To investors,

The widely quoted annual deficit number is $2 trillion. In layman terms, the United States spends $2 trillion more than we pull in as revenue. That is obviously not good.

But we got even worse news recently.

The US government is not running a $2 trillion deficit. They are actually running a ~ $2.5 trillion deficit based on the annual run rate from the first four months of the 2025 fiscal year.

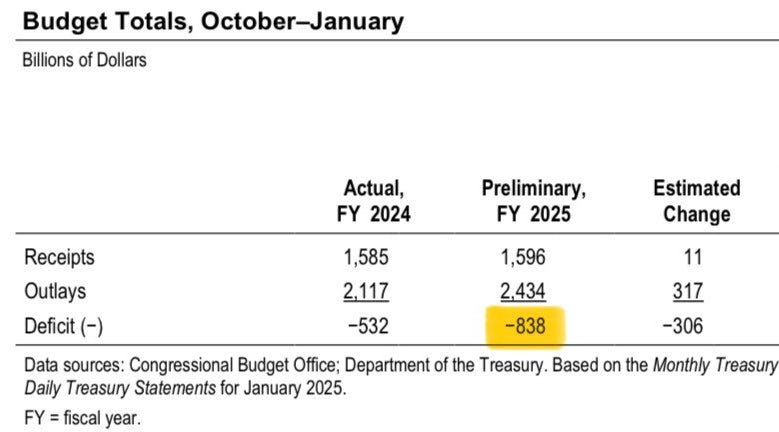

Geiger Capital points out “the first four months of FY 2025 produced a deficit of $838 Billion. That’s $306 Billion more than the deficit recorded in the same period last fiscal year. We’re running a $2.5 TRILLION annual deficit.”

The most shocking aspect of these numbers is not the nominal values, but rather the rate of growth. It is unsustainable if our annual deficit is growing 25% year-over-year or more.

This explains why we are adding approximately $1 trillion to the national debt every 100 days — insane!

Thankfully, we have the Department of Government Efficiency working around the clock to stop wasteful government spending. Here are the various savings DOGE was able to create for the American taxpayer yesterday:

The Department of Agriculture terminated 18 contracts for a total of ~$9 million.

The Department of Education terminated 29 DEI training grants totaling $101 million.

The Department Of Education terminated 89 contracts worth $881 million.

This means that the agency tasked with eliminating government waste was able to stop ~ $1 billion of spending in the last 24 hours. These $1 billion days are a great start, but we are going to need even larger cuts to get to a balanced budget.

But lets stick with the national debt for a second — we know the higher the number goes, the worse off Americans are. But there is a weird solution in bitcoin that has presented itself over the last 15 years.

Before you roll your eyes, hear me out for a second.

We know inflation is bad for people who hold dollars. So what do smart people do? They exchange their cash for investment assets. Now inflation works for the smart people, rather than working against them.

The same is true of bitcoin and the debt. Porter Stansberry said it best on Marty Bent’s podcast recently:

“Their debt is your problem until you own bitcoin. The moment you own bitcoin, their debt is your greatest asset.”

Plenty of people understand this phenomenon. Historically, they have not held bitcoin though. Gold has been a winning asset for these investors. As gold hits a new all-time high and nears the magical $3,000 price level, we can see that the precious metal has benefitted significantly from the insane monetary policy and debt explosion over the last 5 or 6 years.

Here is inflation-adjusted gold prices since the early 1970s:

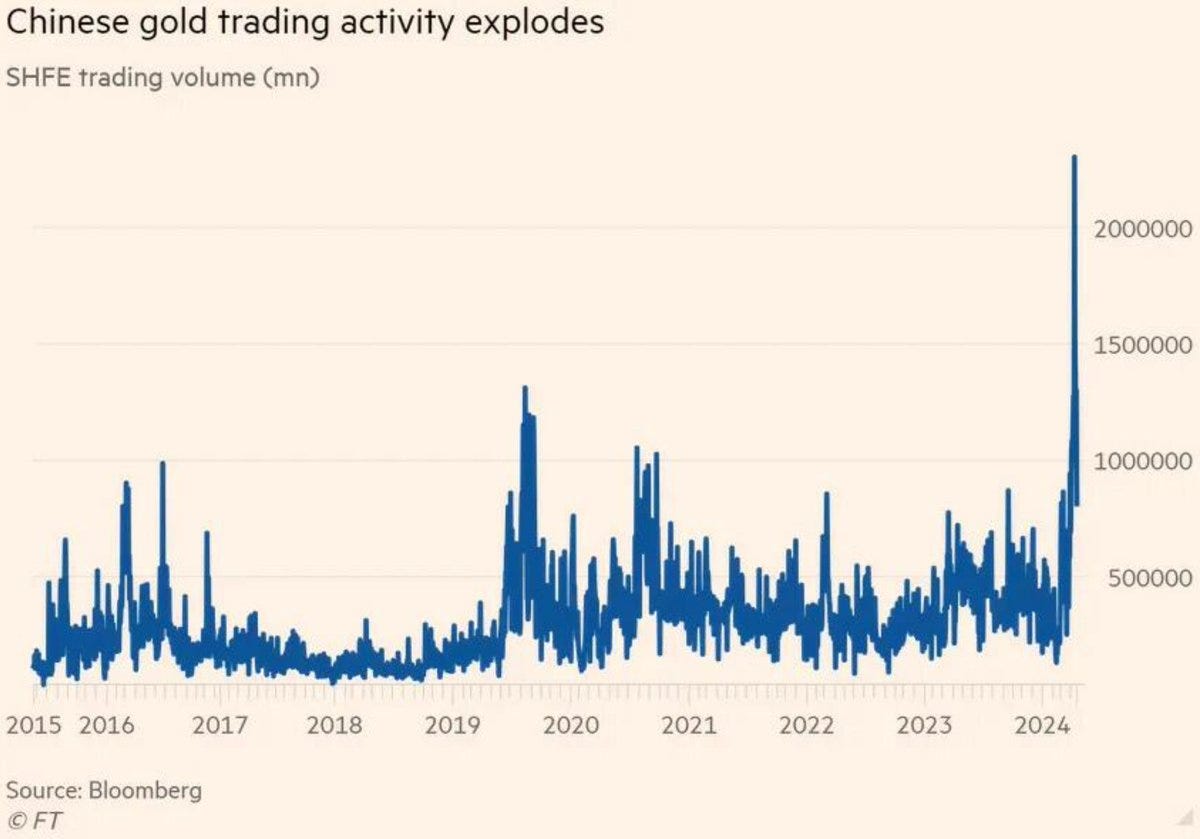

And you want to know the craziest part? The gold price is not being driven by American capital allocators. Instead, the price is being driven by Asian investors. You can see here the recent rise of gold trading volumes in China as one example:

The incumbent investors want gold, but the new generation wants bitcoin. You can see bitcoin is quickly closing in on gold’s market share. A great prompt to think about for your portfolio is whether you think bitcoin will continue to make up ground on gold or if you believe gold is poised to turnaround this trend?

You can probably guess where I stand on this. And now that the national debt is actually growing faster than we previously thought, we can hope DOGE is successful while simultaneously protecting ourselves with a little bitcoin.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Today’s letter is brought to you by Bitcoin Investor Week!

I am hosting Bitcoin Investor Week in New York City from February 24-28th. It is the largest annual meeting for sophisticated Wall Street investors who are interested in bitcoin.

Speakers include Cathie Wood, Vivek Ramaswamy, Mike Novogratz, Senator Cynthia Lummis, Jan van Eck, Anthony Scaramucci, Jack Mallers, Natalie Brunell, and many more.

This is an entire week of high-quality conversations with the top people across traditional finance and bitcoin. The venues are incredible. The planned events will be incredibly fun. And I promise you will learn something, along with make important connections, if you attend this year.

This will be one of the highest quality bitcoin conferences of the year. See you there!

Paxos CEO Chad Cascarilla Explains Why Bitcoin & Stablecoins Will Both Continue To Win Together

Chad Cascarilla is the CEO & Co-Founder at Paxos, a regulated blockchain infrastructure provider and stablecoin issuer. Visit Paxos (https://www.paxos.com/). Chad is also one of the earliest investors in bitcoin.

n this conversation we talk about the early days of bitcoin, the rise of ethereum and other blockchains, the importance of stablecoins, tokenization, helping onboard enterprises, where we are going, and the mission of Paxos.

Enjoy!

Podcast Sponsors

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $500 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post