If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

To investors,

Algorithmic stablecoins elicit intellectual curiosity from people across disciplines. Whether you are coming from the technology industry, finance, or academia, creating a digital currency that holds stable value without being pegged to another asset is a fascinating problem. The value of this type of asset is obvious, but no one has been able to figure it out.

In November, Ryan Clements published a paper tilted Built to Fail: The Inherent Fragility of Algorithmic Stablecoins, where he argued:

“Algorithmic stablecoins are inherently fragile. These uncollateralized digital assets, which attempt to peg the price of a reference asset using financial engineering, algorithms, and market incentives, are not stable at all but exist in a state of perpetual vulnerability. Iterations to date have struggled to maintain a stable peg, and some have failed catastrophically. This Article argues that algorithmic stablecoins are fundamentally flawed because they rely on three factors which history has shown to be impossible to control.

First, they require a support level of demand for operational stability. Second, they rely on independent actors with market incentives to perform price-stabilizing arbitrage. Finally, they require reliable price information at all times. None of these factors are certain, and all of them have proven to be historically tenuous in the context of financial crises or periods of extreme volatility.”

This is important context because there is an experiment underway in crypto that is worth paying attention to.

Terra is undergoing a transition from a dollar-pegged stablecoin to a bitcoin-backed stablecoin. There is a lot to unpack here, so let’s start from the top. Terra is described as a public blockchain protocol deploying a suite of algorithmic decentralized stablecoins which underpin a thriving ecosystem that brings DeFi to the masses. The stablecoin at the heart of this ecosystem, TerraUSD (known as UST), sits at more than $15 billion in market cap.

This is the fourth largest stablecoin in the market behind Tether, USDC, and BinanceUSD. Based on a recent conversation with members of the Terra community, there is approximately $100 million to $200 million of new demand for UST per day. Not only is UST large, but it is growing quickly too.

The other asset that you need to know about is LUNA. This is the native staking token to the Terra ecosystem. The purpose for LUNA is to absorb the price volatility of the fiat-pegged stablecoins, along with use in governance, mining, and staking. A simple framework to evaluate LUNA with is that “the more Terra is used, the more LUNA is worth.”

So here is how UST gets created today — if someone wants UST, they have to burn LUNA. For every $1 of UST that the person seeks, they have to burn $1 of LUNA. This burn mechanism is similar to a stock buyback. It contracts the supply of LUNA and is used as mechanism to keep UST pegged to the US dollar at the preset value of $1.

This is obviously not a simple mechanism though and the complexity can create significant challenges. Many of these challenges were highlighted in Ryan Clements paper that we talked about at the start of this letter.

So what is Terra going to do differently with UST moving forward? They are going to back UST with bitcoin.

There is approximately $3 billion in bitcoin, Tether, and LUNA sitting in the Luna Foundation reserves today. They are slowly converting the majority of this into bitcoin. As for new issuance, the Terra team will refrain from having market participants burn 100% of their LUNA when they seek UST.

Instead, Terra may burn 60% of the LUNA and use 40% to purchase bitcoin. Here is an example — I want $10 of UST. Instead of burning $10 of LUNA, I may have $6 of LUNA burned and $4 would be used to purchase bitcoin. This dual strategy begins to slowly add a bitcoin-backing to the UST stablecoin that is in circulation.

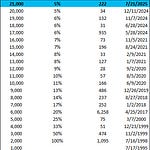

The math shows that UST won’t be 100% backed by bitcoin initially. The idea is that over time, bitcoin’s price will continue to rise and will eventually pull in-line with the outstanding value of UST. There is a strong likelihood that the bitcoin-backing will actually exceed the UST value over a long enough timeline.

So what are the ramifications of this decision by Terra?

First, Terra is becoming a persistent buyer of bitcoin. They are slowly purchasing $3 billion of bitcoin from the Luna Foundation reserves. This is being done via aggressive buying on price dips. Terra will then be a daily, persistent buyer of bitcoin based on the new issuance mechanism that I just described. You can think of Terra as new demand for bitcoin that will be measured in tens of millions of dollars per day to start.

Second, Terra is highlighting the opportunity for bitcoin-backed assets. Terra’s Do Kwon has discussed at length his belief that bitcoin is pristine collateral. It is the hardest, most decentralized asset in the world. The move to back UST with bitcoin creates a symbiotic relationship, which allows UST to have confidence that the asset is backed by the most superior collateral.

Third, bitcoin gets a credible layer two in Terra, one of the largest smart contract platforms in the world. There is a lot of conversation around what bitcoin can and can not do, but now it is becoming obvious that bitcoin’s role as pristine collateral opens a world of possibilities.

Now this evolution of Terra, and bitcoin’s role as collateral, doesn’t come without risk. The team at Terra has identified the biggest risk being a successful bridge between bitcoin and their ecosystem. The security model for bridging bitcoin to a large system with lots of users is still unproven. Many people will point to wrapped bitcoin as a successful answer, but the process of wrapping bitcoin in its current form eliminates the decentralized elements of bitcoin, so this isn’t a true bridge from bitcoin to a decentralized ecosystem.

Lastly, Terra is pioneering an idea of bitcoin-backed currencies that bitcoiners have long discussed. If you think of the US dollar, there has been no underlying commodity backing the currency once we went off the gold standard. The gold bugs think we will return to the gold standard, but that seems hard to fathom. Some bitcoiners believe we will use bitcoin as the next global reserve currency, including bitcoin denominated goods and services, bitcoin as the only currency, and failure of all existing fiat currencies.

While the bitcoiners may or may not be right about hyperbitcoinization, it is easy to see a world where fiat currencies continue to exist but they are simply backed by bitcoin. This would be a replication of the gold standard, but using digital gold instead of the analog version.

Regardless of how this situation unfolds, Terra’s move to back UST with bitcoin is worth paying attention to. There are lots of risk, but if they successfully pull this off then they will be creating a playbook for other stablecoins and/or central banks to follow. Bitcoin is a decentralized, digital currency that has successfully achieved the properties necessary to serve as superior collateral.

As more people recognize this achievement, I would anticipate many other assets to adopt the bitcoin standard. Bitcoin-backed assets are coming. It just may not be in the form that you previously thought. Hope each of you has a great day. Talk to everyone tomorrow.

NOTE: If you’re interested in helping Terra create better bitcoin bridges, they are taking applications and proposals at agora.terra.money

-Pomp

If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

SPONSORED: As Web3-enabled tech — like NFTs, smart contracts, and DAOs — drive more elements of our “real world” lives online, proving that you’re a person – without surrendering personal data – becomes exponentially more valuable. And exponentially more difficult.

This is why Unstoppable Domains launched Humanity Check.

Humanity Check proves that you’re, well, you – without revealing personal data. No matter where you go on the web, you’ll have total control over which apps you want to share data with…and which ones you don’t. Prefer to be completely clouded in mystique? No worries - Humanity Check is 100% opt in.

If you want to feel alive, or at least prove you are, head to UnstoppableDomains.com and get your NFT domain with Humanity Check.

THE RUNDOWN:

Fund Manager Jim Chanos Says He’s Shorting Coinbase: Jim Chanos told CNBC Friday he’s shorting cryptocurrency exchange Coinbase, calling it a “bubble stock.” Chanos expects fee compression as competition increases across crypto exchanges, and doesn’t think Coinbase can be profitable this year. “We basically think Coinbase is over earning,” Chanos said in the interview. “If you do the numbers, their revenue base is roughly 3% to 4% of their custodian assets, their customer assets.” Read more.

Andrew Yang Wants Web 3 to Prove the Haters Wrong: After two spirited bids for elected office (a long-shot run for Democratic Presidential nominee, followed by an unsuccessful bid for New York City mayor), Andrew Yang now finds himself Web 3’s newest poster child, perhaps becoming the highest-profile politician to embrace the cause. Yang’s dive down the crypto rabbit hole is not exactly surprising. It’s hard to ignore the parallels between Yang’s culty supporters (known as the “Yang Gang”) and the similarly zealous coalition crypto has amassed. Read more.

DC Lobbying Group Expands to New York State Capital: The Blockchain Association has expanded operations to the state of New York, adding an office in Albany, the state’s capital. The expansion comes as the crypto trade association, which is headquartered in Washington, D.C., is taking steps to get more involved in regulation at the state level. Read more.

Regulatory Uncertainty a Recurring Theme at London’s Token2049: Regulatory uncertainty kept coming up at London’s Token2049 conference on Thursday. Speaking via Zoom, Galaxy Digital CEO Mike Novogratz said U.S. Securities and Exchange Commission Chair Gary Gensler was smart and committed but questioned the scope of the regulator’s purview where crypto is concerned. “Gensler wants to be the sheriff of crypto, but he doesn’t have full authority because of the newness of our industry,” Novogratz told the crowd in London. Read more.

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Bitcoin 2022 is the largest Bitcoin event in the world that takes place 4/6 - 4/9 in Miami Beach. Click HERE to learn more and use promo code POMP for 10% off.

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain here today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

Abra lets you trade, borrow, and earn interest on crypto. Earn up to 13% interest on USD stablecoins or crypto, borrow USD stablecoins, and trade in 110+ cryptocurrencies in a simple, secure app. Download Abra and get $15 in free crypto when you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Those products include BlockFi Wallet, no fee Trading, crypto collateralized Loans and the World's First Crypto Rewards Credit Card. To get $75 back on the first swipe of your BlockFi Rewards Credit Card, sign up today at http://www.blockfi.com/Pompcc

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go to okcoin.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visithttp://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post