Today’s Letter Is Brought To You By Consensus: Hong Kong.

The world’s most ambitious builders and boldest investors are coming to Consensus Hong Kong (Feb. 18-20, 2025) to make connections and shape the future of digital assets. Whether you’re focused on Bitcoin’s evolution or the latest breakthroughs in Web3 and DeFi, this is where the industry does business.

Here’s a glimpse of what’s in store:

Bitcoin: The Basis for a New Financial System – Unpack Bitcoin’s role in reshaping global finance.

Bitcoin, DeFi & L2 Innovations – Explore how layer-2 solutions are expanding Bitcoin’s utility.

Bitcoin Mining & the Future of Layer 2 – Get insights into mining, scalability and what’s next.

Beyond Bitcoin, you’ll gain access to discussions with leading Web3 builders, institutional investors and global brands, plus exclusive networking with top decision-makers shaping the future of digital assets.

Take 15% off your registration with code POMP and secure your seat at the table.

To investors,

The stock market sell-off yesterday has everyone predicting a larger crash on the horizon. But as we have discussed in the past, the more people talk about an incoming market crash, the less likely the crash will occur.

Let’s play a hypothetical game though — what if a market crash did occur right now?

Creative Planning CEO Peter Mallouk shared this chart to show “bear markets pale in comparison to bull markets, both in market movement and duration. Remember this chart during the next - and inevitable - correction or bear market.”

The secret to handling bear markets is to simply keep buying great assets that you can hold for a long time. Young people have the greatest advantage because of the long period of time they will continue investing in markets for, but the rule of thumb applies to everyone.

You make more in bull markets than you lose in bear markets.

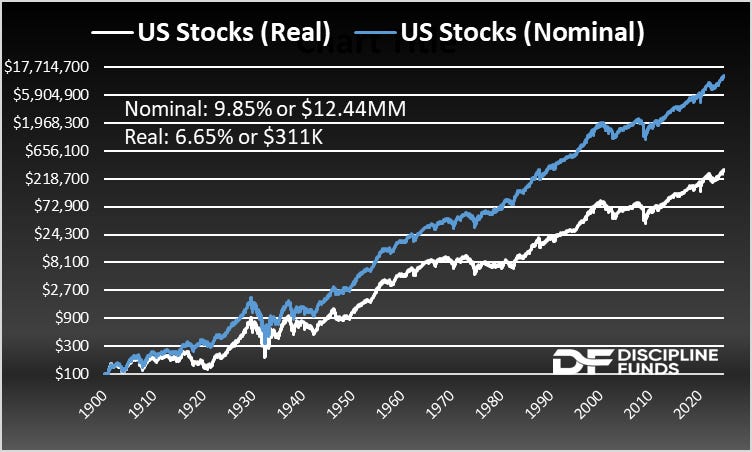

We must have a grasp of the accurate data in order to better understand this concept. Discipline Funds Founder Cullen Roche recently analyzed the nominal and real stock market returns over the last 125 years. Here is what he found:

US Stocks Real: 6.65% per year

US Stocks Nominal: 9.85% per year

This data suggests that most investors are actually capturing only 2/3rds of the financial return they previously thought they were capturing. As Roche eloquently put it, “Inflation. The biggest fee of all them all. By a mile.”

So lets go back to the events yesterday. We saw approximately $1.5 trillion erased from the US stock market. That is an amount comparable to the entire GDP of Spain.

People are worried. But everyone is forgetting the most important development in financial markets — Donald Trump is back in the White House.

He measures the success of the US economy through the price appreciation of the stock market (and increasingly the bitcoin price). It would be devastating to him if the stock market crashed throughout his administration. This is why you have seen him advocating for lower interest rates, along with spending so much time with corporate leaders.

Donald Trump wants to command the stock market to go higher.

And given he is the most powerful man on the planet, and the leader of the free world, I wouldn’t bet against him. Take the comments Trump made last night about Deepseek and the market response:

We are locked in a global competition for AI supremacy. The United States has the talent, capital, and regulatory environment to win. If we accomplish what we are capable of, there should be an explosion of economic activity and stocks will go much, much higher.

Bears sound smart in the short-term, but bulls make money in the long-run. A great example of this is Nassim Taleb. He was screeching in Miami yesterday about a large market crash on the horizon. For a guy who wrote a book titled Skin in the Game, you would expect Taleb to have material skin in the game.

Of course, it doesn’t appear that he does. Taleb and the market crash predictors are looking for headlines and attention. Thankfully, the stock market and bitcoin don’t care. They will continue to go up as the United States adds $1 trillion to the national debt every 100 days.

Betting against the American economy during a golden age of innovation has never played out well. There is no reason to believe it will work this time either.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Anthony & John Pompliano Discuss The Deepseek Market Crash

John Pompliano and Anthony Pompliano discuss bitcoin, why the price is crashing, why you shouldn’t care, the future outlook for bitcoin, Donald Trump tariff threats, DeepSeek, why investors are scared, and why America needs to compete.

Enjoy!

Podcast Sponsors

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $500 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.