To investors,

There is a vibe shift underway in America. It is hard to describe, but you know it when you see it. Take this yard sign as an example. My friend Based Beff Jezos tweeted this photo from a home in Los Angeles.

This yard sign would be expected in the American South, but it is shocking to see in Southern California. That is part of the vibe shift.

But the vibe shift is happening in financial markets as well. The talk of an incoming recession has died down and investors are becoming more optimistic. Carson Research’s Ryan Detrick points out today is historically the most bullish day of the year for stocks.

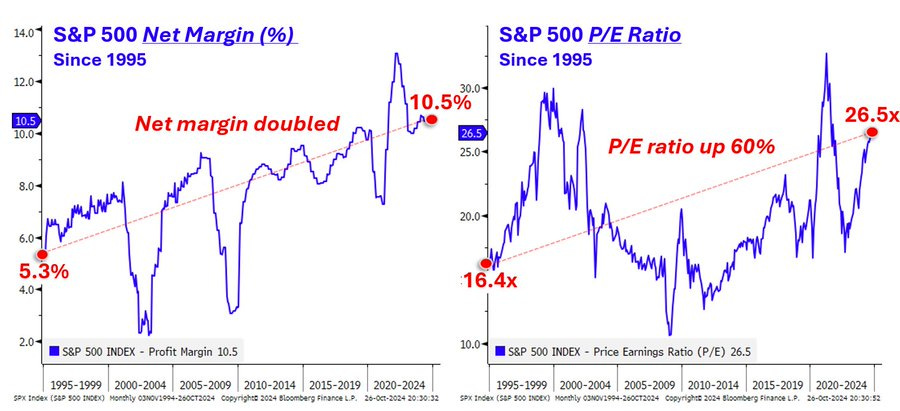

Investors getting more bullish doesn’t mean that stock prices have to go up. Instead, stocks could become overvalued and suffer a significant future decline. The P/E ratio is one statistic I see doomsayers pointing to as proof that stocks are in for a rude awakening.

Matt Cerminaro brought up a great point over the weekend:

“The rise in P/E is justified. Businesses have gotten twice as efficient at making money now vs in 1995. The net margin has literally doubled. Just look at the chart on the left. Whose to say this trend doesn't continue higher. [It] would support a continuous rise in P/E.”

This is important to understand about historical comparisons. Valuations may be changing, but the underlying businesses have been improving as well. If companies make more money, then they should be worth more to an investor.

But is the vibe shift only happening in equities? No. You can see it in bitcoin as well.

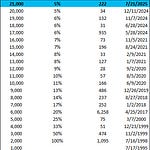

Let’s compare bitcoin, gold, and the S&P 500. You can see that gold and the S&P have very little difference in returns according to the 5-year compound annual growth rate.

It is bitcoin that stands out on a 1-year, 5-year, and 10-year timeframe. You could make a strong argument that allocating gold and equities over the last 5 years has been a wash, but buying bitcoin would have transformed your portfolio.

Many buyers of gold are not allocating for pure price appreciation though. Win Smart highlights that “central banks now hold 12.1% of global gold reserves, the highest level since the 1990s.”

So what do you think happens when these central banks start allocating to bitcoin?

Gold is a story of the past, bitcoin is a story of the future.

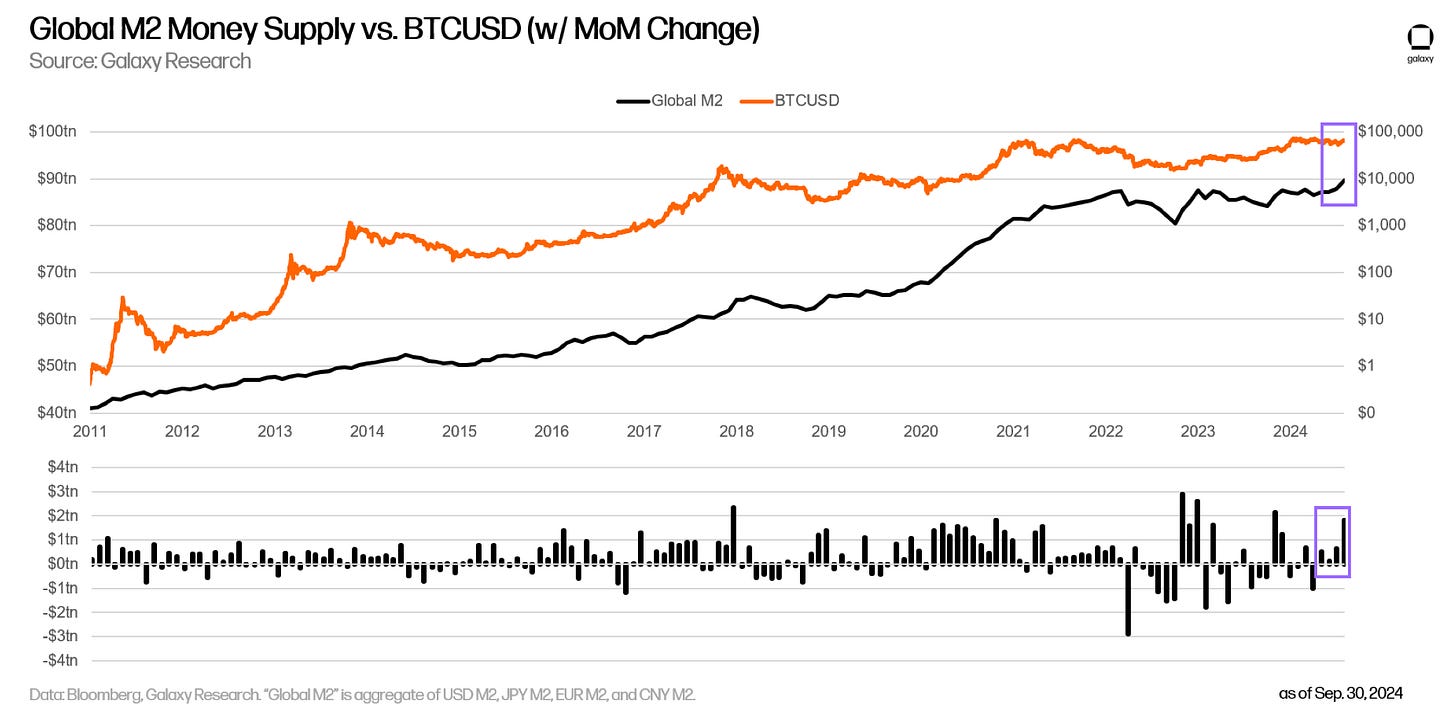

Take a look at bitcoin compared to the M2 money supply. Galaxy’s Head of Research Alex Thorn shows that bitcoin has not caught up to the recent money expansion.

This doesn’t mean you shouldn’t own gold. It doesn’t mean you shouldn’t own stocks. It just means that a vibe shift is underway. Investors who have chosen to allocate to a digital store-of-value are continuing to outperform over the long run.

If it works for individuals, it is only a matter of time before governments start implementing the strategy. That is when the real fun will begin. Until then, don’t get lulled to sleep by sideways summer. We should be coming out of hibernation soon and decision-makers become much more interested after prices have increased.

As Mark Yusko always says, “people are really good at buying the things they should have bought and selling the things they are about to need.”

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC on Friday November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward.

The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here

Navy SEAL Becomes Humanitarian And Save Lives

I spoke with Ephraim Mattos about his life journey, which is inspiring to say the least. Ephraim is not only one of America’s greatest warriors, but he also wrote an incredible book about his transition to become a humanitarian.

Enjoy!

Podcast Sponsors

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post