Today’s Episode is brought to you by Figure!

Figure’s building the future of capital markets through blockchain with $20B unlocked in equity.

Use Democratized Prime for your chance to win big with $25k USDC and Earn ~9% APY. The more you participate, the better your odds!

Figure is the only account you need in the DeFi ecosystem. For every dollar you commit, you get another chance to win $25K USDC.

Start now and enter to win while earning money on your crypto with Democratized Prime1.

To investors,

If you listened to the Fed for the last few decades, you made a lot of money. When the Fed was easing, you could have just plowed your money into the market. When the Fed started tightening, all you had to do was sell everything and hide in cash for a few years.

Investors have been yelling “don’t fight the Fed” for a long time.

But I don’t think that old adage applies the same way anymore. At least it doesn’t apply right now. Let me explain…

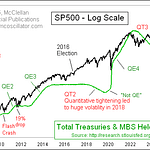

The US economy, and corresponding financial markets, have been hyper sensitive to the Fed’s monetary policy decisions for the last ~ 30 years. The central bank was cutting rates in the mid-to-late 1990s, which helped propel the internet boom higher. Finally, when the Fed started to raise rates in the second half of 1999, the tech bubble popped shortly afterwards and everything came back down to reality.

During the Global Financial Crisis, the Fed invented the insane Quantitative Easing policy that led to a prolonged period of 0% interest rates and hundreds of billions of dollars bring printed. This QE playbook kicked off a decade-long bull market that made every stock market bear look like a fool.

Finally, during the 2020 pandemic, the Federal Reserve pulled out the old QE playbook again. Interest rates went to 0% via two emergency cuts and the government decided to print trillions of dollars, which created more than 9% inflation within a 24-month period.

The main thing that stopped the 2021 party was the Fed’s decision to reverse course and start hiking interest rates at the fastest pace in history. We went from 0% to over 5% rates in a very short period of time. The regime shift was so abrupt that multiple banks failed because of their inability to navigate the volatility.

This brings us back to the “don’t fight the Fed” adage. It made sense because the Federal Reserve would set policy and the world would react to those decisions. Quite literally, the Fed was in control.

That doesn’t seem to be the case right now though.

The current President and his administration have effectively taken control of the US economy and financial markets. They have implemented a set of policies to reimagine the country, including deregulation, tax cuts, smaller government, and re-shoring of American jobs and manufacturing.

In taking this approach, the government is rapidly changing the economic conditions of the market and it is putting the Fed on their back foot. The central bankers already had a hard enough time trying to make monetary policy decisions based on faulty data from the Bureau of Labor Statistics. Now these folks are being asked to understand substantial changes across the economy, including policy differences and advancements in cutting-edge technology like artificial intelligence.

This is why I don’t believe the Fed is in control anymore. In fact, I think the exact opposite is true. The market is forcing the hand of the Fed. America’s central bank begrudgingly cut interest rates at the end of 2025 because the labor market was softening at a much faster pace than forecasted. The softness in the labor market was not due to normal business cycle developments, but rather a combination of policy decisions and technology innovation.

Jerome Powell essentially said he and his colleagues were more worried about the labor market than about inflation coming back. But the Fed’s fight against the market is not over yet. My base case is that inflation is going to continue falling in the coming months.

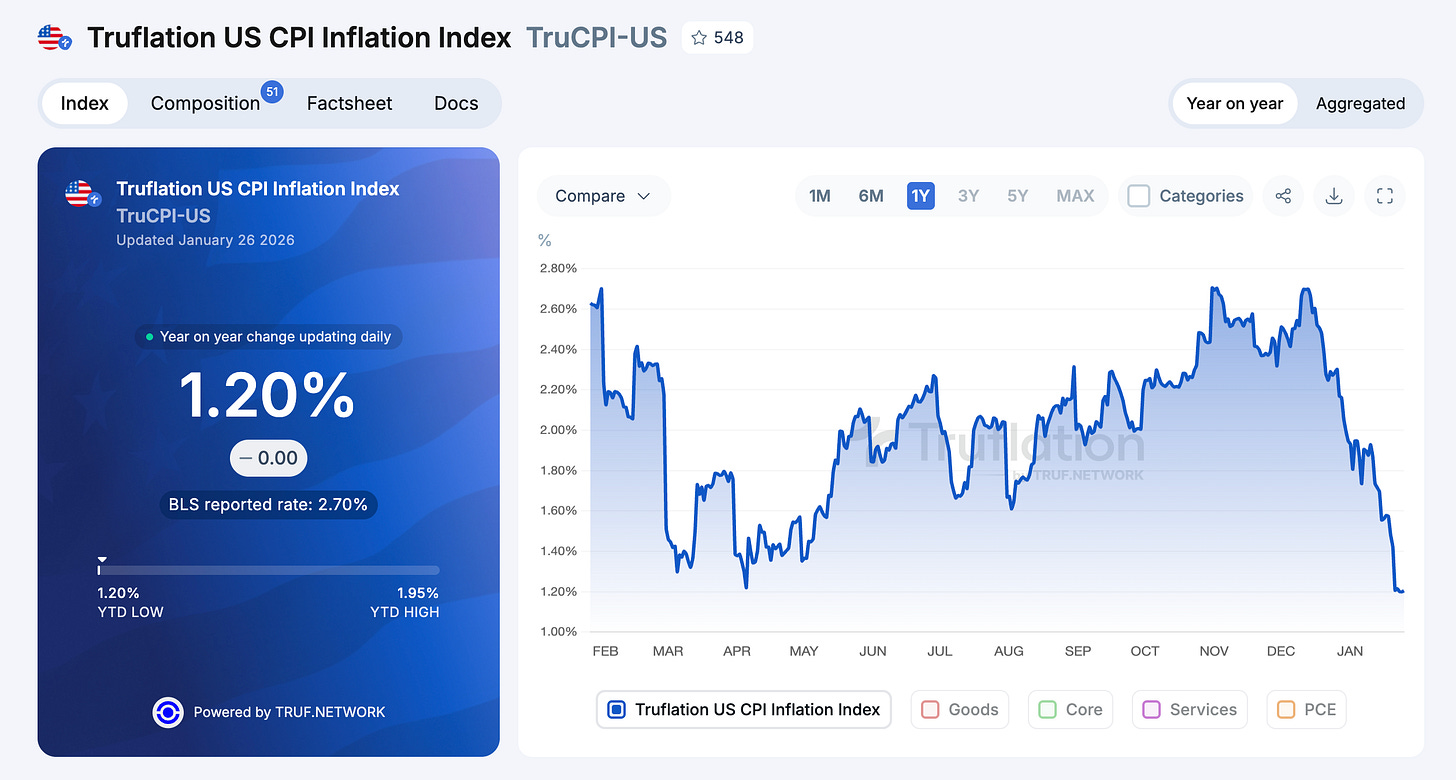

Truflation is reporting inflation at 1.2% as of last night. If you take the BLS’ methodology, and you replace the ~ 40% of inputs that are estimations with accurate measurements of the input goods, then Truflation shows inflation would be less than 1% year-over-year.

The big takeaway from this situation, according to Truflation, is that inflation has collapsed from its recent peak, dropping 151 basis points in just three months.

Truflation’s real-time data, which is sourced from over 14 million daily price points across 40+ independent providers, captures this deceleration far faster than traditional metrics, revealing a pricing environment that’s shifted decisively toward disinflation. For investors, this signals a fundamental reset in cost pressures that official data will only confirm weeks later.

So what is my big takeaway from this situation?

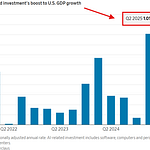

The Federal Reserve has lost control of the economy. They are serving at the pleasure of market forces now. The labor market is weakening, inflation is falling aggressively, artificial intelligence is a very real deflationary force, and productivity is booming thanks to the deregulation, tax cuts, and reshoring.

It does not matter what the Fed thinks they should do right now. The old playbook is out the window. We have supply-side economics taking over. We are seeing high-growth and low-inflation. The Fed is having their hand forced. They need to cut interest rates by about 100 basis points in the next few months, but they also will have to participate in the timeless act of printing more money.

The US economy may be booming, yet the inflation data is telling us that we could have a major problem on our hands if the Fed doesn’t stimulate more economic activity. For the trigger happy Fed, this should be their Super Bowl. Cut rates and let the economy fly.

Hopefully the great people at our central bank are paying attention.

Have a great start to your week. I’ll talk to everyone next time.

- Anthony J. Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: We’re officially a few weeks out from Bitcoin Investor Week 2026, happening Feb 9th – 13th in NYC.

Join thousands of sophisticated investors and institutional leaders to discuss Bitcoin’s impact on the global economy, corporate balance sheets, and personal portfolios.

**To kick off the new year, we’re offering 50% off General Admission tickets for the next 48 hours. Use code NEWYEAR50 at sign-up.**

Expect fireside chats, panels, networking events across the city and a top lineup of speakers including Mike Novogratz, Grant Cardone, Anthony Scaramucci, Fred Thiel, Lyn Alden, Jeff Park, and Bo Hines — with more announcements coming soon.

🎟️ Tickets are limited. Buy yours at www.bitcoininvestorweek.com

Bitcoin vs Silver: The Ultimate Rotation Is Happening Right Now

Jordi Visser is a veteran macro investor with 30+ years of market experience and the author of the VisserLabs Substack. This was recorded live at the Real Vision 2026 Crypto Gathering.

In this conversation, we discuss the scarcity trade across markets, bitcoin’s potential short squeeze, silver’s role as a critical industrial metal, and the inflation vs. deflation debate. We also explore how AI, robotics, and productivity shifts could reshape markets in the years ahead.

Enjoy!

Podcast Sponsors

Figure – Enter to win $25k USDC with Democratized Prime while earning ~9% APY! They also have the lowest industry interest rates at 8.91% with 12 month terms! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check outFigure! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply.

Award-winning Fountain Life - Energy supercharged. Memory sharper. Life extended. Ready for the best investment you’ll ever make? Schedule a life-changing call at www.FountainLife.com

Gemini - Earn crypto rewards on every purchase with the new Gemini Credit Card.

Abra - This podcast is sponsored by Abra. Abra is the secure way to access crypto and crypto based yield and loan products through a separately managed account. To create an account, click here for individuals and here for entities.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Arch Public - Arch Public’s cutting-edge algorithm tools ignite profits, harnessing razor-sharp data analytics to nail perfect entries, exits, and risk management. Turn volatility into opportunity and do it hands free with Arch Public. (Oh, and yes, try us out for FREE too!)

Uphold - Uphold is the all-in-one platform to trade, earn, stake, and swap across 300+ assets with real-time proof-of-reserves and any-to-any conversions. Manage your entire crypto portfolio in one place at www.uphold.com

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit https://www.simplemining.io/

Bitlayer - Bitlayer is powering Bitcoin beyond just a store of value, making Bitcoin DeFi a reality while staying true to its core principles of security and decentralization. Learn more about Bitlayer at https://x.com/BitlayerLabs

🚨READER NOTE: If you want to sponsor The Pomp Letter, you can fill out this formand someone from our team will get in touch with you.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

*Democratized Prime uses a Dutch auction; rates may fluctuate. Loans remain subject to collateral, margin, and variable-rate requirements. Anyone who qualifies for a reward under this promotion will only receive such reward if they are a Figure Markets user, have a Figure Markets wallet address, are verified through our Know Your Customer requirements before the end date of the promotion, and are in good standing with Figure Markets at all times between meeting the eligibility criteria and the time the reward is deposited. Figure Markets reserves the right to request additional documentation to verify identity and/or bank account verification before conveying any rewards.