To investors,

We got news yesterday that a federal court has thrown a major wrench into President Trump’s economic plan. CNBC writes:

“The U.S. Court of International Trade on Wednesday blocked steep reciprocal tariffs unilaterally imposed by President Donald Trump on scores of countries in April to correct what he said were persistent trade imbalances.

The ruling deals a potentially serious blow to the Republican president’s economic agenda and ongoing efforts to negotiate trade deals with various nations.”

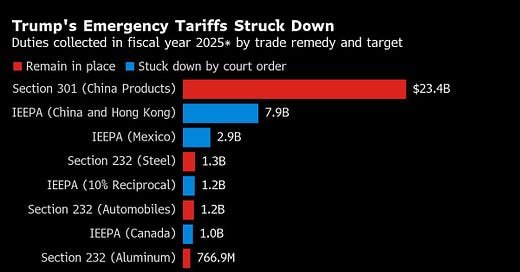

Bloomberg shows that not all tariffs are being struck down by this ruling, but a very large percentage of them will be negated.

The legality of the tariffs will be highly debated and I anticipate the case will eventually be heard by the Supreme Court. Regardless of the outcome over time, there are two repercussions of the court’s ruling. A large part of the market will see this decision as a removal of majority of the tariffs, which means we will see capital flood back into assets as investors gain confidence that the worst economic pain is behind us.

Another large part of the market will have a different read on the tariff court ruling. They won’t gain confidence, but rather they will see this development as a return to uncertainty because of the appeals process. This second group won’t allocate capital back into the market until there is finality in the court cases, which could take weeks if not months.

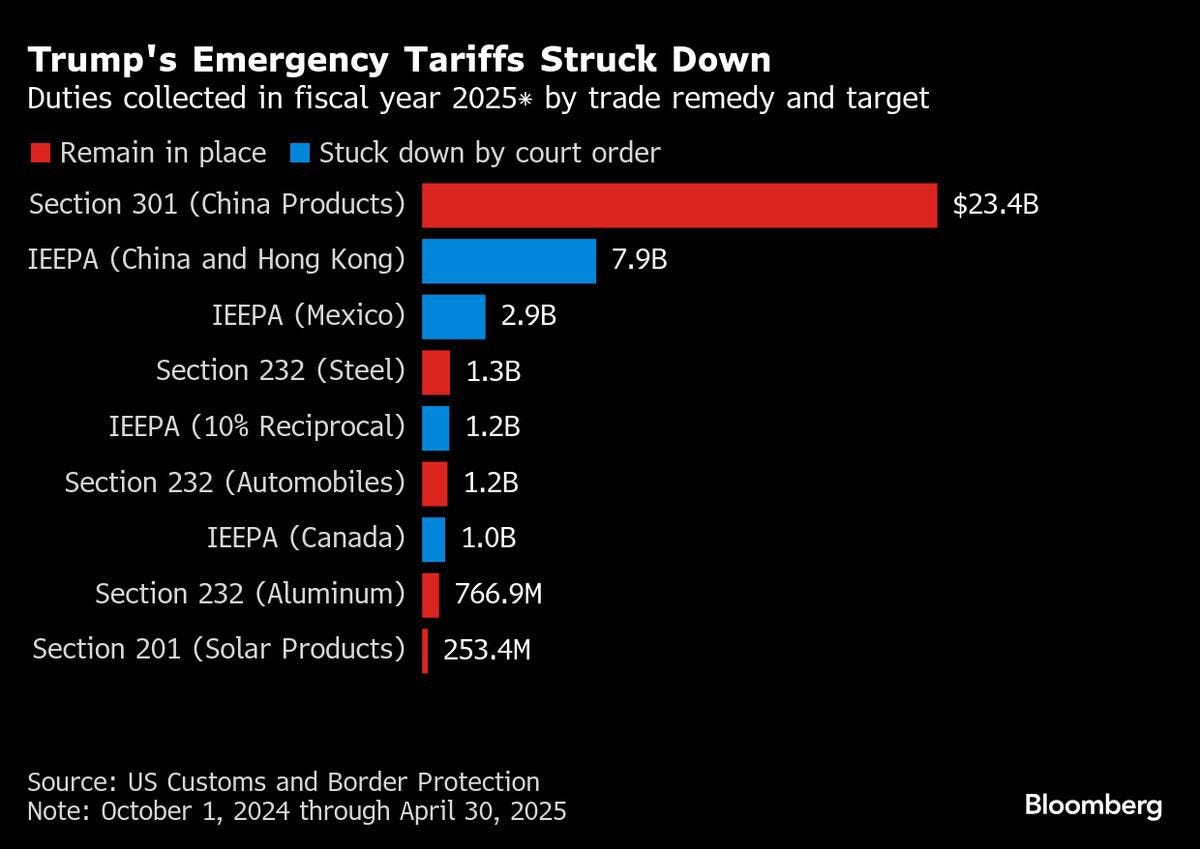

My guess is that self-directed retail investors will accelerate their investing pace, while institutional investors will continue to be cautious. This ultimately boils down to a key difference in how these two groups think about financial markets. Retail understands that the dollar is going to be debased, bear markets have been outlawed, and there will be a persistent bid for stocks for decades to come. Institutions not only question those three assumptions, but they are more focused on delivering their quarterly and annual return numbers.

Retail is investing for profits, institutions are investing to keep their AUM.

The crazy part about this situation is that both groups may be right. Stocks have become very expensive, according to Barchart, who points out the Warren Buffett Indicator has officially hit 193.5%, which surpassed November 2021 as the second most expensive time for stocks in history.

They also show that the 30-year Treasury yield has risen above 5% again, which is not what sophisticated investors want to see.

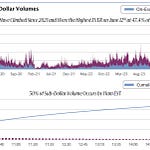

Retail investors are playing a different game though. Global Markets Investors writes “According to Bank of America, hedge funds sold ~$1.5 billion equities on net in 4 weeks, the most since the 2022 bear market. Institutional investors sold ~$2 billion. Retail investors bought nearly $2 billion, the most ever.”

So while retail and institutions battle it out in the markets, the new court ruling around tariffs will only further complicate the situation. But I don’t think anyone is going to change their mind. Retail will keep buying. Institutions will keep selling. And the world will keep spinning.

Only time will tell who is right and who is wrong. And the beauty of capitalism is that the market will be the ultimate referee.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: We launched a new product this weekend to help investors manage their financial lives. The product uses AI models to track your net worth, analyze your portfolio, answer any questions you have about your finances, and make suggestions on how you can improve. You can add public stocks, private investments, crypto assets, cars, houses, investment properties, collectibles, and any other assets you own.

You can text, email, or call the CFO too which is really cool. The CFO, called Silvia, now has more than $1.8 billion in assets connected on the platform.

You can sign up for the product completely free here:

https://www.cfosilvia.com

Is The Bitcoin Bull Run Back?

John Pompliano and Anthony Pompliano discuss bitcoin, bitcoin conference in Las Vegas, bitcoin treasury companies, macro environment, inflation, timeless investing principles, and how this all impacts your portfolio.

Enjoy!

Podcast Sponsors

Figure Markets – Bitcoin backed loans so you can buy more Bitcoin with your Bitcoin or earn 8% lending cash to HELOC providers! Learn more about Figure Markets and their Crypto Backed Loans!

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post