To investors,

The phrase “Web3” has taken the technology world by storm. It is used to describe the next iteration of the internet, which includes the belief of Web3 proponents that decentralized protocols and tokens will be core features of a new system. There are thousands of entrepreneurs and investors betting their time, money and energy that this new iteration will be the future of technology. There are thousands more who believe that the entire Web3 system is unsustainable and simply a way to enrich the proponents.

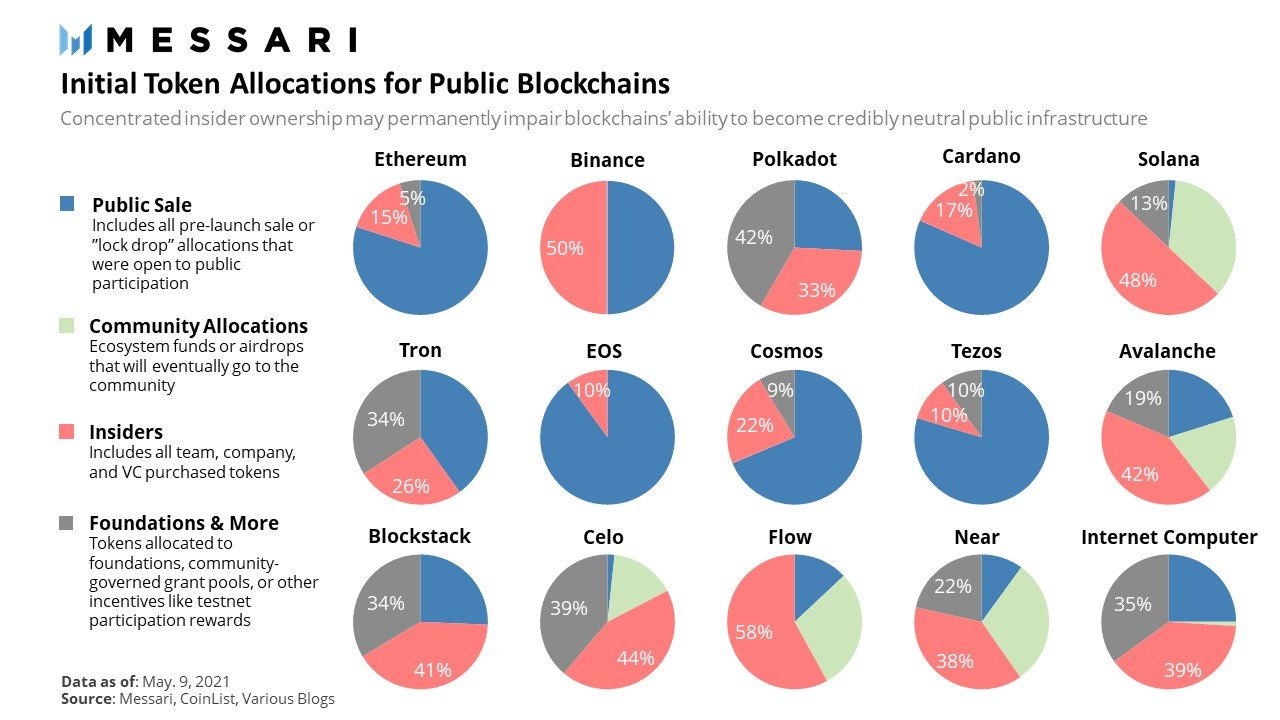

Regardless of where you fall on the debate, I thought it would be interesting to investigate the question “who owns Web3?” In order to do this, we can look at the token supply breakdown of various projects. First, here is Solana’s initial token distribution (source: Messari):

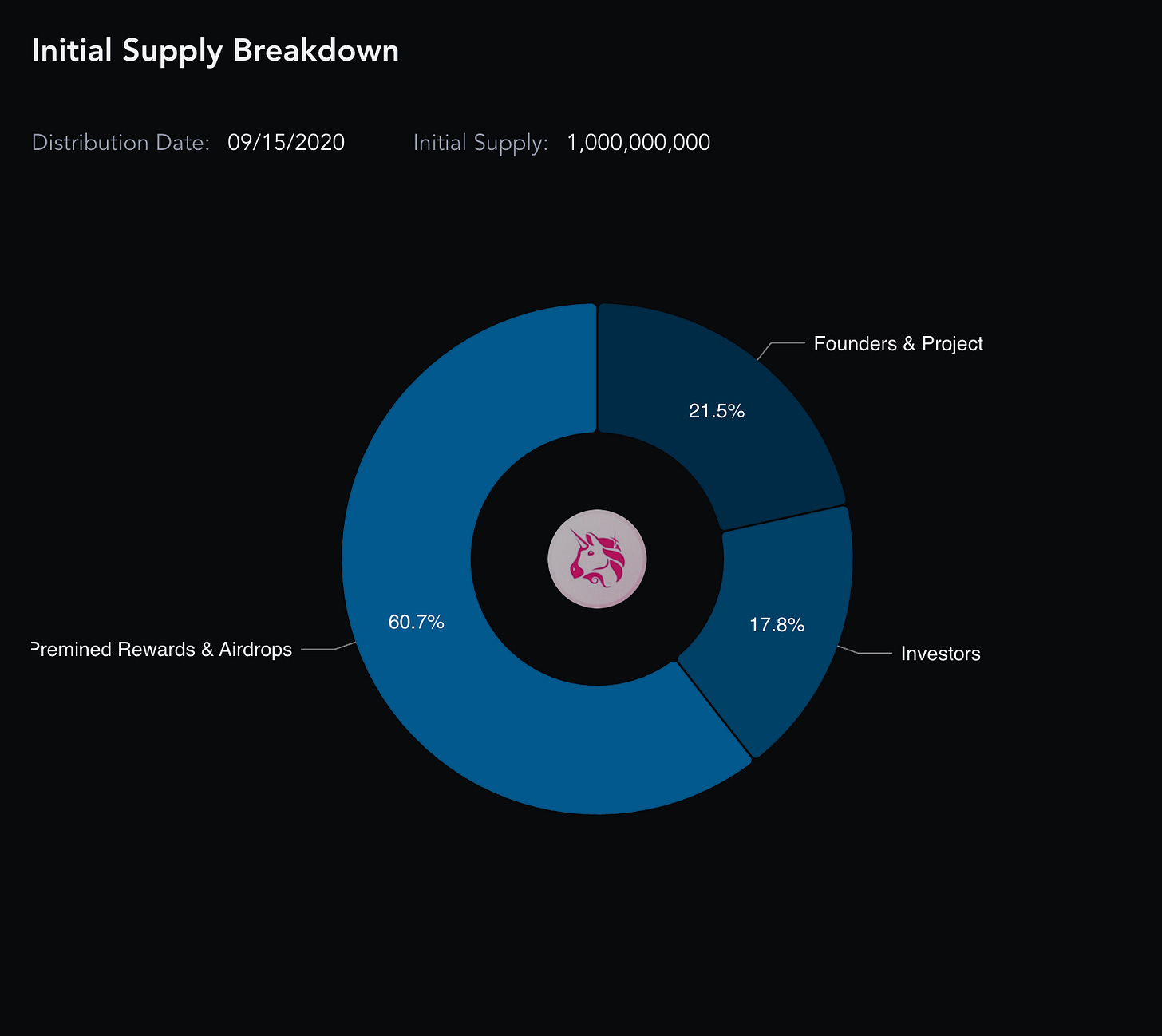

The second example we will use is Uniswap’s initial token distribution:

These two examples highlight a few takeaways. The team’s normally hold between 20-30% of the token supply, private investors are somewhere between 15-50%, which depends on how much of the token was sold before launch. And the remainder of the token supply is used for various activities, including premined rewards, airdrops, yield farming, ecosystem funds, and many others.

Here is another visualization of various projects:

This is interesting because in a recent study it was concluded that founders in “Web2” companies held approximately 15% of their company’s equity at the time of the IPO. The comparison isn’t perfect (not all of the founder/project token allocation goes to the founders specifically), but it appears that Web3 founders are able to hold on to more of the economic value for what they create compared to Web2 founders.

But this still doesn’t answer the question of “who owns Web3?”

There are three specific groups of people who own tokens in these ecosystems. They are the team, private investors, and the community. In the legacy Web2 world, only the team and private investors end up owning equity in a company, so the Web3 world has a structural advantage in their ability and desire to get economic incentives in the hands of their community. Web2 companies have tried this before, but were largely unsuccessful. Airbnb tried to give equity to the hosts on their platform and Uber tried to give equity to their drivers. The explicit acknowledgement of the asset being equity meant that regulations prevented these companies from doing it.

Ok, back to the owners of Web3. The team is fairly straightforward. If you are the founder, early employee, or a contributor to the project, you are compensated for your efforts in a way that is determined by the team. This is no different than a traditional equity.

The big debate in the Web3 world is about investors. Obviously, the more that a project claims that they are decentralized, the more critics will complain that any ownership by large investors (venture capitalists and private equity) is antithetical to that mission. Maybe this is true or maybe not, but it is important to remember that the actual investors are not the VC firms themselves.

For example, if Sequoia Capital invests in a company or project, then the ownership mostly lies with nonprofits and schools. Here is an excerpt from the Sequoia website:

“Sequoia invests primarily on behalf of nonprofits and schools, with organizations such as the Ford Foundation and Boston Children’s Hospital forming most of our limited partner base. Working for them gives us a greater sense of responsibility and purpose.”

The average VC firm takes 20% carried interest on their investments, so if a firm owned 30% of a project’s tokens, the non-profit LPs would have 24% of the tokens and the venture capitalists would have approximately 6%. This doesn’t mean that venture investors owning large stakes of tokens is right or wrong, but it is important to understand the economics of who actually owns these tokens, rather than who purchased them.

The next point is that Web2 companies are all owned by large venture capital and Wall Street firms. Chris Dixon of A16Z made this point last night when he tweeted the top 10 holders of various public company stock:

As you can see in these breakdowns, most of the largest holders are passive investing vehicles from Vanguard and their peers. These passive vehicles are usually owned by retail investors and/or pension funds, etc. So in a crazy way, the VC fund LPs are nonprofits, foundations, pension funds, etc. These same investors are the owners of the Web2 companies through these passive investing vehicles as well. The more things change, the more they stay the same. The difference is whether Wall Street or Silicon Valley are getting to charge fees for the privilege of allocating the money.

Lastly, the bitcoin community hangs their hat on no venture capitalist investment needed to launch the network. This is one of the strongest arguments that is put forward by the community. But the start of the network does not necessarily reflect the current state of the network. What do I mean? There is billions of dollars now in the hands of Wall Street and Silicon Valley.

Take the Grayscale Bitcoin Trust as the first example. They currently hold more than 3.4% of the outstanding bitcoin supply. Just one investment product, which is also the world’s largest bitcoin investment product, holds a material percentage of all bitcoin in circulation. We also must mention that Satoshi Nakamoto is believed to hold approximately 1 million bitcoin, which would make him the largest holder of bitcoin in the world.

Next let’s take a look at the public companies that hold bitcoin. MicroStrategy holds over 124,000 bitcoin on their balance sheet, Tesla holds more than 43,000 bitcoin, Square owns 8,000 bitcoin, and the various bitcoin mining companies own a few thousand more bitcoin combined. This means that publicly traded companies around the world hold approximately 1% of all bitcoin that will ever be in circulation.

This analysis also doesn’t take into account that a large portion of cryptoassets are actually held as IOUs in centralized custody or exchanges. For example, Coinbase is reported to have more than $90 billion of assets under custody and at one point held 11% of all cryptoassets in the market. Mindblowing numbers.

So what is my conclusion on who owns Web3?

Simply, the same people who own Web2 companies and the same people who own bitcoin. Out of the three of these types of assets, bitcoin appears to have the most decentralized ownership, but Web2 and Web3 aren’t as far behind as the public narrative would tell you. Ultimately, ownership of an asset is predicated on the ability to convert other assets, whether they are fiat currencies or not, into the desired asset. Essentially, wealthy people and organizations have the financial resources to acquire significant chunks of an asset.

We shouldn’t compare the asset ownership percentages today as a snapshot in time. We should instead look at how the trend is evolving. The legacy Web2 companies are becoming more and more concentrated in ownership. Bitcoin has shown to become more decentralized in ownership over time. Web3 tokens are still up in the air. Will they become more centralized or more decentralized over time? No one knows yet, but that is going to be the most important question when it comes to answering “who owns Web3?”

Hope each of you has a great start to your week. I’ll talk to everyone tomorrow.

-Pomp

SPONSORED: Bitcoin 2022 is the LARGEST Bitcoin event in the world that takes place April 6th - 9th in Miami Beach, Florida.

All four days will be jammed-packed with exclusive content, exciting announcements and an incredible lineup of bitcoin speakers, artists and leaders. Day 1 is INDUSTRY DAY for enterprising bitcoiners who are looking to build a business or career within the ecosystem.

Days 2 and 3 are general conference days featuring 300+ speakers. The conference caps off on the fourth day with the world's first and largest Bitcoin Music Festival - Sound Money Fest. Last year’s conference SOLD OUT and this year’s is on pace to be 3x larger so make sure you grab your tickets before it's too late.

Click HERE to learn more. Ticket prices increase on JAN 14th, use promo code POMP for 10% off and I will see you in Miami!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Bitcoin 2022 is the largest Bitcoin event in the world that takes place 4/6 - 4/9 in Miami Beach. Click HERE to learn more and use promo code POMP for 10% off.

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Mode allows you to buy, earn and grow Bitcoin, all in one app. Download Mode on the App Store and Google Play. Only available in the UK.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain here today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

Abra is an all-in-one secure app that allows you to trade over 110 cryptocurrencies. Download Abra today and get $15 in free crypto once you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

MyBookie allows you to bet and withdraw with Crypto. Use promo code ‘POMP’ to double your first crypto deposit at MyBookie.

Coin Cloud is the world's leading digital currency machine operator. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. To start earning today visit: http://www.blockfi.com/Pomp

Circle Yield offers qualified businesses superior returns on USDC holdings for terms of up to 12 months. Visit circle.com/pomp today; terms apply.

BTCS was the first US-public company to secure today’s top layer one protocols. Test out the BTCS Data Analytics Dashboard today at BTCS.com

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go tookcoin.com/pomp

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.