READER NOTE: I have spent the last few years mostly managing balance sheet capital. There have been a few people who have reached out asking if they can invest with me or our investment firm. While I have not made a decision yet, I am increasingly open to the idea.

As a way to gauge interest, I made this Google Form. If you are interested in potentially investing alongside me in the deals we do, please fill out the form to indict your interest: Click here

To investors,

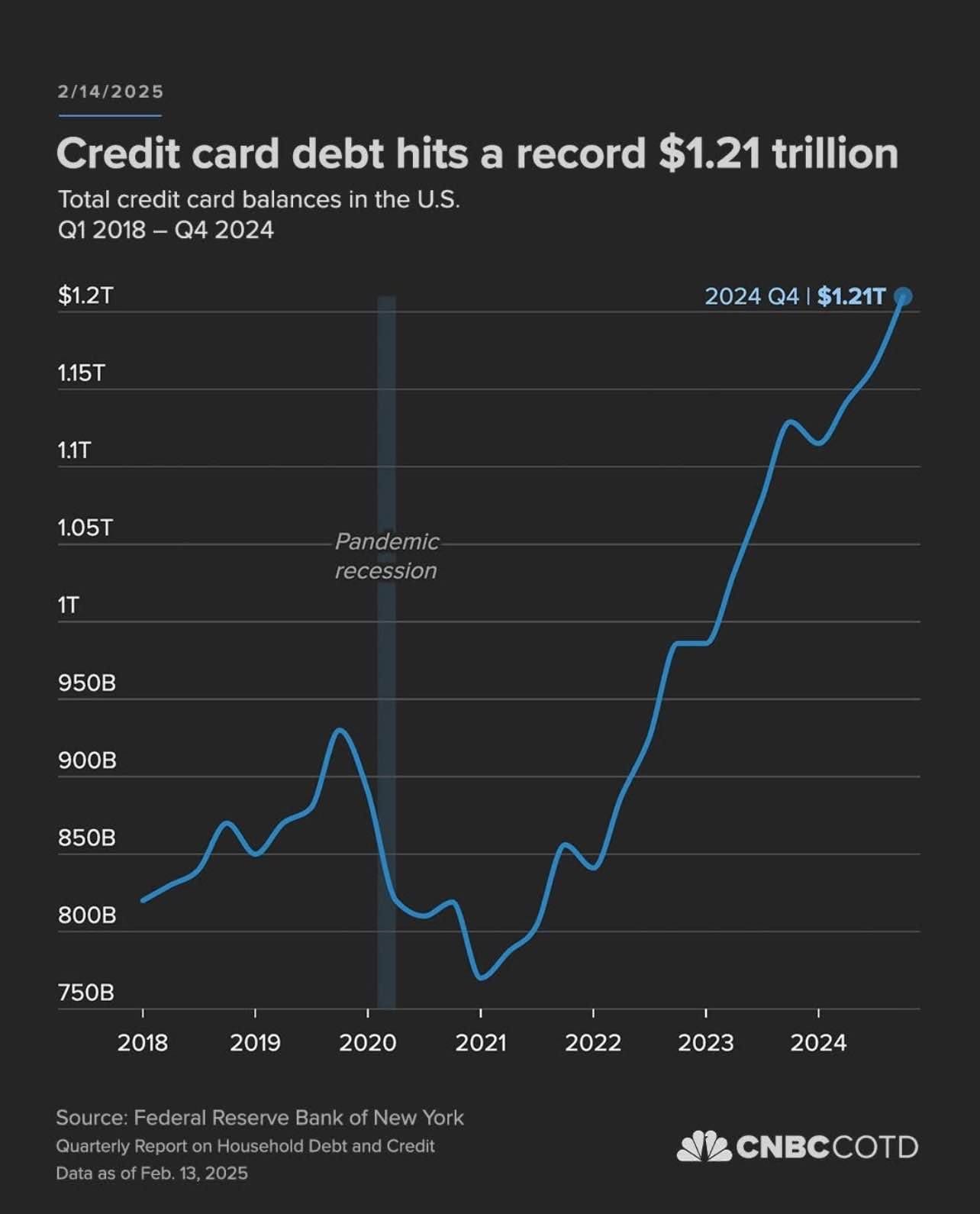

American consumers are feeling immense financial pain. I started thinking about the problem after I saw this post from my friend Balaji Srinivasan showing credit card debt hit a record $1.21 trillion:

If you dig into the data further, you see that the average credit card balance is $21,000 and Americans are paying an average of 28.6% interest on that debt. This is insane. Imagine paying 28.6% on your debt — you would double your debt in about 30 months.

But credit cards are only part of the story.

Home affordability is at the lowest levels in four decades. The median US home price has gone from ~ $280,000 in 2016 to more than $400,000 today. There is a decreasing amount of people who have the cash laying around to make a downpayment, let alone the increasing wages to keep up with this level of real estate appreciation.

Home prices accelerating are helping the boomer generation who have around 50% of their net worth in their primary residence, but it is pricing out the younger generations who have become a renter generation.

We can also see this financial pain for the American consumer in their spending behavior. Retail sales in January fell 0.9% and has caused a number of stocks to fall in recent days — retailers are calling out the weakened consumer demand as a significant headwind.

Not only is the consumer frustration showing up in spending patterns, but we are now seeing the sentiment surveys come in negatively for President Trump and his administration. Here is the data:

“According to a recent Gallup poll, Trump's approval rating on the economy stands at 42 percent. This is lower than any president's first-term February reading in recent history, Gallup notes, including those for Joe Biden (54 percent), Barack Obama (59 percent), George W. Bush (53 percent) and Bill Clinton (45 percent).”

Economies don’t turn around overnight obviously. But the American consumer bought into the campaign promises of inflation coming down and a strong, growing US economy. Vice President JD Vance said Americans should expect the positive impacts to “take a bit of time.”

Another data point worth paying attention to is the rising prices of gold and bitcoin. Both assets benefit from sound money principles and operate outside the system. They serve as a safe haven for investors who are nervous about the economy or seeking protection from inflation.

Gold continues to hit new all-time highs and sits right below $3,000 per ounce. The precious metal is up more than 50% over the last 12 months. Bitcoin is also on a tear. The digital currency has doubled in the last year, while continuing to hover around $100,000 per coin.

Consumers are feeling the pain of 3% year-over-year inflation (if you believe the official government metrics). They are starting to contract their spending. They can’t afford a home and they are living on credit more frequently. Plus investment capital is seeking assets that benefit from inflation.

These various trends lead back to one big idea — the American consumer is in financial pain.

Thankfully, we don’t have to spend all of our time complaining. There are solutions we can pursue. First, we need DOGE to be successful in slashing government spending. This will act as a deflationary force on the economy and help keep inflation under control. Second, we need the private sector to create the products, services, and companies necessary to get GDP growth cranking higher. This will also create a deflationary force that leads to more economic gain for the average American family.

Citizens can’t impact the political apparatus until the next election, but we can focus our time and effort on making sure that GDP is growing faster. The future will be bright if we can do that.

Grow our way out of the problem.

Until then, people will continue to use bitcoin and gold as a way to store their hard-earned economic value. Stocks and real estate will also benefit from the high inflation environment. Investors are winners in today’s economy and savers are losers.

Crazy situation. Let’s hope the new administration is successful for the sake of all Americans.

Hope you all have a great day. I’ll talk to everyone next week.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Will Bitcoin Generate Yield?

David Tse is the Co-Founder of Babylon Protocol.

In this conversation he explains two use cases for bitcoin, why he is trying to build a third use case, staking in the bitcoin network, and what David thinks the future looks like.

Enjoy!

Podcast Sponsors

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post