To investors,

The Grayscale Bitcoin Trust (GBTC) is the single largest bitcoin fund in the world. With more than $19.25 billion in AUM, they hold over 640,000 bitcoin inside the fund. The fund’s AUM was over $40 billion before bitcoin’s recent 2022 price drawdown.

Many people may not realize though — GBTC was a major driver in bitcoin’s increase in price from ~ $10,000 in October 2020 to $64,000 in March 2021. Without getting too deep into the details, GBTC does not have a redemption functionality.

This means that you could go to Grayscale and give them money in the private market. They would take your money to go purchase bitcoin for the fund. In return for your money, Grayscale would give you shares in GBTC under one condition — you were not allowed to trade those shares for 6 months.

So a bunch of very smart investors started giving Grayscale millions of dollars in the private market. But why would they do that? Well, at the time, if you gave Grayscale $1 in the private market, then waited for 6 months and 1 day, you would be able to sell that sale at a premium in the stock market for approximately $1.20. This means that the GBTC shares were trading at ~ 20% premium to the value of bitcoin in the fund (NAV).

You can easily understand why so many people were giving them money to exploit this detail. Here is Grayscale’s bitcoin holdings over the years and the ramp up in 2020-2021 is very obvious.

The premium percentage went up and down, including reaching as high as 40% at one point, but it was always positive. It doesn’t take a genius to understand that giving someone $1 and being able to sell it for $1.20 about 6 months later is a good investment. This wasn’t risk-free though, so what was the risk?

What happens if so many people realize that you could do this that the premium went away and eventually became a discount? That couldn’t happen, right? You guessed it — it happened.

Grayscale’s Bitcoin Trust now trades at a 30% discount to the value of the fund. No one wants to give Grayscale $1 and get $0.70 for it 6 months later, so the fund has stopped taking inflows at the moment.

Now here is where things get a little weird. Grayscale has about $20 billion of assets (at current BTC price) sitting in a fund, but the shares are trading at 30% less than that value. So if you’re holding the shares, which have gone done significantly, you would just want to tell Grayscale “hey, I’ll give you my shares and you give me back the equivalent bitcoin.”

That sounds like a good idea but Grayscale doesn’t have a redemption feature. This is one of the big reasons why the company has been spending so much time trying to get the SEC to approve a conversion from the trust structure to a bitcoin spot ETF structure. If they are successful, investors will rush to buy the shares at a discount so they can redeem the bitcoin, which is worth more, driving a profit. As more investors buy the shares, the price will go back up towards the value of the fund and everything in the world will be good again.

The problem is that the SEC hasn’t been too interested in this idea. SEC Chairman Gary Gensler and his team have approved bitcoin futures ETFs in the United States, but there is no bitcoin spot ETF yet. Other countries have them. The United States does not though.

So this brings me to a development yesterday that is very interesting. There is a man named Robert Whaley who wrote a letter to the SEC about the Grayscale ETF conversion issue. He isn’t just a random guy, but rather Whaley created the Cboe Volatility Index (VIX) in the early 1990’s. It would be an understatement to say that Robert Whaley understands financial markets, indexes, and trading products or structures.

He highlighted the main reason for his letter when he wrote:

“Bitcoin is a new asset class. Its usefulness arises from the fact that its returns are relatively uncorrelated with traditional asset classes like stocks and bonds, thereby providing more efficient return-risk opportunity. Bitcoin ETPs are an effective mechanism for investing in bitcoin. Public demand for such investment tools is evidenced by the launch of ProShares bitcoin futures-based ETF (BITO) in October 2021. In its first 1 day of trading, its assets under management (AUM) reached more than $1B, one of the most successful product launches in the 30-year ETP history. However, as further described below, futures-based bitcoin ETFs like BITO are a much more costly and inefficient way for investors to access bitcoin compared to what would be a more transparent and well-designed spot-based bitcoin ETP like GBTC. And because the Commission has already approved futures-based bitcoin ETFs, it must implicitly be comfortable with a spot-based bitcoin ETP like GBTC.”

Robert’s argument breaks down into three distinct categories:

Index construction

Market depth and liquidity

Product design

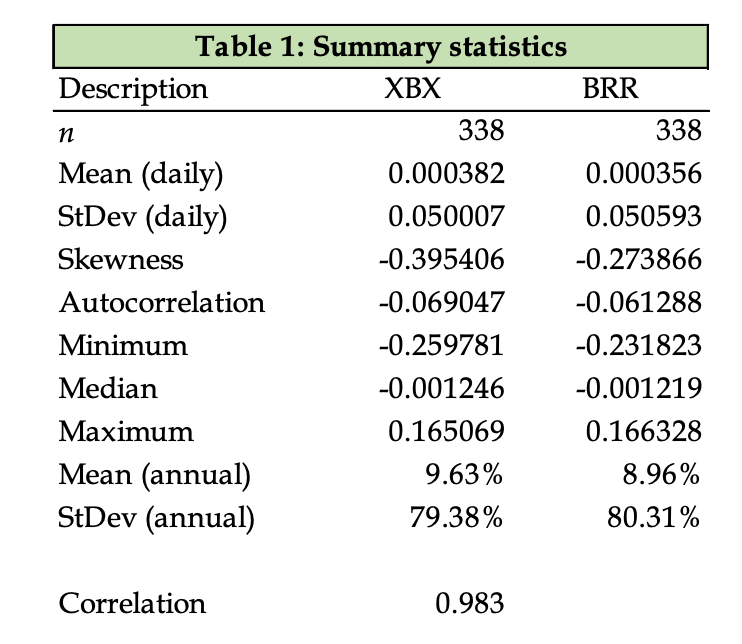

The first argument on index construction is quite simple. “Two bitcoin indexes are relevant to this discussion: the CME CF Bitcoin Reference Rate (BRR) that underlies the CME’s bitcoin futures contract and the CoinDesk Bitcoin Price Index (XBX) that underlies GBTC described in the NYSE application.” In his analysis, Whaley shows that there is no difference between the two indexes in regards to the index construction.

Next up was market depth and liquidity. Here Whaley shows that the bitcoin spot market is drastically more liquid than the futures market. Not really a surprise to anyone, but these two sentences stuck out to me: “In terms of USD value, the market cap in the CME’s bitcoin futures market averages less than one-quarter of one percent of the bitcoin spot market. The dollar trading volume of bitcoin futures averages about 5.5%.”

On product design, Whaley makes it very clear that his analysis concludes the bitcoin spot ETF would do a better job of giving investors the exposure they are seeking: “The GBTC ETP price is inextricably linked to the price of bitcoin because it holds actual bitcoin. The conversion/redemption arbitrage process will ensure it. There is no equivalent claim that can be made for the futures-based bitcoin ETFs, however.”

Makes sense, right? Robert Whaley ends his letter with a synopsis of why Grayscale’s Bitcoin Trust should be approved in his opinion:

“The three key elements that cause me to strongly endorse the NYSE Arca application to list and trade shares of GBTC under NYSE Arca Rule 8.201-E as a spot bitcoin ETP are: (a) the XBX bitcoin index that GBTC is priced on is virtually a perfect substitute for the BRR index that underlies the return-risk exposure for the futures-based ETFs that the Commission has already approved, (b) the bitcoin spot market is vastly deeper and more liquid that the bitcoin futures market, and (c) the product structure is much more transparent and well-designed.”

I have no clue what is going to happen with the Grayscale conversion to an ETF. I hold bitcoin personally and I hold GBTC in a retirement account. From an uneducated viewpoint, the exposure to bitcoin has been superior to the exposure to GBTC. According to a number of studies, if the SEC was to approve Grayscale’s conversion, they could unlock approximately $8 billion of economic value for Grayscale investors. It will be fascinating to watch this play out.

Hope each of you has a great day. I’ll talk to everyone tomorrow.

-Pomp

If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

SPONSORED: Introducing the newest way to build and share your web3 wins - Unstoppable Domain Profile Badges!

Badges translate your wallet activity into web3 achievements. Before, these stories were buried in transaction logs, making them difficult to find, read, and understand. Now with Badges, it’s easier than ever to celebrate and share your crypto story. Since Badges are issued based on a wallet’s transactions, they’re a fun and easy way to build your portable, on-chain reputation just by supporting whatever projects interest you.

UD owners can activate badges from their account’s Domain Profile page right now. Haven’t minted an NFT domain yet? Go to Unstoppable Domains to own your name, starting as low as five dollars.

In this conversation my brother, John Pompliano, breaks down the business of Walmart and their recent earnings report. Is Walmart in trouble with their sales? John explains Walmart's history, why the founders who aren't involved anymore so wealthy, and the future prospects for this behemoth retail business.

Listen on iTunes: Click here

Listen on Spotify: Click here

How To Get A Job During A Recession

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain here today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

BetOnline allows you to use Bitcoin and other altcoins to bet on sports, casino games, horse racing, poker and more. Click here and use PROMO CODE: POMP100 to receive a 100% matching bonus on your first crypto deposit.

Abra lets you trade, borrow, and earn interest on crypto. Earn up to 13% interest on USD stablecoins or crypto, borrow USD stablecoins, and trade in 110+ cryptocurrencies in a simple, secure app. Download Abra and get $15 in free crypto when you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Those products include BlockFi Wallet, no fee Trading, crypto collateralized Loans and the World's First Crypto Rewards Credit Card. To get $75 back on the first swipe of your BlockFi Rewards Credit Card, sign up today at http://www.blockfi.com/Pompcc

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go to okcoin.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visit http://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.