Today’s letter is brought to you by Shortform!

Shortform has the world’s best guides to 1000+ nonfiction books. Learn key points and gain insights you won't find anywhere else. Understand the world’s best ideas.

Crystal-clear logic — We take confusing ideas and explain them in plain and simple ways. Never get confused by a complicated book again.

Brilliant new insights — We add smart analysis, connecting ideas in novel ways and discussing key updates since the book was published.

Always concise — Your time is valuable, and we don't waste it. We write with zero fluff, making every word and sentence deserve your time.

They cover the world's most popular books, including New York Times #1 bestsellers and universally recommended titles. Learn from books in categories like: management, entrepreneurship, business, money and finance, career and success, productivity, and health & well-being.

Join Shortform today (www.shortform.com/anthony) and get a free trial. Once the free trial is over, you will get 20% off the service as well. Highly recommend if you want to get smarter and be time efficient!

To investors,

The national debt is now over $34.6 trillion. Despite that insane number, the US government continues to run a deficit that is estimated to be ~ $2 trillion annually.

Given the high interest rate environment, our interest payment on this debt has now crossed over $1 trillion annually.

As The Kobeissi Letter put it:

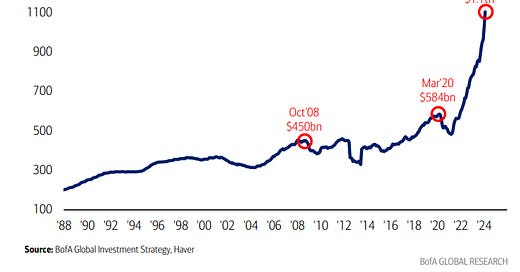

“The annual interest expense on US debt is literally moving in a straight line higher, now at $1.1 TRILLION. To put this in perspective, less than 3 years ago the annual interest expense on this debt was $450 billion. That's a 144% jump as total US debt has surged by over $11 TRILLION since 2020. Even in 2008, at the peak of the Financial Crisis, annual interest expense was just $450 billion. As interest rates surge and debt levels hit record highs, we are paying the prices for decades of deficit spending. The era of "free money" is over.”

So the government is broke and they need more money. One solution is to keep borrowing and driving the national debt higher. But another solution is to raise taxes on American citizens.

While unpopular, politicians may feel like they have no other choice. Yesterday, there were a number of tax proposals that went viral online and caused significant uproar.

The most egregious proposal was for the government to tax unrealized gains. Technically they want to focus on the wealthiest Americans, but that doesn’t matter here. The idea of taxing unrealized gains is probably one of the stupidest ideas ever created by the political class.

Under this proposal, an American would owe taxes each year based on the price appreciation of their home. So if you have a $500,000 home and it appreciates $100,000 in 2025, then you would owe $25,000 - $40,000 in unrealized capital gains taxes depending on your income bracket and the state you live in.

Obviously this would bankrupt a large portion of the population considering the average American doesn’t have $400 for an emergency payment.

Additionally, imagine a tech founder who starts a new company. If they raise capital at $5 million valuation, work hard throughout the year to build a solution to a real problem, and then raise capital again at a $10 million valuation, the founder would owe tens or hundreds of thousands of dollars in taxes.

The problem in both of these situations is that the individual holding the unrealized gain never had true profit from the asset, so there is no money to pay the taxes. Plus, we won’t get into the difficult questions like “what happens if the asset depreciates later?” or “who gets final say on what an asset is worth?”

As I tweeted last night, “If they want to collect unrealized gains, we’re going to need refunds on unrealized losses.” The latter will never happen, but thankfully neither will the former.

On a more realistic basis, another tax proposal put forward is that the Biden administration would like to reinstate the 39.6% income tax for high earners. President Trump had removed this tax bracket and made the highest income tax only 37%. My guess is that this proposal’s fate will be determined by whoever is elected in November.

So, in conclusion, the US government is broke and we only have two options ahead of us — borrow more money or tax our citizens more egregiously. Even if the politicians are able to force a tougher tax regime through the legislative process, I don’t see a path where tax revenue can cure the federal deficit we run annually.

The only viable path the US has in my opinion is to continue borrowing money. That means the national debt will grow to the sky. The US dollar will be debased. Hard assets will continue to appreciate in value. And the investors who understand investing, not saving, is the path to financial freedom will be rewarded handsomely.

It is a tale as old as time. We have reached the point of no return. Our government is allergic to a balanced budget. They have a money printer and they aren’t afraid to use it.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Adam Sullivan is the CEO at Core Scientific, one of the largest bitcoin miners in North America.

In this conversation, we talk about building Core Scientific, public company impact, bitcoin halving, bitcoin ETFs, future of bitcoin miners, consolidation in the industry, metrics to evaluate a business, and future plans for Core Scientific.

Listen on iTunes: Click here

Listen on Spotify: Click here

Core Scientific CEO Adam Sullivan on Bitcoin Halving & ETFs

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post