To investors,

Bitcoin is going to infiltrate every corner of financial markets. This has become increasingly clear over the last few years.

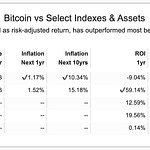

Everyone knows that retail investors had the opportunity to purchase and hold bitcoin before the institutions. This is one of the first times in history we saw the little guy get an advantage, but the big guys are not going to sit around and ignore the digital asset any longer.

In 2018, my partners and I raised capital from the first US public pension funds to actively get exposure to bitcoin. Those investors are happy today. Around the same time, our firm and others were able to raise capital from university endowments, hospital systems, and foundations.

The professional LPs were in the game.

Next came the large hedge fund managers. We saw Paul Tudor Jones and Stanley Druckenmiller announce in 2020 that they were long bitcoin. This removed career risk for every hedge fund and quickly most large funds began to buy bitcoin.

In 2020, we also saw the first public corporation put bitcoin on their balance sheet. Microstrategy started buying bitcoin with cash and then eventually used debt and equity issuances to acquire more than 2% of the total bitcoin supply. As other public company CEOs saw this strategy work, they began to copy the playbook.

Finally, we saw the large financial institutions capitulate in 2024. They launched bitcoin ETFs once the regulators gave them the green light. Those ETFs have been the most popular product launch in Wall Street history.

What a whirlwind of adoption in the last 6 years.

But the party is not over yet — bitcoin is going to infiltrate every corner of the financial system.

Let me give you a few examples.

Here is the Newmark CEO talking about their new product to offer a term loan for real estate investors, but include bitcoin as part of the collateral package to ensure the loan is less risky for investors. He describes it as “bitcoin in” instead of “cash out.”

This is not the only area where bitcoin and real estate are meeting. Billionaire Grant Cardone recently announced a Bitcoin Real Estate fund as well. Julie Taylor of Realtor.com says “he’s raising a total of $87.5 million, with each investor required to make a minimum investment of $250,000. Of that, $15 million will be spent on bitcoin, while $72.5 million will be spent on a portfolio of 300 residential units in Florida.”

Another area is Microstrategy’s recently announced perpetual preferred equity offerings. This will allow insurance companies and other large organizations to gain bitcoin exposure.

Next we have Blackrock putting bitcoin in their fixed income funds. So another mix of a traditional financial product combined with bitcoin.

Then we have companies like Meanwhile which have created bitcoin life insurance, which means that the entire policy and payout is denominated in bitcoin. Here is how they describe themselves:

“At Meanwhile, we believe digital currencies are here to stay and that new financial products and institutions will be built on top of them. That's why we are offering the first—and only—life insurance policies based on Bitcoin.

With Meanwhile, you can get the same level of protection as traditional life insurance, but your premiums and payouts will be denominated in Bitcoin.”

Do you see what is happening? Do you get it yet?

Bitcoin is going to become a staple in traditional finance. It won’t be a single commodity that people buy and hold. It is a new lego piece that has been introduced to Wall Street. They are going to figure out a ton of different ways to leverage the asset. This will include new products, new variations of old products, and much more.

This is an important trend to watch because I predict much of bitcoin’s adoption moving forward is going to be through these indirect means. People will put 1-5% of their portfolio into bitcoin, but they are not going to put 50% of their portfolio.

They will put a large percentage of their net worth into fixed income, real estate, and their life insurance policy though. Those are areas where bitcoin can start to eat into the wallet share it has for each individual investor. There will be plenty more areas in the coming months and years.

Wall Street is just getting started with playing with bitcoin. I can’t wait to see what they come up with next.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Darius Dale Explains The Impact of Global Liquidity on Bitcoin and Stocks

Darius Dale is the Founder & CEO of 42Macro, which you can check out here.

In this conversation we talk about a strong US dollar, impact on stocks, bitcoin, many other assets, why international investors own so much of US assets, and what could possibly happen if they decide to sell.

Enjoy!

Podcast Sponsors

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $500 in rewards.

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intedneded to serve as financial advice. Do your own research.