Today’s letter is brought to you by Sidebar!

Ready to accelerate your career? As we all know, navigating a big career transition is hard to do. It’s one thing to set a lofty goal, and it’s another thing to have the support system for yourself to follow through.

Sidebar is a private, highly vetted leadership program for those who want to do more, do it better, and do it faster.

Sidebar’s approach to helping members level up their careers is focused around small peer groups, a tech-enabled platform, and an expert-led curriculum. Members say it’s like having their own Personal Board of Directors.

93% of members say that Sidebar has made a significant difference in their career trajectory.

"Providing and receiving support from others who play a similar role to you is one of the best ways to grow your capabilities and succeed." - Vice President, Roku

“The facilitation has been great. I love the timer bar, the way the conversation is structured, the commitment and accountability.” - Vice President, Clip

“I've been impressed by Sidebar’s technology platform. The real time agenda tracker at the top of our weekly meetings really helps the group stay on track.” - Senior Director, Microsoft

Nothing will get you further in your career than learning from your peers - it’s a true competitive advantage. Join the growing waitlist of top senior leaders, and apply to become a founding member.

To investors,

Stanley Druckenmiller is an investing legend. He never had a down year in the three decades that he ran Duquesne Capital Management, while simultaneously achieving investment returns of about 30% annually during the same time period.

To say he understands macro economics and financial markets would be an understatement.

This is why it is so important to pay attention when Druckenmiller calls our attention to an issue. Lately, the famed investor has been on a roadshow of speeches and interviews to warn about the dire financial situation that the United States finds itself in at the moment.

There are three big categories that I would put Druckenmiller’s comments in:

The United States has too much debt and should avoid worsening the situation

The United States has a serious spending problem and should cut expenses

The United States should have refinanced the national debt at low interest rates

This is not the first time that Druckenmiller has raised these concerns, but given the recent explosion in spending (and the increase of $500+ billion in the national debt) he seems to have a renewed interest in surfacing the warning yet again.

Rather than spend our time debating the nuances of Druckenmiller’s comments, including controversial analysis related to whether the Treasury could have found a bid in the market for extremely long duration bonds, I want to call out my biggest takeaway—the solution is not going to come from the government.

The national debt is over $33.5 trillion according to government measurements. The actual debt, including future entitlements that have been promised, is actually over $100 trillion already. In order to get spending under control, politicians would have to make incredibly difficult decisions that would be unpopular with voters. This would include cutting entitlements (which Druckenmiller has been saying for years) and refraining from sending hundreds of billions of dollars abroad in support of proxy wars.

Some of you will read that last sentence and say to yourself, “that is impossible” which highlights the lack of popularity in both decisions.

Essentially, politicians would have to do the hard thing that would guarantee that said politician would lose their job at the next election. It would be a personal sacrifice for the future of our country.

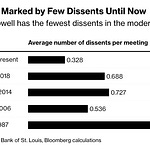

There are some great Americans who serve in positions of leadership, but the majority of politicians appear to be more interested in gaining and keeping power, rather than sacrificing themselves for the collective long-term good. So I would not hold your breath waiting for decreases in spending, regardless of which political party is in office.

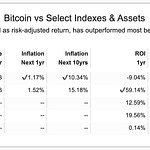

Instead, the American people will have a choice. We can either brace ourselves for the economic pain that comes from crippling national debt, a tailwind for higher inflation, and a complete lack of monetary policy discipline, or we can choose to build our way out of the situation through entrepreneurship, innovation, and technology.

The default state for any human is entropy. A society is no different. If we do nothing, the economic pain will be brutal. We can look to numerous examples around the world where this has already happened.

If we don’t want our fate to follow these failed economies, then we must create a renaissance of innovation. Rebuild our national infrastructure. Rebuild our military industrial base. Create the next 100 companies that reach $1 trillion market cap. Ensure we are the leader in aerospace, bitcoin, artificial intelligence, virtual reality, nuclear power, and a plethora of other important technologies.

It is time to build. It is time to create. It is time to innovate.

We have to grow GDP faster than the government can take on debt. Builders vs destroyers. That is the competition now. And we don’t have time to sit around and complain, this will require a herculean effort from our smartest and most skilled citizens.

Let’s just hope it is not too late. I’ll talk to everyone tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Lyn Alden is the author of a brand new book called "Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better." This book is almost 500 pages, and it is a fantastic breakdown of the history of money, why the system is broken, and where we go from here.

In this conversation, we talk about how the average individual is being impacted, saving vs investing, diversification, energy as the arbiter of truth, interest rates, US treasury, national debt, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Lyn Alden on How Bitcoin Fixes Broken Money

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.