To investors,

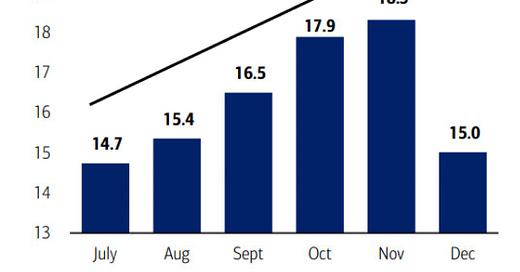

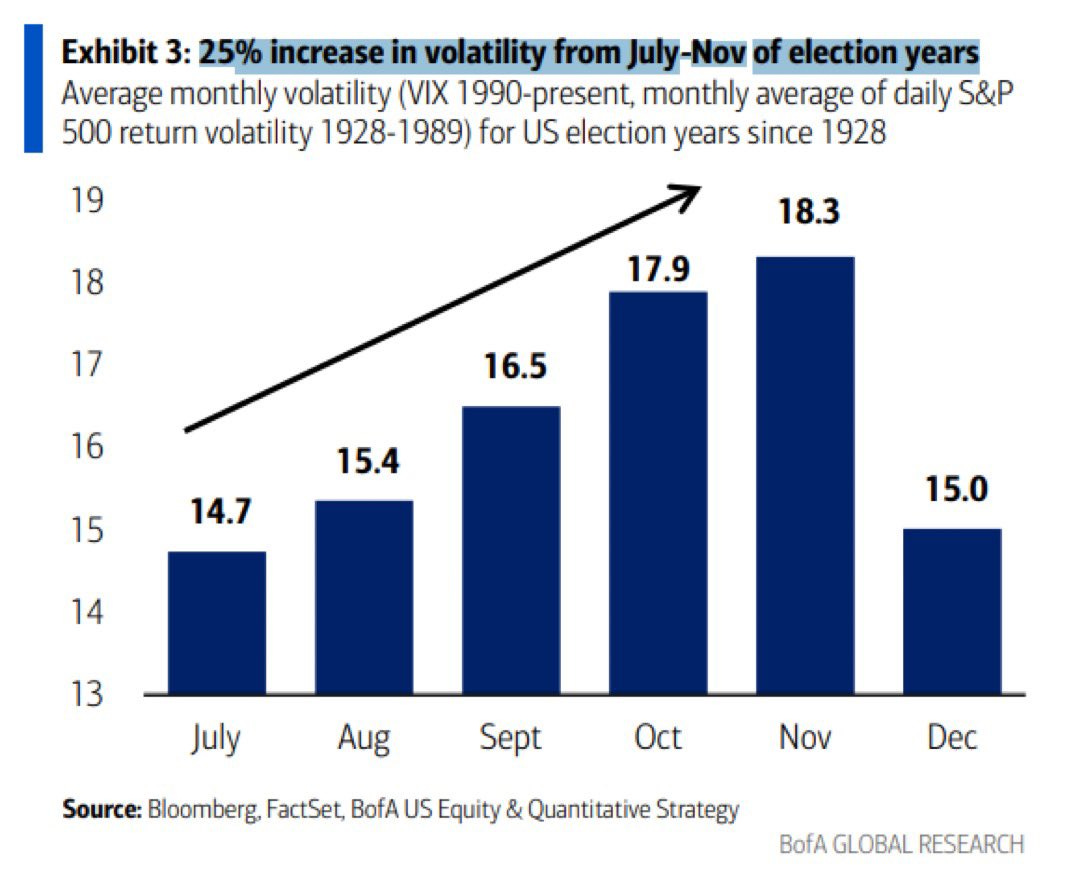

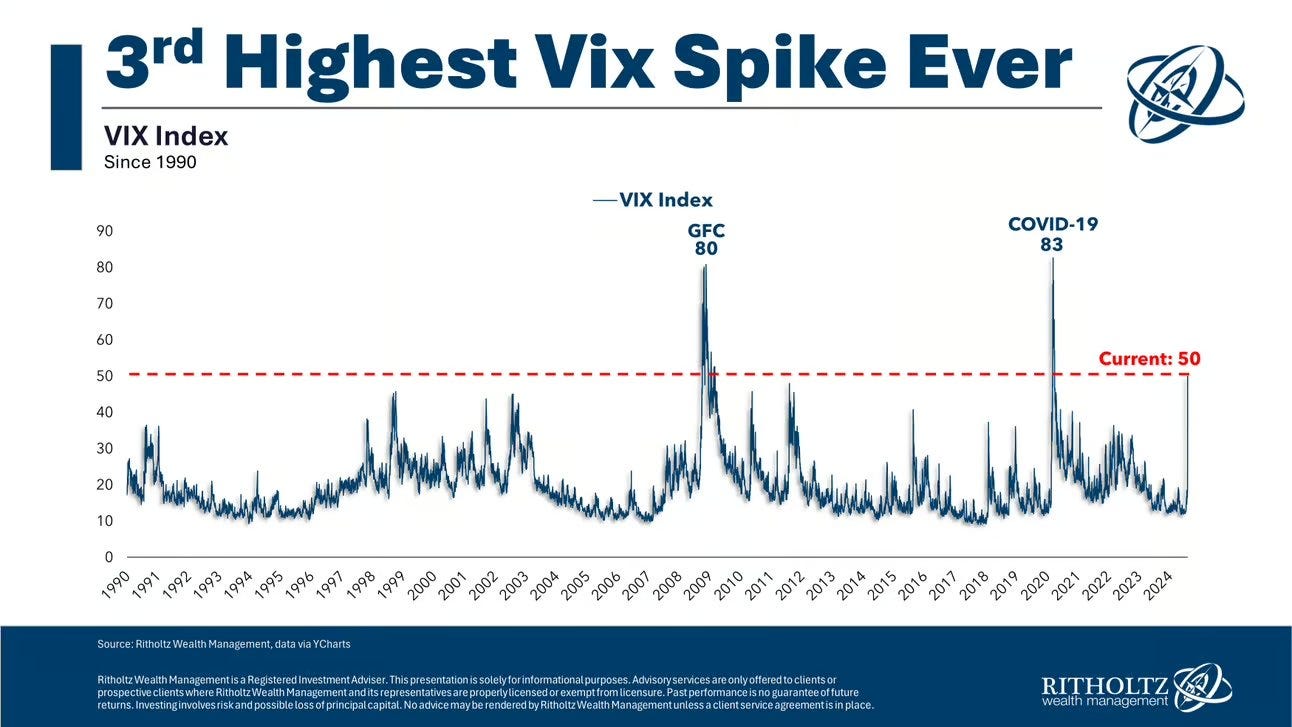

On June 27th I wrote a letter to this group titled “Prepare For A Volatile Second Half Of The Year.” It included the following chart from Bank of America, which highlighted a 25% increase in volatility from July - November of election years.

Almost exactly on cue, volatility exploded within the next 45 days. Michael Batnick from Ritholtz Wealth Management put together this chart to show the volatile move was the third highest VIX spike since 1990.

Volatility works in both directions. It can force asset prices higher or lower. This time it pushed the stock market lower, which created fear that spread through markets.

But Batnick writes on his blog that “everybody [should] be cool.” Why? Because 94% of all stock market years since 1928 have seen a drawdown of 5% or more.

Although the data suggests we are living through the norm, it won’t change investors’ amnesia. People love to freak out every time the market drops.

This is not only investors though. CEOs and company operators are watching the market and interest rates with a microscope. The Kobeissi Letter writes:

“The number of "Federal Reserve" mentions during the earnings conference calls is on track to hit a new record in Q2 2024. It is estimated the Fed will be mentioned ~380 times during Q2 earnings calls, according to Bloomberg. This would be more than TRIPLE the number of references seen in 2021. CEOs and CFOs are trying to figure out the future path of US interest rates. Weaker consumer demand and the pain of high inflation have put the Fed's next move in the spotlight. Everyone is waiting on the Fed.”

Interest rates obviously matter for stock market performance, but the higher rates have pushed our national debt interest payments to absurd levels. Charlie Bilello writes:

“The Interest Expense on US Public Debt rose to a record $1.11 trillion over the last 12 months, more than doubling over the past two years. At the current pace it will soon be the largest line item in the Federal budget, surpassing Social Security.”

We are only a month and a half into the second half of the year. Volatility is spiking as predicted. There are still more than 100 days until the end of November. It would be naive for us to believe the chaos is behind us.

Investors should buckle up, keep their head on a swivel, and realize it may be a bumpy ride for the next 3-4 months.

The good news? If you are a long-term investor, the short-term volatility won’t matter. But if you are living your life based on the day-to-day fluctuations of your portfolio, then you may be in for a few surprises.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Jason Les is the CEO of Riot Platforms, one of the largest miners in North America. They are a publicly traded company that is exclusively focused on mining as much bitcoin as possible.

In this conversation, we talk about public policy, politicians becoming interested in bitcoin mining, what is going on with the bitcoin halving, hardware updates, rise of AI, competition for power, and much more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Riot Platform CEO Jason Les on Mining, Regulation, and Energy Critiques

Podcast Sponsors

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo Bank is the only way to bank with Bitcoin.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible. They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post