This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 160,000 other investors today.

To investors,

Elon Musk posted a tweet last night that stated Tesla would be ceasing acceptance of bitcoin for any purchases. All hell broke loose almost immediately. Bitcoin was already down about 8% for the day, but the price dropped even further to under $50,000.

The reasoning for Tesla’s decision is that the company has concerns around the energy consumption needed to run the digital currency. There is a lot to unpack here, so let’s dig into it.

First, Elon Musk and Tesla did not sell any bitcoin because of these energy concerns. They explicitly stated that they are holding their bitcoin. As I always say, don’t listen to what people say. Simply watch what they do with their money. Elon Musk owns billions of dollars of bitcoin across his personal holdings, Tesla, and SpaceX. He isn’t selling that bitcoin because of this inaccurate narrative. That should tell you everything you need to know.

Next, the entire narrative of “bitcoin is bad for the environment!” is inaccurate. There is study after study that concludes bitcoin is one of the single greatest financial incentives for the world to develop and adopt renewable energy. You can read fintech firm Square’s white paper titled “Bitcoin is key to an abundant, clean energy future.”

The logic behind this claim is that bitcoin mining as a business requires an operator to find the cheapest power possible. The cost of electricity is the largest input in the business model. So in order to attain the highest levels of profitability, bitcoin miners have been running around the world to find cheap power. That usually results in the miners consuming renewable power, which is historically the lowest cost power available.

An additional point is that bitcoin miners are persistent consumers of power. This is important because a material amount of energy production around the world is wasted because there is no one to consume it in real-time and the storage of energy is still facing too many obstacles. Because of this challenge, bitcoin miners have become a preferred method for power grids to ensure that they can have a balanced grid at all times. When they have a surplus of power, they can monetize it by sending it to the bitcoin miners. In an interesting, nuanced way, the bitcoin network serves as one of the most effective batteries in the world.

When we start talking about energy consumption and bitcoin, many people will claim that miners in China predominantly use coal to mine the digital currency. That is not necessarily true either. According to Nic Carter and the team over at Coin Metrics, here are some interesting facts about power consumption and mining in China:

Inner Mongolia was the 2nd biggest coal-powered province in china for mining, but they recently banned mining. This reduced a big portion of coal miners.

Xinjiang, which is the last remaining mining-heavy province in China with lots of coal power, is still approximately 40-50% renewables.

Sichuan and Yunnan, which accounts for about 50% of total hash rate during the wet season (starting this month), are almost 100% hydro-powered miners.

There was a blackout in Xinjiang that only reduced bitcoin hash rate by 25% in the dry season. This suggests that China has lost significant market share when looking at global hash rate.

I highly suggest you follow Nic or pay attention to the research that the team puts out around this topic.

So if China’s miners are becoming more green, while also losing market share, what is happening in the rest of the world? The United States and Canada are quickly gaining market share. These countries tend to have much more renewable energy focused power grids. This leads to more renewable energy mining facilities as well.

One of my favorite examples is Great American Mining, an early stage company that is partnering with oil and gas companies to capture flare gas for use as the power source in bitcoin mining rigs. Flare gas is one of the worst things that humans do for the environment, so the fact that bitcoin miners are able to capture that waste before it harms the environment is quite interesting. Not only are they refraining from the use of coal, but they are actually preventing other industries from creating environmental destruction.

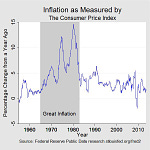

Next up in the debunking of this nonsense is the comparison of bitcoin and US dollar energy consumption. This is frankly the easiest part of the conversation. Michael Arrington posted this image on Twitter:

It shouldn’t surprise anyone that the banking system has higher energy expenditure. The banking system is bigger (for now). But as Mark Cuban said yesterday, the disruption of both gold and physical coins will be a big environmentally friendly development in the world.

So now we have two billionaires that are both trying to improve the environment, yet they are viewing the role of bitcoin differently.

Another argument that you’ll hear is that the bitcoin network uses more energy than some small countries. While true, this is not some big revelation. To put it in comparison, the amount of energy used every year by Americans to run their Christmas lights is also greater than the total energy consumption of some small countries. Should we end Christmas? Maybe outlaw Christmas lights?

That is what the anti-bitcoin crowd sounds like — completely ridiculous. The truth is that small countries simply don’t use that much energy compared to many other things. That is okay. Somehow this fact never makes it into the salacious headlines used to attack bitcoin.

This leads us to what exactly could potentially be going on here in regards to Tesla’s announcement to stop accepting bitcoin because of energy concerns. My guess is that we are watching the first step in a master stroke of marketing from Elon Musk and the team. Here is what I think is about to happen:

The company announces that they have energy concerns. (done!)

The company creates a bitcoin mining hardware that is based on renewable power and launches it to the mass retailer.

The company claims they are helping to push the world to a more renewable energy future, including making bitcoin more environmentally friendly.

Why do I think this? Frankly, it is intuition. I don’t have any inside information or special knowledge. Tesla is a renewable energy company that ultimately serves as a battery technology. The Powerwall is described by the company as “a home battery designed to store energy from solar or the grid, so you can use it anytime you want—at night or during an outage.”

Guess what one of the best uses for that stored power is going to be? Mining bitcoin. It can provide income for the owner of the Powerwall, including potentially paying off the purchase of the device in a relatively short period of time (under 1 year). This also would allow for Tesla to tap into a brand new segment of customers — bitcoiners — with a product that is already developed in a significant way.

It is unclear to me exactly how they would launch the product. Would it be a version of the current Powerwall that connects to an at-home miner? Would it be a new type of device? Maybe a refurbished Powerwall that is vertically integrated? No one knows. But it feels like this is all a big ploy to get into the renewable power mining business.

Long term this is smart for Tesla and Elon if that is what they are doing. Short term it causes chaos in markets. I’ve spent all morning running from CNBC to CNN to Twitter to email to text messages. Everyone asking the same questions over and over again. While it is annoying that we have to keep debunking this FUD, we do know one thing is certain – bitcoin is anti-fragile.

It has been attacked over and over again for 12 years. The digital currency continues to survive each attack. In fact, it continues to thrive despite the attacks. The $1 trillion asset can’t be stopped by any one person or group. The energy conversation will once again be a small blip on the historical radar when we look back in 20 years. The end game here is inevitable in my opinion. The hardest, soundest money will win.

Hope you have a great day today. I’m having a blast learning from each of you and couldn’t imagine working on anything else. Talk tomorrow.

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 160,000 other investors today.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Amanda Cassatt is the CEO of Serotonin, a marketing firm and product studio for transformative technologies. She is the former Chief Marketing Officer of Consensys.

In this conversation, Amanda and I discuss:

Brand positioning

Public relations

Marketing

What most teams get wrong

How to talk about your product

The positive impact of marketing

I really enjoyed this conversation with Amanda. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Exodus is an absolute game changer in the crypto wallet space. With over 100 assets supported, one-click built-in exchange, Trezor hardware wallet integration and 24/7 customer support, this is a no brainer for both newcomers and crypto heavyweights. Download Exodus on desktop, iOS, and Android using my code http://get.exodus.com/pomp

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

OKEx is a leading crypto exchange known for providing the most options for crypto traders and investors. Whether you want to trade spot, futures, options or swaps, OKEx gives you institutional-grade tools and a best-in-class trading engine. The platform offers credit and debit card funding options and supports 40 different fiat currencies, including EUR, CAD, GBP, TRY, INR and RUB, to name just a few. You can invest, trade, and earn yield, all within one place at okex.com. OKEx is not available to customers in the United States.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains makes crypto easier by replacing your address with [AnyName].crypto. They allow you to send and receive over 70 cryptocurrencies, including BTC, ETH, and LINK with a single blockchain domain. Go to unstoppabledomains.com and get [YourName].crypto to make your crypto life easier.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Public Rec is where indoor comfort meets outdoor style. Their best-selling All Day Every Day Pant is a more stylish alternative to sweatpants, and a more comfortable alternative to jeans. From the couch to the gym to the grocery store, and everywhere in between, Public Rec has you covered. Comfort starts with a better fit. Free shipping. Free returns. Visit www.publicrec.com/pomp and use POMP at checkout to get 10% off.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

Revolut is a finance app in the US and UK, that say they're the simplest way to access crypto. Sign up today at Revolut.com/pomp and make 3 card transactions to get $15, which you can exchange for any tokens Revolut supports. As usual, when you move your money from fiat to crypto your capital is at risk. See T&C's for details. Revolut is a financial technology company. Banking services provided by Metropolitan Commercial Bank, Member FDIC. Cryptocurrency services provided directly by Paxos Trust Company, LLC.

Did you know nearly 338 million dollars worth of NFTs were sent last year? And in 2021 that number is growing faster than ever. Looking to make your first NFT? Check out NEAR’s fast, scalable, low-cost, open-source platform. Learn why NEAR is the infrastructure for innovation at near.org

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

Bitcoin, Mining, and Elon Musk