To investors

The bitcoin halving is scheduled to happen later today. I asked Meta’s new AI model to explain what the halving was and here is the output:

“The Bitcoin Halving is a preprogrammed event that occurs roughly every four years and impacts the production of bitcoin. The halving reduces the reward for mining Bitcoin transactions by half, which reduces the rate at which new coins are created and thus lowers the available amount of new supply.”

Not a bad description. There are a few important things to unpack around this event, so I will do my best to address each of them.

First, investors want to know — has the halving been priced in? Bitcoin is up approximately 40% year-to-date. Theoretically, if everyone knows the halving is happening, especially if they all know when it is happening, then the market should price the event in advance.

The problem with that theory is that everyone doesn’t know about the halving though. You could take a poll of bitcoin holders and a non-zero percentage of them would be hearing about the bitcoin halving for the first time. On top of that, some portion of the investors could not accurately describe what the halving is, how it works, where the impact is seen on the supply side, nor when it is scheduled to occur.

This information gap is a clear sign that the halving can’t be priced in.

The second question is how impactful will the halving be on bitcoin’s price in the coming days, weeks, months, and years? Castle Island’s Nic Carter made a great point yesterday on Bloomberg when he said “the halving represents an issuance reduction on an annual basis of 83 basis points.” Nic and I disagree on the halving being priced in, but his point here about the relatively small change in issuance percentage for this halving is important.

The smaller the percentage, the less impact that the halving event should have on the price of the asset.

Bitwise analyst Juan Leon quantified the historical impact on bitcoin’s price when he wrote:

“Historical data tells us that on a short-term return basis, the halving is a “sell the news” event.

On average, the price of bitcoin has risen 19.03% in the month preceding the halving, versus 1.70% in the month following the halving. Zooming out, however, the reverse is true: On average, bitcoin has risen 3,224% in the year following the halving, versus 185% in the year preceding it.

Those numbers are skewed by the huge (8,839%) return in the year following the 2012 halving. But ignoring absolute numbers, returns have been higher post-halving than pre-halving in each of the three historical examples we have.”

Placeholder’s Chris Burniske looked at the past price movements and showed that strong hands have benefitted greatly within 18 months from holding bitcoin post-halving.

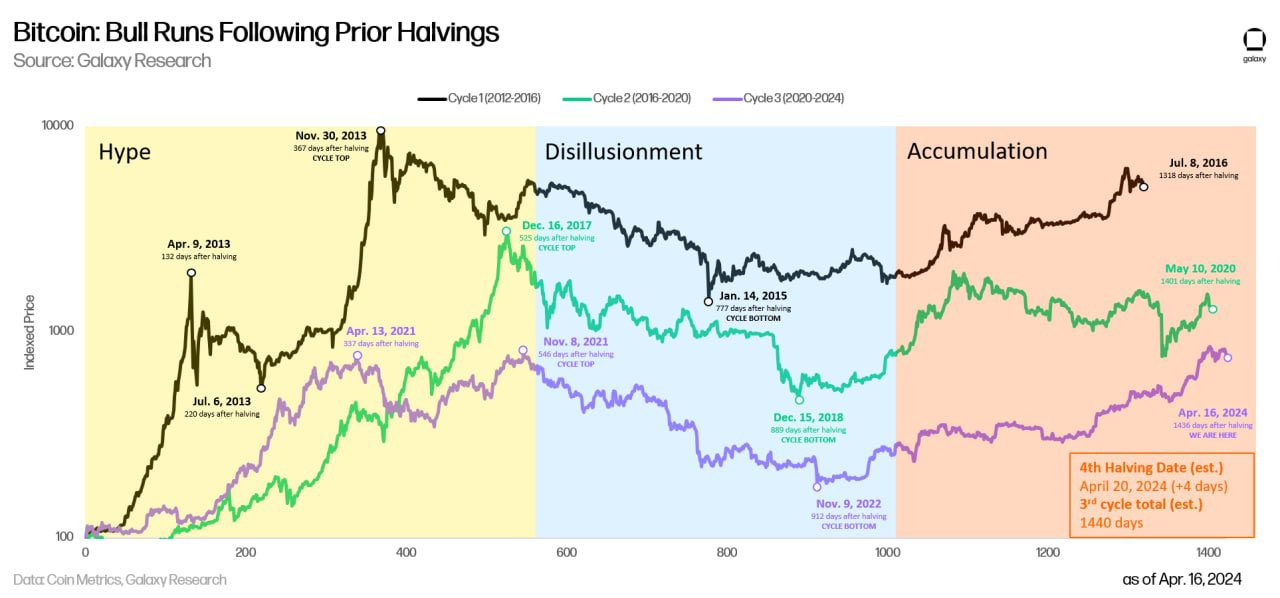

Galaxy Research’s Alex Thorn came to a similar conclusion when analyzing the post-halving bull run data.

So my big takeaway is that the actual halving is historically a sell the news event. The price of bitcoin does not immediately take off higher. Instead, it takes a few weeks or months to see the supply change impact the market. Over the coming months, we should see bitcoin’s price continue to rise aggressively as demand stays constant or potentially increases.

One thing to call out, which runs counter to the public narrative, is that we should not expect bitcoin to experience as large of a return to the upside as we have seen in past bull markets. The market size is much larger and net new capital into the market has a smaller percentage impact.

You can see in Thorn’s analysis above that the price appreciation in percentage terms has been decreasing in the last few bull markets. Bitcoin still remains one of the best performing assets in the world, but it is much less risky to buy the asset today so you should expect to capture a lower return than those who took higher risk years ago.

Speaking of risk, I am constantly asked what I perceive as the biggest risks to bitcoin. One of my answers is some version of “the software potentially not executing as designed.” I measure this risk to be near-zero probability, but it remains a small risk worth watching. Today is one of the days where we will get another data point that bitcoin continues to do what it was designed to do — the halving should come and go without a hitch. But we never have 100% certainty until it happens.

Here is to hoping that we have an uneventful day. Happy Halving Day to all of you.

I’ll talk to everyone on Monday.

-Anthony Pompliano

Sandy Kaul is the Senior Vice President at Franklin Templeton.

In this conversation, we talk about bitcoin, client demand, tokenization, real world assets, regulation, portfolio construction, future narratives, meme coins, and where Franklin Templeton sees value in the future.

Listen on iTunes: Click here

Listen on Spotify: Click here

Trillion Dollar Investor Is All-In On Crypto

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post