This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

To investors,

It has been almost exactly 5 months since the original lockdown orders went into place in the United States. There has been incredible economic carnage that transpired since, so today I want to spend time zooming out and recapping those developments.

During times of uncertainty and chaos, it is always important to level set on what has happened, where we are now, and what are the possible situations yet to play out. Fortunes are going to be won and lost throughout this financial crisis. Certain narratives will disappear and many trends will be accelerated. The best investors are merely trying to be right more times than they’re wrong.

Let’s start with an analysis of the job market. We started the year with a historic low in unemployment around 3.5%. Once the pandemic hit the US in March, it quickly became clear that businesses would be unable to keep employees on payroll if they had near zero revenue. In my March 18th letter to each of you, I wrote the following:

“As I have talked to people about this issue [unemployment] over the last 24 hours, most are relatively calm about it because the general belief is that it would take quite awhile for high levels of unemployment to take hold. The data says otherwise though. These large increases in unemployment filings tells a much different, and very scary, story.

While I don’t want to cause panic or fear monger, it appears that most investors are drastically underestimating the economic crisis we have on our hands. This is not going to be a few weeks of pain. This is likely to be months and months, if not a few years, of material slowdown in economic activity.”

My belief at the time was that we would see unemployment reach approximately 9% by the end of Q3, but we ended up in a much worse position than I could have imagined. There have been more than 56 million first time unemployment claims filed since the week of March 20th, which is approximately 1 in every 3 people in the US workforce. The continuing jobless claims currently sit at just over 15 million and the civilian unemployment rate is being reported at 10.2% for July 2020.

We all know that these official unemployment numbers can be wildly misleading — they don’t account for certain types of workers, they rely on self-reporting, etc — but they are the best data points we have to understand the general magnitude of the situation and any directional trends. In the last 5 months, more people lost their job than most investors had expected and it appears that there will be inflated unemployment levels for many years to come.

Why are the unemployment numbers going to be high?

The businesses that employ many of these people are getting decimated throughout this economic crisis. It doesn’t matter how big or small the business is. Governments forced people to shelter in place, which drastically slowed the velocity of money. They even mandated the shut down of many types of businesses, which only further accelerated the damage.

Take restaurants, one of the most heavily affected business sectors. A recent Yelp report from the end of June showed that “23,981 restaurants that are listed on their platform shut down completely at some point during the pandemic, and 53% of those have already decided to close their doors for good.” It also shows that approximately 41% of the businesses on Yelp that chose to close their doors at some point since March 1 have since decided to permanently shut down the business.

We won’t know the true damage on small businesses until the government releases a more complete data set later this year or in early 2021. With that said, my belief is that we are likely to see 20-25% of small businesses in the United States be shut down for good before this economic crisis is over. If that were to be the case, we could see 10% of all jobs in America destroyed (small businesses make up 50% of jobs in the US).

Big businesses aren’t doing much better. As you would expect, the damage is sector specific. Ride hailing companies like Lyft saw revenue decline more than 60% and airlines like Southwest experienced an 80%+ decline. This is in direct contrast to the big tech sector, where we saw revenue gains of 10% or more in year-over-year Q2 numbers in some cases.

The damage was not exclusive to the revenue, and subsequently the equity, of businesses though. McKinsey created an interesting report that highlights the probability of default among various industries:

The nuances of the damage are important, but the macro picture is quite clear — the public health crisis led to a government mandated shut down. That shut down created a scenario where tens of millions of Americans lost their jobs and millions of businesses lost majority of their revenue or were forced to shut down permanently.

Thankfully, the US government wasn’t completely asleep at the wheel. They recognized rather quickly that the economic damage would be severe and immediately reached into their tool box to implement the 2008 financial crisis playbook. This action saw two emergency interest rate cuts that got us to 0%, which was then followed by multiple monetary stimulus packages totaling approximately $3 trillion.

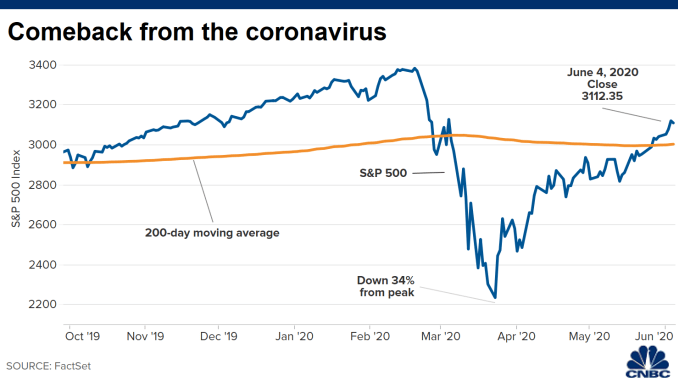

This whiplash from high-flying economic activity at the beginning of the year, to catastrophic damage within weeks, and then back again to an economy supported by the injection of trillions of dollars has led to complete chaos in markets. Early on during the initial liquidity crisis public equities saw an approximate 30% drop across the board. Gold was down almost 15%. Bitcoin went down 50% in a single day. It literally felt like there was no floor for any asset.

But once the stimulus started to hit the market, we about faced and went up even faster than we had fallen. Stocks are essentially flat to the beginning of the year. Gold is up almost 30%. Bitcoin is now up more than 60% year-to-date.

Every asset didn’t go down though as you would have expected. Let’s use real estate as an example. The median home price in the United States actually rose during the pandemic. This was mainly due to an incredibly advantageous rate environment enticing people to use the cheap capital to purchase a new home, while being combined with an overall shortage in US housing. It isn’t rocket science. Any time you have low, relatively-fixed supply intersecting with increasing demand, you are likely to get prices rising.

When you unpack this even more, most asset prices plunged before skyrocketing again. Real estate stayed strong throughout the crisis. And somehow we have entered into an even more dangerous credit cycle — landlords are seeing double-digit percentages of their tenants unable to pay rent, banks are feeling the pressure from landlords (both commercial and retail) that are suddenly with significantly less revenue, and credit card balance payments essentially became zombie land.

I share all of this to highlight one critical factor — the US government and Federal Reserve have done a fairly decent job at masking the economic damage that has occurred, but we are watching in real-time as the struggle between “whatever it takes” style Democrats negotiates with “we don’t have unlimited money” Republicans. They all agree that more monetary stimulus is needed if you want to mitigate the short term damage for American citizens and businesses. What they can’t agree on is how much money, and for what purposes, that monetary stimulus includes.

The Democrats are currently looking to spend approximately $3 trillion and the Republicans only want to spend $1 trillion. Frankly, using the word “spend” is comical but I will use it for ease of understanding today. This deadlock between two political parties has left Americans in the cross-hairs during an election year. The simple answer is that we are likely to see some compromise in the middle, but it may take much longer than any reasonable person would expect.

It is unclear how long the monetary stimulus can be used to artificially inflate the economy. The economic damage on the ground is worse than most anticipated and it is concerning that it is not improving in any dramatic way. This leaves us with a solid understanding of what has happened and where we are today. But where are we going?

Honestly, this is the scariest part to me. We seem to be heading toward a world where the leaders of our country become more emboldened to make decisions optimized for short-term gain, rather than long term sustainability. This is best illustrated in the recent talking points coming out of various Federal Reserve organizations. We have heard from multiple people that they believe we should set the inflation target higher than 2%, while also committing to no action to slow it down until the official numbers reach as high as 2.5%.

Another way of saying this is that the Federal Reserve is suggesting that we violate their own guidance in an effort to solve the problem this “one time.” We all know how this temporary measures in government go — they almost always become permanent. As I have discussed ad nauseam in these letters, a 2.5 - 4% official inflation number could lead to the lowest socioeconomic classes experiencing 10-20% inflation at the same time.

The pandemic has been incredibly painful for many people. Some have lost loved ones. Others have found themselves jobless. And many have been hurt financially. The idea that the Fed and their government counterparts are going to solve the problem is wishful thinking in my opinion. Not because they are incompetent, but rather they don’t have the tools to solve the problem for the average citizen. They can pull the large levers at a macro level, but those efforts tend to be quite ineffective in helping the little guy.

So what can you do moving forward?

First, this has been an incredible learning opportunity for many people. You must do the hard, disciplined things during the good times, so that you can drastically reduce the likelihood of economic ruin in bad times. Spend less than you make. Invest your capital intelligently. Let compound interest work for you. Hold assets that protect you against inflation. These timeless personal finance rules are as true today as they have ever been.

Second, you can prepare yourself for what is likely to transpire over the coming months and years. There have been trillions of dollars printed, with more probably on the way, so it is a common belief that inflation will naturally rise. As this happens, those caught holding cash will get their purchasing power destroyed, while those holding real assets will see their wealth artificially inflated. Building wealth is a game and that game has rules. You have to understand these rules in order to successfully play the game.

While I don’t give financial advice, my best way of guiding you on potential paths forward is to simply explain what I am doing. I have set aside a pre-determined amount of cash that provides me about 6 months of expenses. This gives me peace of mind that I won’t find myself completely screwed if every investment went to zero tomorrow. With the rest of my wealth, I have aggressively invested over the last few months in inflation-hedge assets. These include Bitcoin and real estate. The only public stock I hold is GBTC, which is in my retirement account. Other than that, I have a long-time horizon and have worked to position myself to benefit, rather than suffer, from the inflation that I believe we are about to experience.

Lastly, the coming months and years will most likely require incredible patience. Once you have done the work to understand the structural changes that are occurring, you can position yourself to capitalize. But once you are in position, it becomes a waiting game. It will be important for people to remain calm. Don’t overreact to short term price movements. Hell, don’t even look at the day-to-day news. Generational wealth isn’t built overnight. It is actually built historically by making directional bets and then doing nothing for very long periods of time.

You don’t have to be a genius to get wealthy during times of economic crisis. You have to be diligent in doing your work. Be courageous and convicted in how you position yourself. And disciplined and humble enough to patiently wait for markets to play out. This is all incredibly easy to talk about and just as difficult to execute.

Best of luck to each of you. Hope you’re staying safe. Continue to be kind to each other. You never know what your neighbor is going through. We will always be stronger when we collaborate, learn together, and seek cohesiveness rather than divisiveness.

Talk to you tomorrow.

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

SPONSOR: History has taught us over and over again that those who diversify into alternatives like art outperform those who don't. No one has proven this more than investors like Leon Black (22% of his net worth in art) and David Geffen (20%) who have, quite literally, made billions from art. There is one major problem for the rest of us though—the kind of paintings that can score big-time returns require big-time capital. Masterworks allows anyone to add stability to their portfolio at a cost anyone can afford. Don't wait, Pomp subscribers can skip the 15,000 waitlist today.*

THE RUNDOWN:

Chia Network Raises $5M to Rival New Crop of DeFi-Friendly Base Layers: Chia Network, led by BitTorrent creator Bram Cohen with the aim of creating a programmable money platform, just raised another $5 million in an equity round led by Slow Ventures. Despite the resurgence of token sales this summer, Cohen said the plan since 2018 has been to go the IPO route and rely on venture capital until the token launch. Read more.

Grayscale Tells SEC Its Bitcoin Trust Rose $1.6B Over Six Months: The total value of Grayscale’s flagship Bitcoin Trust increased over $1.6 billion in the first six months of 2020. The New York-based crypto investment firm said the dollar value of total assets in GBTC went from $1.87 billion at the end of 2019 to $3.5 billion by the end of Q2 2020 – an increase of 90%. Read more.

UK Crashes Into Deepest Recession of Any Major Economy: UK economic output shrank by 20.4% in the second quarter of 2020, the worst quarterly slump on record, pushing the country into the deepest recession of any major global economy. This crash in GDP in the April-June period, compared with the first quarter, is the worst since quarterly records began in 1955. Industries most exposed to government lockdown measures to contain the coronavirus pandemic — services, production and construction — saw record drops. Read more.

Lyft May Suspend Service in California: Lyft may suspend services in California if the state does not overturn a recent ruling requiring it to classify its drivers as full-time employees, Lyft co-founder and President John Zimmer said on the company’s second-quarter earnings call. Read more.

Sheryl Sandberg: Facebook Will Work With Whoever Wins the Election to Address Big Tech Concerns: Facebook COO Sheryl Sandberg on Wednesday said the social media company needs to work with whoever wins the 2020 U.S. election to address their concerns about Big Tech. “We know that there’s real concern about the size and the power of the American tech companies, both here in our country and around the world,” said Sandberg, speaking at the CNBC Small Business Playbook virtual summit. “It’s our job to work with anyone who’s in office, whether they’re in the Senate or anywhere around the world, to address those concerns.” Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Bill Barhydt is the founder of Abra, a simple to use cryptocurrency investment platform. After working for the CIA, NASA, and Goldman Sachs, Bill decided to join Netscape working on telecom and Internet banking deals, mostly in Europe. After the AOL acquisition of Netscape, Bill founded WebSentric. The technology for WebSentric exists today in SAP's online portal service.

In this conversation, Bill and I discuss:

Macroeconomics

The Federal Reserve

Monetary policy

Bitcoin as a reserve asset in corporate treasuries

Decentralization

A number of new products and features that Abra has launched recently

I really enjoyed this conversation with Bill. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

We have started a new show exclusive to YouTube called Lunch Money. The goal is to cover current events in business, finance, and technology from the perspective of the every day citizen, rather than the talking heads on television. It is just as funny and entertaining as it is educational. Hope you enjoy it and make sure you go subscribe to the YouTube channel!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Helium Hotspots allow you to earn cryptocurrency by building a new wireless network for the Internet of Things and creating a more connected future in your city. Get $50 off your Helium Hotspot by going to helium.com and using my special code POMP at checkout.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

WSOT is the biggest trading competition in the crypto space, with a massive 200 BTC prize pool and bonuses of 9,400 USDT up for grabs!

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

*See important disclaimer

Share this post