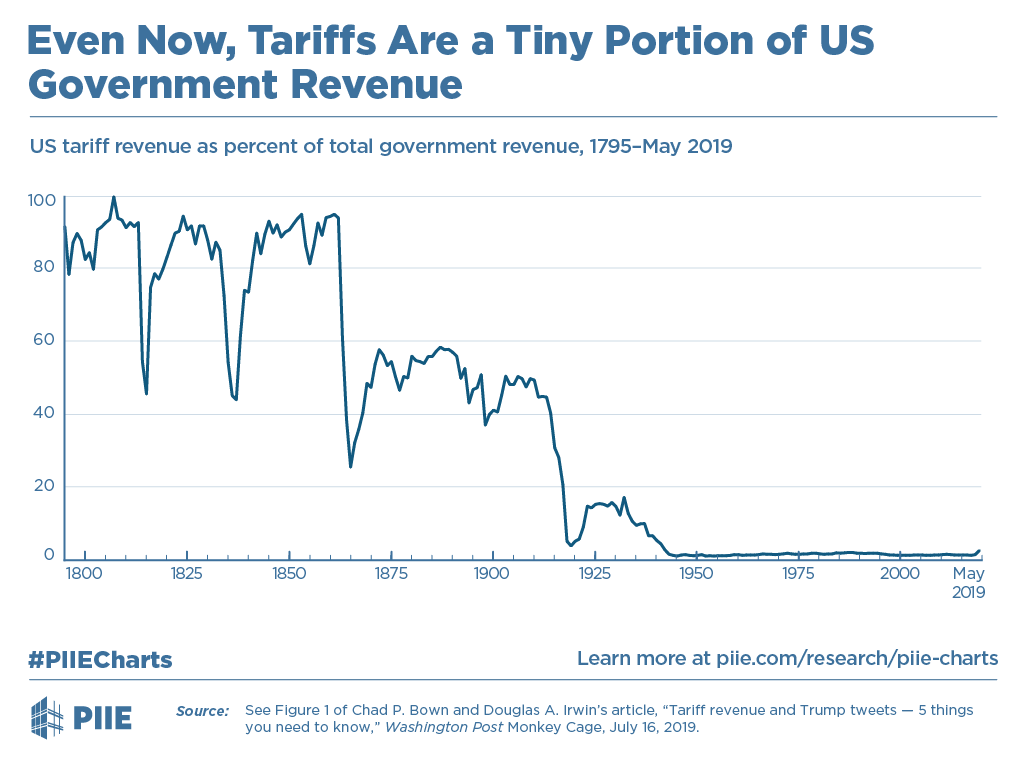

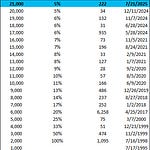

However, as you can see in the chart below, we went from more than 90% of US government revenue via tariffs in 1850 to almost 0% of government revenue via tariffs by 1950. It took about a century to destroy one of America’s greatest advantages.

Tariffs are widely credited as an essential tool for the success of the Industrial Revolution, which created the American economy we know today — the greatest economy ever constructed by a nation state in human history.

“Tariffs have historically served a key role in the trade policy of the United States. Their purpose was to generate revenue for the federal government and to allow for import substitution industrialization (industrialization of a nation by replacing imports with domestic production) by acting as a protective barrier around infant industries. They also aimed to reduce the trade deficit and the pressure of foreign competition. Tariffs were one of the pillars of the American System that allowed the rapid development and industrialization of the United States.

The United States pursued a protectionist policy from the beginning of the 19th century until the middle of the 20th century. Between 1861 and 1933, they had one of the highest average tariff rates on manufactured imports in the world. After 1942, the U.S. began to promote worldwide free trade.”

Historical figures like George Washington, Thomas Jefferson, Henry Clay, James Monroe, Abraham Lincoln, William McKinley, and Theodore Roosevelt were all outspoken supporters of tariffs as a necessary tool for America to thrive. The famous Lincoln quote on tariffs is “Give us a protective tariff, and we shall have the greatest nation on earth.”

Historical Takeaway

The main takeaway from a historical perspective is that America was built on tariffs. They created government revenue without having to tax US citizens with a federal income tax and they created an attractive environment so US entrepreneurs could create new domestic industries with American workers.

This brings us to modern society.

We have infrequent use of tariffs today and instead derive an inordinate amount of government revenue from income taxes. American companies and industries are also subjected to global competition where foreign countries and companies often take advantage of the American consumer.

So Trump’s big idea is to bring back the tariffs that made America the greatest economy in the world. He wants to create an advantageous operating environment for US companies, drive government revenue, and leverage tariffs as a negotiating tool to get foreign nations to act in America’s best interest.

But this idea has a plethora of critics. The main issues that people claim about tariffs are:

Tariffs lead to higher prices for American consumers.

Tariffs and the related higher prices lead to inflation.

Tariffs do not create American jobs.

The beauty of our current situation is that we don’t have to go back hundreds of years to see how tariffs would play out in the modern economy. We can study the real world experiment that Trump ran during his first term.

Let’s take a look at the main products that were tariffed in 2018 — solar panels, washing machines, and steel.

Solar Panels

We can start with solar panels. The original tariff was a 30% tax on foreign solar panels and modules imported into the United States. The tariff decreased by 5% each year until it bottomed out at 15%.

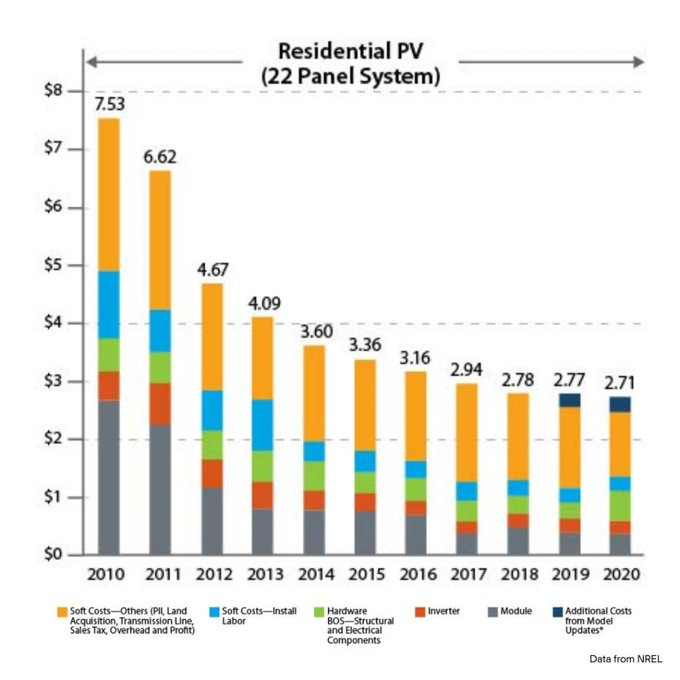

So what happened to solar panels? According to the critics, solar panel prices should have gone up, right? Well, the exact opposite happened. Domestic solar panel prices continued to fall in price as they had been for years before the tariffs.

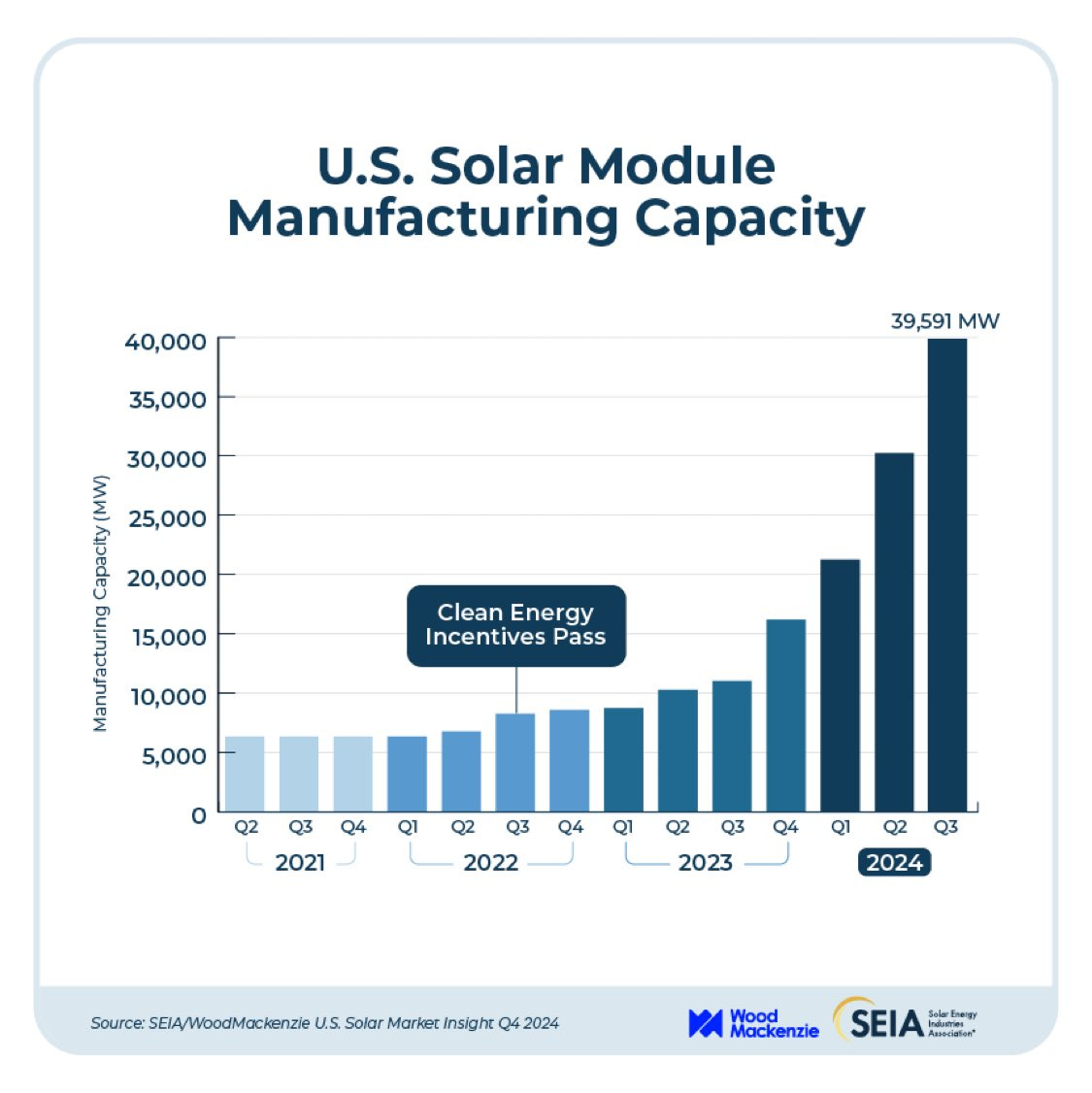

We also saw a continued increase in the domestic manufacturing of American solar panels after the tariffs were implemented.

And American consumers never slowed down their appetite for solar installations. The US solar industry, regardless of where the products come from, has seen a 26% average annual growth rate over the last decade.

This is an important example because it shows the critics of tariffs were disproven when it comes to solar panels. Not only did the price of solar continue to drop, but American manufacturing of the product skyrocketed in the years following the tariff (solar panel production was increasing from 2017-2021 and then the IRA incentive program for solar was implemented which poured gas on the demand fire).

The solar tariff program worked so well that Joe Biden doubled the tariff from 25% to 50% last year in 2024 before he left office.

Now there will be people who claim that solar panels are an exception to the rule. They had a structural advantage because of the deflationary nature of technology combined with a secular tailwind of demand, so let’s move on to the next example of washing machines.

Washing Machines

President Trump implemented a tariff on imported washing machines in January 2018. The tax ranged from 20-50% depending on a variety of details. This was a big deal because washing machines were the most pure consumer good that Trump initially taxed, so critics of the tariff believed it would be the most obvious example of how bad the tariffs were.

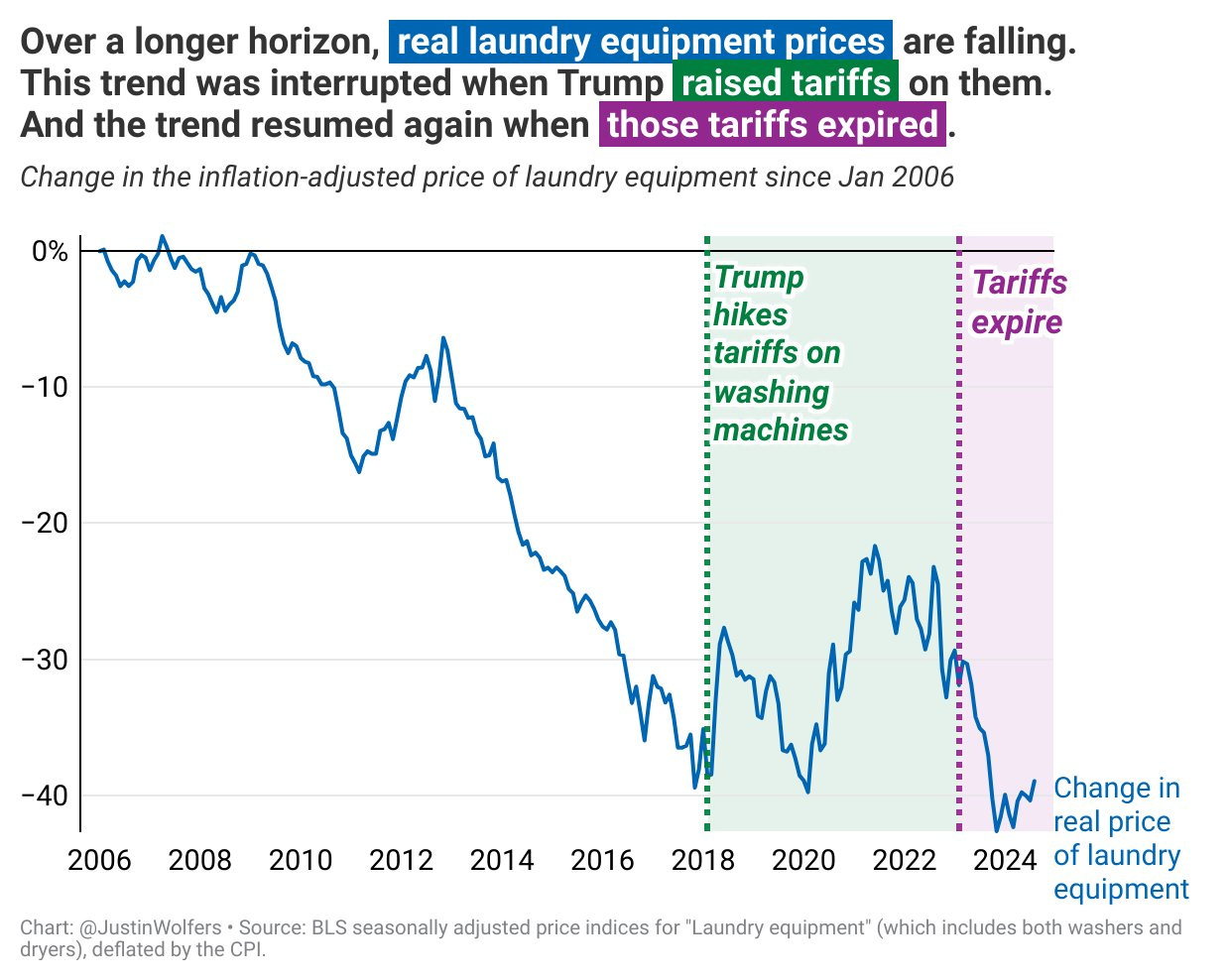

If you fast forward to today, washing machine prices are lower now than they were pre-tariff implementation. But critics will use this chart below to screech that tariffs actually increased the price of washer machines until the tariffs were removed at the start of 2024.

But don’t be fooled by the beautiful colors and twisted data. You can see that washing machine prices jumped in the first 90 days after the tariffs were announced, but then the price fell aggressively for the next 2 years. Washing machine prices were lower at the start of 2020 than they were pre-tariff. This is a narrative violation.

Obviously the pandemic broke most supply chains and the insane monetary policy from the Federal Reserve drove inflation over 9%. Here is the funny thing — not only were washing machine prices falling with decreasing inflation growth before the tariffs expired, but washing machine prices have actually risen less than consumer inflation rate since the tariffs were implemented.

So the idea that tariffs drove any sustainable price increase in washing machines is objectively false. In fact, washing machines became cheaper than pre-tariff prices before the pandemic hit.

If that was not good enough, two Korean manufacturers of washing machines opened manufacturing facilities in the United States in response to the tariffs. These facilities created at least 2,000 new American jobs. So the tariffs not only had no sustainable impact on prices, but they also lured investment in American manufacturing and created American jobs.

But maybe you don’t like the solar panel and washing machine examples. Don’t worry, I have another example — US steel.

Steel

Trump implemented a 25% tariff on steel imports in March 2018. His reasoning was related to national security, along with a desire to get US steel mills operating at 80% capacity or higher.

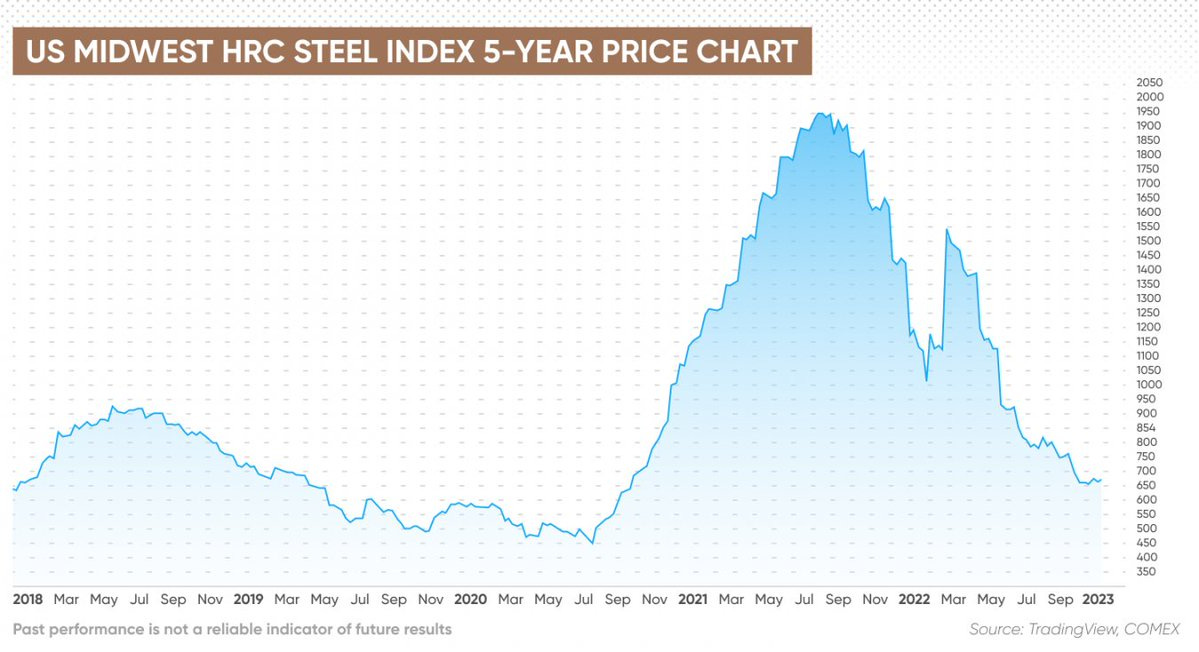

Naturally, the critics of tariffs would argue that steel prices should have increased by 25% or more post-tariff, but as you can see in this chart — steel prices increased through the summer (steel prices had already been skyrocketing pre-tariff too) and then began falling substantially. US steel prices eventually fell to price levels much lower than pre-tariff prices.

Why did the price of US steel decrease? Domestic manufacturing of steel increased by nearly 10% for the 2 years post-tariffs.

"The USGS data show that Trump's tariffs may have helped goose domestic steel production in the first few years after they were implemented. Production rose to 86.6 million metric tons in 2018 and 87.8 million metric tons in 2019, before cratering in 2020 as a result of the COVID-19 pandemic. Production bounced back in 2021, as American steel mills produced 85.8 million metric tons of raw steel that year."

This means the 2018 tariffs worked — US manufacturing of steel increased and US steel prices dropped lower.

Obviously, the pandemic created significant issues for manufacturing and industrial companies, but US steel prices still sit right now at nearly the same level as they were pre-tariff. Most importantly, steel prices have not kept up with consumer inflation since 2018.

So now you have three concrete examples from the 2018 tariffs that show the critics were wrong. The tariffs led to lower prices, increased American manufacturing, more government revenue, and the creation of American jobs. Also, US inflation (CPI) fell from 2.1% in January 2018 to 1.6% in January 2019, so the tariffs didn’t lead to higher inflation either.

No wonder Trump is trying to expand his experiment and create a new Tariff Era.

American Production of Goods

This brings me to the next critique that I hear — America can’t make their own goods.

This is obviously not true, but I will entertain the idea as a way to educate those who believe the absurdity.

The United States is the largest producer of lumber. We are leaders in corn, soybeans, dairy, beef and chicken production. We produce 12% of the global supply of semiconductors and the US is one of the largest oil and natural gas producers in the world.

We are the largest manufacturer of aircraft and we remain dominant in pharmaceutical production. The US leads in software production and exports an insane amount of technology innovation globally. We also are very large producers of industrial chemicals and fertilizers.

It is essential that you stop blindly believing the mainstream narratives. The United States can achieve anything we want as long as political leadership empowers our entrepreneurs to build solutions to our problems.

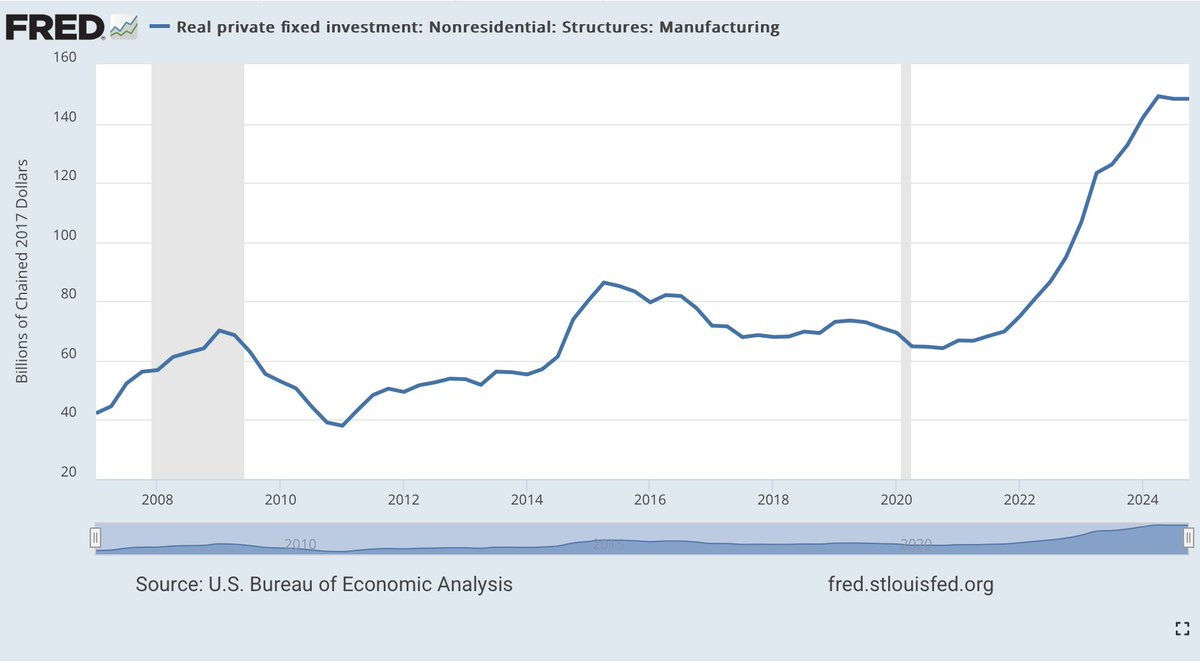

And you can see that US manufacturing is just getting started — private investment in US manufacturing capabilities has exploded in recent years.

Potential Risks

As I stated in the beginning, I have completely changed my mind on tariffs. I believe them to be a great tool for the United States to increase revenue, protect American industries, and incentivize other countries to act in our best interest.

I don’t believe that most of the mainstream narratives are correct. That doesn’t mean tariffs come with no risks though. For example, consumers will pay a higher price for tariffed goods in the first 3-6 months while the market works out the changing demand patterns to shift towards domestically produced goods.

There could be a sustained price increase in products where the United States has no manufacturing capability. You could also see reduced economic growth if American manufacturing of the tariffed goods does not increase to make up for the added friction in the market. We saw steel, washing machines, and solar panels successfully make the transition, but it does not mean every product will be able to do this.

If you get sustained higher prices, you could see inflation stick around longer than desired. But over the long run inflation will dissipate — Norway has a 25% VAT on all imported goods and their inflation rate is under 2% currently (inflation is about the rate of change, not the nominal prices of a good, so inflation is most likely to surface when tariffs are first introduced).

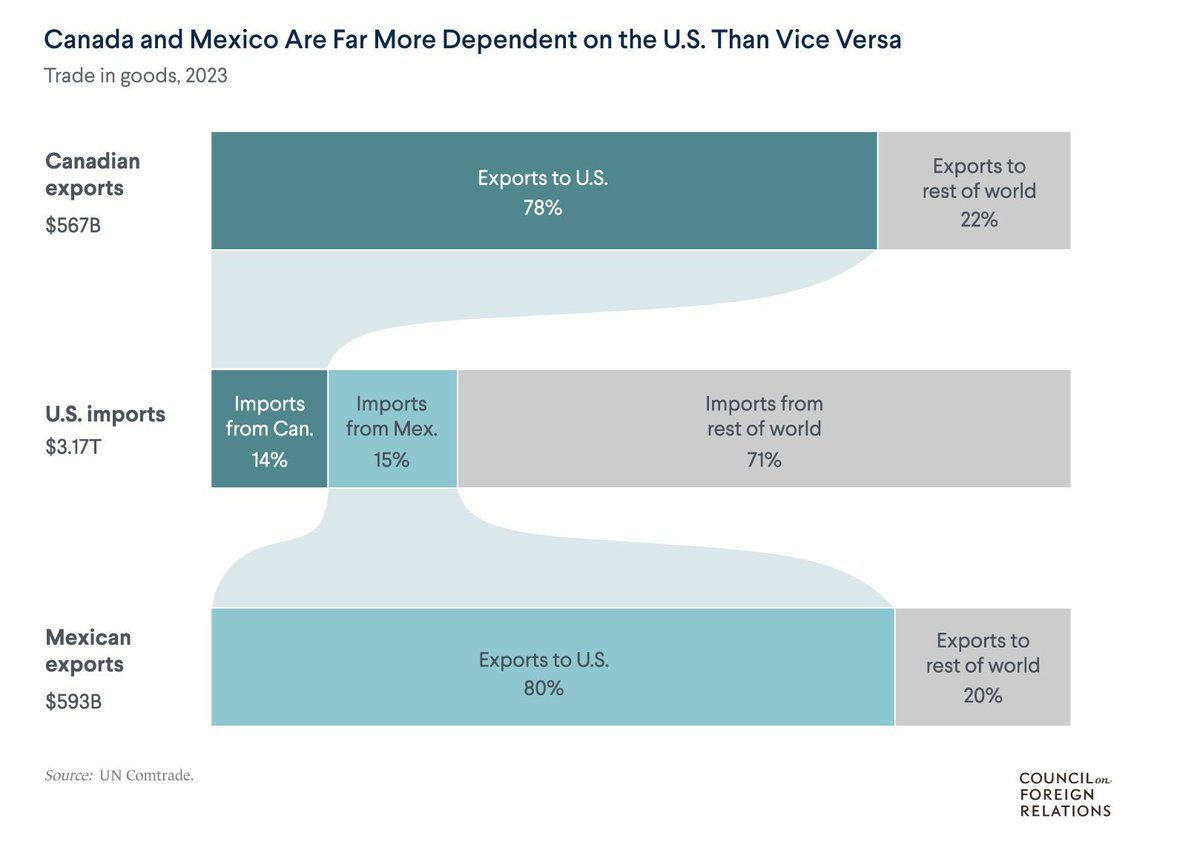

And we already see Canada retaliating against the US with their own tariffs. Thankfully, the United States is much less reliant on Canada and Mexico than they are reliant on us.

The Ace in our Back Pocket

I want to highlight a part of the analysis that almost no one is including from what I have seen. Tariffs don’t operate in a silo. They are part of the complex economic machine. You have to understand the whole system in order to get a sense of how one input will impact various outputs.

A good example of this is the work that the Department of Government Efficiency is doing. Elon Musk recently explained how the United States could reach 0% inflation:

“Reducing the federal deficit from $2T to $1T in FY2026 requires cutting an average of ~$4B/day in projected 2026 spending from now to Sept 30.

That would still result in a ~$1T deficit, but economic growth should be able to match that number, which would mean no inflation in 2026. Super big deal.”

Musk then followed up with a tweet on Saturday saying “I am cautiously optimistic that we will reach the $4B/day FY2026 reduction this weekend.” So the entire tariff conversation is happening with a backdrop of drastic reduction in government spending, including a potential 0% inflation environment.

This gives Trump even more license to exert America’s leadership position on the global stage. Tariff the countries who are taking advantage of us. Protect American industries and create American jobs. Increase government revenue.

And as Milton Friedman said, “inflation is made in Washington,” so the risk of inflation is coming off the table as DOGE slashes the bureaucratic waste that existed for decades.

Conclusion

Tariffs are a powerful tool. They can incentivize desired behaviors and punish undesired behaviors. The mainstream narrative is full of misinformation and fear-mongering. It is always important to read source material, so you can think for yourself.

It was reported this morning that almost half of Canadian companies surveyed “plan to shift more investments and operations to the U.S. to mitigate potential tariffs and maintain market access.” As I have tried to point out in this letter, America’s tariffs will create a black hole that will suck investment dollars and business operations into the United States. If a business does not want to pay the tariffs, they can come build their products in America. If a consumer does not want to pay higher prices for tariffed goods, they can buy American made products.

Tariffs work and the United States is about to go on a big winning streak.

I hope this overview of tariffs has been helpful. I specifically wanted everyone to understand that the 2018 tariffs proved majority of the market does not understand how these economic tools impact prices, jobs, and consumers. Regardless of what side of the political aisle you sit on (I am an independent), we should all be hoping for the success of the United States of America.

Have a great start to your week. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: Today’s letter is free for everyone to read. If you would like to receive this letter every morning in your inbox, you can becoming a paying member of The Pomp Letter.

I spend hours per day trying to make sense of financial markets and then I share my thoughts every day with paying members.

Share this post