🚨 READER NOTE: Next Tuesday, I am hosting a free webinar for anyone who wants to learn more about Bitcoin self-custody. It will be a 3+ hour masterclass where my team and I will walk through step-by-step instructions for implementing self-custody and answer questions.

The event is completely free and open to anyone who wants to attend. Register for free here: https://lu.ma/selfcustody

To investors,

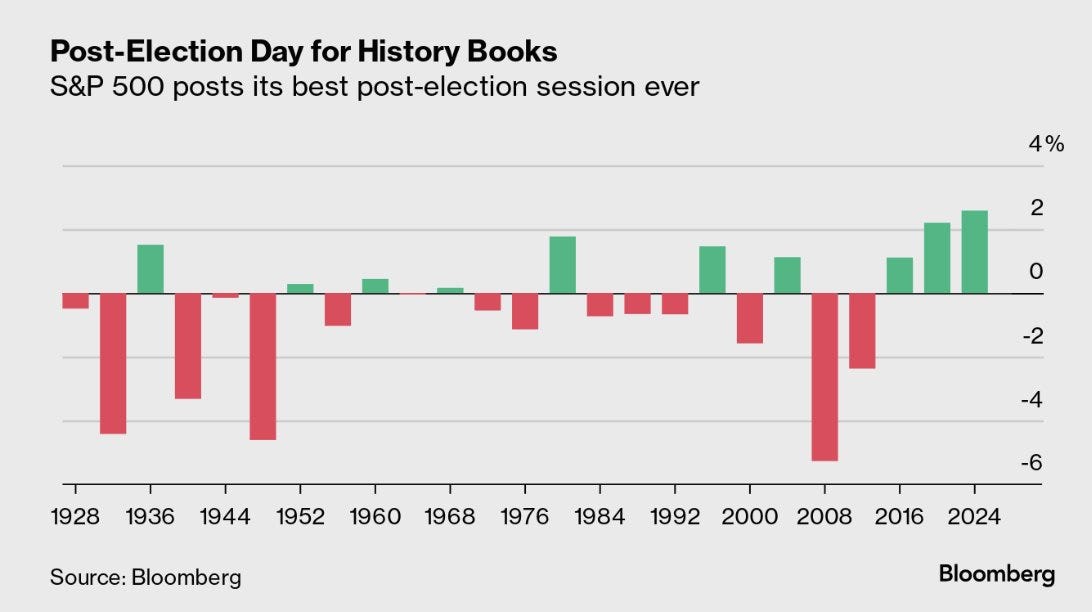

Yesterday we witnessed the best performance in history for the S&P 500 on the day after an election. It is clear that capital allocators are positioning themselves for higher prices across the market.

An area to keep an eye on is the Russell 2000 — these small cap companies tend to be more sensitive to interest rates. The index was up nearly 6% yesterday. The market believes under President Trump capital will be cheaper and regulation will be decreased, which creates a tailwind for these businesses.

Speaking of deregulation, I continue to tell friends that the energy sector is on the starting block of a renaissance. The United States is already a net exporter of crude oil, but the Trump administration continues to boast of an even larger pro-energy approach. Drill, baby, drill.

But stocks and energy are not the most interesting developments over the last few months — Trump previously committed to a “bitcoin strategic reserve” if he was elected.

There are a lot of campaign promises made on the trail, so it seemed unlikely this would actually come to fruition. Not so fast though. We saw Senator Cynthia Lummis tweet yesterday about the strategic reserve. Her post has received more than 5.6 million views as of this morning.

A bitcoin strategic reserve would kick off a level of global FOMO unlike anything we have seen before. Every nation and every central bank would have to quickly create a bitcoin strategy. Whether they bought bitcoin in the open market or chose to mine bitcoin with national energy resources, many countries would begin stockpiling bitcoin for a rainy day.

Lastly, my friend Howard Lindzon has an interesting idea around the “degenerate economy.” He writes:

“For the last year I have been digging into what I call the ‘degenerate economy’ which is the next phase of investors, ownership, gambling, living life with a wallet on/in your phone. The 'degenerate economy' includes education, experiences and activities. We onboarded and connected hundreds of millions of young people into investing, trading, speculation, crypto and gambling/betting.”

Howard created an index for tracking this thesis and the index is up ~ 90% in the last 18 months. It was up 7% yesterday after Trump was confirmed as the election winner.

Stocks up. Energy production up. Bitcoin up. Degenerate economy up. This is the future we are headed into.

The biggest risk to the US economy is not a recession, but rather a resurgence of inflation. President Trump wants to stimulate the economy. But the US dollar is sitting on the other side of the table from that plan. We already have a Fed that is cutting interest rates and M2 money supply is growing, so Trump adding fuel to the fire would potentially create another 2020-style boom to markets.

Those holding assets will get rich. Those holding cash will not. A tale as old as time.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC tomorrow. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward.

The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here

Anthony & Polina Pompliano Discuss Why Trump Won and How It Will Impact Various Financial Assets

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss 2024 election, why Donald Trump won in landslide, what that means for your investment portfolio, stocks, bitcoin, predictions during a Trump Presidency, JD Vance, Elon Musk, and all the impacts of the election.

Enjoy!

Podcast Sponsors

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token designed to outperform BTC returns. Learn more and view live analytics on our performance dashboard.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

BetOnline is your #1 source for all your crypto sports and politichttp://gemini.com/gowheredollarswonts betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post