This installment of Off The Chain is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 40,000 other investors today.

To investors,

The market chaos has continued across asset classes this week. We are seeing incredible levels of volatility, which is exacerbated by the likelihood that the US will see more than 2 million unemployment claims this week alone.

Many investors are losing control of their emotional discipline. You can see confusion, fear, panic, and uncertainty in different sectors and strategies. It seems like every day a different billionaire is calling into CNBC with their hot take on how bad the economic situation is, what industries need to be bailed out, or which monetary stimulus option they are supportive of.

While this makes for entertaining television, it doesn’t do a lot to help the average investor navigate these chaotic times. Below I have tired to put together my thoughts on a few assets and how they are likely to perform over the next 18-24 months. You should know up front that making accurate predictions is nearly impossible, so that is not my intention here. Instead, my goal is to document my thought process at this point in time. It will serve me well in the future as a data point to look back on, but hopefully it can inform a few people today as well.

Obviously, I am not giving investment advice. Do your own research. Never invest more than you are willing to lose. And frankly, try not to be an idiot :)

In order to share what I think is going to happen in the coming months and years, let’s start with an understanding of where we sit at the time of this writing:

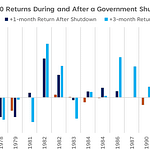

Equities — The S&P 500 and Dow Jones Industrial Average are both down approximately 30% in the last month. The same thing goes for the Vanguard Emerging Markets Stock Index and other variations of public equities.

Oil — The price of oil is currently down about 60%, which includes a recent 25% rally that brought a barrel of oil from around $20 to just over $25.

Gold — The price of gold is currently down about 12% from a local high of approximately $1,700.

Bitcoin — The price of Bitcoin is down approximately 40% from around $10,000 to approximately $6,000 currently.

I am intentionally leaving out the bond market from this analysis. I may cover that in a different letter, but unfortunately don’t have the time to research and produce valuable analysis there for today’s letter.

We have seen large drawdowns in asset prices across markets, so where do we go from here?

The answer is quite simple — almost every asset price is going to rise substantially in the next 18-24 months. It doesn’t take a rocket scientist to realize this. In fact, as long as you believe the United States will not fail and certain assets won’t go to zero, then these dips in price are actually attractive opportunities to increase your return although you are buying the same assets.

But which assets are actually going to perform the best? The worst? I’ll break each asset down to elaborate on what I am anticipating will occur over the coming 18-24 months. Before I do that though, it is important to understand that these asset prices are dropping rapidly because the US dollar is strengthening. Any liquidity crisis presents a desire for investors to gain access to dollars. They will sell any asset they own that has a liquid market so that they can get liquidity.

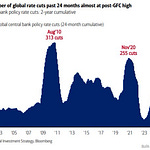

Over time, the dollar will have to be weakened in order for markets to stabilize and eventually recover. This is done by flooding the market with liquidity (dollars) which will devalue the global reserve currency. Let’s dig into what that means for the various assets:

Equities [8 out of 10 rating]

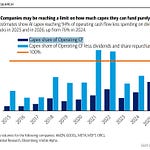

Most stocks are being sold off as part of the larger trend. The S&P, DJIA, and emerging markets are down about 30%. The sectors that are getting hit the hardest (hotels, airlines, hospitality, food services, etc) are seeing drawdowns that range from 50% (ex: Marriott Hotels) to 75% (ex: United Airlines). The big question on these “corona-impacted sectors” (CIS) is whether (a) they can survive multiple months of near complete loss of revenue, (b) will have to declare bankruptcy, or (c) the government will step in with assistance that bails out the industry.

I separate the US public equity market into CIS and non-CIS because the non-CIS equities are likely to make a faster recovery during the next 24 months. I don’t think we will see a full recovery back to February 2020 highs. That type of recovery would likely take 3-5 years. This means that investors are likely looking at 20-30% return over the next two years in public equities if prices don’t go lower. If they do extend lower before the recovery starts, you would be looking at 40-70% returns over 24 months in non-CIS stocks (based on a total market drawdown of 40-50%).

The “corona-impacted sector” (CIS) is a different story. The big risk here is that these companies could go bankrupt because most of their revenue has evaporated. I am not a believer that this will happen. Instead, it is more likely that we will see significant consolidation in sectors overlaid with government assistance to prevent the destruction of entire industries. If this is accurate, the best returns are likely to come from the stocks that have drawn down the farthest (side note: as long as they don’t go to zero). Due to this, most of the hotels, airlines, and food sectors look incredibly cheap right now.

It wouldn’t be surprising to see multiple airline or hotel stocks 2-3x over the next two years. Take United Airlines for example — it has fallen from an $80-85 stock price earlier this year to almost $20. The company did $6.5 billion in EBITDA during 2019, but today the stock is trading at a market cap of $5.7 billion. It is such a ridiculous drop in value that you almost can’t believe it is real. Again, as long as you believe the US airline industry is not going to zero, there are great investment opportunities available throughout the CIS stocks.

I personally don’t own any stocks (except GBTC in my retirement account), but if you can control your emotions and view the recent price drawdown as an opportunity, there is a lot to get excited about in public equities right now. If prices draw down even further, the 8 out of 10 rating would move to 9 out of 10.

Oil [5 out of 10]

This is the scariest market for me. Oil is one of the most essential commodities in the world right now, but there is an increasing amount of complexity surrounding what will happen over the next 24 months. Russia’s recent actions have not only plunged the price of oil, but also put most of the American shale industry in a position where they must operate at a loss or shut down. The United States is talking a big game, which the market responded to positively yesterday (oil up approximately 25%), but it remains to be seen how effective any of the proposed measures would be over the long term.

In addition to the geopolitical complexity, there will be continued pressure from the electric vehicle industry and others to move off our dependency on oil. I don’t believe that will have significant impact in the next two years, especially given the recent economic shock, but it remains a larger threat over the long term.

One way to think about oil’s future performance is that it is unlikely to continue trading at a price below where American shale oil companies can be profitable. This would mean that the upside here seems to be oil rising to at least $35, if not closer to $45-50. With that said, there is too much uncertainty and geopolitical risk for it to be attractive to me coming out of an economic shock where opportunities are everywhere. 5 out of 10 rating.

Gold [3 out of 10]

As I previously mentioned, the US dollar continues to strengthen, both against traditional assets, but also against other currencies. The US government will have to flood the market with dollars in order to weaken the currency, so any inflation hedge assets should do relatively well during the next 24 months. Gold is one of the top two assets in this category.

Investors are not stupid. They understand that quantitative easing is merely the devaluation of their cash. As they seek out those inflation hedge assets, gold should benefit, but my concern is that gold’s upside is not nearly as attractive as other opportunities in the market.

Gold fell from approximately $1,700 to just under $1,500 recently. This “store of value” asset has gained investors’ trust because it is relatively stable over time. That lack of volatility is great during bad times, but it is actually a negative during good times. If you want to drive outsized returns, you need high levels of volatility. I could see gold outperforming current expectations and easily eclipsing $2,000. I don’t think we see it move over $2,500 in the next 24 months though.

This means that an investor would be looking at 35% to 65% return over the next 24 months. Most investors would salivate over these types of returns in normal times, but this will likely be underperformance compared to other assets during the same time period upcoming. Gold lacks the volatility needed to be overly attractive. 3 out of 10 rating.

Bitcoin [11 out of 10]

Bitcoin’s outlook is similar to gold with a few key differences. As the dollar gets devalued, investors will seek inflation hedge assets — Bitcoin and gold are going to be the two beneficiaries of this. One key difference is that Bitcoin has much greater levels of volatility than gold though. While I believe gold has 35-65% upside, I have relatively high confidence (85%+) that Bitcoin will more than 3x at a minimum. This would bring it back to a new all-time high above $20,000.

The volatility that Bitcoin presents is normally looked at as a negative by the mainstream media and some investors. It is a feature, not a bug. Bitcoin possesses all of the same inflation hedge qualities that gold has, including a more accurate understanding of the asset’s scarcity. It also brings with it much more potential upside given how early the asset is in the lifecycle and how relatively small the current investor base is.

As we see high levels of quantitative easing (my estimation is total of $5 trillion or more), we will see an influx of investors seeking out Bitcoin for protection. In just the last 36 hours, Bitcoin is up more than 20% as monetary stimulus proposals are floated around. This type of hyper volatility will continue, while still presenting all the protections of gold’s inflation hedge.

The second key difference is that Bitcoin is less than 60 days away from a significant supply shock as well. The Bitcoin halving will programmatically cut the daily incoming supply of Bitcoin from 1,800 to 900. A good way to think of this is that when everyone ran to gold in 2009-2011, it would be similar to having 50% of the gold miners shutting down operations. The scarce asset would become even scarcer. That is what is about to happen to Bitcoin in my opinion.

Quantitative easing will push people to Bitcoin and in May 2020 the incoming supply will get drastically cut. You have a positive demand shock happening at almost the exact same time that you have a negative supply shock. This is going to be rocket fuel for the decentralized digital currency. My price targets over the next two years are $20,000 on the low end and $100,000 on the higher end. This would present a 3x - 15x type upside opportunity in a short period of time, while still protecting your wealth from the inflationary response from the government. 11 out of 10 rating.

Conclusion

The recent market turmoil has presented an incredible investment opportunity for investors that have cash available and are able to remain emotionally disciplined. The price drops in traditional assets have meant that any long term investor is likely to make money by simply buying the discounted assets and waiting for prices to recover. This isn’t rocket science. You just have to believe that the United States won’t fail and that the assets you are buying won’t go to zero.

This leads me to the most important conclusion of this work though — Bitcoin will provide the greatest outperformance of any asset class over the next 24 months as we survive and come out of this financial crisis. Other assets will do very well too, but Bitcoin is uniquely positioned for an incredible risk-reward trade-off that is rarely seen.

Bitcoin was born in the last financial crisis and it will dominate as we come out of this financial crisis. When this is all said and done, people will look back and say “Bitcoin was born in the Global Financial Crisis and it took the world stage in the Corona Financial Crisis.”

In closing, many of you have been asking about my personal portfolio right now. As I always say, “Don’t listen to what they say, watch what they do with their money.” My portfolio currently consists of cash, Bitcoin, and a small selection of illiquid investments (real estate and startup investments). I have tactically increased my portfolio allocation to Bitcoin based on the recent opportunities presented, while keeping enough cash to comfortably survive a two year recession with no income.

My level of conviction in what is about to happen is at an all-time high. I understand that there are a number of things that could change that analysis, both internally and externally to Bitcoin, but as long as those are avoided, I plan to stay the course and watch this unfold. Please don’t take anything written here as financial advice, nor as predictions for what is to come. It is merely my personal opinion as of today and you should do your own research, never invest more than you are willing to lose, and consult a financial professional if you need advice.

Stay safe out there my friends. And be kind to your fellow humans 🙏🏽

-Pomp

This installment of Off The Chain is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 40,000 other investors today.

THE RUNDOWN:

Israeli Bitcoiners See Surveillance as Unavoidable During Coronavirus Crisis: What if the coronavirus pandemic is to data tracking as 9/11 was to homeland security? The Israeli government approved an emergency measure this week to track civilian mobile-phone data in order to monitor the spread of COVID-19. Although Israel's parliament is still hammering out the logistics of this mandatory program, Ynet news reported the Health Ministry activated the initiative on Wednesday, texting 400 people to inform them they were exposed to the virus and must now stay in quarantine.Read more.

Crypto Lender Cred Is Offering Investors 10% Interest With Spencer Dinwiddie Partnership: Spencer Dinwiddie, the Brooklyn Nets guard who launched his own tokenization platform, has launched an interest-bearing stablecoin service in partnership with crypto lending firm Cred. The new service launched Friday on Dinwiddie’s personal website. There, visitors can “pledge” TrueUSD and UPUSD stablecoins as well as bitcoin, litecoin, and ether, earning up to 10 percent interest over the course of the term, according to Cred CEO Dan Schatt. Read more.

80% of Australians Know About Crypto but Only 1% Use It: Central Bank Study: Fewer than 1 percent of Australians paid for consumer goods with cryptocurrency in 2019, according to a study published Thursday by the Reserve Bank of Australia (RBA), Australia’s central bank. Revealed in RBA’s triennial Consumer Payments Survey (CPS), the findings from about 1,100 respondents shows that while consumers are largely embracing digital and alternative payment methods over cash, they’re just not paying in crypto. RBA conducted the survey in October and November 2019. Read more.

Bitcoin May Need Months to Recover, Fundstrat Chartist Says: Bitcoin’s technicals are in rough shape after its spectacular tumble last week and a recovery might take months, according to Fundstrat Global Advisors LLC. The largest cryptocurrency is trading about 40% below its mid-February high, with a particularly notable drop between March 12 and 13, when it lost more than $3,000 in about 16 hours. Now it has broken below its 2015-2020 uptrend, leaving its price action “badly compromised,” according to technical strategist Rob Sluymer. This has all been happening as assets from stocks to bonds and currencies struggle to factor in the huge hit to global growth coming from the coronavirus. Read more.

LISTEN TO THIS EPISODE OF THE OFF THE CHAIN PODCAST HERE

Meb Faber is co-founder and the Chief Investment Officer of Cambria Investment Management. He and his team takes a highly quantitative approach to asset management, which means that Meb is full of nuggets of data & analysis. I really enjoyed his calm, unemotional approach to the current chaos. This conversation is one of the most educational ones that I’ve done on the podcast so highly recommend!

In this conversation, Meb and I discuss:

How these chaotic markets compare historically

Why global asset allocation is important

How passive and active strategies stack up

What people need to know about share buybacks and bailouts

Why Meb is so heavily invested in farmland

I really enjoyed this conversation with Meb. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE OFF THE CHAIN PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

TaxBit automates your cryptocurrency taxes, enabling you to effortlessly track, calculate, and report your transactions. Get 10% off your tax plan today with a free trial by going to www.taxbit.com/invite/Pomp

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

If you enjoy reading “Off The Chain,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.