To investors,

Investing is a game of demographics. You want to select markets that are ascending, not descending. Data points like population growth, percent of young people, and life expectancy are key indicators of where the world is going. Pick the right market and you can make the trend your friend. Pick the wrong market and you’ll have a strong headwind.

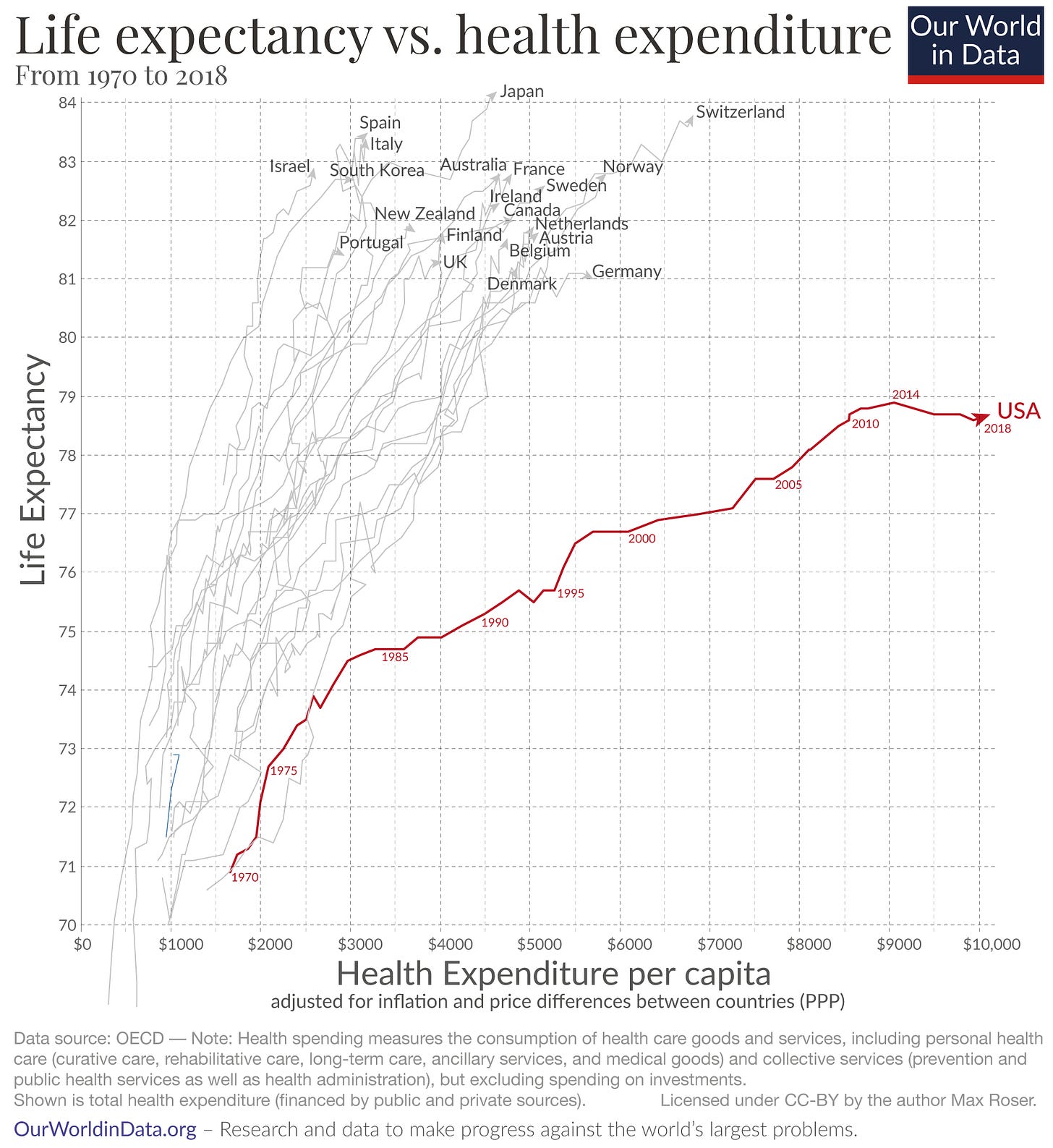

I want to spend our time today focused on life expectancy, which is simply “the average period that a person may expect to live.” You would anticipate that the most developed nations have the highest life expectancy, but that is not necessarily the case. We’ll use the United States as an example.

Max Roser and the team at Our World In Data point out that the United States has a lower life expectancy than other rich countries. Why is this? Roser explains:

“Americans suffer higher death rates from smoking, obesity, homicides, opioid overdoses, suicides, road accidents, and infant deaths. In addition to this, deeper poverty and less access to healthcare mean Americans at lower incomes die at a younger age than poor people in other rich countries.”

This is kind of crazy to think about. America, likely the most developed nation in the world, is worse off than other developed nations. But it gets even wilder when you add in how much Americans spend on healthcare in comparison to these other countries.

The United States is in a league of its own. There is no other wealthy country in the world that has a life expectancy below 80 years old, nor is there another wealthy country that has a health expenditure per capita above $7,000. The US checks both boxes.

These statistics alone would be concerning, but unfortunately there is another story that is capturing the attention of people who pay attention to national demographics.

Wait, what is going on here? According to Mary Hui from Quartz:

“The US’s life expectancy continued its decline from 2020 to 2021, dropping sharply to 76.1 years.

With the latest decline, US life expectancy is now at its lowest since 1996, according to new data from the Centers for Disease Control and Prevention’s (CDC’s) National Center for Health Statistics. It also means that the gap in longevity at birth between people in the US and China has now widened to a full year.”

This is not exactly shocking when you understand the reasoning. Hui writes:

“The biggest driver in the drop in US life expectancy is covid, accounting for 50% of the decline, according to the CDC. Government figures show that as of Aug. 31, over 1.04 million deaths in the US have been attributed to covid.

“Unintentional injuries”—which include opioid overdoses and motor vehicle crashes—were the second-largest contributor to the drop in life expectancy, making up 15.9% of the decline.”

This begs the question — will the US life expectancy recover or will the US buck the trend of wealthy nations as it sees a further decline in future years?

No one knows the answer. But we better hope that a quick reversal occurs, because other demographic data points like fertility rate aren’t going to make up for the loss. Data from Census.gov states:

“Fertility rates in the United States gradually declined from 1990 to 2019. In 1990, there were about 70.77 births each year for every 1,000 women ages 15-44. By 2019, there were about 58.21 births per 1,000 women in that age group. While broadly stable, annual births in the United States declined from about 4.1 million to 3.7 million from 1990 to 2019.”

So we are seeing US life expectancy recently drop for the first time in decades, and the fertility rate is on a three decade decline, so the demographics in the United States are not looking too hot right now. This doesn’t guarantee the leading democracy while fail, nor does it mean that investors should pull all of their capital out of US markets.

It simply highlights that the future may not look like the past. Investing is all about demographics and there is a strong, data-driven argument to highlight the US could have some of its most compelling trends left in the past. There are few countries that have been able to thrive for decades in the face of deteriorating demographics, so this is worth continuing to watch in the coming years.

Demographics are complex. There is plenty of debate and controversy around data collection, measurement methodologies, and what is actually important. Let this letter serve as inspiration for you to dig further and start doing your homework. Your future portfolio will probably thank you.

Hope everyone has a great start to the week. I’ll talk to each of you tomorrow.

-Pomp

If you are not a subscriber of The Pomp Letter, join 225,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

THE RUNDOWN:

MicroStrategy Files to Sell Up to $500M of Stock to Fund Bitcoin Purchases: MicroStrategy, a software developer that has become a corporate bitcoin vault, plans to sell up to $500 million of stock to fund more purchases of the cryptocurrency. A Friday filing with the U.S. Securities and Exchange Commission revealed the stock offering, which will be for “general corporate purposes, including the acquisition of bitcoin.” Read more.

Blockchain.com to Open Dubai Office After Securing Preliminary Regulatory Approval: Blockchain.com has won provisional regulatory approval to operate in Dubai, according to a Reuters report. The London-based exchange has signed a contract with Dubai’s Virtual Assets Regulatory Authority – the city’s new digital assets regulations agency – to open up an office in the emirate, the story said, though it remains unclear when hiring for the office will begin. Read more.

US Senators Press Meta Platforms CEO Mark Zuckerberg to Combat Crypto Scams: Six Democratic members of the Senate Banking Committee have sent a letter to Meta Platforms CEO Mark Zuckerberg asking what the company is doing to fight cryptocurrency scams on its Facebook, Instagram and WhatsApp platforms. The group of senators is led by Bob Menendez of New Jersey and includes Sherrod Brown of Ohio, chairman of the Banking Committee, and Elizabeth Warren of Massachusetts. Read more.

JPMorgan Hires Former Microsoft Executive to Its Digital Assets-Related Payments Group: JPMorgan has hired former Microsoft executive Tahreem Kampton as a senior payments executive within the bank’s payments group. His focus will be on the future of payments, including blockchain technology and the digital ecosystem, according to a statement sent to CoinDesk. “Tahreem Kampton has joined J.P. Morgan Payments as a senior payments executive with a focus on driving thought leadership to help the payments industry and therefore clients, to evolve, thrive and grow,” said JPMorgan. “Specifically, he will lead co-innovation with key partners in payments, blockchain and the digital ecosystem where JPMorgan has already built a strong foundation.” Read more.

Andrii Baryshpolets is a Chess Grandmaster and has a PHD in Economics.

In this conversation, we discuss the path to becoming a grandmaster, machine learning, cheating, Bitcoin & Crypto, and books and resources to become better at chess. Andrii also gives us insight into the Russia / Ukraine war as a Ukrainian and shares his thoughts on the macro economic environment.

Listen on iTunes: Click here

Listen on Spotify: Click here

Weekly Update on Bitcoin

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Alto IRA can help you invest in crypto in tax-advantaged ways to help preserve your hard earned money. There are no setup or account fees, and it’s all you need to do to invest in crypto tax free. Open an Alto CryptoIRA to invest in crypto tax-free by clicking here.

Eight Sleep is the most advanced solution on the market for thermoregulation by pairing dynamic cooling and heating with biometric tracking. Click here to check out the Pod Pro Cover and save $150 at checkout.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Amberdata provides the critical data infrastructure enabling financial institutions to participate in the digital asset class. We deliver comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. Download our Digital Asset Data Guide here today.

SiGMA is the bridge between iGaming, online sports betting, and emerging technology, such as Blockchain, NFTs, fintech, GameFi, metaverse, and AI, is loud and clear. The largest global summit of this kind is heading to Malta from November 15 to 17. Log on to AIBC.WORLD or SiGMA.WORLD to see all our upcoming global summits!

Bullish is a powerful exchange for digital assets that offers deep liquidity, automated market making, and industry-leading security. Click here to learn more.

Valour represents what’s next in the digital economy -- providing simplified, trusted access to crypto, decentralized finance and Web 3.0 investment opportunities. For more information visit valour.com

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain here today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visithttp://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.