To investors,

The last few weeks have been filled with fear, uncertainty, and doubt in financial markets once the Fed made it clear that the anticipated interest rate cuts would not be coming as quickly or aggressively as most market participants were hoping for.

But don’t let market sentiment fool you. The good times are still rolling.

In a Wall Street Journal article this morning titled “Investors Are Striking Gold All Over,” Gregory Zuckerman and Gunjan Banerji highlight how well asset prices have performed over the last 6 months.

“The Dow Jones Industrial Average crossed the 40,000 mark for the first time Thursday amid an almost picture-perfect investing environment featuring resilient corporate profits, low unemployment and easing inflation.

Most everything is going up—established Dow stocks, faster-growing tech shares, bitcoin and other cryptocurrencies, and even gold and other precious metals. Risk-averse investors have a bounty of options, too, including certificates of deposit offering yields of about 5% and rising junk bonds and other fixed-income investments, adding to the glow.”

If you were to add bitcoin’s price to this chart, which is up more than 80% in the last 6 months, it would be the best performing asset on the list by a wide margin.

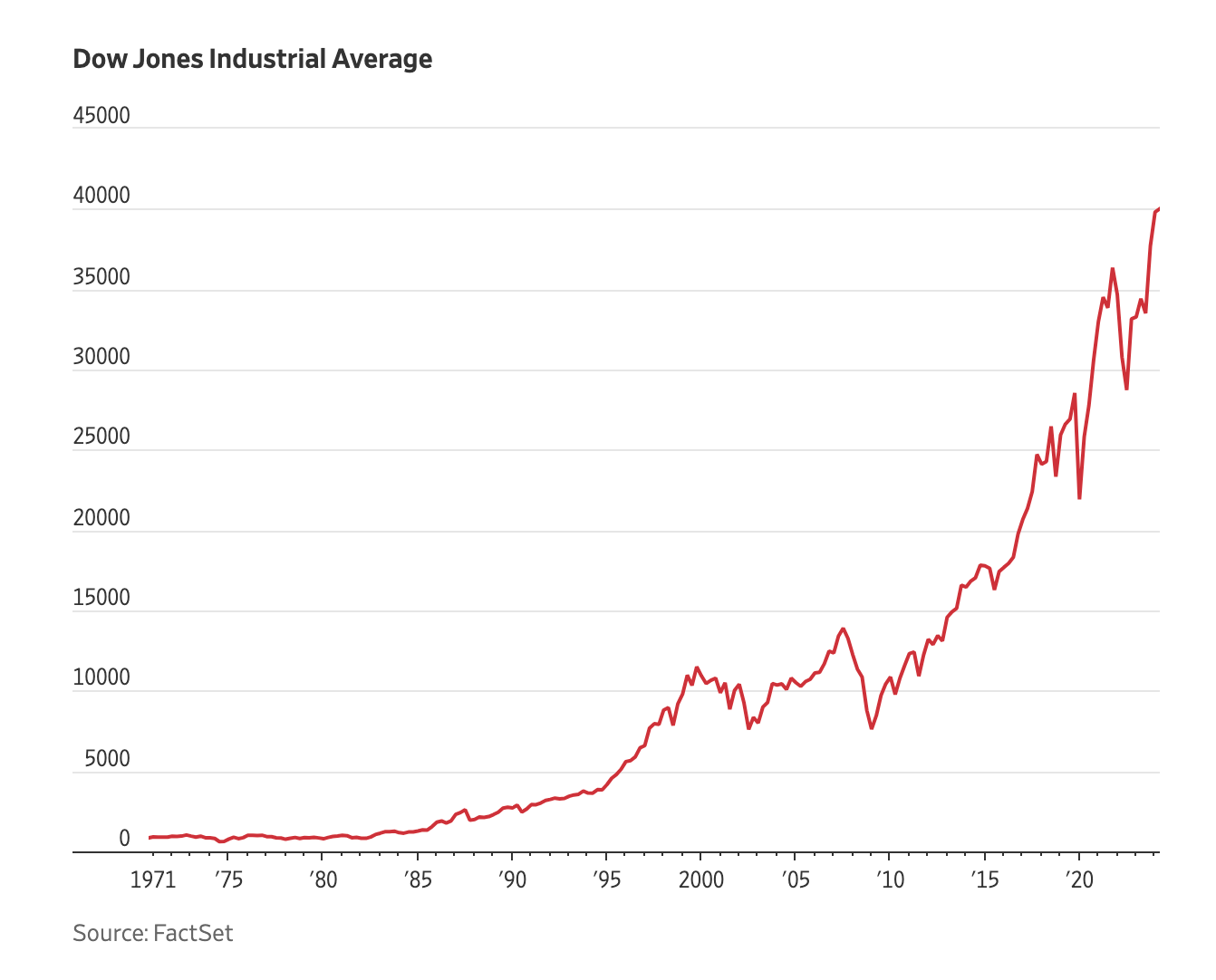

But here is what is the most interesting part to me — if you look at the Dow Industrial Average, you see that COVID and the 2022 rate hikes barely created blips in a longer trend that has seen the index surge parabolically since the Global Financial Crisis.

When you hear people talk about a “regime change” in financial markets, the data is becoming overwhelming. Investors have benefitted from one of the longest bull markets in history. The scale and speed of this is hard to comprehend until you zoom out and see the difference with any time period before 2008-2009.

While this bull market has raged on, some investors have preached about assets being overvalued. They have called for a deflating of asset prices. They have predicted doom and gloom. The story for these individuals or organizations has long been that markets are broken and eventually we will see a return to prior trends and values.

But that hasn’t happened.

Instead, asset prices have merely accelerated even faster and further, regardless of what the critics preached. Historical trends and valuations haven’t mattered nearly as much as the pessimists wanted you to believe. The best investment strategy was literally to get long and chill.

Unfortunately they don’t teach that in finance classes.

The reason I bring this up is because the pessimists have been wrong for almost 15 years now. The Dow Jones shouldn’t be at a new all-time high with interest rates over 5%, but that is exactly what has happened.

You can be right or you can make money.

Be very careful about trying to win the intellectual debates. Your portfolio doesn’t care about the number of likes you get on your social media posts. It only cares if you were correctly positioned to benefit from the structural changes that have occurred in the market.

This doesn’t mean that you should indiscriminately buy every stock or asset you hear about. Gamestop went up quite a bit in the last few days, but it has dropped 20% in the last 24 hours. The market still has some semblance of reality. Laws of supply and demand still rule the day.

When I was growing up in North Carolina, there was something called “redneck rich.” Urban dictionary defines it as “when your truck costs more than your house or owning an expensive truck for which you are too poor to buy gas.”

There are even songs about it. This one starts with “I ain’t Elon Musk, but I got a quarter-inch socket trying to make a rocket out of this truck.”

I feel like markets are becoming redneck rich. The average American is struggling to pay increasing home and food prices, but the $500 they put in their Robinhood account continues to grow in value.

The sophisticated math geeks on Wall Street keep saying their models predict a big crash right around the corner, yet the everyday person keeps buying a few stocks and watching them go up.

Redneck rich is all about having money to get the things you find important. Maybe the equivalent in financial markets is being able to have a small enough brain where you don’t need models — you just get long and chill.

That is my new strategy. Be redneck rich in markets. Don’t overthink it. Don’t fight the trend. Just let the Fed and politicians debase the currency and increase asset prices over time. They will make you rich, regardless of whether you are a redneck or not :)

Hope you all have a great end to your week. I’ll talk to everyone on Monday.

-Anthony Pompliano

Kenny DeGiglio is the Co-Founder of Dream Startup Job and Crypto Academy.

In this conversation, we discuss tips and tricks for landing a job in crypto, remote work vs in-office, US-based vs. international firms, compensation, bear vs. bull market, Dream Startup Job, an overview of Crypto Academy, and the benefits of going through the training program.

Listen on iTunes: Click here

Listen on Spotify: Click here

How To Get A Job In Bitcoin & Crypto

Podcast Sponsors

Consensus is the largest event dedicated to all sides of crypto, blockchain and Web3. Use code POMP to get 20% off your pass and join me in Austin this May 29th-31st

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post