Today’s letter is brought to you by Trust & Will!

Trust & Will is the most trusted name in online estate planning and settlement.

The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy.

Their mission is to make estate planning simple, affordable, and inclusive.

All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements.

To investors,

Tom Rees wrote an article in Bloomberg recently titled, “Gen Z Will Carry the Deepest Psychological Scars From Inflation.” My first reaction was to point out how ridiculous it would be for young people to claim psychological scarring from an economic event. This just reinforces the idea of a generation of kids who have become soft and weak, right?

Maybe.

Put aside the use of the phrase “psychological scars” and focus on Rees’ larger point—young people have higher inflation expectations than any other generation. That doesn’t seem like such a ridiculous claim. These young people just lived through the highest inflation in decades, while not having a lengthy personal experience living through an economy with low inflation.

You can only base your future expectations off your personal experience.

The Bank of England conducted a study recently that shows at least 50% of people from ages 16-75, except those 25-44 years old, expect inflation to be over 3% in the future.

This makes sense given the older generations lived through the high inflations of the 1980s and the younger generation had their formative years during the high inflation of the 2020s.

So why is this important?

It has long been the position of central banks that inflation expectations drive inflation outcomes. If a business owner believes higher inflation is on the horizon, then the business owner will begin to raise their prices in anticipation. If a consumer believes inflation is coming, they may start to buy more goods in bulk or change their consumption behaviors.

Economies are complex machines. There is no right answer on how to handle these situations. Central bankers have two tools in their toolbox—expand/contract the money supply and increase/decrease interest rates.

At the same time that central bankers are trying to manage the economy, which is a nearly impossible task by itself, they will also have to be cognizant of the increasing chaos and conflict around the world.

For example, the United States is being forced to drastically increase our national debt in response to our geopolitical strategy. Here is how it works:

War breaks out somewhere in the world. Other nations ask the US for weapons & money. The US gives the weapons and money to other nations. Then the US begins to run low on weapons & money. More war breaks out globally because the US is weakened. Other nations ask the US for weapons & money. The cycle repeats.

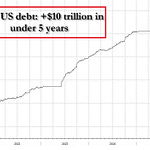

As the US gets weaker, and the world becomes more chaotic, we are forced to increase our national debt at a furious pace in order to pay for all the weapons and money we are giving everyone else. You can see this happening with the conflict in Ukraine already. There has been more than $500 billion added to the national debt in a matter of weeks (not all for Ukraine but a material amount in response to that conflict). Some estimates are that the US will add $1 trillion to the national debt in a single month for the first time in history.

This is insanity.

Add in the fact that Israel is now asking the US for weapons and money, along with potential conflicts that could kick off in Taiwan and other geographic regions, and it is not hard to see a situation where the US gets stretched thin. We can’t fund every war on Earth without printing ourselves into ruin.

You are watching a global chess game between superpowers. China and others never have to enter into direct conflict with the US to secure victory if they can simply watch us bleed ourselves dry. It is imperative we do not repeat the mistakes of the great civilizations that came before us.

But here is the crazy part—remember the gen z crowd with high inflation expectations? They are probably going to end up being right. Central banks can not continue to print trillions of dollars annually without driving prices higher. Instead of laughing at the young generation because a journalist used the phrase “psychological scars,” we will be better off trying to understand what the young people know that we don’t.

Hope everyone has a great start to their week. I’ll talk to you tomorrow.

-Anthony Pompliano

Emma Hinchliffe is a senior writer at Fortune, where she covers women in business. She also is the author of the 5-time a week newsletter called "Broadsheet."

Emma recently wrote an article "Kim Kardashian turned Skims into a $4 billion company. She wants to build the next generation of unicorns with SKKY Partners, her new private equity firm." In this conversation, Emma breaks down why Kim Kardashian is going into the private equity sector, advantages & disadvantages, biggest risks, and how Kim & Jay Sammons got partnered up.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Kim Kardashian’s Private Equity Firm Broken Down In Detail

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Velo Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.