Today’s letter is brought to you by Sidebar!

Ready to take your career to the next level? Make your transition successful by leveraging a Personal Board of Directors. A trusted peer group, with battle-tested perspective, and proven playbooks, to have real, tactical discussions with to propel you forward.

With Sidebar, senior leaders are matched with a small group of highly-vetted, private, and supportive peers to lean on for unbiased opinions, diverse perspectives, and raw feedback. Everyone has their own zone of genius. Together, we’re better prepared to navigate professional pitfalls and push each other to do more, do it better, and do it faster.

“Providing and receiving support from others who play a similar role to you is one of the best ways to grow your capabilities and succeed.” - Vice President, Roku

“You’re the average of the people you keep closest; Sidebar helps you raise that bar.” - Global Director, Reddit

“Tap into a new level of coaching support, professional development, and peer-driven accountability.” - Senior Director, Credit Karma

Why spend a decade finding your people – join Sidebar today. Join the growing waitlist of over 3,500 top senior leaders, and apply to become a founding member.

To investors,

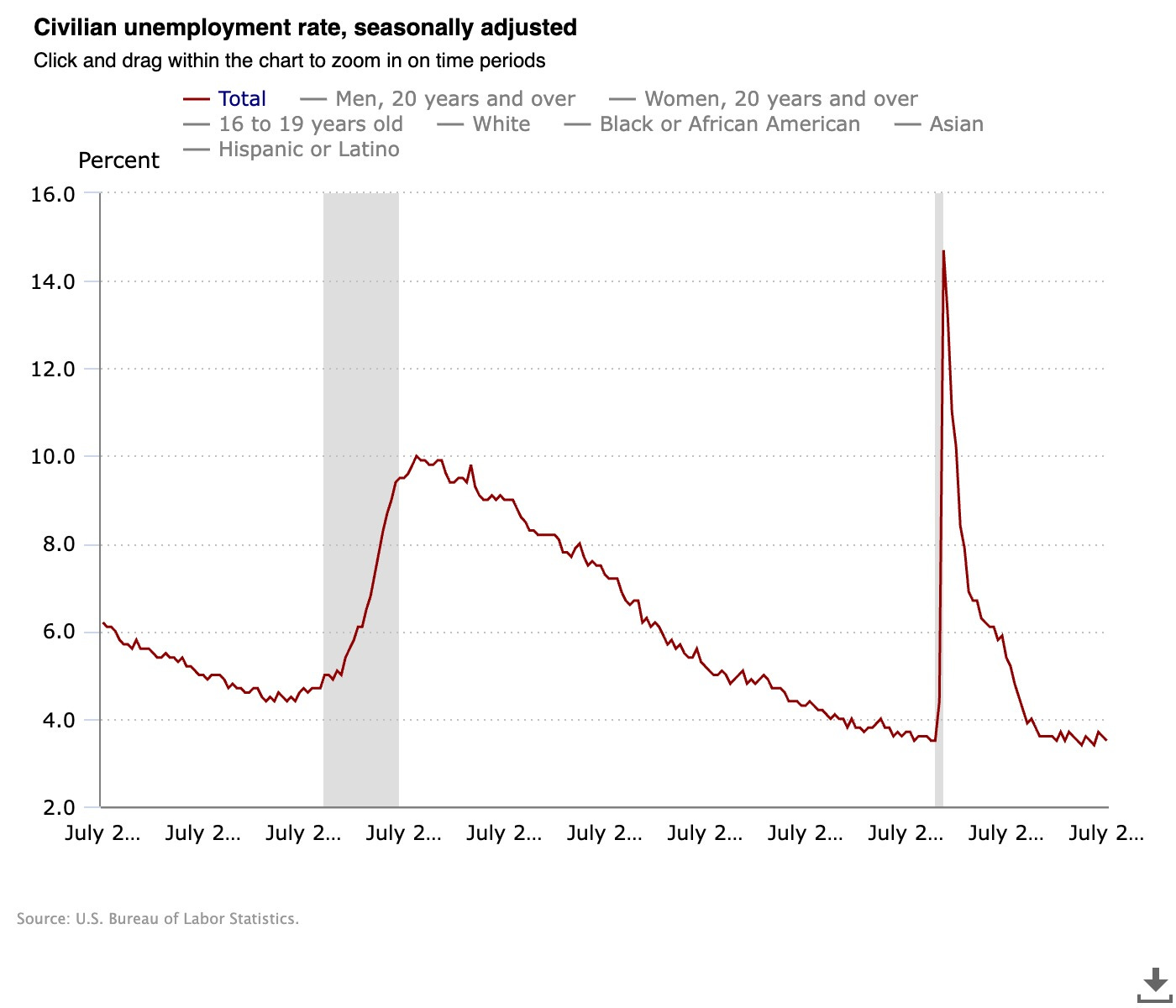

People have been predicting a recession for months. But the economy doesn’t seem to care. The S&P 500 is up 15% year-to-date and nearly back to all-time highs. Unemployment also remains stubbornly low at 3.5%.

As Charlie Bilello points out, “after a record 25 consecutive months of negative real wage growth, wages have now outpaced inflation on a year-over-year basis for 3 straight months. This is a great sign for the American worker that hopefully continues.”

But the Federal Reserve is not out of the woods yet. In fact, the Fed is likely in an impossible situation. They have raised interest rates more than 500 basis points in about 18 months, which is the fastest pace on record. Headline inflation has fallen from over 9% to less than 4%, yet there are lingering concerns that inflation could reverse and accelerate again.

These inflation fears are largely driven by the fact that numerous economic measurements continue to come in at higher levels than expectations. According to Bloomberg’s Lisa Abramowicz, “investors are throwing in the towel on hopes for near-term central bank rate cuts. Global bond yields are at the highest levels since 2009 as economic data keeps coming in hotter than expected.”

She goes on to highlight that “a San Francisco Fed study estimates that US consumers have about $190 billion of excess savings left and that it'll likely be depleted during the current quarter.”

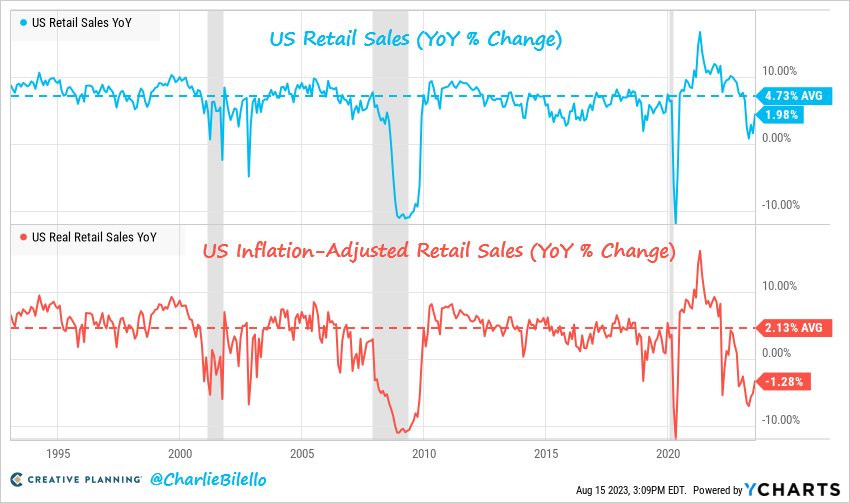

Then we can look at something like retail sales — Bilello states “after adjusting for inflation, US retail sales fell 1.3% over the last year, the 9th consecutive YoY decline. That's the longest down streak since 2009. Nominal retail sales increased 2% YoY vs. a historical average of 4.7%.”

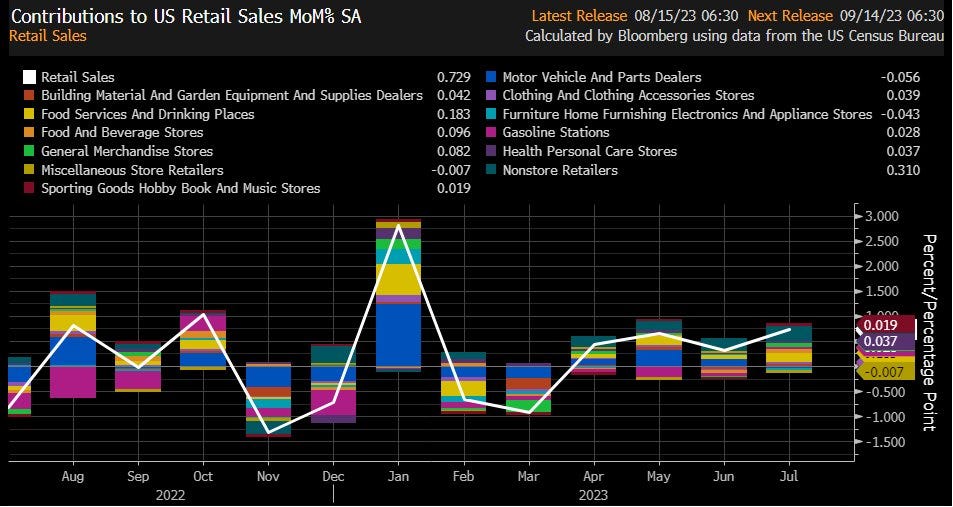

But Kathy Jones says is more excited about the “large upside surprise in retail sales. Retail sales increased 0.7% vs. an expectation of 0.4% month-over-month. The control group, which feeds into GDP, increased 1.0% vs. an expectation of 0.5%.”

So what exactly is going on in the US economy? Are we headed towards good times or bad times? Up or down? Pain or bliss? The short answer is that no one knows.

The Federal Reserve has to use these conflicting data points to determine whether they have done enough rate hikes. If they have, then inflation will continue to come down, the Fed will eventually cut rates, and asset prices will continue their decade-long trend of up-only. But if the Fed misjudges this, and they mistakenly pivot now prematurely, then we could see an accelerating inflation trend that catches the central bank unprepared.

“Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary in the future unless conditions change, minutes released Wednesday from the session indicated.

That discussion during a two-day July meeting resulted in a quarter percentage point rate hike that markets generally expect to be the last one of this cycle.

However, discussions showed that most members worry that the inflation fight is far from over and could require additional tightening action from the rate-setting Federal Open Market Committee.

“With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy,” the meeting summary stated.”

The public narrative in recent weeks has switched from “the Fed will have to continue hiking interest rates and a recession is on the horizon” to “the Fed is done hiking interest rates and the good times are coming back.” These meeting minutes reveal that the central bank has a different view of the economy.

It is nearly impossible for a human to use backwards-looking economic data to make monetary policy decisions that impact the future. There are too many moving parts and an economy is too complex. The Federal Reserve will do the best they can, but the conflicting data is compounding the challenge in the current environment.

Regardless of whether the Fed continues to hike interest rates or not, someone is going to complain that the governing body got it wrong. Inflation never shows up — people will say it was never going to come anyways. Inflation comes roaring back — the “hike interest rates forever” crowd will be screaming “I told you so!”

Unfortunately the people caught in the crossfire of the monetary policy debate are everyday Americans who simply want to live their lives. They want to plan their future, including choosing a city to live in, a home to purchase, children to raise, and a job to obtain. These big life decisions are directly and indirectly impacted by the cost of money, whether people realize it or not.

If we don’t know the cost of money a month from now, it becomes nearly impossible to plan your future life with any degree of accuracy. That has always been the case, but seems more obvious today than ever before.

Hopefully we can escape this complex, uncertain, and chaotic time with minimal damage to the economy and the financial health of Americans. I am hoping for the best but preparing for the worst. I suggest you do the same.

Hope everyone has a great day. I’ll talk to you tomorrow.

- Anthony Pompliano

Darius Dale is the founder & CEO of 42Macro.

In this conversation we talk about global liquidity, what drives it - both in private & public sector, and how to understand its future impact on asset prices.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

My Appearance on CNBC with Brian Sullivan Last Night

Podcast Sponsors

Velo Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem.

StartEngine - Sign up for a StartEngine account today explore live investment opportunities where you can start investing with as little as $100.

Range - Get started today with code POMP15 for 15% off any quarterly plan for your first year.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post