Today’s letter is brought to you by Espresso Displays!

I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop.

So I started to use a second screen and it seems to have fixed the issue.

It took awhile to evaluate many different screens — Espresso Displays was by far the best one.

I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself.

Any reader of The Pomp Letter who orders one today will get $100 off before midnight. Highly recommend!

To investors,

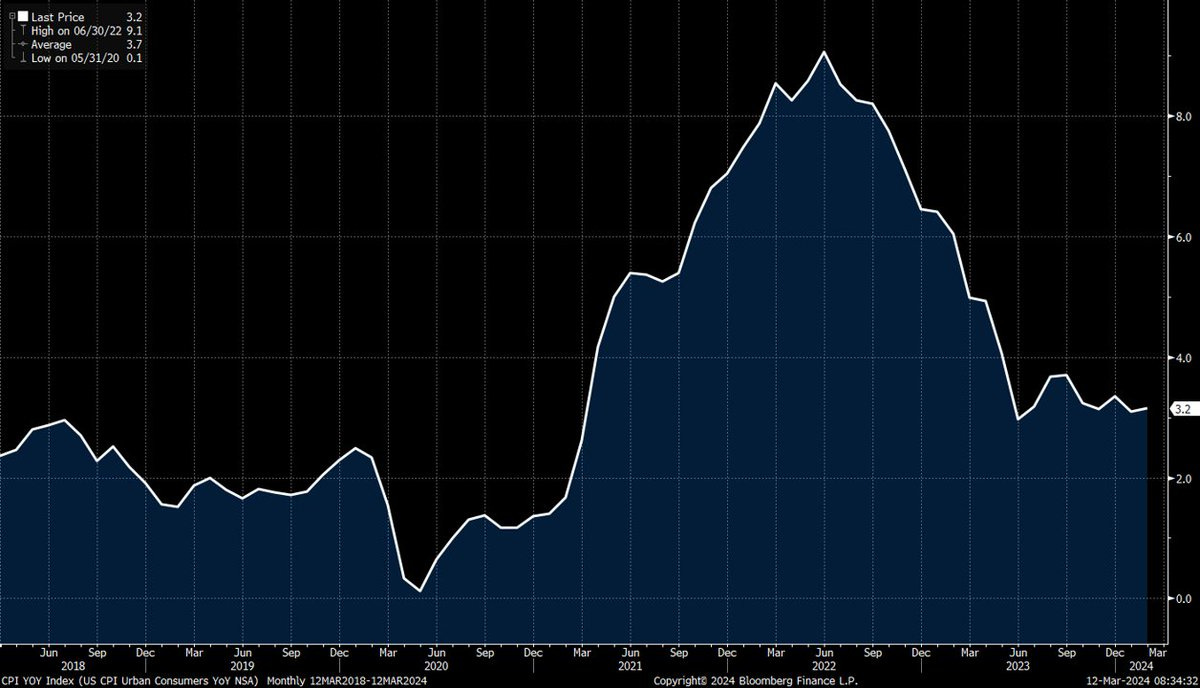

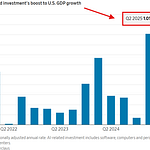

Inflation is becoming a big problem again. February’s core CPI numbers show that month-over-month inflation growth has been accelerating since October 2023.

Augusta Saraiva writes, “the so-called core consumer price index, which excludes food and energy costs, increased 0.4% from January, according to government data out Tuesday. From a year ago, it advanced 3.8%.”

Ken Griffin, the founder of Citadel, sees this rise in inflation as a key reason why the Federal Reserve should not rush to cut interest rates. Griffin said the following at a conference yesterday:

“If I’m them, I don’t want to cut too quickly. The worst thing they could end up doing is cutting, pausing and then changing direction back towards higher rates quickly. That would, in my opinion, be the most devastating course of action that they could pursue. So I think they are going to be a bit slower than what people were expecting two months ago in cutting rates. I think we are seeing that play out.”

It makes sense that people would be spooked if the Federal Reserve became unpredictable or volatile in their decision-making. But the truth is that the Fed shouldn’t be worried about their reputation at this point — they have a much bigger problem on their hands with the potential resurgence of inflation.

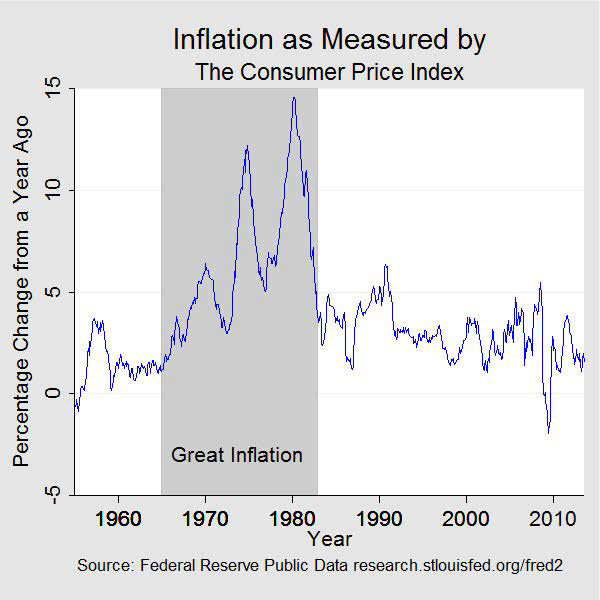

Unfortunately, we have a historical example of what could happen. The Great Inflation of 1965 - 1982 had an initial surge of inflation, followed by what seemed to be inflation falling to manageable levels, before inflation resurged to even higher levels of pain and destruction.

Michael Bryan, who served at the Federal Reserve Bank of Atlanta, describes that time period with the following paragraph:

“The Great Inflation was the defining macroeconomic event of the second half of the twentieth century. Over the nearly two decades it lasted, the global monetary system established during World War II was abandoned, there were four economic recessions, two severe energy shortages, and the unprecedented peacetime implementation of wage and price controls. It was, according to one prominent economist, “the greatest failure of American macroeconomic policy in the postwar period” (Siegel 1994).

It would be catastrophic to endure another two decade period of mismanagement to the degree we saw during The Great Inflation. While I don’t think our future is that bleak, it wouldn’t be surprising to see inflation continue to return with a vengeance.

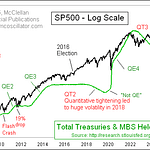

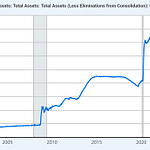

Ben Hunt posted this chart and said, “Friends, every month I make the same post. Inflation stopped going down 8 months ago. Wage and price inflation is embedded well above target. I don't know why this is so hard to understand.”

Again, not exactly what you want to see if the Fed has been telling you that inflation should continue to come down and will be under control shortly. This chart seems to show a new average inflation number post-pandemic that is noticeably higher than pre-pandemic levels.

As Lisa Abramowicz from Bloomberg explains, “the Atlanta Fed's gauge of sticky inflation has risen to about 5% on a 3-month annualized basis. Inflation is moving in the wrong direction for the Fed, so it's interesting that the market's base case is still that the Fed is going to cut rates by about 100bp by January 2025.”

So rather than scratch your head asking yourself why bitcoin and the stock market are at all-time highs when interest rates are over 5%, you should probably ask yourself why these assets aren’t higher given how crazy things could get if inflation mounts a comeback.

Let’s hope for everyone’s sake that inflation will be slayed, but don’t hold your breath for it to happen.

Hope you all have a great day. I’ll talk to each of you tomorrow.

-Anthony Pompliano

Darius Dale is the Founder & CEO of 42Macro.

In this conversation, we talk about inflation, small business optimism, bitcoin, stocks, energy, global liquidity, and macro environment.

Listen on iTunes: Click here

Listen on Spotify: Click here

Bitcoin and Stocks at All-Time Highs - But Things Are Still Bullish?

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.