Today’s letter is brought to you by Crypto Academy!

Do you want a job in the crypto industry?

My team and I have been working with the top HR teams in the industry to create a training program that teaches the fundamentals of bitcoin & crypto. We’ve helped over 3,000 people get new jobs, and the training program has played a huge part in our success.

This three-week intensive program offers over 60 lives events with me and our team of coaches. This includes workshops with me, deep dives, discussion groups, social events, and a Career Day with the industry’s top companies.

You’ll learn a lot, meet a ton of new people, and accelerate the process of transitioning to your dream job in the bitcoin & crypto industry.

Our next cohort starts in March. Apply today.

To investors,

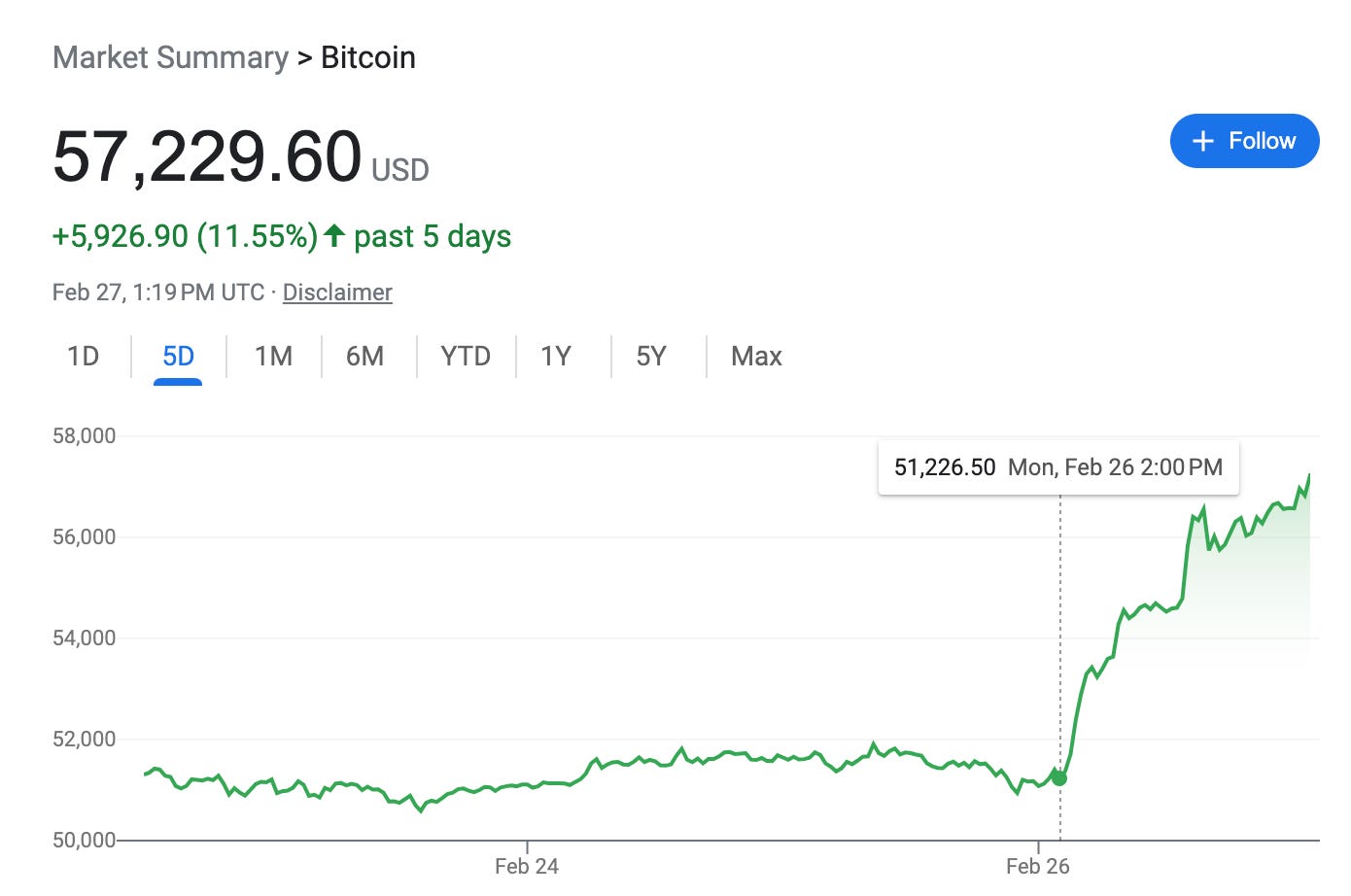

Bitcoin went vertical yesterday. The digital currency is up more than 11.5% in the last 24 hours. This type of performance is rare in financial markets, especially if there is no obvious catalyst such as an earnings announcement or M&A activity.

So why is bitcoin rapidly appreciating over the last few weeks?

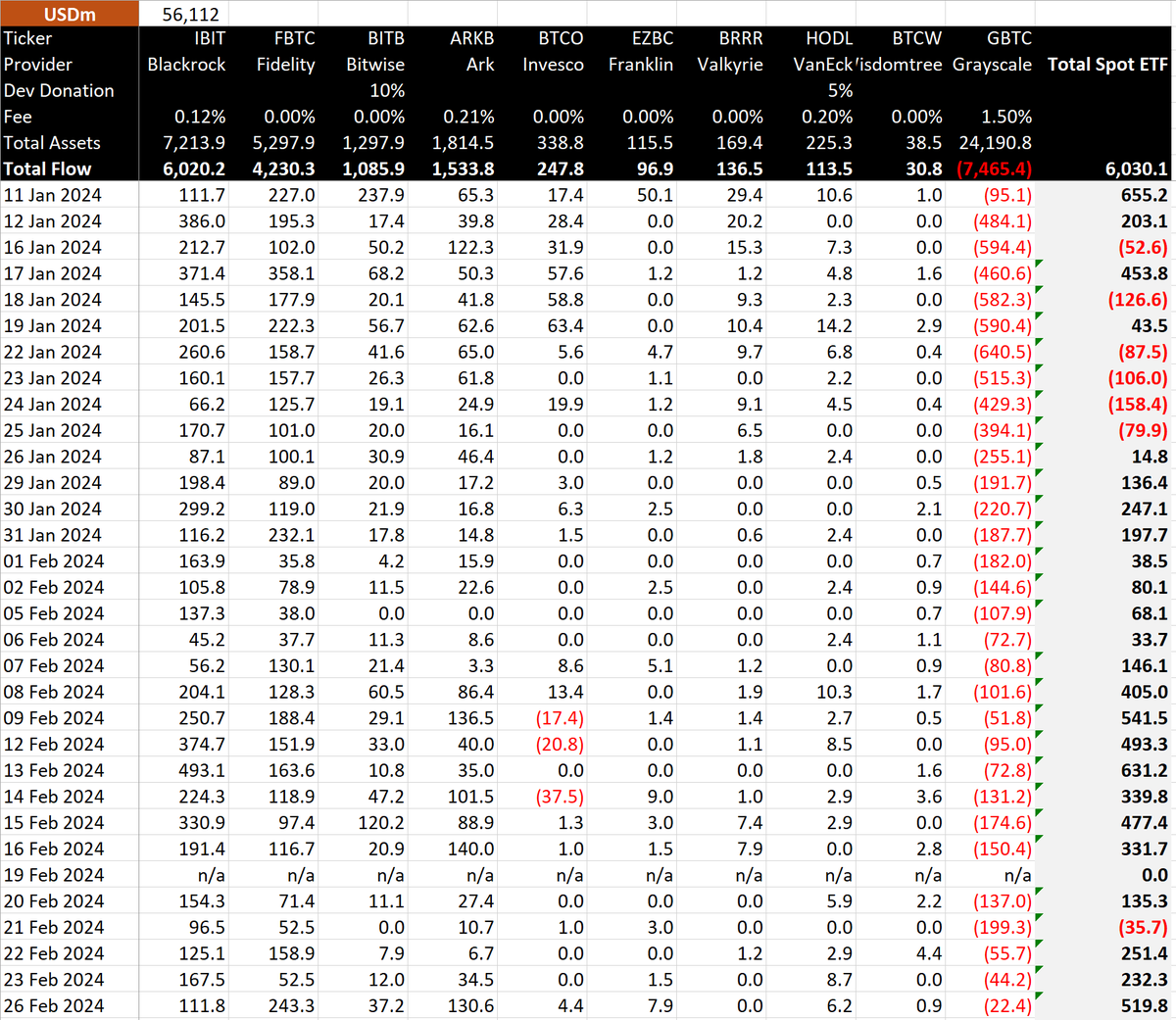

The common answer is that the bitcoin spot ETFs have led to significant demand for the asset. This answer is not wrong. Yesterday we saw $520 million in net inflows to the ETFs.

As the folks at Bitmex Research pointed out, that is 9,510 bitcoin of net inflows when you price the capital flow in bitcoin. To put it in perspective, the bitcoin network is producing 900 net new bitcoin per day. So there is more than 10x demand for bitcoin than what the network can produce daily.

That imbalance of supply and demand would not be shocking if we were evaluating it during the first few days of the ETF launch. But we are now 45 days after the ETF launch, so the 10x demand imbalance is mind-boggling.

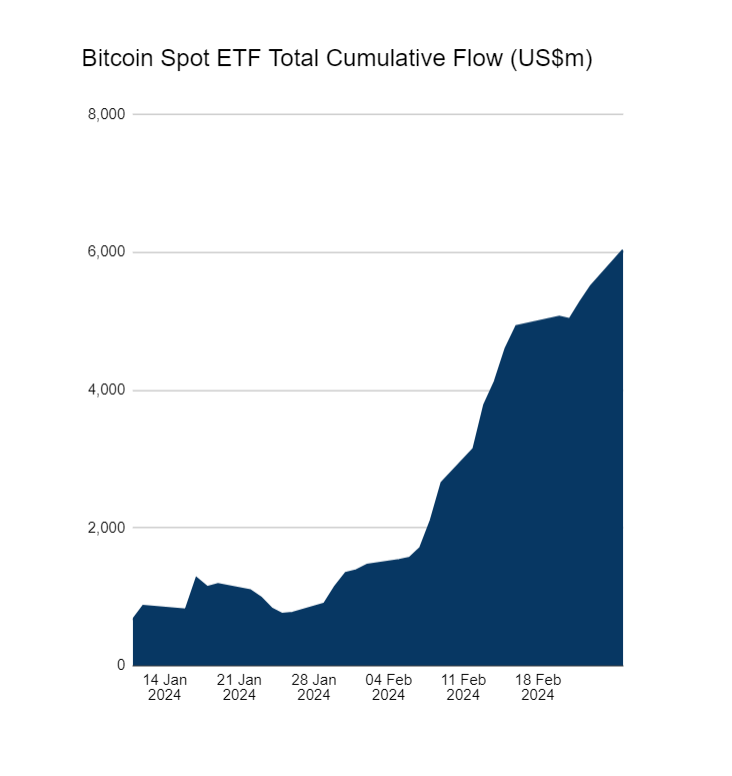

The ETFs have also officially crossed over $6 billion in cumulative net inflows since launch. Blackrock’s fund has $7.2 billion in assets as the leader and there are 5 ETFs with at least $1 billion in AUM. The launch of the bitcoin spot ETFs have been the single greatest launch of any ETF in history by almost every measurement.

This brings us to the most important question — why are so many people buying bitcoin right now?

The easy answer would be some version of “the institutions want to make money and now that they can buy the best performing asset of the last 15 years, they are going to buy as much as they can.” There is some truth in that statement, but I don’t think it is the full story.

In fact, there is a hidden detail that most people are missing, which may scare the hell out of you.

What if people are buying bitcoin because we are going to see a resurgence of inflation and investors are preparing for the inflation shock to their portfolio?

Let me explain.

First, let’s go back to 2020. The pandemic had a chokehold on the economy. Government officials and central bankers stepped in with unprecedented monetary and fiscal stimulus. Trillions of dollars in liquidity was sloshing around the economy.

The state talking point was to not worry about inflation, which was later followed by “inflation is transitory.” Sophisticated investors were not fooled though. Paul Tudor Jones and Stanley Druckenmiller went on CNBC to say “inflation is coming!” They each said they were buying bitcoin because the belief was that inflation would be the fastest horse in the inflation-hedge category.

That was a correct prediction.

Bitcoin’s price was around $8,000 during the summer of 2020 and inflation was under 2%. By March 2021, less than 1 year later, bitcoin was trading at $64,000. That 8x increase in price was attributable to a few things, but a major reason was that markets are forward-looking.

Investors saw that inflation was coming, so they began buying bitcoin hand-over-fist. They wanted to be protected when the inflation arrived. Remember, investors don’t wait for inflation to come before buying inflation-hedge assets. They buy them in anticipation.

And there is a strong argument that investors are doing it again now.

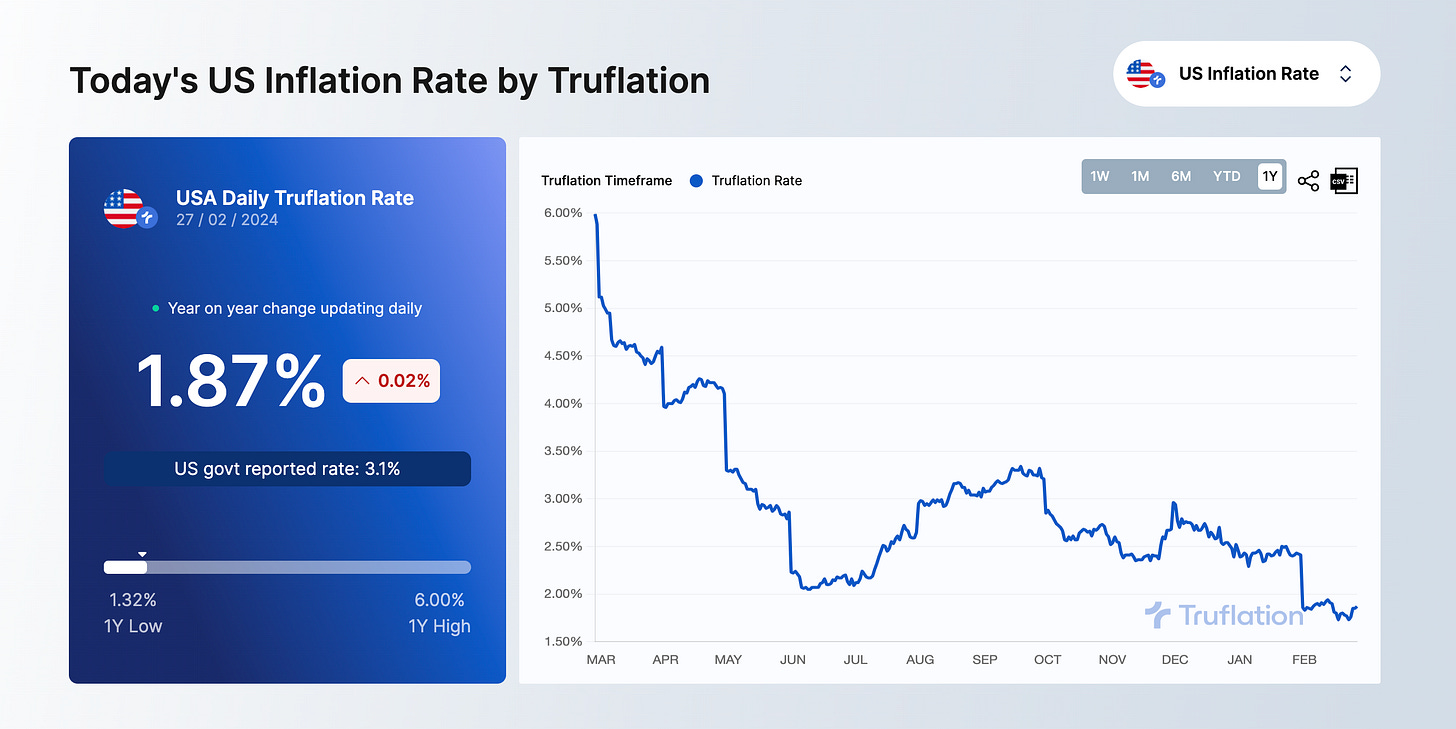

The Fed has worked tirelessly to get inflation down. The media has celebrated that year-over-year CPI continues to fall aggressively. But that is not an honest evaluation of the situation.

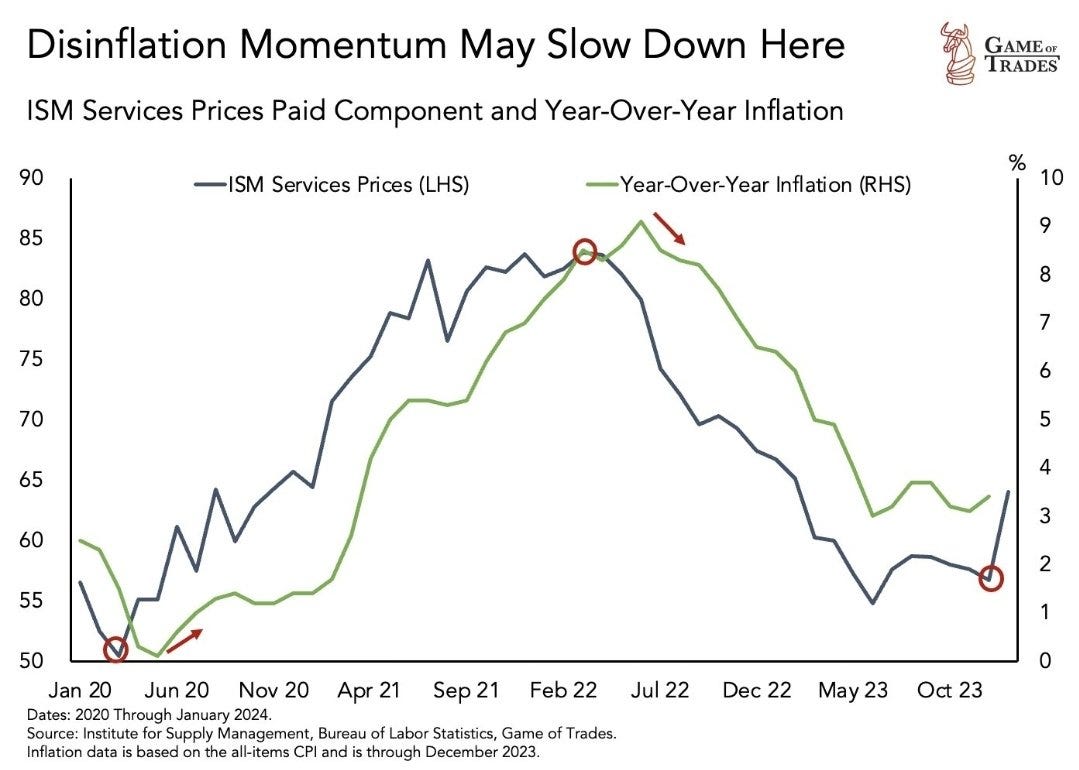

According to Winfield Smart, “Inflation resurfacing is a real risk today. ISM services prices has been an accurate leading indicator for inflation. And it has just moved up sharply.”

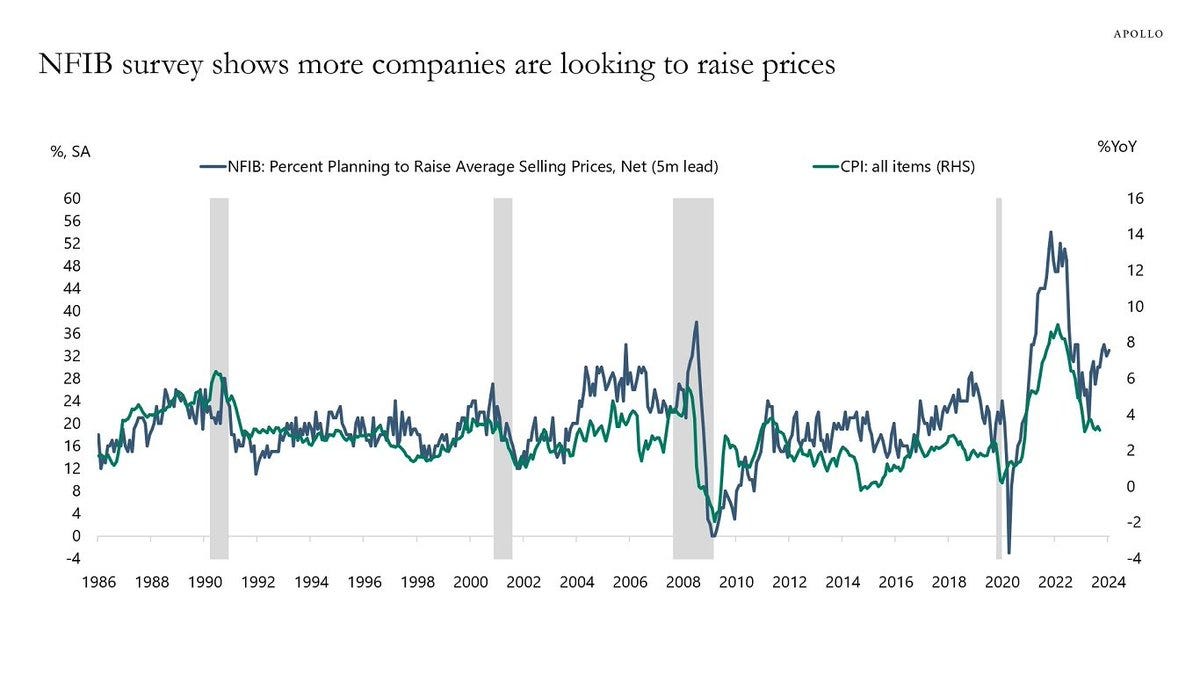

Most importantly Brent Donnelly points out, companies are still looking to raise their prices. This is the ultimate measure of future inflation — if companies continue to raise their prices then it won’t matter what the Fed is doing.

So the risk of inflation coming back is getting higher each day. Some investors are buying bitcoin in anticipation of that situation coming to fruition. The new investment vehicle presented via ETFs gives more capital the option to use this asset than at any other time in history.

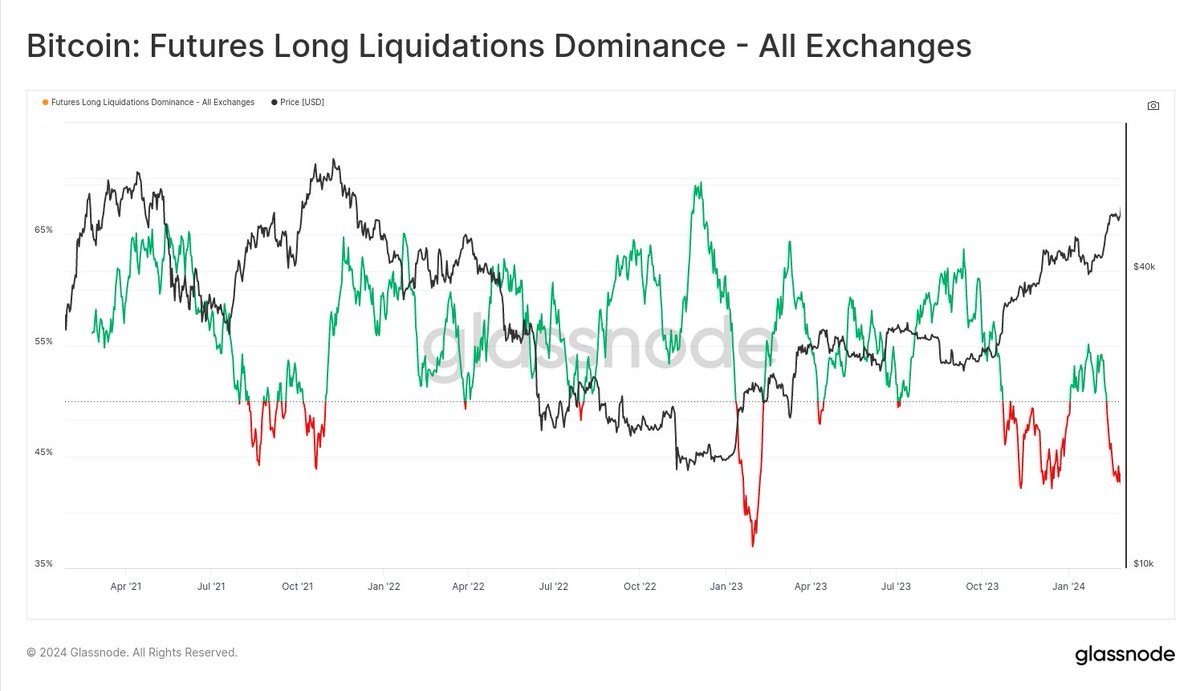

As this capital flows in, the numerous investors who were short bitcoin are being liquidated. Bitcoin analyst Checkmate explained by saying, “You know what sets this rally apart from the last time bitcoin hit $57,000 in 2021? This time, short-sellers continue to bet against the prevailing uptrend, getting liquidated as a result. At true bull market peaks, it is the levered longs that get wiped out. Right now, its the shorts.”

This is reflexivity at it’s finest. The market begins to chase the asset that is running away from them. The smart investors kick off the trend, but the followers push everything further and faster than previously thought possible.

Will Clemente wrote yesterday, “Anyone that’s bought a Bitcoin ETF is now up at least 15%, as it trades just 25% away from price discovery. Any suit waiting to see whether the ETFs would have impact will soon become momentum buyers. Then all time high breakout buyers will follow. Reflexivity.”

I couldn’t agree more.

The bitcoin ETFs are getting most of the attention because the capital inflows are quantifiable. They have exceeded all expectations. It is fun to watch Wall Street push the price of bitcoin up in order to get bitcoin holders to sell their coins.

But don’t buy the narrative that this rally is only tied to some speculative interest from large capital allocators. There is a big risk of inflation lurking in the dark corners of the economy. Many investors have seen this story before and they are not going to be fooled twice.

Inflation. ETFs. Media attention. Liquidated shorts. Reflexivity.

Satoshi couldn’t have drawn it up any better.

Have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Nate Fischer is the Founder of New Founding and American Reformer.

In this conversation, we talk about economics, geopolitics, where the world is headed, why he owns an ammunition company, breakdown of globalization and how that could occur, allocating capital, and much more.

Listen on iTunes: Click here

Listen on Spotify: Click here

The Shocking Future of Bitcoin, Economy, Government & Geopolitics

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.