This installment of Off The Chain is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 40,000 other investors today.

To investors,

I interviewed Raoul Pal, the CEO of Real Vision Group and macro trader, about two weeks ago. He predicted that the COVID-19 issue would become the greatest financial event of our lifetime. At the time of the interview, many people were questioning the salacious nature of Raoul’s statement. That is no longer the case though. Many people are now worried that he may actually be correct.

The country is grinding to a halt. Every day brings new challenges for small businesses and individuals. We are seeing some cities and states ordering bars and restaurants to close, while other cities are asking people to “shelter in place” and not leave their homes for any non-essential activity. It is not possible to have material economic activity or growth when everyone is sitting in their homes for weeks at a time.

These letters have been focused on the macroeconomy and the Fed’s actions the last few days, but I want to take time today to talk about what is on the horizon — the unemployment numbers in the United States have the potential to quickly match the numbers from the Great Depression.

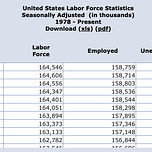

I understand that the statement may seem ridiculous at first glance, but let me walk you through some math. The United States currently has about 164.5 million people in the work force and the unemployment rate is hovering around 3.5% (5.8M Americans).

Here are the statistics on the Great Depression:

Timeline: August 1929 - March 1933

Duration: 43 months

Size of total labor force: 49 - 51 million people

Peak global unemployment: 24.9%

Low of US unemployment: 3.1% in 1929 (1.5M Americans)

High of US unemployment: 24.7% in 1933 (12.8M Americans)

Real GDP decrease during depression: 25%

It goes without saying that the Great Depression was incredibly bad. At the peak, 1 in 4 Americans were unemployed. But the Depression started off in 1929 with a relatively low unemployment rate (3.1%), which is actually 40 basis points lower than where the United States was in February 2020.

There was a relatively slow ramp up in unemployment in the beginning of the Depression. Here are the year by year unemployment statistics in the US:

1929 — 3.1%

1930 — 8.7%

1931 — 15.9%

1932 — 23.6%

1933 — 24.9%

1934 — 21.7%

1935 — 20.1%

So as you can see from the data, it took until the third year of the Depression before we hit double-digit unemployment numbers. People always focus on the peak number of 24.9%, but they forget that 3 of the 5 years of the Depression (1929-1933) had unemployment levels under 20%. This doesn’t mean that 8 - 20% unemployment levels are good. It just means that the peak number isn’t a great representation of the entire period.

Today the United States is sitting at 3.5% unemployment as of the end of February 2020. This means that 5.8M Americans are without a job but still counted in the workforce. In order to reach the various annual unemployment levels of the Great Depression, here are the number of Americans that would be without a job:

9% unemployment = approximately 14.8M Americans without a job

15% unemployment = approximately 24.7M Americans without a job

25% unemployment = approximately 41.1M Americans without a job

Given that we only have 5.8M people unemployed today, these numbers feel astronomical and frankly, unattainable. That may not actually be the case though. Most people don’t realize that we are facing one of the greatest immediate drops in unemployment in American history. There has been a near complete shutdown of the hospitality industry and a significant blow dealt to the travel industry. Plenty of other businesses are being crushed as well.

According to the US Bureau of Labor Statistics, there are approximately 16.8M people employed in the hospitality industry, including 14.3M in the Accommodations & Food Services Sector and 2.5M in the Arts, Entertainment, and Recreation Sector. The hospitality industry is obviously getting hit incredibly hard as multiple cities and states are ordering the closure of restaurants, bars, theaters, and other related venues. In many cases, these businesses are run on super thin margins, so the owners of the business are forced with the decision to immediately fire majority, if not all, of the staff or run at deep losses due to a lack of material revenue.

Here are the various levels of national unemployment we would have according to specific percentages of the Accommodations and Food Services (AFS) Sector being laid off:

10% AFS layoff = 1.68M people = 4.5% US unemployment (current + 10% AFS)

25% AFS layoff = 4.2M people = 6.1% US unemployment (current + 25% AFS)

50% AFS layoff = 8.4M people = 8.6% US unemployment (current + 50% AFS)

75% AFS layoff = 12.6M people = 11.2% US unemployment (current + 75% AFS)

I highly doubt that we are going to see more than 50% of the Accommodations and Food Services Sector laid off, but there is a good chance that we could see at least 25%. Again, that will seem ridiculous right now, but there are a few important early data points to keep in mind.

First, the LA Times published an article recently that stated 18% of respondents to a survey said that they have already lost their job or had their hours cut at work. The article goes on to state:

“The proportion affected grew for lower-income households, with 25% of those making less than $50,000 a year reporting that they had been let go or had their hours reduced, according to a survey released Tuesday by NPR, PBS NewsHour and Marist of 835 working adults in the contiguous United States.”

So we are only 2-3 weeks into the COVID-19 slowdown and we are already seeing double-digit numbers of unemployment or earning losses being reported. There are plenty of people who will brush these numbers aside because it is a poll of less than 900 people though. Lets keep digging deeper.

There are other data points surfacing that suggest the jump in unemployment is going to be multiples from where they are today. Take this tweet about unemployment claims jumping almost 7x in the state of Ohio from one week to the next.

But some readers will brush this data off as an anomaly. They may even claim this is directly attributable to the fact that Ohio has been aggressive in closing restaurants, bars, and other service-oriented places of employment. But unfortunately, this doesn’t appear to be “an Ohio thing,” but rather it is happening all over the country.

This explosion in Google searches for “unemployment benefits” would suggest that people are seeking relief after finding themselves without a job. Again, many readers will claim that Google search trends aren’t a great proxy for actual impact on unemployment. Lets dig a little further.

This tweet shows that the state of Minnesota had 31,000 people apply for unemployment insurance in just the last two days.

If the extrapolation to the national numbers is correct, that would mean 1.8M people across the country have applied for unemployment insurance in THE LAST TWO DAYS. That is fucking wild. Why? Because that would be equivalent to more than 10% of the Accommodation and Food Services Sector (remember that would put us at 4.5% unemployment nationally).

This isn’t an Ohio, Minnesota, or Google search thing though. This is happening all over the country. In a recent Politico article, they stated:

“In New Jersey, 15,000 people applied for unemployment benefits on Monday, a twelvefold increase over normal levels. In Connecticut, nearly 8,000 applications arrived over the weekend, an eightfold increase over the norm. Rhode Island officials reported Tuesday a five-day rise in claims due to the coronavirus from 10 on March 11 to 6,282 on March 16.”

This isn’t about a small increase in unemployment claims, but rather multiples from the levels that we have seen over the last few months. The second year of the Great Depression saw 8.7% unemployment, which would 2.4x increase from our February unemployment numbers. It makes me incredibly sad to say this, but I think we could see those types of numbers by the end of Q3 2020.

Year 3 of the Great Depression saw 15.9% unemployment, which would be 4.5x from our February numbers. Again, this type of increase over a long period of time would be crazy, but the early data we are seeing would suggest that many states have seen larger increases on a percentage basis just in the last few days.

The government isn’t asleep at the wheel on this either. It was reported that Treasury Secretary Steven Mnuchin told politicians yesterday that if the US doesn’t act now, we could see 20% unemployment numbers rather quickly. Why? Because everyone is being forced to stay in their homes due to COVID-19 and many businesses are being asked or forced to shut down operations also.

As I have talked to people about this issues over the last 24 hours, most are relatively calm about it because the general belief is that it would take quite awhile for high levels of unemployment to take hold. The data says otherwise though. These large increases in unemployment filings tells a much different, and very scary, story.

While I don’t want to cause panic or fear monger, it appears that most investors are drastically underestimating the economic crisis we have on our hands. This is not going to be a few weeks of pain. This is likely to be months and months, if not a few years, of material slowdown in economic activity. Here are a few people who are waking up to the realities on the ground:

Again, I really hope that I am wrong here. I just don’t think that the data would support any other conclusion. The COVID-19 virus has literally stopped the world in its tracks. It has forced people to retreat to their homes and economic activity to fall off a cliff. The healthcare and science community is hoping that a vaccine or cure can be found quickly, but this thread tells us that we may be more than a year away from that occurring (highly recommend reading the Imperial paper that is linked here).

This entire data exercise has been incredibly demoralizing. The world feels like it is collapsing in some weird way. I have to continue to remind myself that we have experienced worst things and we will get through this, just like we overcame previous obstacles. There will be people in your life, whether family, close friends, or mere strangers, that are going to go through tough times in the near future. Please be kind to everyone. You never know what others are going through. Together, we are always stronger 🙏🏽

-Pomp

This installment of Off The Chain is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 40,000 other investors today.

THE RUNDOWN:

BitGo Allows Customers to Extend Crypto Insurance Cover Over $100M: Customers of digital asset security specialist BitGo can now boost their insurance limit beyond $100 million to cover the loss or destruction of crypto stored in special vaults. BitGo came out with a Lloyd’s-backed cold storage insurance product in February 2019 and is now allowing customers to extend the $100 million worth of cover to suit their needs. It’s a sign of the continued maturation of the crypto insurance sector. Read more.

Tezos Co-Founder Turns to Gaming With ‘Hearthstone’ Competitor: Digital card games like Hearthstone are fun, but getting the cards needed to play is not. That's a problem that Coase – a company launched by Tezos co-founder Kathleen Breitman – aims to solve with its new game, Emergents. The new title, whose alpha version opens up to a select few in early April, comes as the market for online card games nears $2 billion in size and coronavirus-related shutdowns drive gamers indoors. Read more.

Regulated Exchange Launches in US With Crypto-Backed Visa Card Offering: A FinCEN-registered crypto exchange has launched with its own debit card that allows holders to pay for goods and services with digital assets. Utah-based CoinZoom announced Wednesday it would begin onboarding new institutional and retail clients, and will offer a Visa payment card that instantly converts cryptocurrencies into U.S. dollars. Read more.

Coinbase Card Users Can Now Make Crypto-Backed Payments With Google Pay: Google Pay users can now make payments with cryptocurrencies, thanks to a tie-up with Coinbase's debit card offering. The cryptocurrency exchange announced Tuesday that Coinbase Cards can now be added to users' Google Pay wallets, enabling crypto-backed payments from Google Pay-enabled devices, such as phones or smartwatches, apparently for the first time. Read more.

Toyota Reveals Blockchain Lab Exploring Auto-Industry Applications: Toyota has said declared its deeper aspirations for blockchain technology within the automotive industry, recently announcing that it would be exploring opportunities from research it began in early 2019. Toyota Motor Corporation and Toyota Financial Services Corporation revealed a previously launched "cross-group virtual organization" known as Toyota Blockchain Lab on March 16, announcing the group had been operational since April 2019 alongside four other Toyota group subsidiaries. The group is hoping to better understand the applications of blockchain within the auto industry. Read more.

LISTEN TO THIS EPISODE OF THE OFF THE CHAIN PODCAST HERE

Scott Adams is the creator of the Dilbert comic strip, and the author of several nonfiction works of satire, commentary, and business. His recent books include Loserthink: How Untrained Brains Are Ruining America (2019) and Win Bigly (2017). Scott has spent decades perfecting a view of the world that is not only impressive, but also incredibly refreshing. I really enjoyed talking to such a clear-headed thinker who can articulate ideas in an easily digestible way. This episode is a highly recommend from me!

In this conversation, Scott and I discuss:

The coronavirus

The impact on the healthcare system and the economy

How he evaluates President Trump's response

What his current thoughts on the November election are

Why he recently sold Bitcoin

What his best advice to business leaders is during the current environment of uncertainty

I really enjoyed this conversation with Scott. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE OFF THE CHAIN PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

TaxBit automates your cryptocurrency taxes, enabling you to effortlessly track, calculate, and report your transactions. Get 10% off your tax plan today with a free trial by going to www.taxbit.com/invite/Pomp

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

If you enjoy reading “Off The Chain,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post