Today’s letter is brought to you by Cal.com!

What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)?

We are all early investors in Cal.com and we use it instead of Calendly. Cal.com is the leading open-source scheduling platform, which gives you the same superpowers of efficiency previously reserved for elite corporations and tech gurus.

Stop wasting your time with scheduling software that doesn’t work. Use technology to make your life easier.

Cal.com is transforming sophisticated calendar management into an accessible tool for all via a user-friendly interface. Set up is quick, easy, and you will never go back to your boring calendar tool.

Exclusive for Pomp Letter subscribers, use code “POMP” for $500 off when you set your team up with Cal.com. Save time. Save money. Use Cal.com.

To investors,

Javier Milei became President of Argentina last night. He was originally thought to be a long-shot candidate, but after running a high-energy campaign that embodied unique (and many times controversial) ideas, he prevailed with majority of the vote.

Argentina’s economy and the 46 million citizens have had a tough run for the last few years. Inflation is nearly 140% year-over-year. More than 40% of the country is living in poverty. Farmers experienced the worst drought in over 60 years a few months ago.

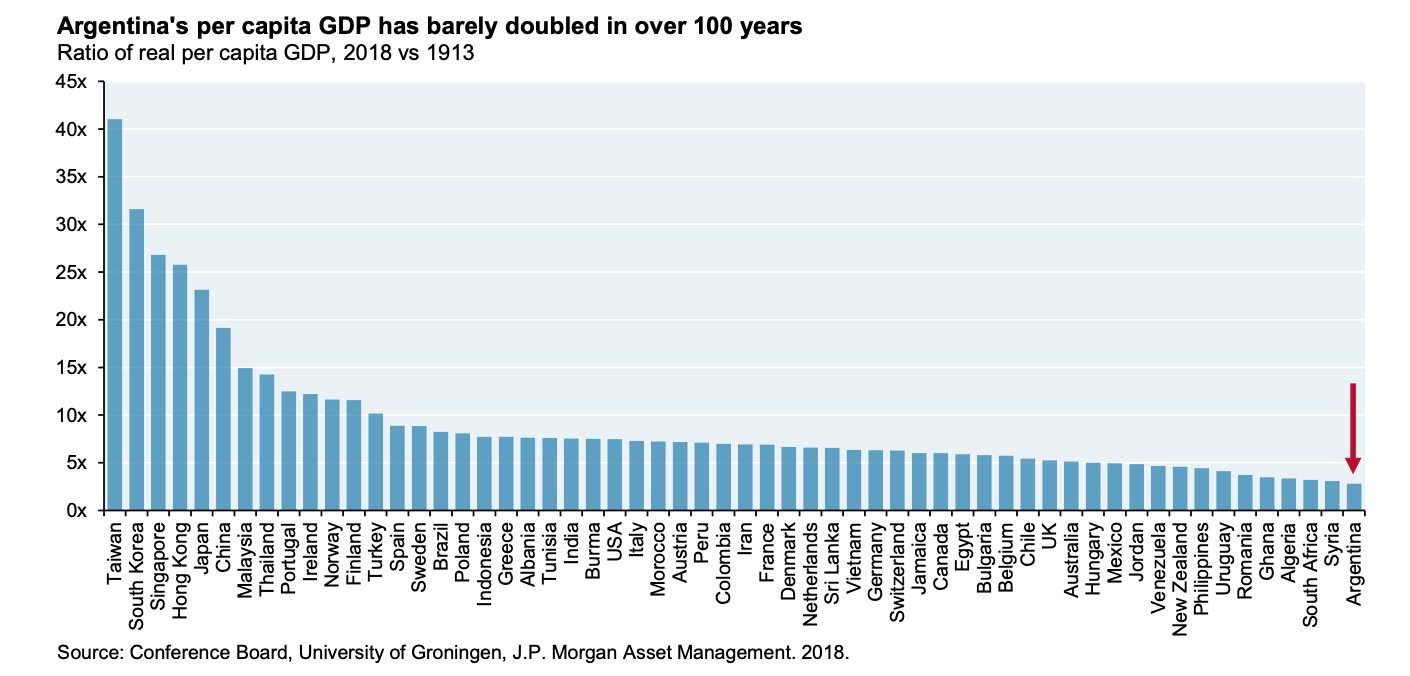

The problems were accelerating before the COVID pandemic ravaged the country. In the second half of 2019, Michael Cembalest of JP Morgan Asset Management wrote that Argentina had “defaulted 7 times since its independence in 1816, which has seen the largest relative standard of living decline in the world since 1900, and which is on the brink of political and economic chaos again in 2019.”

To put these challenges in perspective, Cembalest pointed out that Argentina’s per capita GDP has barely doubled in over 100 years.

The existing economic and political plan simply has not worked. The Argentinian people appear to be ready for a radical change.

That is exactly what Javier Milei has promised.

Nicolás Misculin and Walter Bianchi wrote for Reuters:

“Milei is pledging economic shock therapy. His plans include shutting the central bank, ditching the peso, and slashing spending, potentially painful reforms that resonated with voters angry at the economic malaise, but sparked fears of austerity in others…

…But Milei's challenges are enormous. He will have to deal with the empty coffers of the government and central bank, a creaking $44 billion debt program with the International Monetary Fund, inflation nearing 150% and a dizzying array of capital controls.”

While these economic promises may seem extreme in a Keynesian world, Milei is essentially pledging to do the unpopular things that seem to be necessary for the country to get back on track.

One reason why this is interesting is because notable voices in the United States have been calling for similar radical reform. As I wrote to this group on November 1st in my letter titled Entrepreneurs Have To Build Since Government Is Spending Like Drunken Sailors about comments from Stanley Druckenmiller:

“The national debt is over $33.5 trillion according to government measurements. The actual debt, including future entitlements that have been promised, is actually over $100 trillion already. In order to get spending under control, politicians would have to make incredibly difficult decisions that would be unpopular with voters. This would include cutting entitlements (which Druckenmiller has been saying for years) and refraining from sending hundreds of billions of dollars abroad in support of proxy wars.”

The consensus view historically has been that it would be impossible to pledge a significant cut to entitlement spending and get elected. The people of Argentina basically just blew up that theory. In fact, Milei is promising to blow up the central bank and national currency too.

This doesn’t mean that a Presidential candidate could be elected in the United States on an entitlement cut pledge too, but it doesn’t hurt to have people like Stanley Druckenmiller calling for the necessary cuts.

We can take this analysis even a step further. Cardi B, who is better known for her musical talents than her economic analysis, went live on Instagram over the weekend and delivered a profanity-laden rant about the United States’ economic situation. She explicitly called out the Biden administration’s continued funding of two international proxy wars, while places like New York City and other major cities are begging the national government for more monetary relief to handle their mounting budget deficits.

I highly recommend watching the 5-minute video. While the delivery is unique and entertaining, pay attention to the substance of what she is saying. A perfect example of “funds for thee, but not for me.”

Now let’s go back to Javier Milei and his victory in Argentina. I mentioned that he plans to get rid of the national currency, which would open the dollar for the Argentinian goverment to solidify what has already happened in the local economy. The people of Argentina have long used US dollars as their choice currency. It may have been difficult to get ahold of, but the people wanted something that was more stable and trustworthy.

This pursuit of dollars led to a rise in stablecoin usage in the country as well. Davide Montagner writes:

“According to reports from Chainalysis, a blockchain analysis firm, Argentina leads Latin America in raw transaction volume of cryptocurrencies, with more than $85 billion in value received in the year to July 2023. Within that number, the sale of stablecoins amounts to roughly 31% of Argentina’s small retail-sized crypto transaction volume.”

The logical end to Milei’s rise would be a dollarized Argentina, both officially and unofficially. But there is one tail-risk that many people in the mainstream media are completely discounting.

Milei is a hardcore bitcoiner. Dylan LeClair pointed out that Milei previously said in an interview:

“With legal tender, they scam you with the inflationary tax… Bitcoin is the natural reaction against central bank scammers; to make money private again.”

It would be incredibly difficult for Argentina to move exclusively to a bitcoin standard. Even El Salvador, the shining example of a bitcoin country, has been unable to shed US dollars for transactions and general usage.

But maybe the point is not to drop dollars and embrace bitcoin. As I wrote in my letter titled The Dollar And Bitcoin Co-Existing on November 9, 2021 — Michael Saylor and I discussed the idea of US dollars and bitcoin both strengthening simultaneously, while weak fiat currencies fail. Saylor said in one of my interviews with him:

“If I had one request from the bitcoin community, my request would be - focus your guns on gold. Ultimately, gold is being de-monetized. This is not speculation on the part of Michael Saylor. You have all the stats. It has been de-monetized for the past decade. It doesn’t have a country. It doesn’t have an army. It doesn’t collect taxes. There is not a single person on earth that is going to lie down in front of a tank to protect the nation of gold. And yet, gold is the enemy. Because gold is a dumb rock. You can’t mortgage your gold. You can’t lein on your gold. It is hard to rent your gold. Or license it. Or develop it further. Gold is not big tech. You can’t put gold on your iPhone.

There are two things that should succeed and grow — the US dollar, if you live in the United States and believe in western values and freedom and justice and western law and the progressive movement. You want the US dollar to grow. Instead of saying that the dollar is a problem statement, instead say that if you live in Africa and Asia than you would give your left arm to trade in dollars. So the dollar should expand on Lightning rails and bitcoin should expand and they go together. And we all win. We all win. The world is a better place. Every company, everyone wins.”

So maybe the direction of Argentina is the embracing of US dollars AND bitcoin. Not dollars exclusively and not bitcoin exclusively. You need both of them at the moment. And that is what Javier Milei ultimately represents.

A new way of thinking about economics that appears to be built for the 21st century. The change may be bumpy along the way, but it is becoming increasingly obvious that the change is needed.

This is something to keep in mind as we head into the 2024 Presidential election here in America. Multiple candidates have already come out in strong support of bitcoin, which could lead to a similar situation where US dollar dominance is continued and bitcoin is embraced as a digital gold.

Let me know what you think. Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Aaron Ginn is the CEO & co-founder of Hydra Host, revolutionizing the way data centers operate by bringing GPUs everywhere to you easily and quickly. He also is the founder of the Lincoln Network, which connects the tech industry with policy makers.

In this conversation, we talk about the state of venture capital, advanced computing, geopolitical conflict, politics, contrarian ideas, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

This Founder Raised $10 Million To Protect Artificial Intelligence From Governments

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post