READER NOTE: Today is a free email to everyone.

I am hosting a webinar tomorrow morning at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and graphs to explain the US economy, inflation, the global liquidity situation, and where I think various asset prices are going in the next 24 months.

You can join us by becoming a paying subscriber here. I will send out the Zoom link to all members in the morning. Thank you.

To investors,

I went on CNBC’s Squawk Box yesterday morning. The conversation largely revolved around bitcoin’s recent price increase, the significant inflows for spot ETFs, and what I anticipate to happen in the future.

You can watch the full interview here:

This conversation was well received by the bitcoin community, except one sentence I said. Towards the end of the discussion, I stated “The return profile is going to come down. And so if you think you are going to buy bitcoin and retire, those days are probably behind us.”

While it may not be popular, I believe it to be true.

Let’s look at some math. 57% of Americans are uncomfortable with the amount of emergency savings they have and 22% of Americans don’t have any emergency savings at all.

Add in the fact that 91% of Americans have a net worth less than $1 million. This means that majority of the population can’t invest $100,000 or more into any investment opportunity, let alone bitcoin.

So we will have to make an assumption in our hypothetical situation — the average person could find $20,000 to invest in bitcoin. This amount is highly unlikely but we will give the detractors the benefit of the doubt for our example and use an inflated number.

Next, let’s assume that bitcoin goes up 20x in the next decade. This would bring the digital currency from $50,000 to the coveted $1 million per coin.

If this happened, then the person who put $20,000 into bitcoin would have $400,000 of bitcoin at the new, higher price. Sounds amazing, right?

Not so fast.

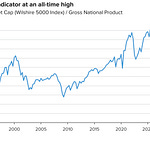

If bitcoin is trading at $1 million than it is likely that the dollar has been significantly devalued. $400,000 in a decade won’t be worth what $400,000 is worth today. Inflation punishes everyone.

But inflation is not the only problem. If we completely remove inflation in our example, and say that $400,000 holds its purchasing power for a decade, than the subject of our hypothetical situation still can’t retire.

What do I mean?

A recent Northwestern Mutual study reported that the average American adult believes they need $1.3 million saved in order to retire. That is a BIG number.

This study also proves that our $400,000 of bitcoin, which only occurred because bitcoin went up 20x and inflation wasn’t real, would still leave our hypothetical subject 70% short of what they would need to retire.

But maybe our math is wrong. Maybe some of our assumptions are incorrect. Let’s go with the common belief in the bitcoin community that a holder “will only need 1 bitcoin to retire.” The thought process is that holding a single, whole bitcoin will allow someone to breach the coveted retirement threshold.

But again, if bitcoin is trading at $1 million and you only hold one of them, then you don’t have the $1.3 million necessary to retire today. The $1.3 million number will continue to go up in value too because the dollar is being devalued.

So, this brings me to the conclusion — the hardcore bitcoin holders may not like what I’m saying, but the future returns of bitcoin are unlikely to be enough for the average person to reach a comfortable retirement.

That doesn’t mean that bitcoin won’t go up in price. It doesn’t mean you shouldn’t own any (you should own some after doing your own research!). It doesn’t mean that your favorite bitcoiner is wrong.

I like bitcoin. I hold bitcoin. I think bitcoin is one of the best risk-reward investment opportunities currently present in financial markets. But we should be realistic about the dire financial position the average American is in and how unlikely it is that they have enough money to buy tens of thousands of dollars of bitcoin.

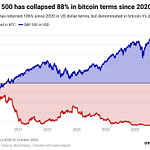

The future returns won’t necessarily look like the past returns and assets historically have seen their financial returns dampen as they get larger. This is all part of the process of bitcoin being adopted by the mainstream.

It is less risky to buy bitcoin today than any other time in history. Naturally, you will get paid a lower return for taking a lower risk.

Hope this explanation is valuable to you. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Travis Kling is the Founder & Chief Investment Officer of Ikigai Asset Management.

In this conversation, we talk about cryptocurrency prices & protocols, the ultimate use case, liquidity, bitcoin vs gold, Saylor vs Schiff, financial nihilism, allocating capital in today’s market, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

My Appearance on Fox Business with Charles Payne

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.