Today’s Letter is Brought To You By Range!

Looking for a tax strategy to offset those BTC gains?

Range has you covered -- they have rebuilt wealth management from the ground up, offering investors like you a modern all-in-one comprehensive suite of financial services.

With Range, you get everything in one place—investments, taxes, estate, real estate, equity, and cash flow. No more piecemealing your way to generational wealth while hunting for the right connections to manage all aspects of your money.

The traditional industry has you convinced that you have to pay ridiculously high fees to get sophisticated wealth management.

Let them know you’re done. You’ve found Range. The search is over.

To investors,

Bitcoin is crashing to levels not seen since….a week ago. No, seriously. That is what has happened over the last 24 hours. Bitcoin has traded down under $92,000 and people are freaking out all over the internet. But bitcoin was hitting a new all-time high of $92,000 just a week ago.

It is always funny how bad our memories are.

First, we should remember that bitcoin had the highest weekly close in history on Sunday night.

So why is the price going down right now? Because there are more sellers than buyers. That sounds simplistic, but that is the truth. Checkmate, one of my favorite bitcoin on-chain analysts, points out “Long-Term Holders have distributed $60B worth of supply in the last 30-days. Out of all the LTH supply moved since the FTX bottom, 21% of it has happened in November. This is the heaviest profit taking we have seen so far this cycle.”

You would expect the price to fall further if long-term holders are selling this much, so why haven’t we seen a larger drawdown? The ETFs are buying up a ton of the supply at the same time. Kyle Doops explains “Long-term Bitcoin holders sold 128K BTC, but U.S. spot ETFs absorbed 90% of the selling pressure. Strong institutional demand is fueling BTC’s rally, bringing it closer to the $100K milestone.”

This doesn’t mean that we are in the clear though — Joe Consorti highlights a potential scenario worth watching: “Bitcoin has tracked global M2 with a ~70-day lag since September 2023. I don't want to alarm anyone, but if it continues, bitcoin could be in for a 20-25% correction. (Bitcoin in orange and money supply in white).”

I don’t think investors can time markets with a high-degree of accuracy, so I wouldn’t try to do it. Plus, if we use Thanksgiving 2020 as a guide, bitcoin has the potential to cool off for a week or two before ripping higher to all-time high records at an accelerated rate.

But maybe you don’t believe history rhymes. Ki Young Ju writes “even in a parabolic bull run, Bitcoin can see -30% pullbacks. Such corrections repeatedly occurred during the 2021 price discovery from $17K to $64K. This isn’t a call for a correction—just manage your risk and avoid panic selling at local bottoms. We’re in a bull market.”

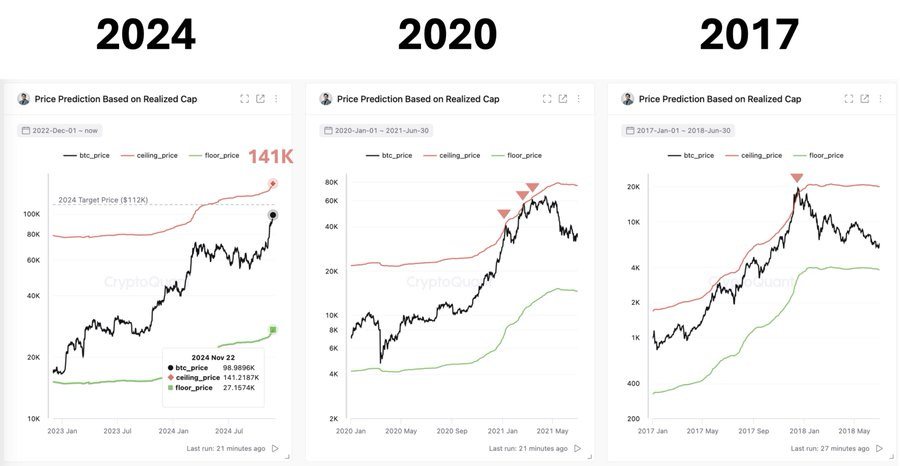

Ki Young Ju explains the “bitcoin market seems too early to call a bubble. The market cap hasn’t increased significantly relative to cumulative on-chain capital inflows. Based on the current realized cap, it could rise to $141K. The realized cap has been steadily increasing every day.”

So what is the big takeaway from all this data? Take a deep breath — everything is going to be alright.

Bitcoin doesn’t go up in a straight line. Yes, the price of the asset is falling. It may fall further. But the long-term trend is still intact. I would not be surprised to see bitcoin hit a new all-time high before the end of the year.

It is a holiday week. Relax. Enjoy time with your family and friends. The world will keep spinning. Bitcoin will keep producing blocks of transactions. And the government will keep printing money. So bitcoin will go higher over time.

Hope you have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Small Business Uses Bitcoin To Improve Employee Retention & Product Quality

Mike Coffey and Julie Denton-Price are the owners of BlueCotton, a small retail-grade screen printing business in Bowling Green, Kentucky. They previously plugged their business into the bitcoin network in a very unique way, and it is changing the lives of 130 employees. In this conversation we discuss, why they did it, how the employees earn bitcoin, and what the impact has been.

Enjoy!

Podcast Sponsors

Bitkey – The hardware wallet built for bitcoin that replaces complex seed phrases with an easy three-key system. Available for $99.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Ledger - Ledger secures 20% of the world’s digital assets. Upgrade to Ledger Flex this Black Friday and get $70 in Bitcoin or save up to 40% on select wallets.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token designed to outperform BTC returns. Learn more and view live analytics on our performance dashboard.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.