Today’s letter is brought to you by Espresso Displays!

I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop.

So I started to use a second screen and it seems to have fixed the issue.

It took awhile but I evaluated tons of different screens — Espresso Displays was by far the best one.

I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself.

Any reader of The Pomp Letter who orders one this week will get a great deal. Highly recommend!

To investors,

Central bankers learned the QE playbook during the Global Financial Crisis. They practiced it during the 2020 pandemic. And now they are about to perfect it.

Multiple people are pointing out that the global liquidity drawdown has bottomed and it appears we are headed up for the foreseeable future. There is Michael Howell at Crossborder Capital with this chart:

You can see the Global Liquidity Index (in orange) turning up on the bottom right of the chart.

Crossborder goes on to point out that more than 1/3 of global central banks were easing at the end of 2023.

That is a very different story than the mainstream narrative inside the United States where majority of the focus has been on when the Federal Reserve is going to cut interest rates.

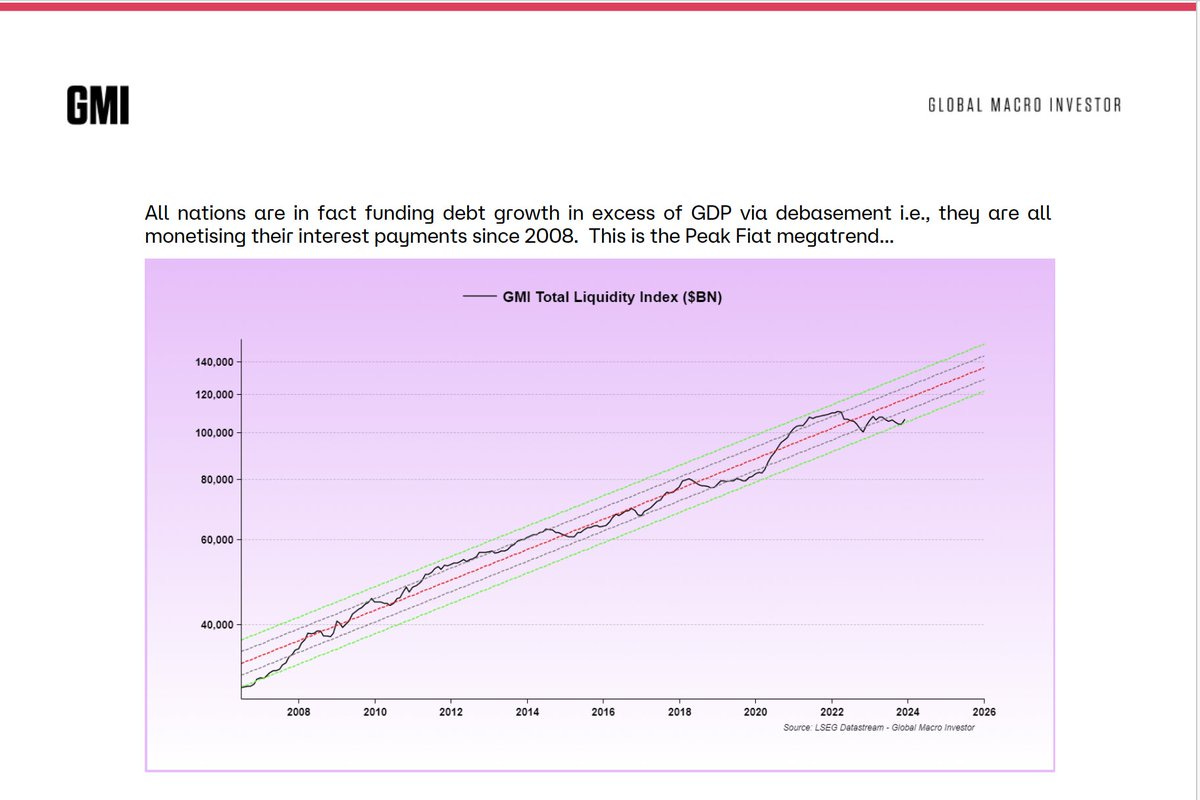

As I mentioned yesterday, GMI’s Raoul Pal recently pointed out that global liquidity is bouncing off the bottom of a well established trend line, which he believes signals a significant increase from here over the coming years.

Onchain analyst Cole Garner recently pointed out that the stablecoin market cap ratio is a leading indicator of crypto market performance. But PBoC’s liquidity index is a leading index of the stablecoin ratio by approximately one week. Given that PBoC has flipped bullish, we should expect stablecoins to follow and then the rest of the crypto market.

These three individuals, along with many others, are pointing out that asset prices are rising because total global liquidity is rising. The US and Federal Reserve may get all the attention, but they aren’t driving the asset price ship at the moment.

This is important because when the Fed joins the party sometime in Q1/Q2 of this year, we should expect an even larger move in investment assets.

So lets go back to the situation I posed at the start of the letter — are central banks about to perfect the QE playbook?

Bryan Hardy and Goetz von Peter from the Bank of International Settlements published a paper in December titled “Global liquidity: a new phase?” In the paper, they state the following:

“Foreign currency credit – a key aspect of global liquidity – has undergone distinct phases. The first phase recorded by the BIS global liquidity indicators (2003–09) featured soaring bank credit amid accommodative financial conditions in the run-up to the Great Financial Crisis (GFC).

The second phase (2009–21) saw a shift towards bond markets and more dollar credit, especially to borrowers in emerging market economies (EMEs), on the back of tighter bank regulation and a loose monetary stance.

Has the recent global surge in inflation and monetary tightening ushered in a new phase? Recent patterns point to a contraction in foreign currency credit, primarily in dollars, and particularly for EMEs.”

Regardless of whether you call this developing situation a new phase or a perfected playbook, the data points are lining up to tell the same story—central banks are addicted to loose monetary policy and asset prices are ready to rip higher at the first sign of the central banks giving up on their tight monetary policy dreams.

And it should go without saying, but just to make sure everyone understands my current view, if asset prices go higher then I believe crypto assets will outperform all other assets. There is something unique about asymmetric assets that are globally available during an injection of global liquidity.

But don’t take my word for it. JP Morgan’s Jamie Dimon was at Davos this morning talking to CNBC and said that he believes the government should be very cautious right now. His point is that we may not understand quantitiative tightening nor quantitiative easing nearly as much as we think. So caution is warranted as we enter this new phase.

Hope you all have a great day. I’ll talk to you tomorrow.

-Anthony Pompliano

Raoul Pal is the Co-Founder & CEO of Real Vision. He also writes ‘Global Macro Investor” and he has a brand new asset management firm (EXPAAM), with a mission to deliver leading returns on invested capital and serve as catalysts of crypto adoption.

In this conversation, we talk about the bitcoin ETF, who is going to win the Cointucky Derby, Ethereum, Solana, his “Everything Code” thesis, macro environment, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Raoul Pal on Bitcoin, Ethereum, Solana, and Macro Environment

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.