Today’s letter is brought to you by Domain Money!

Wondering where to go for financial advice? Domain Money makes financial planning simple. No hidden fees and no sales pitches - you get a personalized roadmap to your goals, from dream vacations to retirement.

Flat-fee advisors create a plan tailored to you, with zero pressure to invest. Don’t be like most people who’ve never had a real conversation about their financial plan. Book a free strategy session today here.

While I'm not a Domain Money client and they are paying me, I've seen first hand the value of their service through the free plan they did for one of my brothers.

Yes, I might have an interest in promoting Domain Money, so just like any major financial decision, it's important you understand what the service is and if it's right for you so make sure to see this important disclaimer.

To investors,

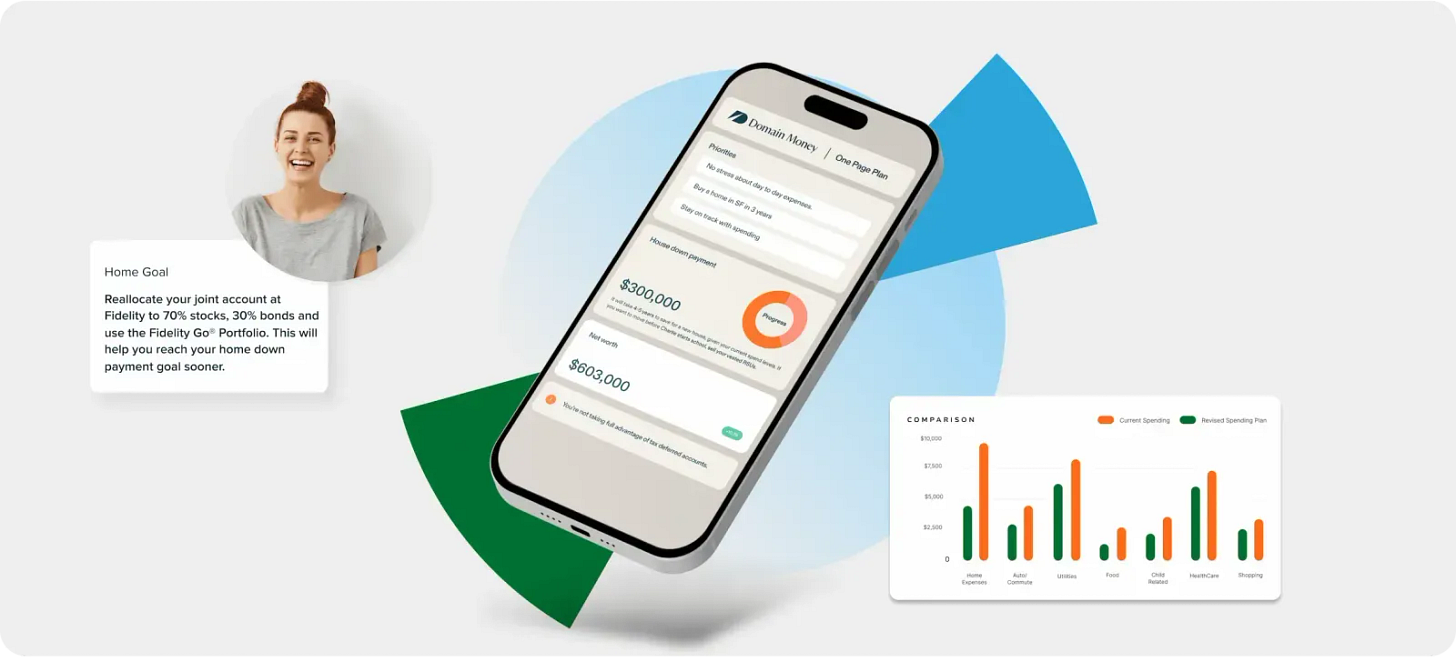

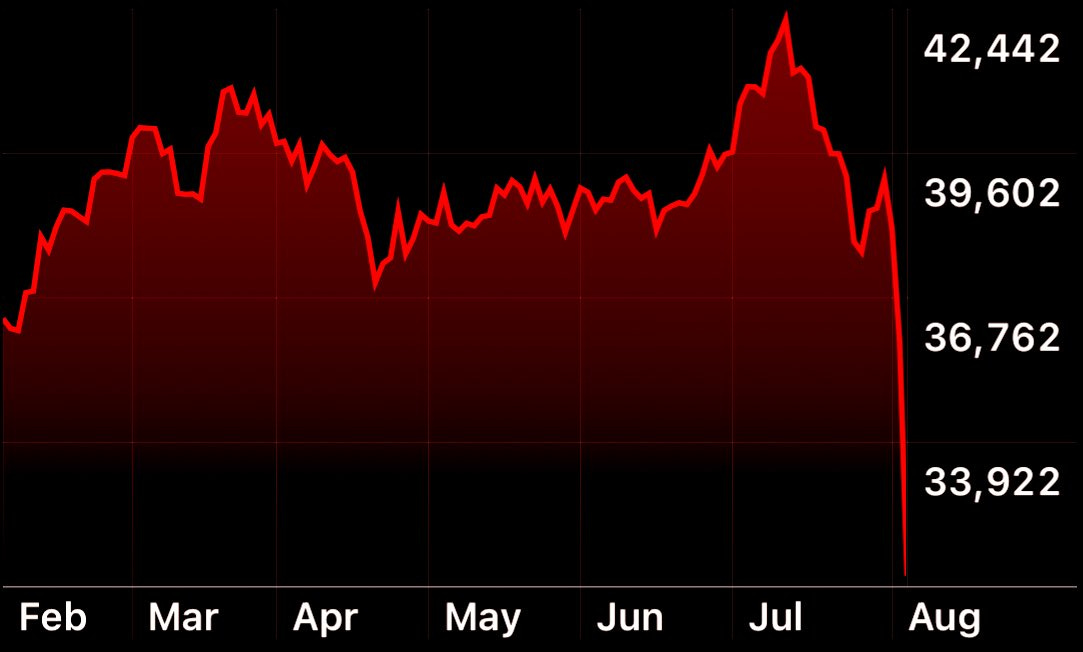

Panic started to set in for market participants at the end of last week. It only got worse last night. Japan’s Nikkei suffered the worst decline since 1987 over the last 24 hours.

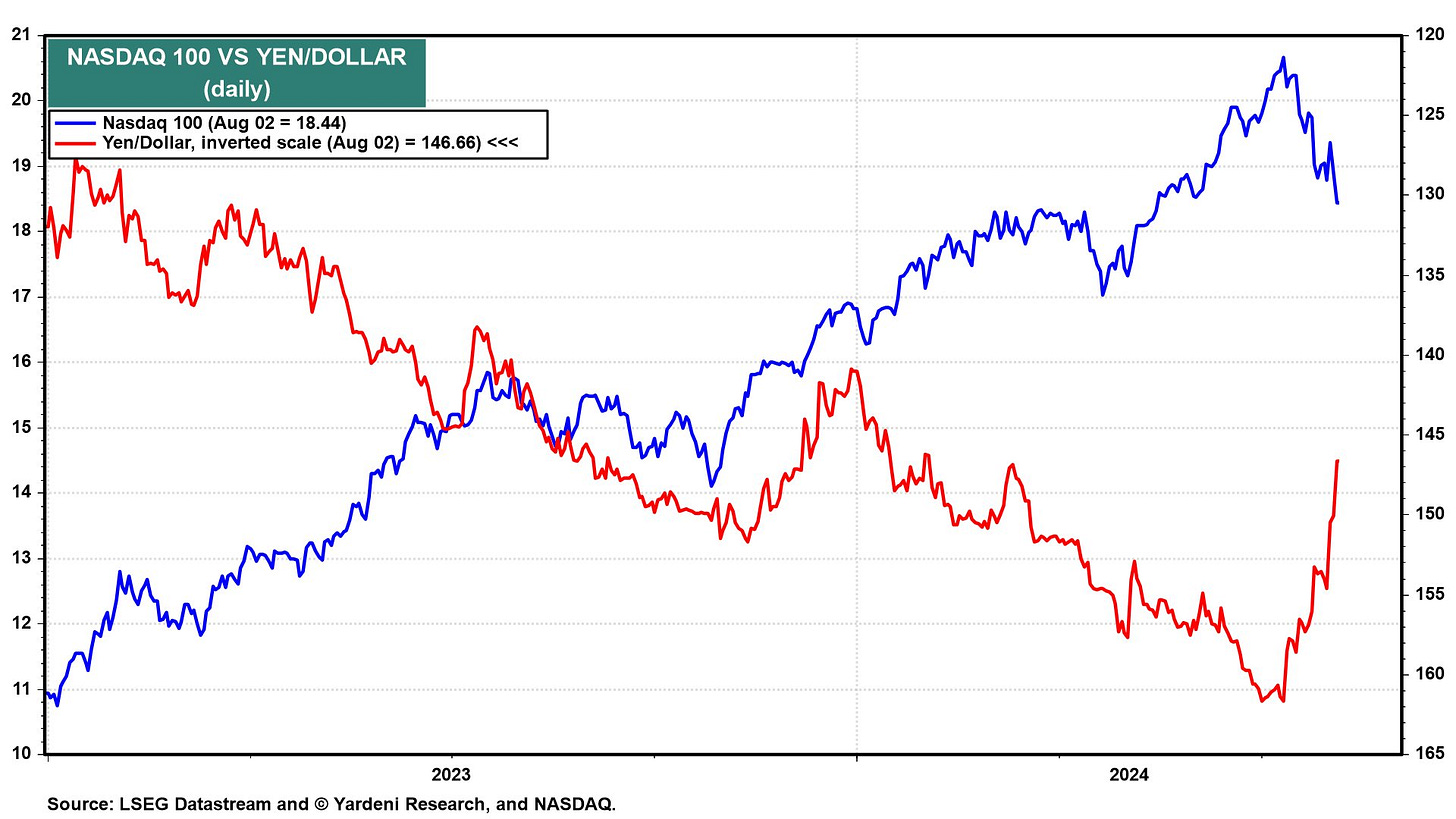

This has caused fear to spread throughout markets, particularly related to the carry trade being executed by investors to leverage the depreciated JPY currency. You can see the issue here:

“Since 2023 (at least), speculators borrowed money in Japan at near-zero interest rates. They converted their borrowed yen into dollars, and bought the Nasdaq 100. That drove the yen further down and the Nasdaq 100 further up. This "carry trade" has been unraveling in recent weeks…as the yen continued to soar in response to the Bank of Japan's recent tightening moves.”

The panic started last week, which saw numerous technology stocks experiencing double-digit drawdowns from their recent highs:

Apple -6%

Meta -10%

Microsoft -12%

Amazon -17%

Adobe -18%

Nvidia -20%

Broadcom -23%

Tesla -25%

Qualcomm -30%

AMD -37%

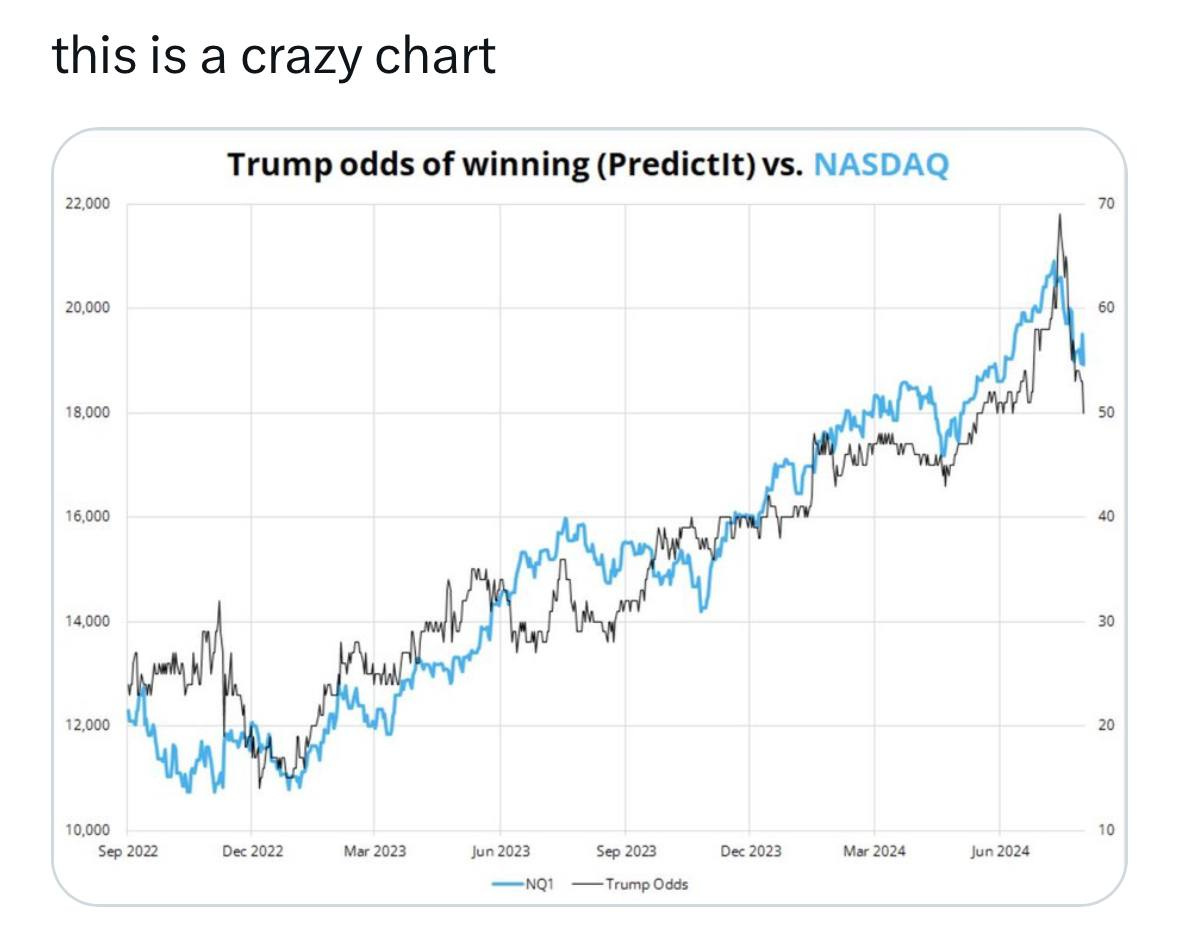

These types of drawdowns get people antsy. They want to know when the market will turn around. One answer is dependent on the Presidential election — the stock market has been trading hand-in-hand with the prediction odds that Donald Trump will win the Presidential election in November.

But Trump’s prediction odds dropping is not the only thing spooking investors. Many people are pointing to the Sahm Rule as evidence that the United States has entered a recession.

“The Sahm Rule recession indicator surged to 0.53 in July from 0.43, suggesting the US economy is in a recession. The Sahm Rule signals a downturn once the unemployment rate increases 0.5 percentage points above its previous 12-month low. After the unemployment rate jumped to 4.3% in July from 4.1% in June, the Rule has been triggered. Over the last 65 years, there has not been a single occurrence where this indicator provided a false signal. Also, every time the threshold has been breached, the unemployment rate surge accelerated.”

If the Sahm Rule has 100% accuracy for recession predictions in the past, we should all be very worried, right? Not so fast. Claudia Sahm, the inventor of the metric, stated she doesn’t think we are already in a recession:

“We’re not in a recession…we are in a place where things have slowed…the momentum is not good.”

“The Sahm rule is likely overstating the labor market's weakening due to unusual shifts in labor supply caused by the pandemic and immigration.”

So two things are important to keep the current market dynamics in context — first, the US economy has been on an epic run over the last decade or so. Hidden Harbor’s John Caple points out that decade-long performance with this chart:

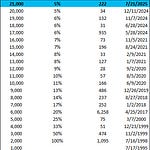

Second, Creative Planning’s Charlie Bilello highlights that all but one of the technology stocks that everyone is focused on remain positive on the year:

The market is down. Unemployment is up. Fear is overriding rational thinking from investors. So the question is — should you panic?

I don’t think so. The Fed has approximately 5.5% of interest rate cuts that it can use to juice the market if we get closer to a recession. Most people are expecting the central bank to start those cuts in September, which would be right on time to avoid some serious market downturn.

Wharton’s Jeremy Siegel went on CNBC this morning and said, “I'm calling for a 75 basis point emergency cut in the Fed funds rate, with another 75 basis point cut indicated for next month at the September meeting - and that's minimum.”

That would be a significant change in monetary policy if the Fed was to follow Siegel’s guidance.

I think of this situation as a military battle. We were firing every bullet we had in 2020 (interest rate cuts, printing trillions, etc) and it worked. The market responded exactly how we wanted. But since the end of 2021, the Fed was able to restock our ammunition. They raised interest rates so now we have plenty of cuts in front of us if we need them.

The bullets are reloaded. If a recession tries to appear, the Fed will fire away with everything they got and I expect the market to respond exactly like we want. The Federal Reserve has perfected the playbook of quantitative easing.

They can ease with the best of them. And that may be exactly what the market needs in the coming months. Let’s see what happens.

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Jeremy Allaire is the Co-Founder, Chairman, and CEO of Circle.

In this conversation, we talk about USDC, what it is, where it is popular, who is using it, why they are using it, and the future of stablecoins.

Listen on iTunes: Click here

Listen on Spotify: Click here

Circle CEO Jeremy Allaire on the Stablecoin Market

Podcast Sponsors

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo Bank is the only way to bank with Bitcoin.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible. They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post