To investors,

Bitcoin’s price has been falling for months and now sits under $25,000. Although these price drawdowns never get easier, they have happened numerous times over the years. It is always a good reminder to re-evaluate the bitcoin thesis and check the underlying fundamental data.

First, the bitcoin thesis is simple — an open-source, decentralized, digital currency that boasts a programmatic monetary policy and finite supply will be valuable in a digital world. Everyone still agrees that we are headed towards a digital world, so the question shifts towards the ideas of decentralization, programmatic monetary policy, and finite supply. In my opinion, people aren’t necessarily adopting bitcoin because of these features, but rather because of what the features empower (prevent currency debasement, censorship-resistance, seizure-resistance, etc).

The thesis is equivalent to perceived long-term value. Price and value are different. But to ensure that value is not also falling as aggressively as price, we must take a look at the underlying fundamentals of bitcoin.

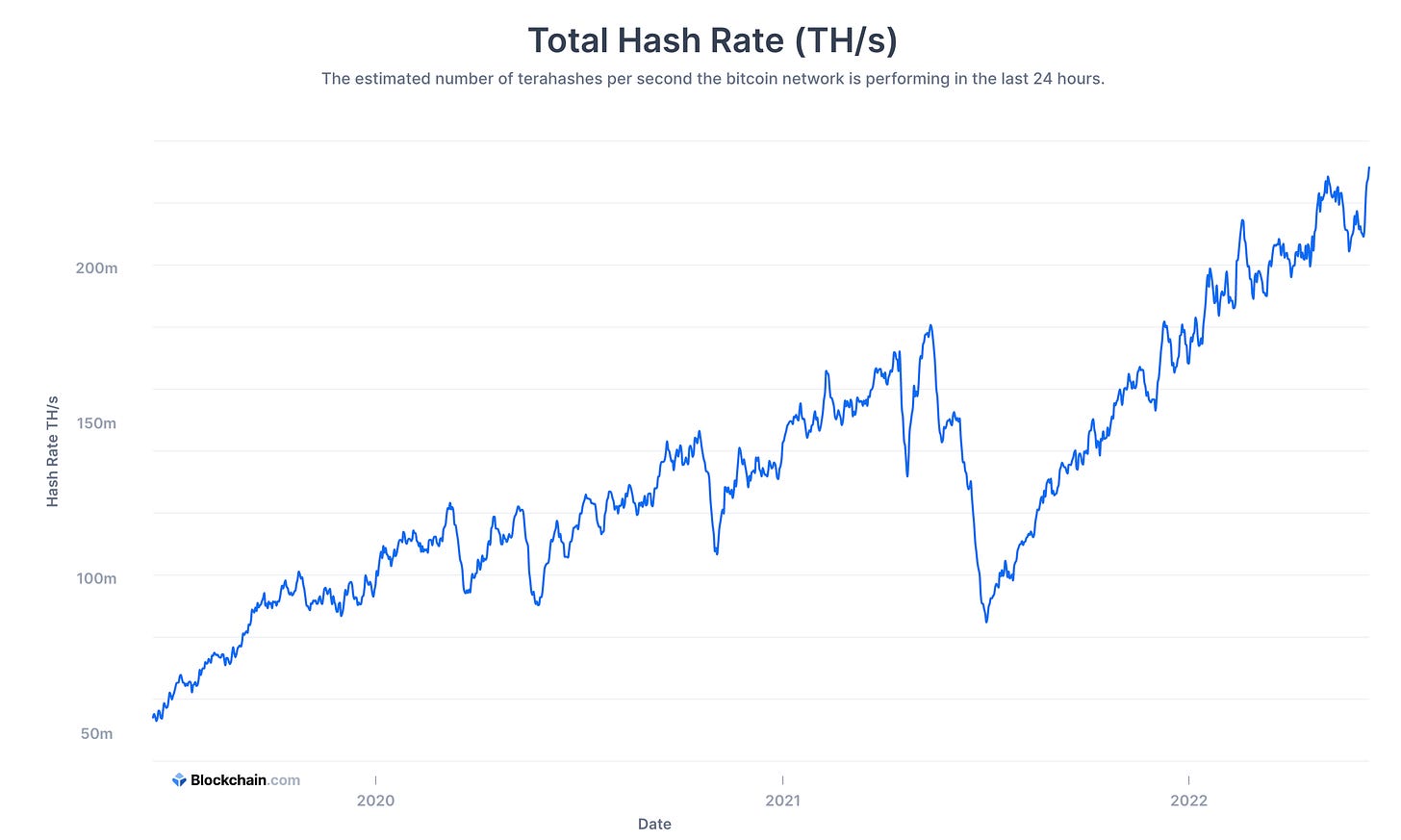

The bitcoin network hash rate has more than quadrupled in the last three years. It continues to hit all-time high levels today, proving that the network has never been more secure.

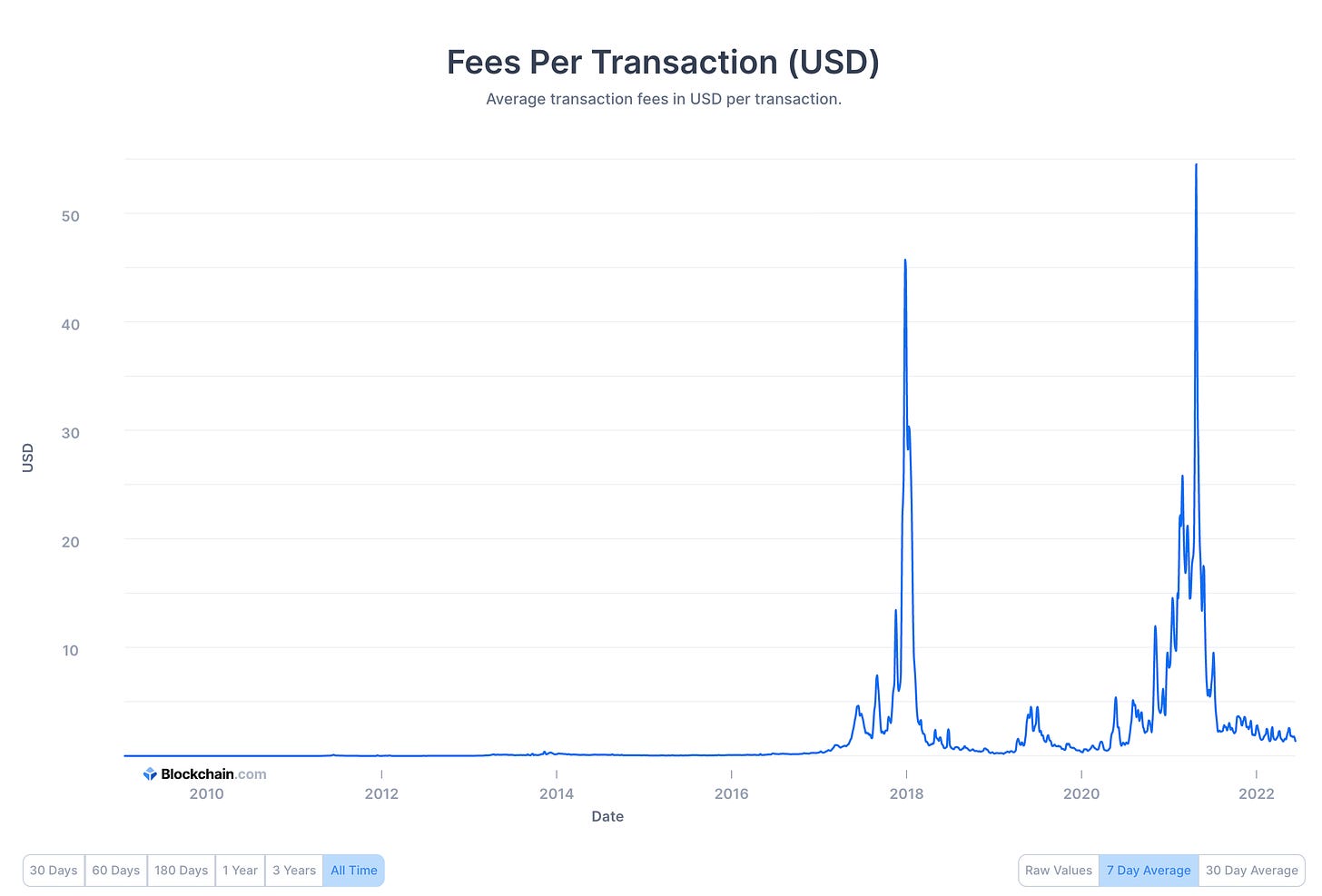

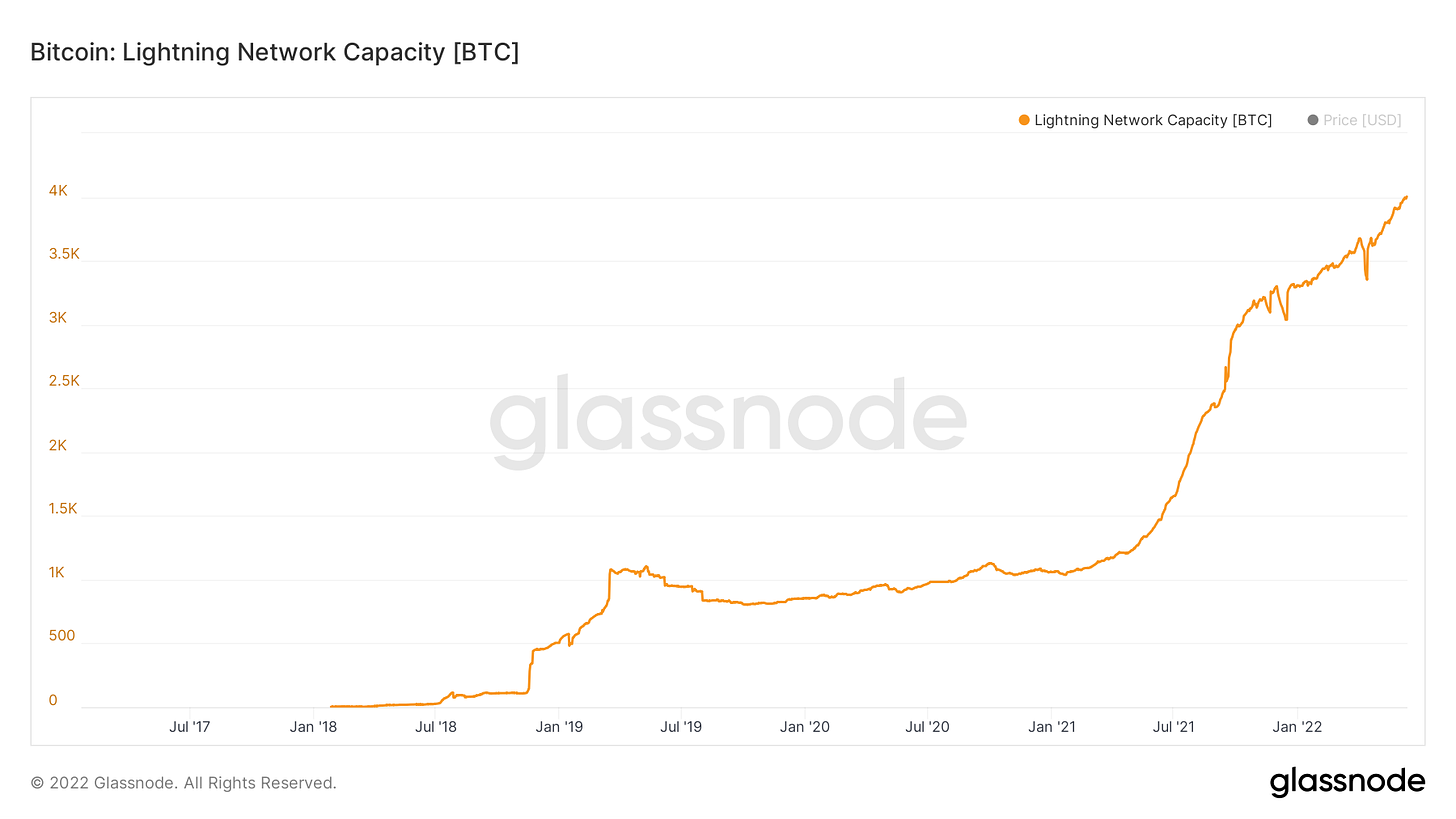

The average transaction fee paid on bitcoin is currently under $1.50 and we didn’t see a spike in fees when bitcoin was hitting all-time highs for the second time in 2021. This is a big improvement from the spike in fees when bitcoin hit the 2017 all-time high and Q1 of 2021. Much of the improvement in fees that started in the second half of 2021 can be attributed to layer-one technology innovation and the continued rise of the Lightning Network.

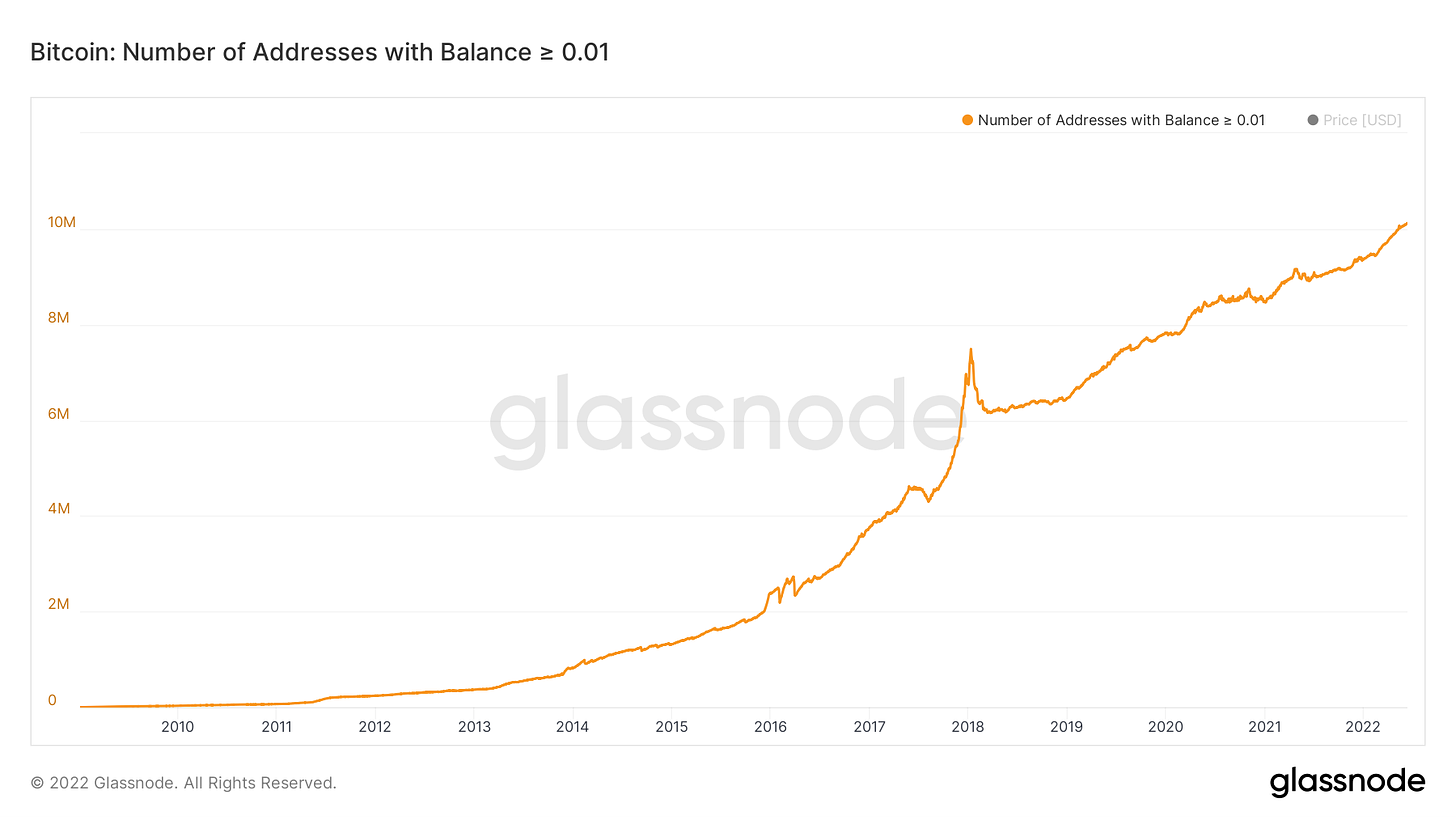

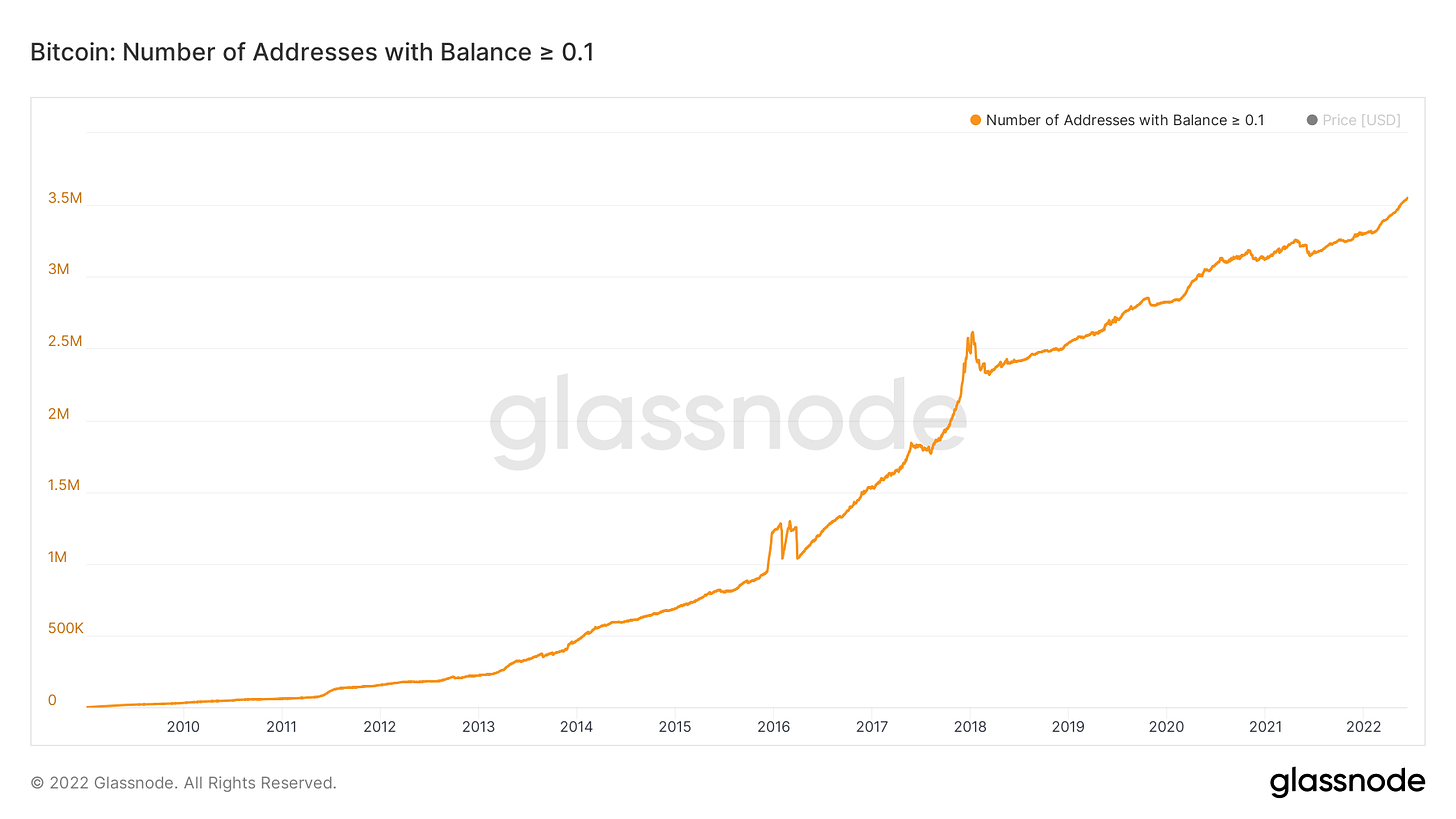

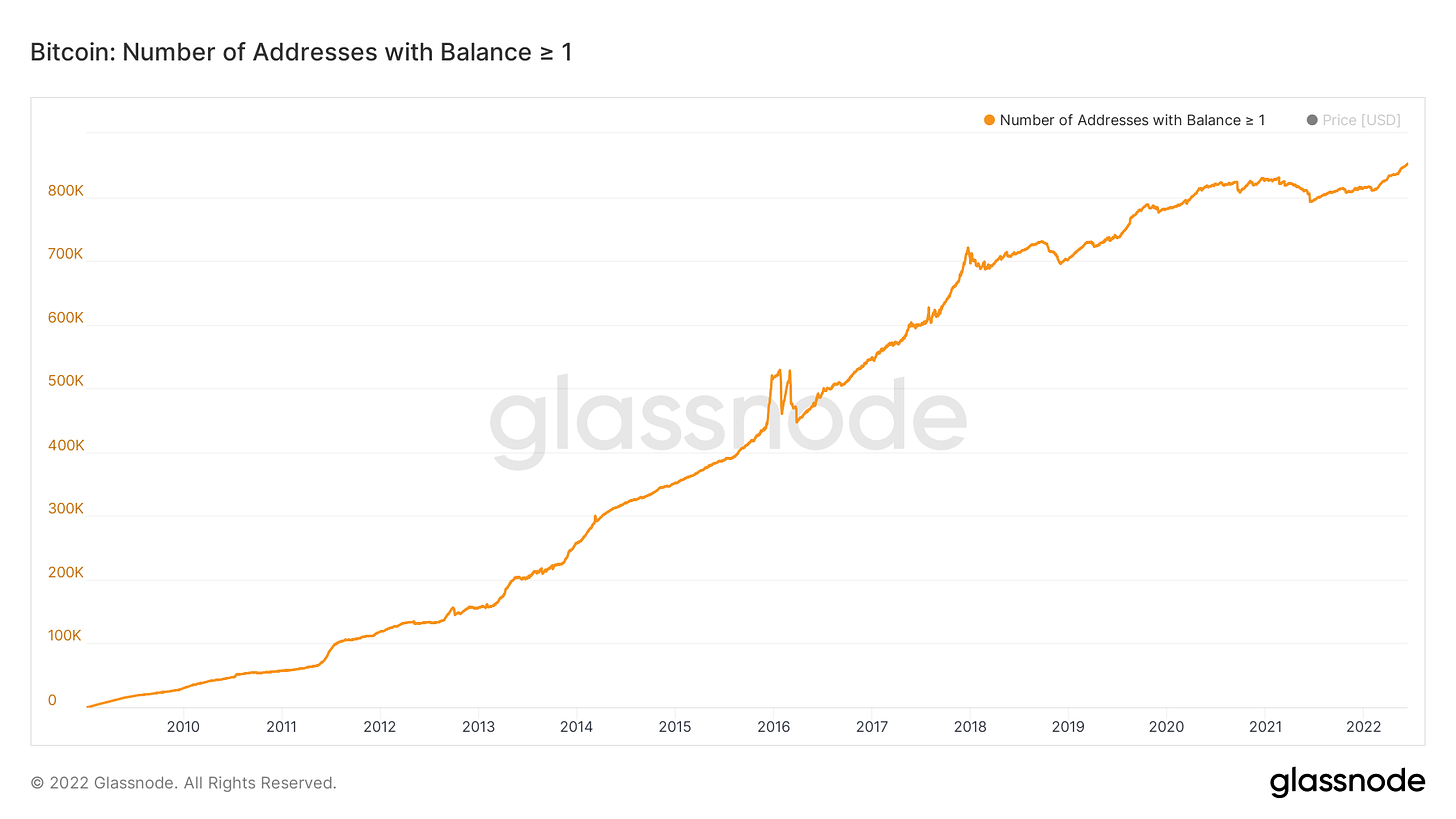

If we look at the on-chain distribution of bitcoin, we see that wallet addresses with 0.01 bitcoin, 0.1 bitcoin, and 1 bitcoin continue to hit all-time high levels. This is different than the major whale wallet sizes, so you can infer that large wallets have been selling and small wallets have been buying.

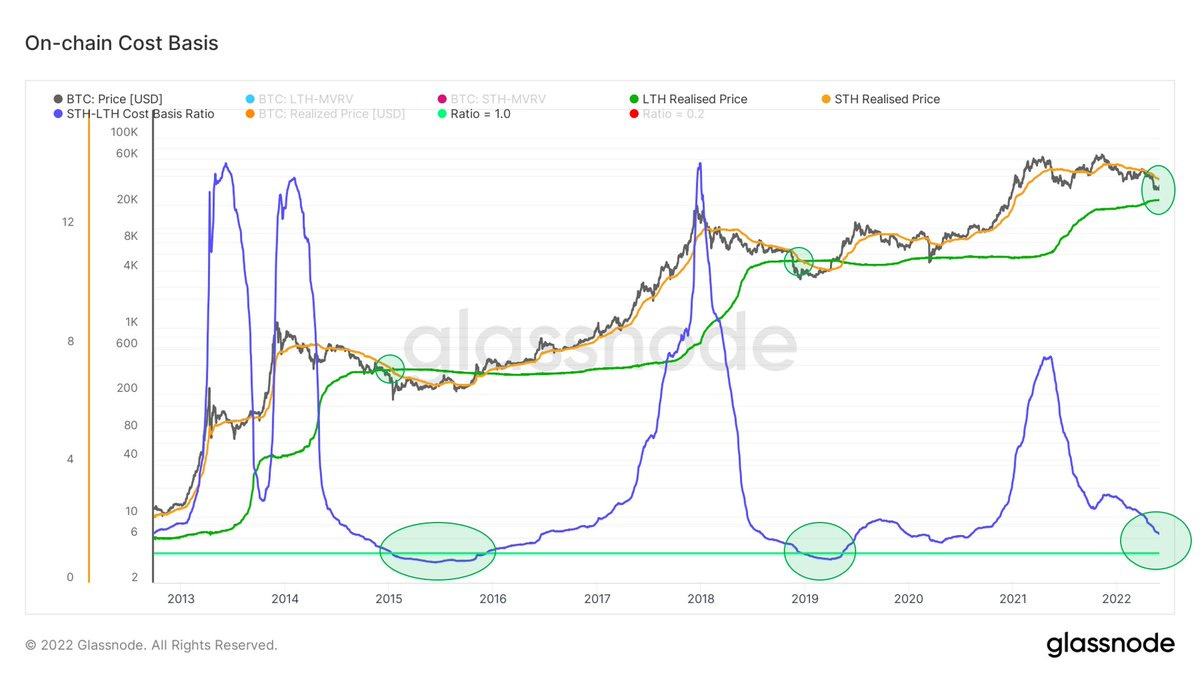

Another way to look at this is the cost basis for the long-term and short-term holders (measured by 155 days of holding). You can see here that Will Clemente pointed out that these two metrics are getting close to crossing, which signals the long-term holders are in the dominant position — “Long-term holder cost basis is rising as short-term holder cost basis declines. If this persists and STH crosses below LTH, historically has marked generational Bitcoin buying opportunities. We are getting close.”

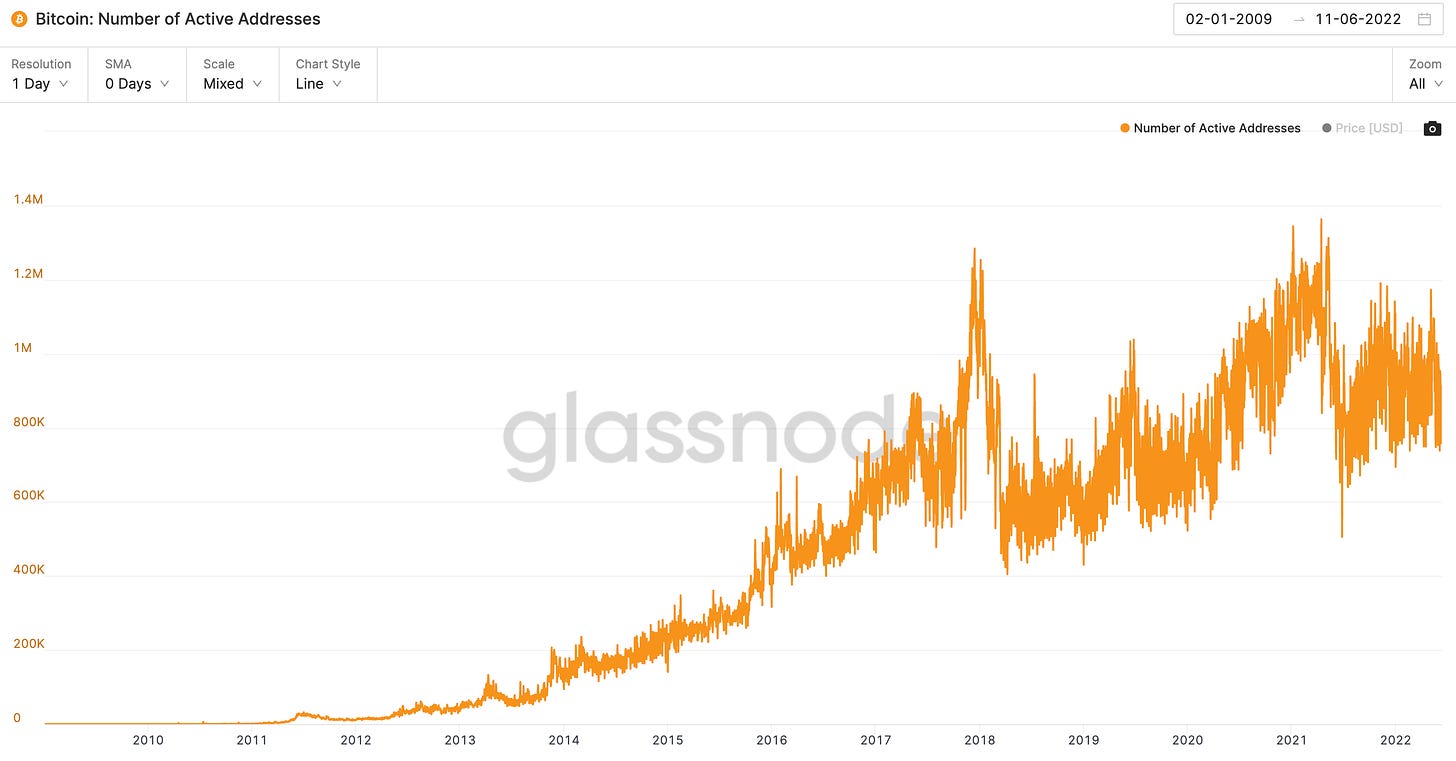

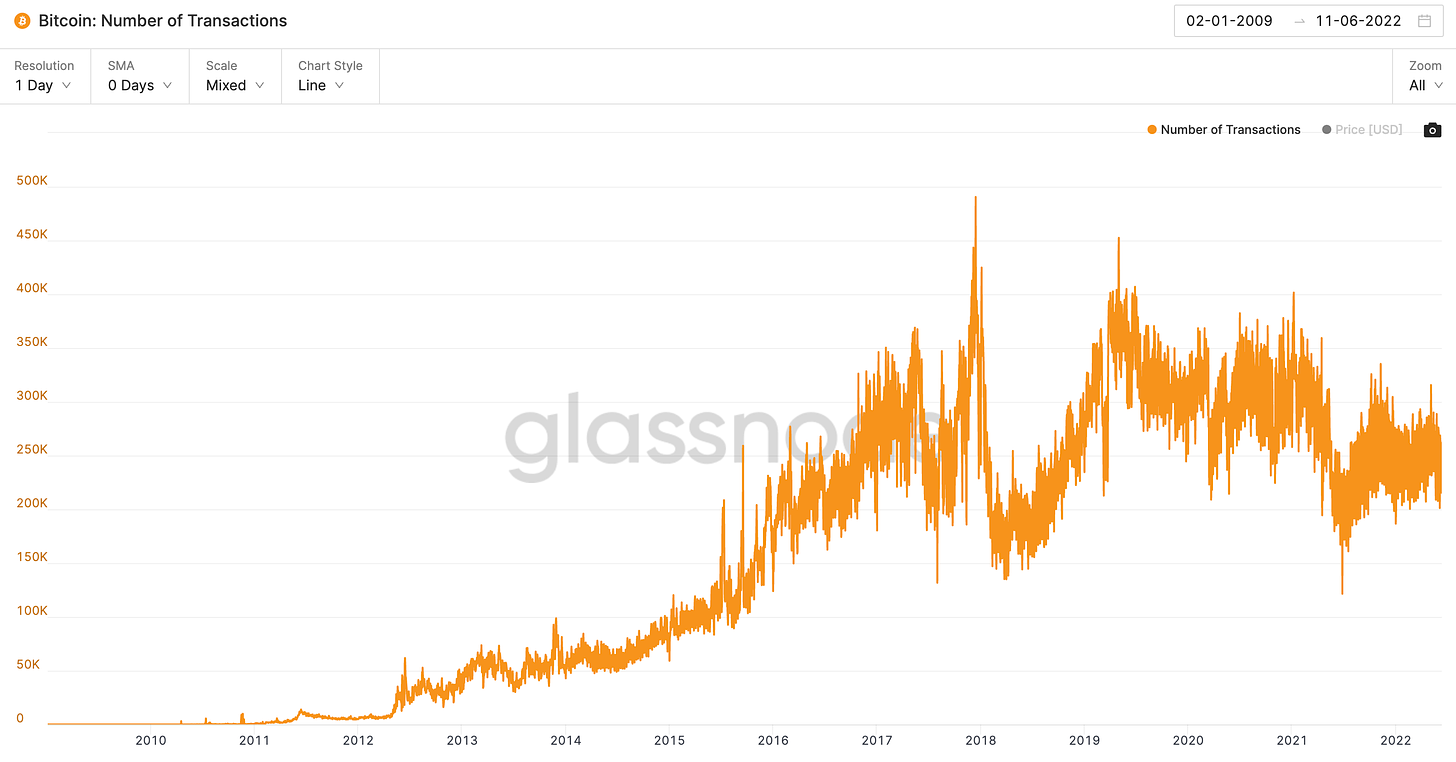

Transaction metrics continue to look healthy as well. We see active addresses and total successful transaction count remaining in line with their historical ranges.

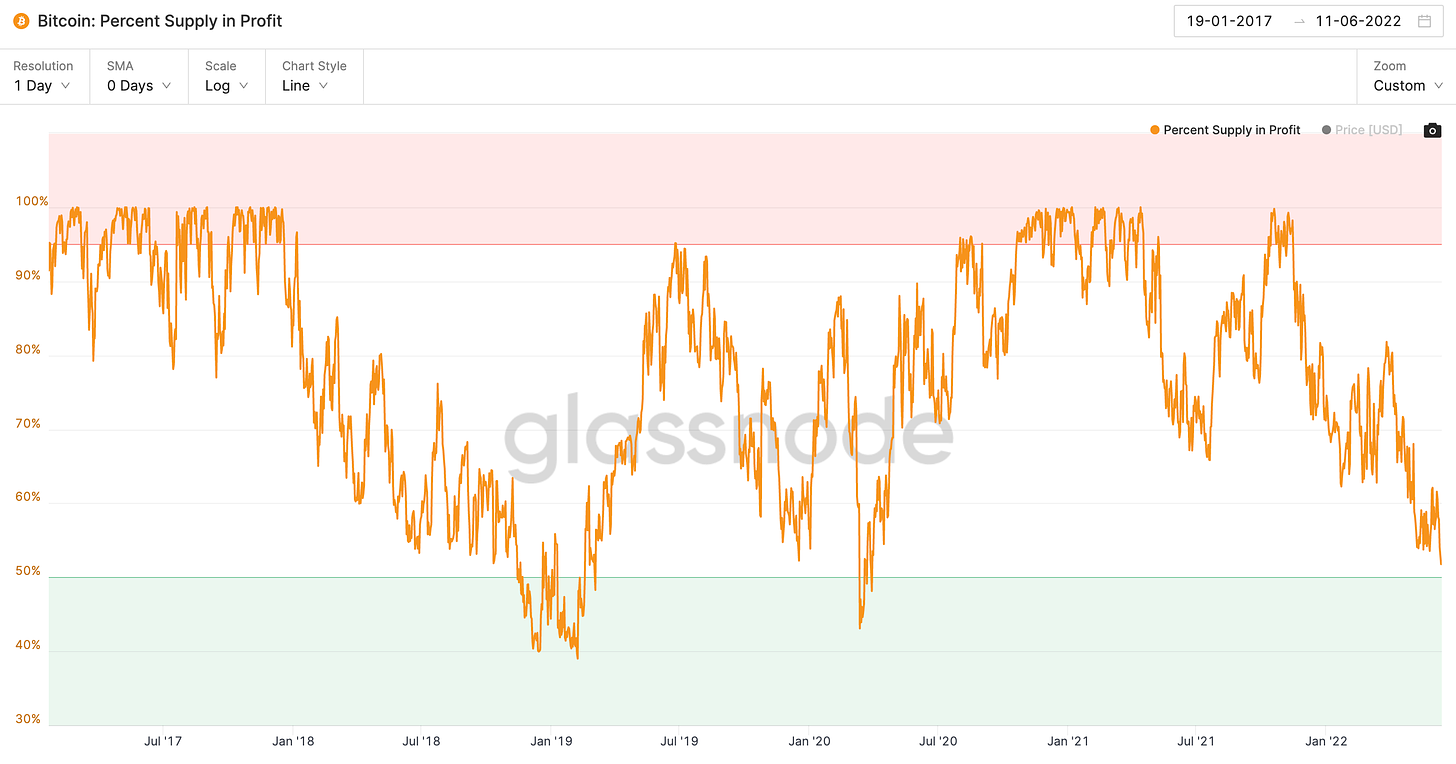

The percent of bitcoin in circulating supply that is in profit is now under 52%, which has historically been close to marking bear market bottoms (usually sub-50%).

Lastly, the Lightning Network capacity continues to reach all-time high levels as well.

It is important to understand that bitcoin’s current drawdown in price is largely driven by changes in the macro economy. Increases in interest rates, coupled with quantitative tightening, has driven correlations across assets towards 1 and we are seeing asset price sell-offs across the financial market.

It is important to re-visit your thesis in these moments. Do the inputs still hold true? Do you reach the same conclusion when new information is included? Are the underlying fundamentals still attractive? Is price merely disconnected from value or has the value changed?

After conducting the re-evaluation of bitcoin over the weekend, I come to the same conclusion. Bitcoin continues to be an attractive store of value for the long-term. The current price drawdown is in direct contradiction to many of the underlying fundamental metrics, which are near or at all-time high levels. The network is healthy. Adoption is continuing. The undisciplined monetary and fiscal policy backdrop is becoming more obvious to the average citizen.

Bitcoin’s price falling is not fun. But value measurements of bitcoin are telling a different story. The best investors understand that controlling their emotions in these moments is important. They make decisions based on value, not price. The big variable here is the Federal Reserve — they are in control and assets generally are one big trade right now.

Keep your head on a swivel. Constantly re-visit and re-evaluate your investment thesis. Think critically. Ensure you are willing to change your mind when the information changes. Your mind and wallet will thank you over the long-run.

Have a great day. I’ll talk to everyone tomorrow.

-Pomp

If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

SPONSOR: Brave Wallet is the first secure wallet built natively in a web3 crypto browser. No extension required.

With Brave Wallet, you can buy, store, send, and swap assets. Manage your portfolio & NFTs. View real-time market data with an integrated CoinGecko dashboard. Even connect other wallets and DApps. All from the security of the best privacy browser on the market.

Protect your crypto. Whether you’re new to crypto, or a seasoned pro, it’s time to ditch those risky extensions. It’s time to switch to Brave Wallet.

Download Brave at brave.com/Pomp, and click the wallet icon to get started.

THE RUNDOWN:

PayPal's Move to Allow Crypto Transfers to External Wallets the First Step Away From Fiat World, CEO Says: PayPal’s move this week to allow customers to transfer crypto out of PayPal's cryptocurrency walled garden to external wallets is the opening step from a fiat-orientated world to a digital currency one, according to CEO Dan Schulman. Read more.

Tesla Board Member Kimbal Musk Says Most DAOs Are Not Actually Decentralized: Kimbal Musk, the billionaire philanthropist and brother of fellow entrepreneur Elon Musk who is now an avid creator of decentralized autonomous organizations (DAOs), says most of these trustless structures are controlled by a few founder members. Read more.

JPMorgan Wants to Bring Trillions of Dollars of Tokenized Assets to DeFi: JPMorgan (JPM) hopes it has found a way for decentralized finance (DeFi) developers to leverage the yield-generating potential of non-crypto assets. Speaking to CoinDesk at Consensus 2022 in Austin, Texas, Tyrone Lobban, head of Onyx Digital Assets at JPMorgan, described in detail the bank’s institutional-grade DeFi plans and highlighted how much value in tokenized assets is waiting in the wings. Read more.

Binance CEO Changpeng Zhao Questions SEC Investigation into BNB: Binance founder and CEO Changpeng "CZ" Zhao said the Securities and Exchange Commission (SEC) has been “asking questions” about the BNB exchange token but the exchange hasn’t yet been subpoenaed. Earlier this month, Bloomberg reported that the SEC is investigating if the BNB token constitutes an unregistered security. Read more.

Uncle Rockstar is a Core Contributor at BTCPay Server and the VP of Engineering at Strike.

In this conversation, we talk about the cypherpunk movement that lead to Bitcoin's creation, developing on the Bitcoin network, and building towards the future.

Listen on iTunes: Click here

Listen on Spotify: Click here

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post