To investors,

Financial markets can be crazy at times. The complexity of an economy makes it nearly impossible to predict what will happen in the short and long-term. Humans are really bad at dealing with uncertainty, specifically when there is a dopamine-driven feedback loop of volatile price movements thrown in their face every few minutes.

Let’s use bitcoin as an example. On at least 6 occasions last year, the digital asset fell in price more than 20%. There was a 50% drawdown in approximately 95 days, which was the 4th time in 4 years that bitcoin had fallen by 50% or more. To say that bitcoin’s US dollar exchange price is volatile would be an understatement. There are few financial assets that compare.

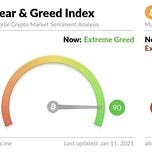

This volatility in price is mirrored by wild swings in investor sentiment in the market. During January 2021, Bitcoin crossed $38,000 for the first time in history. The Fear and Greed Index registered at extreme greed. In January of 2022, Bitcoin crossed below $38,000 and the Fear and Greed Index registered at extreme fear.

This is a great example of wild swings in sentiment. The price of the asset is the exact same, but the difference of one year (and the direction of the asset’s movement) led to very different beliefs about the future.

This is top of mind right now because we are watching the complexity of financial markets play out related to bitcoin. The Federal Reserve spent the last two years flooding the market with cheap capital, which pushed investors further out on the risk curve. Wall Street funds and institutional investors adopted bitcoin as an inflation hedge asset. Public companies started to put bitcoin on their balance sheet. The price of bitcoin pushed higher as inflation raged on.

Now that the Federal Reserve is talking a tough game, including increasing interest rates and tapering quantitative easing, the price of bitcoin and other risk assets have fallen significantly. The anticipation of more expensive capital, and ultimately lower inflation growth year-over-year, has investors scrambling to gain more exposure to value investments.

Simultaneous to the Fed-related speculation, there is a geopolitical game theory playing out involving bitcoin. China has taken an abrasive stance towards bitcoin miners and investors. This led to a massive migration out of China, which can be seen in on-chain metrics and the global hash rate measurements. Elected officials in the United States continue to propose legislation that would create high friction for companies, investors, and miners. El Salvador has leapt onto the global stage by embracing bitcoin in a major way. They are buying bitcoin, building bitcoin ATM networks, launching bitcoin software products, creating a bitcoin city, and raising capital through a bitcoin-backed municipal bond.

The various approaches of China, United States, and El Salvador have been playing out for months. A new entrant to the global game theory is Russia. Their central bank has taken a fairly adversarial position to the industry, including a proposed ban on crypto trading and mining. It appears that Russian President Vladimir Putin disagrees with the central bank and has reportedly signaled his support for a proposal from the Finance Ministry that would allow crypto mining and trading, but in a heavily regulated manner.

Price volatility. Sentiment swings to the extreme. Some countries embracing bitcoin. Other countries attacking bitcoin. The Fed saying one thing, but doing another. There is uncertainty in the market. No one knows what is going to happen. It is easy to be fearful. It is easy to get distracted. The world is moving fast. How can you possibly keep up?

Well, maybe you don’t have to try. The beauty of taking a long-term approach to investing is that you can live a less stressful life. You are able to do the work to identify secular, multi-decade trends and allocate capital accordingly. Barring some significant invalidation of the thesis, a long-term investor can then focus on dollar cost averaging into the investment over time.

MicroStrategy’s Michael Saylor was on UpOnlyTV yesterday and he clearly articulated his bitcoin strategy. Cobie, one of the hosts of the show, asked him “Is you strategy, you just don't give a shit, you're buying Bitcoin no matter what?” to which Saylor answered “yeah.” This may seem crazy to the ill-informed eye, but the conversation evolved to unpack this even further. Michael Saylor explicitly explained that he would periodically buy the tops of bitcoin price cycles, along with buying bottoms.

When you are dollar cost averaging, it is impossible to know whether you are buying the top or the bottom. But if you have a long-term view, you don’t care. You simply continue to convert your currency into the asset of choice. Regardless of what is happening in the world, a long-term bitcoin investor will continue to simply dollar cost average. Geopolitics? Noise. Fed decisions? Noise. Wall Street adoption? Noise. Sentiment? Noise. Price? Noise.

The key to generating outsized returns over decades is to ignore the noise. Focus is a superpower. You lead a less stressful life. You don’t get distracted. As Warren Buffett once said, “our favorite holding period is forever.” Many investors in modern markets could benefit from understanding this advantage. Hope each of you has a great day.

I’ll talk to you tomorrow.

-Pomp

Do you want a job in the crypto industry? My team and I have been working with the top HR teams in the industry to create a training program that teaches the fundamentals of crypto.

We cover everything from how central banks work to bitcoin’s technical architecture to smart contract platforms to niches of the industry, such as NFTs, DAOs, and much more.

This 3-week intensive program has 50+ events packed into the most valuable training program in crypto. We helped more than 400 people get hired last year and you can be one of them.

Our next cohort starts in February. APPLY:

https://www.pompscryptocourse.com/

SPONSORED: Brave Wallet is the first secure wallet built natively in a web3 crypto browser. No extension required.

With Brave Wallet, you can buy, store, send, and swap assets. Manage your portfolio & NFTs. View real-time market data with an integrated CoinGecko dashboard. Even connect other wallets and DApps. All from the security of the best privacy browser on the market.

Protect your crypto. Whether you’re new to crypto, or a seasoned pro, it’s time to ditch those risky extensions. It’s time to switch to Brave Wallet. Download Brave at brave.com/Pomp, and click the wallet icon to get started.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Sven Henrich is the Founder of Northman Trader. He's a highly respected technical analyst and commentator about markets and the macro economic environment.

Sven recently changed his stance on Bitcoin and has started to allocate capital into the asset. In this conversation we talk about the macro environment, fiscal policy and how these unprecedented times led Sven to considering Bitcoin as an allocation in his portfolio.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Bitcoin 2022 is the largest Bitcoin event in the world that takes place 4/6 - 4/9 in Miami Beach. Click HERE to learn more and use promo code POMP for 10% off.

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Mode allows you to buy, earn and grow Bitcoin, all in one app. Download Mode on the App Store and Google Play. Only available in the UK.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain here today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

Abra is an all-in-one secure app that allows you to trade over 110 cryptocurrencies. Download Abra today and get $15 in free crypto once you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

MyBookie allows you to bet and withdraw with Crypto. Use promo code ‘POMP’ to double your first crypto deposit at MyBookie.

Coin Cloud is the world's leading digital currency machine operator. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. To start earning today visit: http://www.blockfi.com/Pomp

Circle Yield offers qualified businesses superior returns on USDC holdings for terms of up to 12 months. Visit circle.com/pomp today; terms apply.

BTCS was the first US-public company to secure today’s top layer one protocols. Test out the BTCS Data Analytics Dashboard today at BTCS.com

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go tookcoin.com/pomp

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post